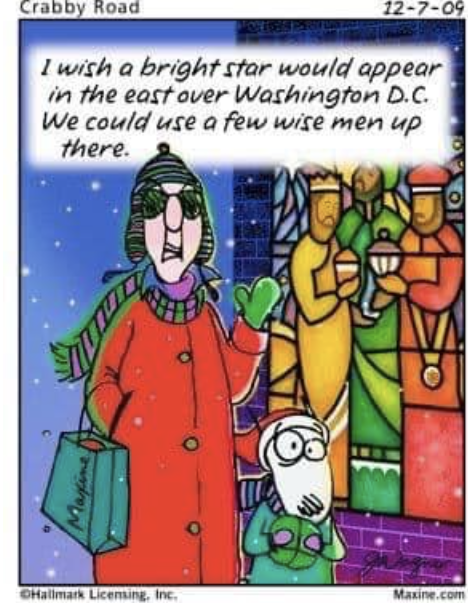

Excerpts from two perspectives for sustaining success as we head into the New Year.

“All social entities or movements need dreams, which can be defined as an indispensable capacity to envision a future for themselves that considers both the practical means at hand and a higher ideal. Societies that do not dream are doomed to die.

“We have no knowledge of any human community where men do fail to dream,” writes Irving Kristol. “Which is to say, we know of no human community whose members do not have a vision of perfection—a vision in which the frustrations inherent in our human condition are annulled and transcended.”*

Source: *Kristol, Two Cheers for Capitalism, pg 153

JPMorgan’s $4 Trillion Balance Sheet Widens Lead Over Rivals – Firm has added the equivalent of one Wells Fargo since financial crisis

“As the spring bloodbath among regional banks began, nervous depositors with more than $50 billion began showing up at JPMorgan’s door. Bank executives went on to raise expectations for net interest income four times throughout the year, eventually pulling in so much cash that managers have taken to warning of “over-earning.”

“That’s put JPMorgan on track for the biggest annual profit in the history of American banking. Analysts predict that by the end of this month, its annual net income will be 36% higher than last year.

“By comparison, the combined earnings of the next five largest banks looks to be about 1%. For JPMorgan and its chief executive, Jamie Dimon, it was a year like no other.” (Source: Bloomberg, December 27, 2023)

As we turn the calendar’s page, which approach will be your credit union’s priority?