More Voting Results Announced by Credit Unions

The recent national elections demonstrated the essence of democracy is voting. Credit unions as co-ops are unique in their governance. All federal credit unions and most states establish member authority as “one person one vote.” The amount of one’s shares or size of loans does not change this basic equality. Rather, that is how private corporate and public companies are governed.

No proxies are allowed for FCUs although seven states permit limited proxy voting for their charters. In one state (IL), proxy voting is permitted in all cases including merger. In states permitting proxies, members give their voting power to the board, unless specifically revoked prior to the vote.

Member voting primarily in the annual election of directors is the most frequent means cooperative governance is practiced. But it is especially critical when a board recommends the merging of a sound, long standing credit union into another institution.

A Multi-tiered Democratic Nation

Cooperative democracy is a micro example of the broader political society in which we live. One co-op commentator described this context as follows:

“Democracy is seen by the public as making decisions regarding laws, taxes and public spending. These tools are necessary, but alone are limited in their ability to improve society. We need to expand our tool-kit and harness our collective imagination and intelligence to utilize not just the mechanisms of democratic governments, but also in cooperatives.”

Co-op democracy only works if members believe their role matters and they are encouraged to exercise their voice. This is not the process being followed in most mergers. If 90% or more voters failed to participate in any political election, many would consider it a façade. “My vote won’t matter so why bother.” Unfortunately this is the pattern in almost all credit union mergers. Two recent examples:

From Ypsilanti, MI : The CEO of Washtenaw announced that 457 or 8.0% of eligible members voted in an election to decide the future of the credit union’s potential merger with the $566 million Financial CU. The $50 million dollar credit union, chartered in 1949 reported 16% share growth, well-capitalized net worth of 7.54% and no delinquencies at September 30. 6.7% of the members voted yes, and 1.3% voted no. Over 92% of the member-owners did not vote to decide the credit union’s future.

The CEO explained the merger with CP Financial CU: “We are extremely proud of the lasting legacy that the good people and good work Washtenaw Federal Credit Union has provided the community for the past 70+ years. That BEST of who we are will still live and breathe at True Community Credit Union (new name); moreover, the sum of CPFCU and WFCU is greater than we were individually. Our credit union family is not dissolving, it is simply growing larger. CP FCU has welcomed us with open arms not solely because they are good people, but because “real recognizes real” and our members aren’t losing a credit union but gaining another one.”

From Garden City Park, NY: 1,843 members of the $265 million Sperry Associates FCU voted on the Board’s recommendation to merge with the $26 billion PenFed, located in Mclean, VA. 68.3% (1,166) of those voted in favor; 35.7% (677) voted no. Of the total membership of 16,303, only 11.4% of the share-owners participated in the merger decision which will end this charter issued in 1936.

The CEO’s justification for merger: “For over a decade, Sperry’s board and executive management team has worked to successfully strengthen the credit union’s standing, and this is the next step in that process.”

Co-op democracy or something else?

In both instances above, over 92% of members did not vote or voted against the merger of these two sound, long-serving credit unions with strong local presence. What does this lack of participation suggest about member interest in the surviving credit union? If they did not value their own institution’s service and record enough to participate, will they have any allegiance to their new one?

Is the so-called democratic process of member voting just an administrative fig leaf covering the naked ambitions and personal agendas of those in charge? What is the meaning of a “vote” when over 90% of eligible members do not participate?

If a credit union is sold to a bank or converts to private cooperative insurance, by rule a minimum of 20% of members must vote for the decision to be approved. There is no participation requirement, however, to end the life of a charter. If a minimal level of member awareness is required in these two situations, is it even more appropriate for the decision to end the life of a charter? Does the fact no required participation is needed, lead to a controlled process to ensure alternative points of view are not raised?

A Special Relationship?

As these consolidations routinely proceed with less than 10% member participation, is this just quickening the pace ending the distinctive credit union cooperative advantage? For if members are treated just like customers being told what is good for them, how is that any different from banks? The CEO’s rhetorical statements justifying their merger decisions contain no facts, no specific member benefits. Only the increase in financial gain by the CEO and senior staff is provided, and that only because it is required by regulation. Surely member owners deserve a fuller explanation than marketing mantras before giving away their institution.

