Much public discussion today debates whether the disruption led by the Trump administration is a turning point in history or just part of a cycle.

Many established institutions are confronting new financial and political realities. Large legal firms, major universities, public and private media have seen long held assumptions about their operations and purpose open to political and monetary challenge.

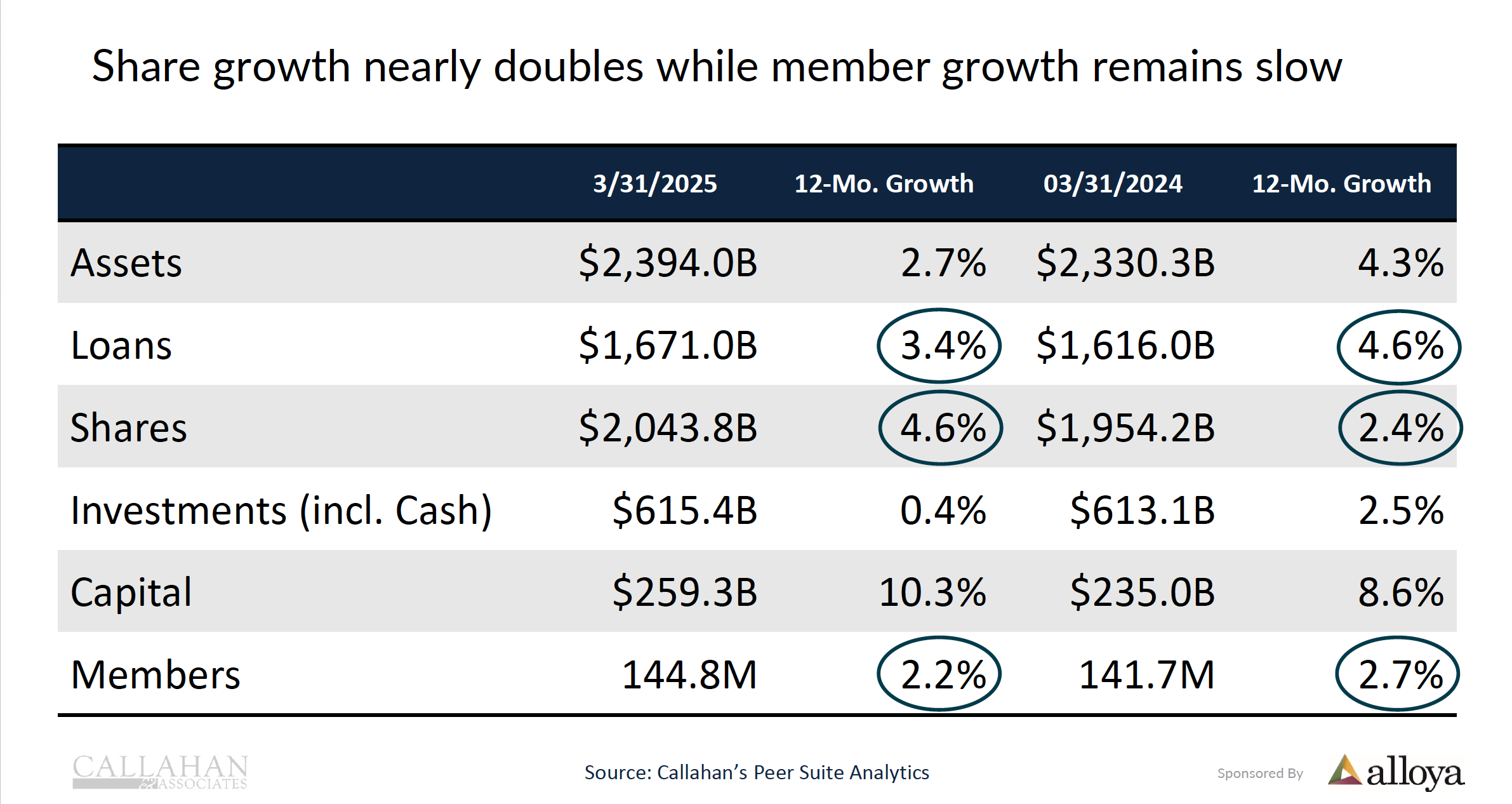

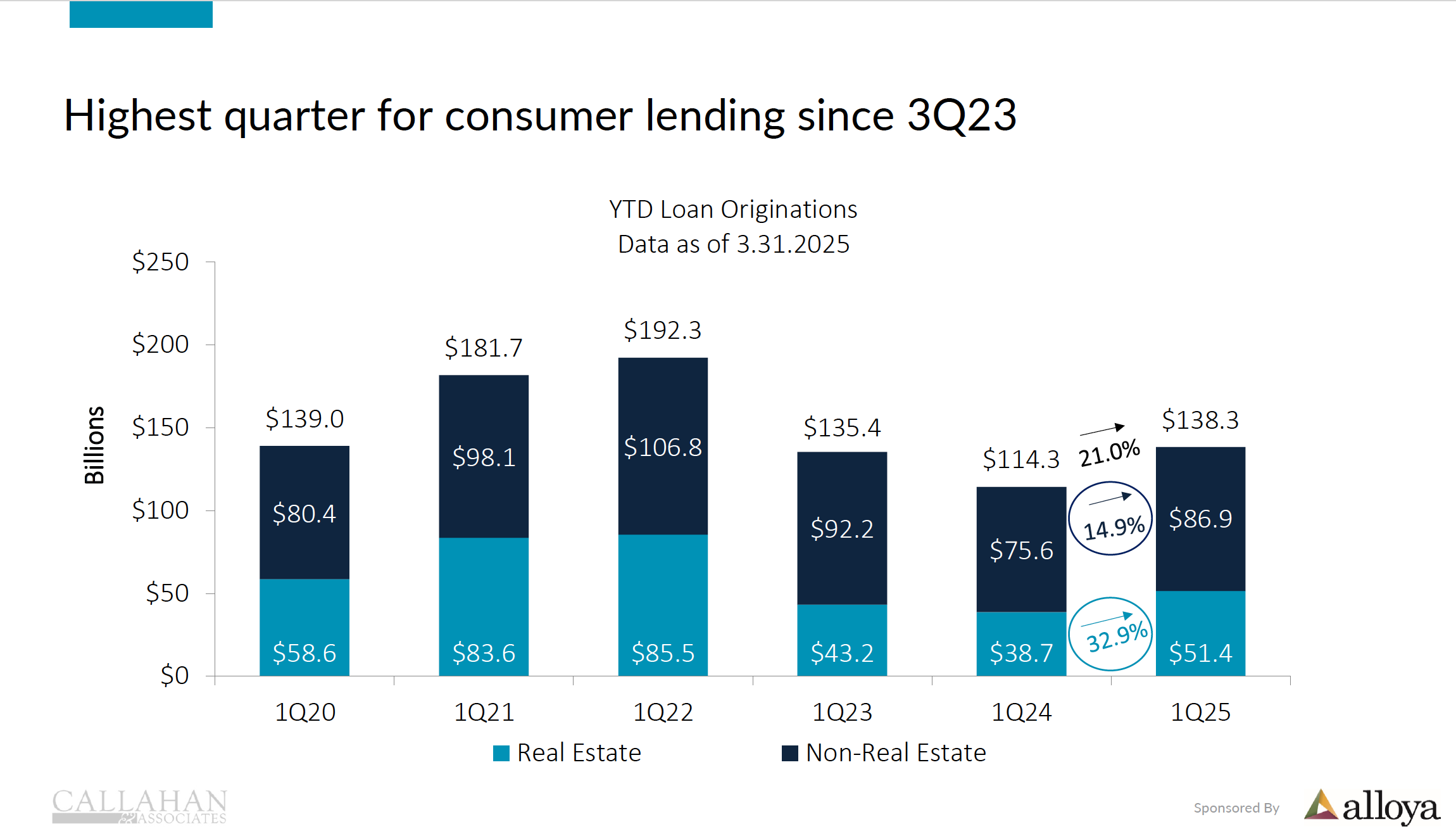

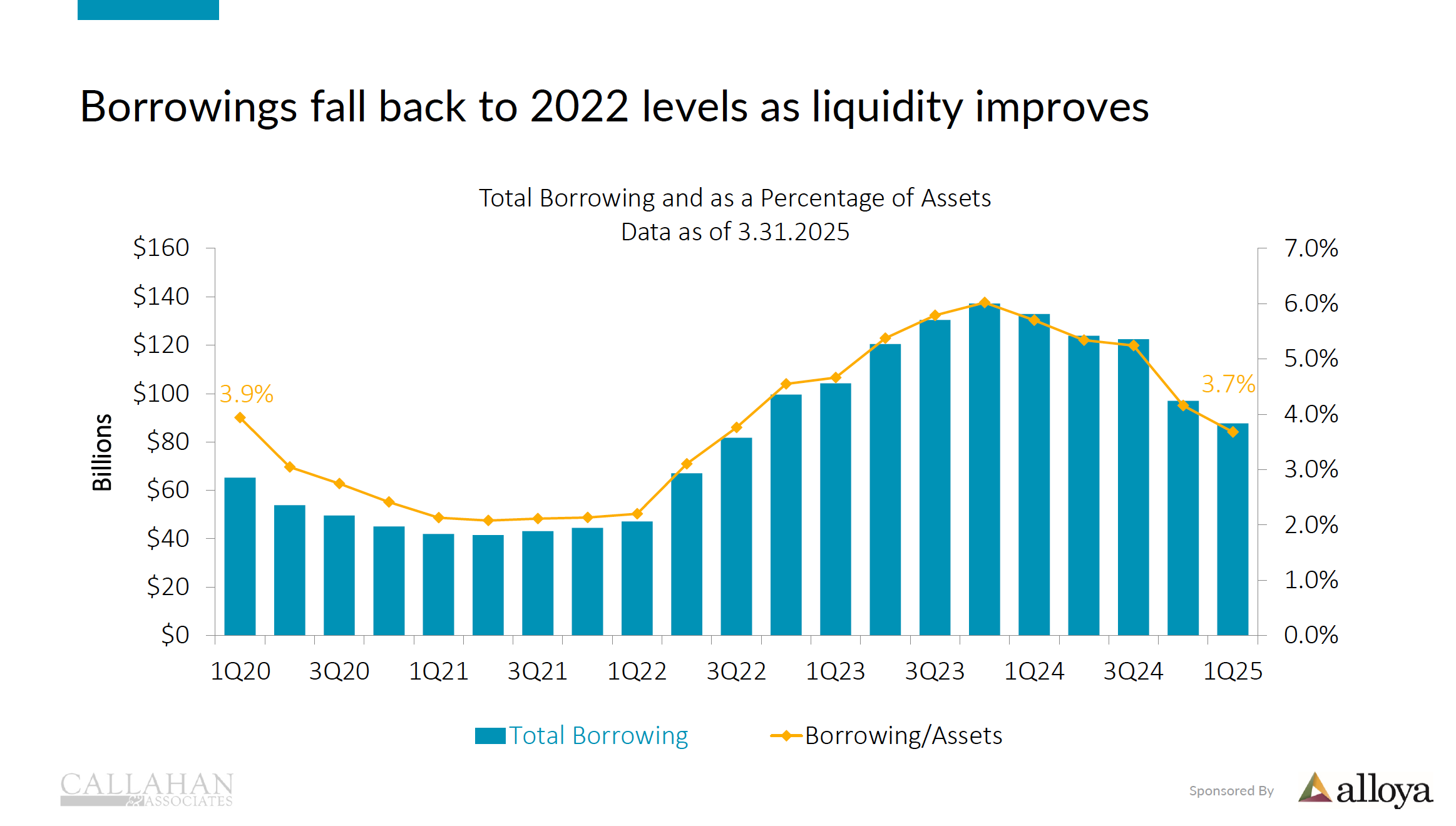

Credit unions are having “modest” internal debates about the propriety of mergers with million dollar payoffs to the initiators, increasing acquisitions of tax paying banks, and whether there should be any limits at all on financial services. I say “modest” because most effort has focused on saving the tax exempt status even as future issues remain unaddressed.

A CEO at the World Credit Union Council meeting asks if it’s time to question where credit unions are going (as reported by Frank Diekmann):

‘I’m here, in part, to make an appeal to all of us as cooperatives and as credit unions that it’s time for us to stand up again. For many of you, your credit union was rooted in a time where your community needed change, it needed support and it needed help. That might even be very recently.

But for many of our credit unions that have become more mature, we have perhaps become a little bit complacent about how we’re seeing ourselves play a role in supporting our communities. Once again, they’re needing us and the call to action is here,’ Wellington Holbrook, CEO of Vancity Credit Union World Council of Credit Unions

An Opportunity to Hear from Leadership

Tomorrow the Texas Credit Union Commission will hold one of its required public meetings beginning at 9:00 a.m. at the Department’s office. (see login information at end)

The Commission is the policy making body for Credit Union Department-CUD. The Commission is a board of five public members and four credit union executives appointed by and responsible to the Governor of Texas.

The mission of this politically appointed group is to safeguard the public interest, protect the interests of credit union members and promote public confidence in credit unions.

