As the CEO of America’s second largest credit union for 37 years, Jim Blaine had the unusual skill of translating simple cooperative concepts into profoundly valuable benefits for members.

Every member received the same rate for the same kind of loan. Believing home ownership was vital to members’ financial security, he designed a 100%, non-conforming first real estate loan for any member with a simple explanation: “Why compete with the government?” (Fannie/Freddie conforming products)

He railed against FICO-determined lending decisions and risk-based loan pricing. This early use of “artificial intelligence” offended his belief in the uniqueness of each person. Character and judgment, not computer algorithms, should be the basis for granting credit to members.

Words Matter

In addition to steering State Employees North Carolina Credit Union, Jim was a wordsmith. His blog, and his talks, were audacious, controversial, fun to read and based on core principles. “Sometimes wrong, but never in doubt” was his tagline. His writing style and graphics were intended so that a reader immediately got the message.

He understood that a leader’s influence was in direct proportion to one’s ability to communicate. To the entire crowd: fellow-believers, opponents, the uninterested and the unwashed, meaning those who corrupted cooperative values for self-interest.

Some of his most scathing and widely read observations were about NCUA, a government agency which believed that its core purpose was to tell credit unions what to do, or not do. Examiners would constantly challenge Jim’s traditional implementation of credit union purpose. He would use the agency’s own words and facts to demonstrate the lunacy of their demands. When he dared to break the code of silence NCUA imposed on examiner ratings and publish his credit union’s score, the regulator wreaked vengeance on the entire North Carolina state-chartered system.

Jim’s most enduring gift to the “movement” may be his writings. As Churchill stated: “Words are the only thing that lasts forever.”

The Course to Be Pursued

In an inaugural address more than 157 years ago, the speaker gave “a statement of a course to be pursued.” That course concluded with this purpose: “with charity for all; with firmness in the right, as God gives us to see the right, let us strive on to finish the work we are in; to bind up the nation’s wounds. . .to do all which may achieve and cherish a just and a lasting peace among ourselves. . .”

Lincoln used 722 words in 1864. Jim’s 503 words address the legacy Lincoln hoped the civil war would resolve.

Jim speaks to the goal of a “lasting peace among ourselves” based on economic fairness and justice, core principles of the cooperative ideal. Diversity, equity, and inclusiveness are matters of the heart, much more than policy; something to practice in your life, rather than just preach.

Jim followed his own drummer when leading his credit union. I believe these latest words will inspire all and even provoke some to answer his closing call for individual acts of rebellion!

Blaine’s “Inaugural” Address

(March 18, 2021)

“I am truly grateful to the African American Credit Union Coalition for this honor. The organization is remarkably successful and on the rise! I have known many of its leaders for a lifetime and have often sought, and even heeded, their advice! We shared a common bond – a belief in credit unions.

My life has been centered around my family, my wife Jean, and credit unions. Why credit unions? Because I could never accept that in America those who had the least and knew the least should pay the most for financial services. I believe that credit unions were created to correct that injustice. In the words of Thomas Paine – a true revolutionary in all respects – “I have always objected to wealth achieved through the misery and misfortune of others”.

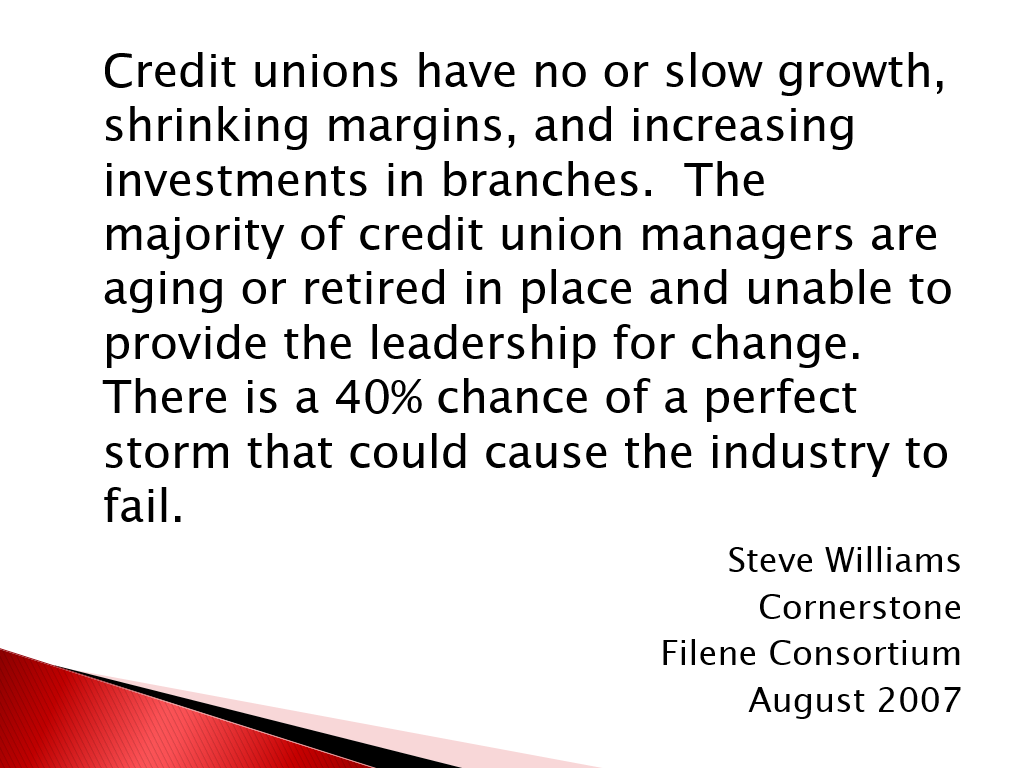

That economic injustice continues to thrive in our financial system today. Credit unions remain the alternative, the best hope, the answer.

We all confront an uncertain future, and many folks would like to rewrite the past. You and I know we cannot change the past. But if we have credit union leaders with integrity, courage and character; we most certainly can reshape the future…but changing the future is very hard work. Arthur Ashe, the great American tennis player, described the credit union leaders we need. Ashe said: “True leadership is not the urge to surpass all others at whatever cost, true leadership is the urge to serve all others at whatever cost.”

One word of caution as we look to the future and choose our new leaders; let’s make sure that diversity, equity, and inclusion is not a false guide, a false prophet. Can we really tell how diverse a credit union is by looking at the faces of our boards and leaders? Choosing our leaders by their race, their gender or their age is the old way – more of the same. We need a new way for credit unions.

And, the new way is to judge people not by how they look, but by how they think. As a famous preacher – I believe his name was King – said over fifty years ago: “Hopefully my children will be judged by the content of their character.” Yes, let’s truly diversify and choose leaders based upon the content of their character. That is a more difficult, complex task, but our future depends upon it.

By the way, if you want to get a jump on reshaping the future, try starting a little personal revolution of your own. Next time you are filling out a form and come to the question of “Race?”, drop down to “Other” and write “Human”. When you reach the ethnicity question, drop down to “Other” and write “American”. And of course when you reach the question on “Sex”, drop down to “Other” and simply write in “Yes!”….and the world will begin to change!

Onward and upward – for all!… With the African American Credit Union Coalition leading the way!

Thank you again for this honor.”