Democracy is not a rule, set of bylaws, or even an idea. Rather it is a discipline requiring personal actions. That involvement was the essential good will that got almost all credit unions started as there was no start up capital. . Today the phrase member relationship is used to define this critical difference in cooperative design. It is a skill and capability that needs continuous effort to sustain this advantage not just once a year at the annual meeting.

Disposable Members: An NCUA Practice That Must Change

My earlier blog today about Fellowship Credit Union (now BECU) contains an even more powerful message than acorns becoming tall oaks.

It is the example of people willing to put limited resources to the aid of their fellow human beings in difficult circumstances. That is, the many giving others the opportunity at a better life—during the hard times of the depression.

Another Reality: Disposable Members

Last year when walking in downtown Chicago, the following message on the side of a public trash unit caught my eye.

This is unfortunately one of the consequences of NCUA’s current practice in problem credit union resolution. Members with savings receive all their money back at full value. Borrowing members are sold off to the highest bidder. For savers this would be the same as NCUA transferring members’ insured balances to Wells Fargo or a finance company. Sell savings accounts for the best price and then let members work out their future relationship on their own.

Borrowers are the primary reason for a credit union. They provide the most important source of revenue. But in problem situations, the borrowing members’ fate is not NCUA’s concern. Loans are only an asset to be rid of.

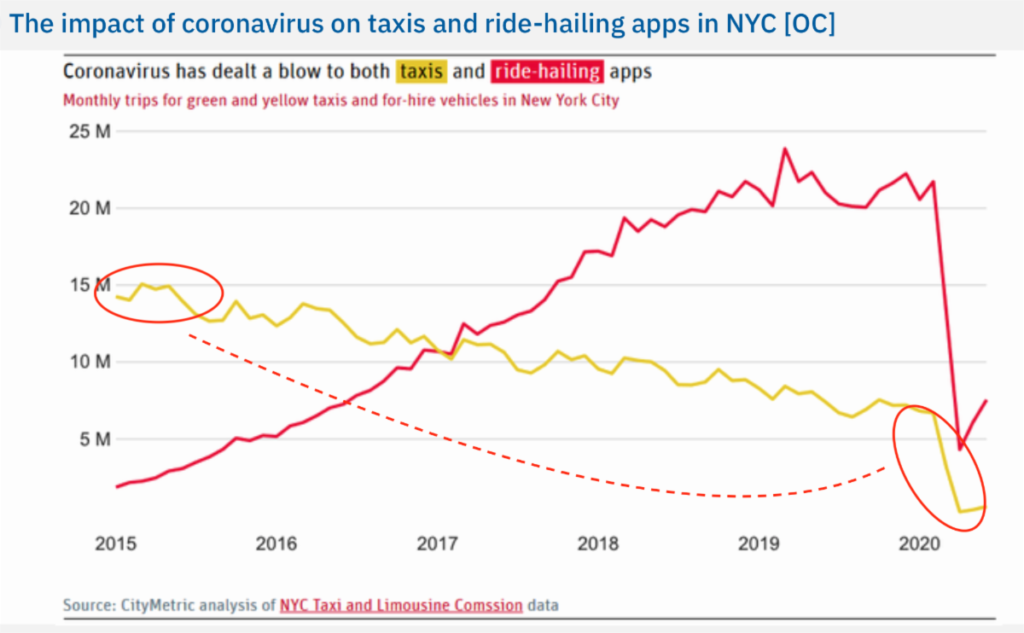

This practice was most dramatically illustrated in the NCUA’s February sale of over 4,500 member taxi medallion loans to a hedge fund seeking to build a dominant share of the NYC taxi medallion market.

How This Topic Came Up Last Week

At NCUA’s Wednesday 2021/22 budget hearing, this issue was raised when one of the presenters gratuitously congratulated his organization and the Agency on this action, according to the CU Times.