Its members incude both credit union professionals and private citizens: Jim Minge, Chair; Becky L. Ames; Elizabeth L. “Liz” Bayless; David Bleazard; Karyn C. Brownlee; Beckie Stockstill; Cobb Cody; R. Huggins; David F. Shurtz and Kay Rankin-Swan.

Tomorrow’s meeting will be one of the few public opportunities for credit unions to hear how their appointed policy leaders assess current trends and events under their purview.

They have an important role not just in Texas, but nationally. NCUA’s solo board leadership considers public meetings as “only when needed” preferring to keep the industry updated on his views via social media posts.

Texas not only has a thriving and large state chartered credit union system. It also has prime examples of two unsettling credit union trends: buying banks and self-serving mergers.

The Commission has a front row seat to both these events. How does the recent Space City-TDECU merger conform to their mission to protect the interests of credit union members?

This was an event marked by egregious self-dealing ($6.750 million bonus to CEO and two senior staff), conflicts of interests, $850,000 in payments by TDECU to the two principals of Space City and misleading information including use of its brand name. (link)

At the very time this merger was completed, TDECU was on a downward financial spiral. It was denied, or withdrew its application to by the Many, La.-based $1.2 billion Sabine Bank (link) announced in April 2024.

There is no evidence in the Space City merger that the CUD in the words of mission acted: to safeguard the public interest, protect the interests of credit union members and promote public confidence in credit unions.

Is this the Commission’s View of the Future of Credit Unions in Texas?

In September 17 and 18, 2024 Houston Business Journal interviews, TDECU CEO Johnson was clear about his ambitions for the credit union and the coop system’s future:

TDECU — soon to be Space City Financial following its merger with Space City Credit Union — wants to become a top-20 credit union in the U.S. by 2034, President and CEO Isaac Johnson said. . .Iowa-based GreenState Credit Union is currently the 20th-largest credit union with $11.1 billion in assets, according to U.S. News & World Report.

To reach its goal, Johnson said the credit union needs to continue focusing on inorganic growth and “take some leaps.” . .“To get to $11 billion within the next 10 years, it’s possible to do it through just organic growth, but upon studying those top credit unions, most of them got there through acquisitions, mergers and organic growth,” Johnson told the Houston Business Journal. “We cannot double down and just do it organically.”. . .

“The merger with Space City Credit Union is a signal to other credit unions that TDECU is open to additional mergers and acquisitions,” Johnson said. “The credit union industry is consolidating as regulatory burdens and other costs increase, a trend Johnson expects to accelerate. TDECU plans to be active in that environment,” he said. . .

“For Space City Credit Union, the merger is ideal from a succession-planning perspective as President and CEO Craig Rohden prepares to retire after leading the organization for 30 years. It also allows both credit unions to grow and scale at a time when regulatory burdens and the costs to compete with other financial institutions are increasing,” Johnson said. . .

“TDECU will focus on closing its merger with Space City Credit Union and acquisition of Sabine State Bank & Trust before making any more deals, Johnson added.

“As the credit union industry continues to shrink — and generally the banking industry continues to consolidate — we want to be that beacon to say, ‘We would like to partner with you. . .” Johnson said. . .

“Credit unions have historically focused on consumer lending, so having “credit union” in the brand implies a limited scope of what the organization may be able to do. With the word “financial,” it more accurately represents the full range of products and services TDECU offers,” Johnson said. . . .

“We must grow. If we do not grow, we will become one of those credit unions that are consumed or have decreasing membership,” Johnson said. “What we’re doing now is ensuring that we have an ongoing credit union for the next 100 years.”

Stand Up or ????

CEO Johnson’s point of view is certainly one of several animating credit union leaders today. What will the commission say about this overt institutional goal devoid of any reference to members or their best interests. Just institutional glory, dominance and national growth. It should be noted that TDECU has its third board chair in the last four years.

Tomorrow’s Commission meeting will give Texas credit unions insight into the policy of their state regulator. Will Johnson’s philosophy of grow or die be addressed? Or will the commission embrace the words of CEO Holbrook , “it’s time for us to stand up again.”

Information to join the meeting:

The Credit Union Department Commission Meeting is scheduled for Friday, July 18, 2025 at 9:00 AM (central time zone)

The Agenda (link)

Microsoft Teams Need help?

Meeting ID: 234 324 784 323 7

Passcode: Tr2qH72w

Dial in by phone

+1 936-213-5778 United States, Waller

Phone conference ID: 773 558 893#