It is accepted as a foregone conclusion that Uber and other shared ride platforms will eventually destroy the taxi medallion industry.

There is no contesting two facts at the moment:

- Ride sharing is a very popular and important addition to the public transportation industry.

- Medallions have been significantly devalued as collateral for lenders.

As a consequence of number 2, financing for taxi medallions has dried up in most cities. This means that medallion sales are now primarily on a cash only basis, which further lessens the value below what their actual earnings potential might be.

But will Uber and its competitors actually eliminate taxis as one form of public transportation in major cities? Recent events suggest that the future viability of ride sharing services is still uncertain.

Financial Performance as Public Companies

As Lyft and Uber are now public companies, they are filing quarterly financial reports. Neither company has ever made a profit. As one reviewer wrote about the Lyft IPO, the company loses money on every ride it makes.

Uber lost $5.4 billion in the 2019 second quarter. Lyft’s losses for the same quarter were $644 million.

The Driver Challenge

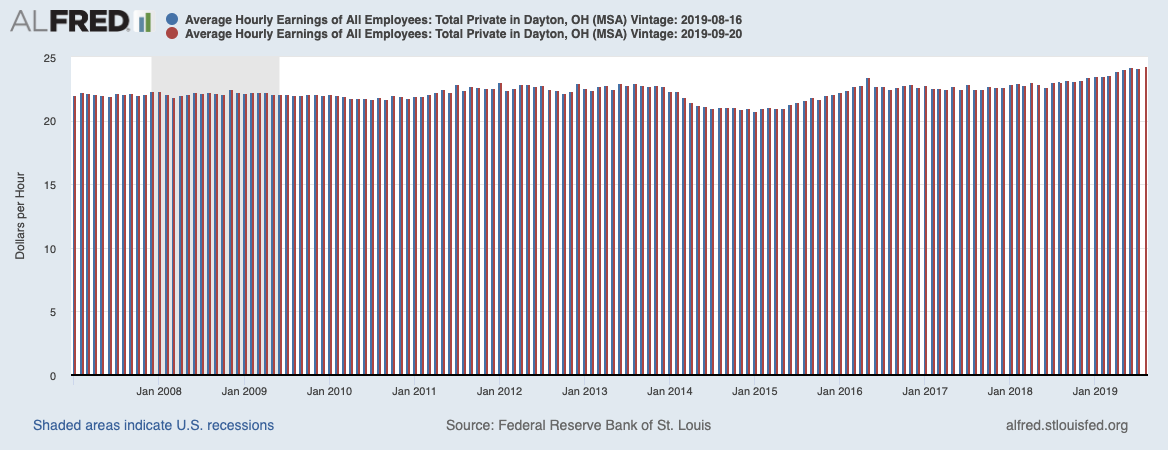

This week, on the dominant local news and weather radio station for D.C., WTOP, Uber broadcasted an ad. Not for passengers, but for drivers. The ad stated that drivers would have a guaranteed income of $2,700 in their first 90 days. All they had to do was complete 400 rides. Even if that did not add up to the guarantee, they would still be paid that amount. That guarantee equates to an annual income of $10,800. If only the minimum total of 400 was completed, the average charge per ride would have to be $27.

If a driver had to work a 40 hour week to achieve this ride total in a 90 day period, that would work out to $5.65 per hour before taking into account any operational expenses from using one’s auto. If the rides could be done in half that time, the rate would be $11.25 per hour, fewer expenses. Still way below DC’s minimum wage law.

At a time of historically low unemployment, finding drivers for ride sharing firms will likely continue to be a challenge. Maybe that is why Uber leads this employment ad with an income guarantee.

The Uber Culture

In a new book, Super Pumped, the Battle for Uber, author Mike Isaac tells the story of the company’s early years led by founder Travis Kalanick. In the words of the book review by Leslie Berlin, “Kalanick understood that Uber could succeed only if it grew faster than any competitor, attracting large numbers of riders and drivers in cities across the globe. He let nothing get in the way of that growth–not the livelihood of the drivers, not the health and welfare of employees, not the counsel of his own advisers, not the laws and regulations of multiple states, and not the rules of Apple’s app store. He hired former NSA, FBI and CIA employees to spy on competitors.”

The review proceeds to describe the undoing of Kalanick by a number of individuals who revealed the toxic culture that had been created.

Disruption Is Not Necessarily Terminal

The future resilience of ride sharing systems, and their systematic underpricing of taxi rates, has disrupted the regulatory monopoly that taxi licensing system created. But it is not clear that the taxi industry will in fact be killed, and that the subsidized, financially losing strategy of ride sharing companies will wipe out their regulated competitors.

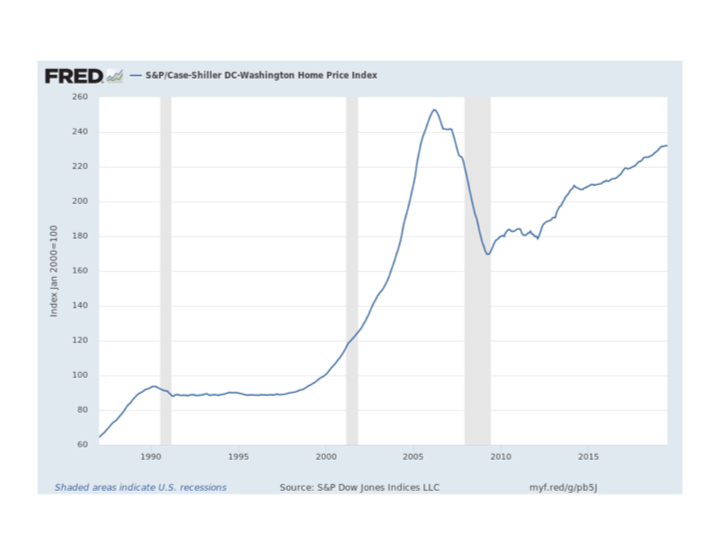

Hedge funds are reportedly buying up taxi medallions in New York for cash. Just as was done in the 2008 housing crisis, investors are coming in, paying cash at the low point in the valuation cycle, hoping to turn an above average return, when the market normalizes.

So the taxi medallion story is a long way from being over, even though there will be painful adjustments in the interim.