The reported statements were:

“As NAFCU’s SIF Committee pointed out prior to the sale the unusually large taxi medallion portfolio would strain agency resources and pose a risk to the credit union community so long as it remained under management by the Asset Management and Assistance Center.

“While NAFCU did not anticipate a global pandemic at the time we offered this advice, we believed that retaining the portfolio in the hopes of extracting a higher sales price presented unnecessary risks, and recommended that the agency divest the portfolio at the earliest opportunity so long as it received a fair price.”

No facts were offered to support this position. The idea that the portfolio would “strain agency resources” in a $19 billion dollar fund is nonsensical. The agency two years earlier had expensed all the estimated loss–at a magnitude 4 times ($750 million) the last reported deficits ($150 million) in conservatorship.

The return on this additional cash in the NCUSIF is under 10 basis points.

Why this superfluous statement was made in a budget hearing is unclear–a crude attempt at sucking up to the Agency or poking a sharp stick in the eye of a group that challenged the sale. Whatever the reason, it not only undercuts the credibility of the presenter, but more critically it supports the unfortunate Agency practice that member borrowers are not NCUA’s responsibility, just savers.

Hiding the Truth on the Taxi Medallions

NCUA has repeatedly refused to present any details that would support its sale as in the best interests of the members. Or even the best financial outcome for the NCUSIF.

At least three organizations requested FOIA information on the sale; all denied. Some of the sale details were already published in a Feb. 20, 2020 WSJ story on the hedge fund’s purchase.

The Journal reported the price of $350 million for a portfolio of 3,000 New York medallions, 900 Chicago medallions, 500 Philadelphia medallions and 100 from other cities.

This is an average loan value of $77,800 each, all secured by medallions. An estimate of the average book value of these loans is the purchase price of $350 million plus the loss NCUA says it has taken on the portfolio of $760 million. These numbers combined total $11 billion and suggest an average book value of $245 thousand per loan. The cash received would be a payment of 31 cents per loan dollar.

What’s Wrong with Cashing Out?

The challenges of the New York taxi medallion market continue to be tracked. One example is the 2015-2020 chart below which shows the rider volumes as the uber/lyft new entrants disrupted the taxi industry. So, wasn’t 31 cents better than holding on? That is the question which NCUA and the presenter have failed to offer any factual information.

For some the chart may be a sufficient justification forgetting the fundamental rule of markets, what goes up must come down and vice versa. Cashing out at the bottom is generally the highest cost strategy—just remember the five corporate liquidations, all supposedly insolvent, whose estates have generated a surplus of over $6 billion so far.

Better options for members are what the Taxi association, CUNA and others offered to present to NCUA which refused to consider all offers. Medallion drivers, one of the most diverse group of credit union members, include many individual entrepreneurs. They were denied any ability to negotiate their own future. The sweat equity that they hoped to build was turned over to a firm that specialize in profiting from others in financial difficulty.

One Easy Solution for a Win-Win

Instead of turning its back on members striving to realize the American dream through their own labor, what if the agency had offered to discount the members’ loans to the same level that the hedge fund bought them? Furthermore, these rewrites could include a contingency that if the borrower was able to sell the medallion for more in the future, the gain could be split between the borrower and the fund.

More proposals for assistance continue to be drawn up today by the alliance and New York city leaders. Some taxi owners were able to receive help from financial programs in the CARES act. But NCUA washed its hands and walked away from the members in trouble as others attempted to find solutions.

NCUA’s lack of transparency suggests there is much to hide in its failed supervision of the taxi medallion situation and sale. The agency used money due credit unions from the TCCUSF surplus to expense $750 million to cover up their inability to carry out basic responsibilities for problem supervision and resolution.

The most unfortunate aspect of the taxi medallion sale was that it proved again that NCUA views credit union borrowers as disposable. This is exactly the opposite of the founding spirit of the Fellowship CU and the purpose for which all credit unions were formed.

December 7th is also a day that no one will forget because it brought America into WWII. A basic code of honor in the US military is that no one gets left behind whether as POWs or MIAs. Decades, even generations later, the US government sends teams to recover the remains of missing from Korea to Vietnam and other places of combat. No one is forgotten, whatever the circumstances.

