On year ago I described the announcement that Colorado Partner Credit Union (CPCU) had arranged to sell its wholly owned CUSO (Safe Harbor), specializing in cannabis banking, to a Special Purpose Acquisition company (SPAC), or publicly traded company.

Serving the cannabis business has been a priority for some credit unions in states where the sale is licensed for several years. This past week credit union leaders and trade associations announced their continued support of changes in federal law to allow all financial institutions to serve the trade-which is now legal only on a state by state basis.

“CUNA said it supports the Secure and Fair Enforcement (SAFE) Banking Act, a bipartisan bill introduced in both chambers in April that would provide a safe harbor for financial institutions serving legal cannabis businesses.-from CU Today.

The Sale of Safe Harbor, a Cannabis CUSO

CPCU was to receive $185 million for selling its CUSO, $70 million in cash and $115 million in stock. Sundie Seefried – who created Safe Harbor cannabis business while the credit union’s CEO– would be the CEO of the new public company (NASDAQ: SHFS).

A $96 Million Turnaround In 90 Days

An immediate result of this September 28, 2022 closing was PCCU reporting a $55 million net income and an 8.7% ROA for the year ending December 2022.

This extraordinary gain occurred even as SHFS reported a $35.1 million loss for the year ended December 2022, compared to net income of $3.2 million in 2021. This result was described as “primarily due to the loss in value of several of the financial instruments placed in connection with the Business Combination.”

SHFS’s December 2022 balance sheet position resulted in the following “going concern” comment by auditors:

Liquidity and going concern

As of December 31, 2022, the Company had $8,390,195 in cash and net working capital of ($39,340,020), as compared to $5,495,905 in cash and net working capital of $5,922,023 at December 31, 2021.

Included in the working capital deficit at December 31, 2022 is $25,973,017 current portion of the long-term payable owed to the seller, PCCU, from the aforementioned business combination, and $14,359,822 deferred consideration current portion related to the Abaca acquisition. The Company has also incurred a significant cumulative consolidated operating loss for the year ended December 31, 2022.

Based upon these factors, management of the Company has determined that there is a risk of substantial doubt about the Company’s ability to continue as a going concern for a period of at least twelve months from the date these consolidated financial statements have been issued.

Results at March 2023

In the March quarter of 2023 CPCU reversed much of the 2022 gain on Safe Harbor’s sale resulting in a $41 million loss. The credit union’s net worth ratio between the two quarter ends went from 20.9% to 14.7% as of March 2023. Its total assets were $699 million which included new subordinated debt of $3.1 million and notes payable of $27.5 million.

The loss was due to a restructuring of the sale terms for CPCU as described in an SEC filing and company press release:

On March 29, 2023, the Company and PCCU entered into a definitive transaction (Refer to Note 22, “Subsequent Events,” of the consolidated financial statements) to settle and restructure the deferred obligations, including $56,949,800 into a five-year Senior Secured Promissory Note (the “Note”) in the principal amount of $14,500,000 bearing interest at the rate of 4.25%; a Security Agreement pursuant to which the Company will grant, as collateral for the Note, a first priority security interest in substantially all of the assets of the Company; and a Securities Issuance Agreement, pursuant to which the Company will issue 11,200,000 shares of the Company’s Class A Common Stock to PCCU.

This restructure was driven by the SHFS’ financial position. CPCU is now the majority owner of voting stock (55%) and CEO Douglas Fagan is on the SHFS’s board.

SHFS’s First Quarter Earnings Call

On Tuesday SHFS reported its first quarter earnings with an 8-page press release. The financial results show revenue of $4.2 million, operating expenses of $5.8 million and an operating loss of $1.6 million.

The release also provides operational highlights and a 2023 financial outlook. During all of SHFS’s nine years building the cannabis business, CPCU has been the primary banking partner. This means revenue from all the deposits, loan funding and investment returns are shared with the credit union under a services agreement detailed in the company’s SEC filings.