That is the heart of the American democratic commitment to each other. It’s the motivation for Fellowship Credit Union, begun this day four generations ago.

Isn’t it time NCUA followed this same principle when performing its responsibilities?

All Credit Unions Start “Small”: The Winner, the Message, the Challenge

Question from the November 16th blog: Can you identify the credit union whose initial name is shown in the image below?

Answer: Boeing Employees CU chartered December 7, 1935.

The “cooperative historical scholar” with the answer was Kathy Tichenor, CLO, Pasadena FCU.

Kathy has been in the credit union movement for over 40 years. Working on her credit union’s founding anniversary she was curious who else had also been around for 85 years or more. She discovered BECU in that research.

She describes herself as “a true believer of why we are here and who we serve” and reminds staff continuously about our roots and how far we have come.

Her message is “we are here for the financial health of our members especially when help is needed during financial distress, sickness and hard times. If I am not assisting a member, I am assisting someone who is.”

BECU’s Founding

Here is the brief beginning from the credit union’s web site:

In 1935, new employees for The Boeing Company were required to purchase their own tools before they could start work. This was the height of the Great Depression. Finding money to buy tools was an insurmountable burden for many prospective employees. A Boeing employee, William Dodge, read an article in Readers Digest about the difference that credit unions were making across the world. Inspired, Dodge got a group of Boeing employees to talk about starting their own credit union. The first loan was for $2.50 to buy tools. https://www.becu.org/members-matter/about-membership/becu-history

BECU Today

With the deposit of 50 cents from each founding member, today the credit union is $25.7 billion in assets. It serves 1.3 million members and employs over 2,405.

The founders’ vision was to help fellow workers during the depression buy the tools necessary for a job at the Boeing Aircraft Company. Their plan was cooperative self-help, a vision that is still the foundation for this billion-dollar cooperative.

Every credit union rests on this same foundation. All start small relying on sweat equity and the communal impulse to aid one another. A few will grow large, most will not. But all demonstrate the power of a vision that inspires and creates legacies benefitting future generations.

From thousands of small seeds, tall trees may grow.

Today’s challenge: are these seeds still being planted? See following blog for why this founding spirit still provides a vital example for today.

A First Step to a Fresh Start for a New NCUA Board

An easy but critical first step for a new NCUA board for insight into the agency would be to change the current auditor, KPMG, of its three credit union financed funds. This is normal good business practice as NCUA documents in its examination recommendations cited below.

It would bring a fresh set of eyes and objective rigor to a series of events such as the ambiguities in managing the corporate AME assets and the inexplicable annual accounting for loss reserves in the NCUSIF.

It would also bring much needed review for how the Inspector General’s office performs both its internal and external audit oversight.

Finally, it would replace a firm whose professional integrity and competence have been publicly and repeatedly called to account in the past three years by both regulators and the financial press.

KPMG’s Recent Press Reports

For several years the business press has reported on the professional and ethical failures at KPMG. The following are a few of the public stories about events from 2016 through this year.

1. The KPMG cheating scandal was much more widespread than originally thought

Jun 18, 2019 — A $50 million fine against KPMG LLP for its use of stolen regulatory information to cheat on audit inspections wasn’t a surprise: The Wall Street Journal warned last week that the Securities and Exchange Commission was ready to impose such a move, and the scandal had been known about for more than a year.

2. KPMG reveals eight audit clients collapsed

Updated Feb 18, 2020

KPMG has revealed it failed to flag problems with the financial statements of two of the eight collapsed listed companies it audited over the last 10 years.

3. Accounting Watchdog Finds Ongoing Problems at KPMG

The Public Company Accounting Oversight Board (PCAOB) said half of the 52 audits it inspected from top accounting firm KPMG were seriously deficient and KPMG was not as committed to quality as the accountancy claimed.

“In 26 audits, certain of these deficiencies were of such significance that it appeared to the inspection team that the firm, at the time it issued its audit report, had not obtained sufficient appropriate audit evidence to support its opinion,” the PCAOB said in its report.