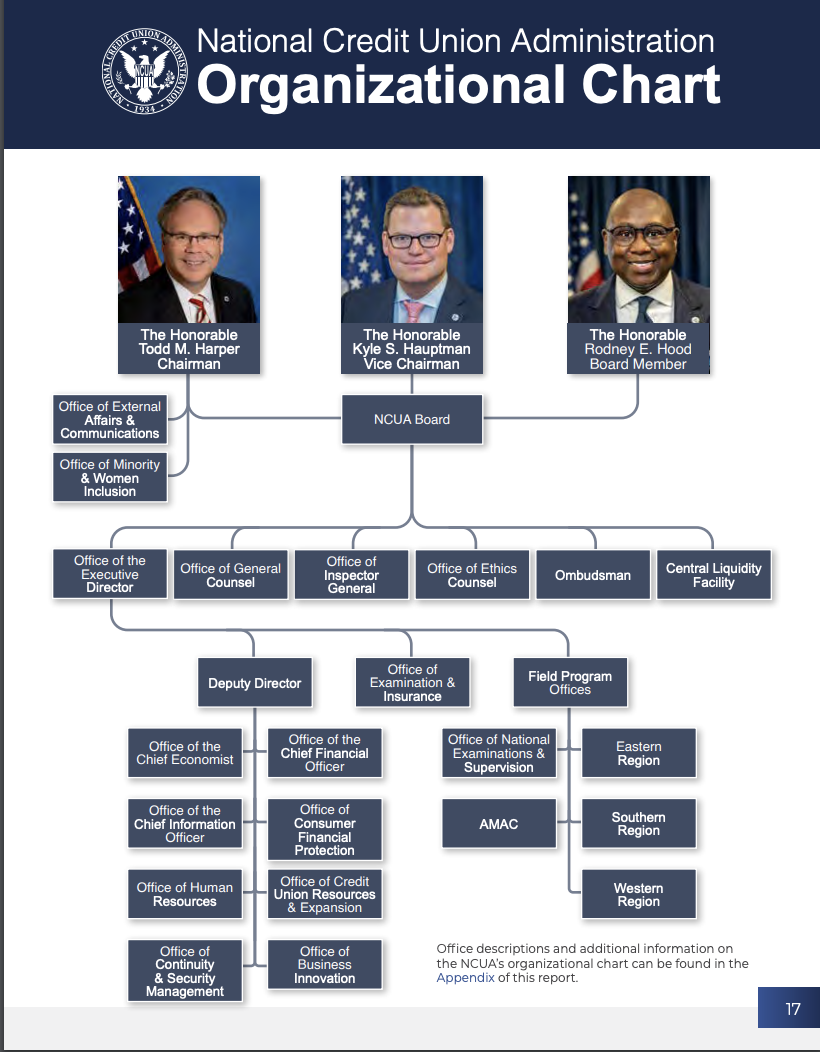

Credit Union and banking partners are key to SHFS’s business model. As descried on the website, the firm is a “financial technology company, not a bank. Banking services are provided by contracted NCUA or FDIC insured financial institutions. Some non-deposit products and services are not covered by FDIC or NCUA.”

On May 11, 2023 SHFS announced another partnership with Five Star Bank in New York that it said will add up to $1 billion in additional deposit capacity. SHFS plan is to scale the business.

External Contexts & Cannabis Opportunity

SHFS’s future is uncertain.

The firm’s stock price is reported daily on its website. The stock’s value since the “business combination” has declined from a peak of just over $10 to yesterday’s close of $.38. The total market capitalization of the company has fallen from over $300 million to $15.7 million at yesterday’s close.

However, SHFS is not alone in its extended financial condition.

SHFS’s public offering via a SPAC transaction was a way to truncate the time, expense and investor scrutiny of a traditional public offering (IPO). As reported in an April 27 WSJ article, SPAC’s Are Running Out of Money.” The story’s lead reads: ”The SPAC boom took hundreds of risky companies to the stock market. The next stop for many is bankruptcy court.”

The article’s implication is that the SPAC process to take a private company public, may short cut a more rigorous traditional IPO due diligence and valuation process.

Another external factor could also be important. SHFS is the front end, or entry platform, for cannabis related businesses accessing financial services. The following is SHFS’s business value proposition: Our services allow Cannabis Related Businesses (herein referred to as “CRBs”) to obtain services from financial institutions that allow them to run their business more efficiently and effectively with improved financial insight into their business and access to resources to help them grow.

Due to limited availability of payment and other banking solutions for the cannabis industry, most businesses transact with high volumes of cash. Our fintech platform benefits CRBs and financial institutions by providing CRBs with access to financial institutions and financial institutions access to increased deposits with the comfort of knowing that those deposits have been compliantly monitored and validated. . .

A recent WSJ news story suggest that Legal Cannabis Can’t Compete because licensed sellers are facing steep taxes and regulation. In states like California (and New York) the article reported unlicensed sales were almost eight times licensed sales.

In many states cannabis began and still is an underground business. So even when either federal or state authorization is achieved, suppliers may wish to retain their business anonymity.

Tomorrow I will analyze what some of the learnings credit unions may take from this the effort to “spin off” this credit union created business to become a publicly traded company.

How did cash decline so quickly following the combination? How dependent is the CPCU on SHFS’s business?

The details of SHFS’s history from SEC filings for this transaction and subsequent updates offer, I believe, instructive insights for others who may harbor similar ambitions.