The accounting watchdog also released a revised inspection report for 2016 that found deficiencies in 22 of 51 engagements.

Some of the most common deficiencies occurred in the area of revenue and included failures to sufficiently test the design or effectiveness of controls.

https://www.cfo.com/auditing/2019/01/accounting-watchdog-finds-ongoing-problems-at-kpmg/

4. SEC Charges Three Former KPMG Audit Partners for Exam Sharing Misconduct

Washington D.C., May 18, 2020

The Securities and Exchange Commission today announced settled charges against three former KPMG LLP audit partners for improperly sharing answers to internal training exams and for subsequent wrongdoing during an investigation of exam sharing misconduct at the firm. The SEC previously charged KPMG with violations concerning the exam sharing misconduct, as well as for altering past audit work after receiving stolen information about inspections that would be conducted by the PCAOB.

An NCUA Examination Comment On External Auditing

Following is an excerpt of standard wording NCUA provided one credit union’s supervisory committee about managing their external audit process: (emphasis added)

Examiner’s Observation: As standard exam procedure, we conducted a meeting with the supervisory committee chair during this year’s examination. We inquired about the process of soliciting bids from audit firms prior to the end of the engagement period, to select the audit firm for the next engagement period. Our discussions with the supervisory committee and review of policies and procedures noted that there is no documented bidding process and that the audit committee has not solicited bids since 2010.

It also appears that the audit committee had no defined timeline as to when they would solicit bids in the future. While specific limits are not required, recent accounting and auditing scandals highlight the importance of rotating audit firms periodically. Otherwise, auditors and clients could loose independence and overlook areas of concern.

Prudent and standard business practices recommend the development of written processes and procedures, outlining the steps the supervisory committee needs to follow when engaging an audit firm to complete the annual audit. The supervisory committee needs to follow the guidelines when soliciting and reviewing bids from audit firms.

We recommend the supervisory committee develop, approve, and implement written procedures for reviewing proposals for the annual audit. Furthermore, the audit committee must understand and implement the procedures as intended, as this is among the most important functions of the committee. It is imperative the supervisory committee maintain documentation to support their review and selection of the audit firm. Furthermore, we recommend that management and the board consider periodically rotating audit firms. It is important to note we are not taking exception to or criticizing the quality of the annual audit report or the audit firm.

An Example of a Board Policy Statement of a Co-op’s Audit Process

Effective audit controls include review as to whether internal and external audits are effective.

-

- The Board of Directors and Executive Management of XYZ expect to be apprised of the condition of the organization, including the system of internal controls.

- On an annual basis the Board of Directors is asked to approve the Risk Based Audit Plan. The Audit Plan describes the internal and external audits designed to prove the adequacy and effectiveness of internal controls and policy, as directed by the Board of Directors and Executive Management of XYZ.

Board Action Required

This brief policy statement should be the starting point for a new NCUA Board to better monitor and understand the effectiveness of the Agency’s management. It is what the agency expects of credit unions. Should it not hold itself to the same standard?

A Simple Solution for NCUSIF Revenue

At the November NCUA board meeting, two members responding to the NCUSIF update made “the sky is falling” projections about whether the fund will have adequate resources in 2021.

One board member confidently predicted that the assessment of a premium is not a question of if, but when.

Neither forecast was supported by factual analysis.

Relevant Facts

Before offering a simple, immediate solution to these future seers’ concerns it is important to affirm basic facts about the NCUSIF’s financial strength and record.

- As reported by Chairman Hood to Congress the fund’s NOL is 1.32, which is above the legal cap of 1.3%. Anytime the fund exceeds this cap, a premium cannot be charged.

- The current NOL is 12 basis points above the 1.20 floor below which a restoration plan must be prepared. This is a financial margin of almost $2 billion.

- In the last 12 years of operations, the total insurance losses for the entire period Is $1.887 BN or less than the current NOL “surplus” margin.

- NCUA’s transfer of its fixed operating expenses to the NCUSIF via the overhead transfer rate (OTR) in this same 12 years is $1.968 BN or more than the total insurance losses.

- NCUSIF’s operating expenses have grown at a CAGR of 8.06% versus the growth of insured shares of only 5.6% in this time span. It is this fixed operating expense, not insurance losses, that eat up the fund’s revenue.

- The fund’s average insurance 12-year loss is 1.727 of insured savings. This includes the entire years of the Great Recession. The current 12 basis point NOL margin is seven times (700%) this average annual rate of loss.

- The September 2020 NCUSIF financials show an allowance reserve already funded for both general and specific losses. Moreover, the total assets of all code 4 and 5 credit unions is only .64% of the industry’s assets, that is less than 1%. This is the lowest level in the past decade.

Full details of the NCUSIF’s operations can be found on this spread sheet.

2019 NCUSIF Performance Spreadsheet_AJ1

The NCUSIF 1% semi-annual deposit “true up” underwriting means the NCUSIF is entirely countercyclical in its structure. The NOL range of 10 basis points(1.20 to 1.30) provides flexibility no matter the uncertainties that might occur. It is the ever-increasing fixed expense charged the NCUSIF in the OTR, not the variable insurance losses, that take the majority of NCUSIF income.

The fund’s financial architecture has proven its resilience since 1984 a period of time in which the FDIC has gone negative three times. The FSLIC failed and was merged into the FDIC in the 1990’s. In spite of these failures, the FDIC is still based on the same premium financial model that has led to its repeated failure.

A Ready, Easy Source of Additional Revenue-Not Premiums

As of September 30, the market value of the NCUSIF investment portfolio exceeded its book value by $586 million. This is due to the precipitous fall in interest rates engineered by the Federal Reserve at the beginning of March responding to the pandemic and economic shut down.

By selling these securities and staying short, the fund would book immediate revenue in the hundreds of millions, become more liquid and be better positioned for the inevitable rise in rates from present historic lows.

This market premium disappears if the securities are held to maturity. The time to realize this gain is now. It will add immediately to equity if the board truly believes the NCUSIF must sustain an NOL above 1.3. A premium cannot be levied if the NOL is above 1.3%

But what about the future revenue possibly foregone when the bonds are sold and reinvested at today’s lower rates? That is a contingency easily modeled, but ultimately relies on the assumptions made about how long the current rate environment is likely to continue.

The NCUSIF reported the following fixed rate investments by the NCUSIF in September:

Term Rate

4 yrs .20%

5 yrs .27%

6 yrs .36%

7 yrs .45%

Is there any CFO or CEO who would make investments for their credit union at these terms and fixed rates into the future? While no one knows the future, the preponderance of experience suggests that it will take only one move by the Fed from its current 0-25 bps overnight range, to a first step raising it to 25-50 bps, for all of these investments to be underwater, that is less than book value.

Yes, there is a risk of some foregone revenue next year, but a reasonable forecast suggests that a strong recovery will bring with it higher rates. And if the opposite happens and economic disaster occurs, then the liquidity would be readily available.

The Action Needed and the Precedent

If the NCUA board decides to keep the NOL above the 1.3% current cap, then sell some of its investments, take the gains and recognize the revenue now. When rates rise, the market premium goes away. This is an opportunity that will decline if not disappear in the not-too-distant future.

The precedent is 2008 when the NCUSIF sold longer term securities to prepare for the potential contingencies brought by the Great Recession. This boosted income so that no premium was necessary with the fund reporting net income of $24 million and an NOL of 1.26.

The Pervasive and Invasive Power of Social Media

In September Netflix released the film The Social Dilemma.

The documentary portrayed the ever expanding influence of social media platforms focusing on Google and Facebook. These services track everything we do online. They store our activity, use AI to create individual profiles, and use algorithms to influence our future behaviors.

Your time on their sites is converted into advertising dollars for marketers, politicians, and influencers seeking specific consumer interests or needs.

The film builds its credibility with interviews from many individuals who worked on the inside of these companies as well as examples showing real world impact. Fake news, for example, spreads six times faster than true stories. One result is growing disinformation and conspiracy falsehoods.

The message is how the computer power in your pocket is changing your behavior, even to the point of addiction.

The film should make a viewer more aware of the manipulative and darker potential of our dependence on technology.

A Close To Home Example

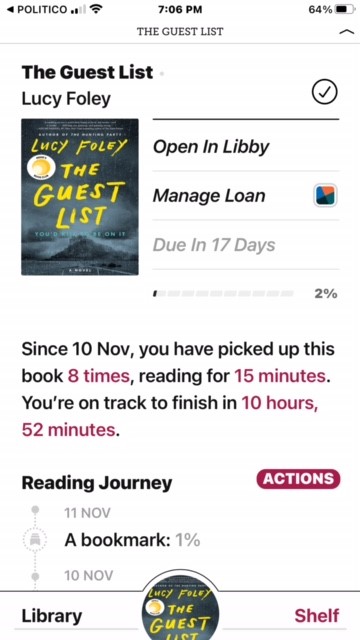

Platforms using AI to inform or influence are not limited to social media. My wife belongs to several book clubs, Her preference is to read books online versus hard copy.

The public library is her fist choice as e-books are free even though time limited in check out.

Recently she received he following email updating her most recent on line borrowing:

A Benefit or a Concern?

She showed the email to me and asked my reaction. The idea the library was monitoring her reading activity raised concern. Meant to be informative, it also demonstrated how a third party can tell you something about yourself that you may not be aware of. What else might the library be tracking and who has access to this data from a public institution?

Every day credit unions store data on their members’ activity that they analyze to better serve them individually and collectively. How members perceive this proactive use of their information can help build or undermine the trust foundation essential in all relationships. Even if intended to be a positive, helpful suggestions can raise concerns. Fr example, how did you know I was laid off?

One way to enhance trust is to be transparent by announcing in advance how you will try to add value beyond traditional transactions. My wife’s concern was due in part because she had no knowledge this reading summary was available. Would your members be surprised by any of your communications that rely on the selected knowledge you compiled about their financial activities?

Early Views from McWatters All Credit Unions Would Still Echo

In an October 6, 2015 CU Times op ed, then new board member McWatters presented his approach to credit union regulation. He resigned his board seat last Friday. Below are selected verbatim excerpts of his original policy priorities that I believe should stand the test of time and party.

Credit unions are best served by having a regulator that understands the not-for-profit, cooperative business model. . .

Rick Based Capital Rule

Last week, by a bipartisan margin of 50-9, the House Financial Services Committee sent an undeniable message to the NCUA: Take more time to review the law, assess the need for additional regulation, evaluate alternatives and consider the real impact now and into the future before moving ahead with the Risk-Based Capital 2 final rule.

This is a message I welcomed and championed in my written dissent (available on the agency’s website) to the issuance by the agency of its proposed RBC2 rule last January as contrary to a plain reading of the Federal Credit Union Act.

Regulatory Burden

I think the agency would do well to heed this message for other major regulatory issues as well, most notably how the agency deals with the growing regulatory burden confronting credit unions, particularly small credit unions. The increasing number, scope and costs associated with regulatory requirements, not just from the NCUA but from all agencies, that credit unions must manage is a concern that the NCUA must take more seriously and devote more resources toward addressing in a meaningful way. , ,

Fraud Losses Cost to NCUSIF

We should also more rigorously address the dramatic losses, year in and year out, to the National Credit Union Share Insurance Fund caused by fraudulent activity committed by a limited number of bad actors within the credit union community. . .

Editorial note: All these issues are still live in the industry today.

Revisiting NCUA’s Mission Statement

With a new leadership team on the horizon, might a first task be to review the NCUA’s Mission Statement?

As now worded:

“Provide, through regulation and supervision, a safe and sound credit union system, which promotes confidence in the national system of cooperative credit.”

Proposed Reframing: Putting Ends First

Promote a national system of cooperative credit by chartering and supervising a safe and sound credit union network.

Thoughts?

Wisdom from the Field

When you label your peers competition and fear them as such you are on the road to simply going it alone.

My confidence comes from the fact that traditionally “competition” is defined by two players racing in the same race.

I have no competition. For the race I am running is my own- my communities – our own reward.