Silent Night Ends with Sonrise

One CEO’s Vision for the Coming Decade

“I hope that it will look like a “back-to-the-future” revolution. Back to the most basic of cooperative design principles, alive and well. Those concepts move front and center in the organizations driving our futures.

And they are actively promoted by regulators, examiners and auditors of our operation.

I would hope that organizations, both small and huge, will capture the attention of cooperative owners in a way that truly radiates a win-win with the consumer side. “Do no harm” will be our thinking. A respect for our community will drive our entrepreneurial spirit to leverage our financial power more broadly.

We will cast aside our centralized thinking about what is relevant and put upon so many today. Instead we embrace the spirit that every charter is relevant for the simple fact that they willed their CU and its future into the mix.

Bottom line: It will be an industry with a resurgence of purpose over the balance sheet score cards of today.”

Crisis and Important News

All Credit Unions Start “Small”: The Winner, the Message, the Challenge

Question from the November 16th blog: Can you identify the credit union whose initial name is shown in the image below?

Answer: Boeing Employees CU chartered December 7, 1935.

The “cooperative historical scholar” with the answer was Kathy Tichenor, CLO, Pasadena FCU.

Kathy has been in the credit union movement for over 40 years. Working on her credit union’s founding anniversary she was curious who else had also been around for 85 years or more. She discovered BECU in that research.

She describes herself as “a true believer of why we are here and who we serve” and reminds staff continuously about our roots and how far we have come.

Her message is “we are here for the financial health of our members especially when help is needed during financial distress, sickness and hard times. If I am not assisting a member, I am assisting someone who is.”

BECU’s Founding

Here is the brief beginning from the credit union’s web site:

In 1935, new employees for The Boeing Company were required to purchase their own tools before they could start work. This was the height of the Great Depression. Finding money to buy tools was an insurmountable burden for many prospective employees. A Boeing employee, William Dodge, read an article in Readers Digest about the difference that credit unions were making across the world. Inspired, Dodge got a group of Boeing employees to talk about starting their own credit union. The first loan was for $2.50 to buy tools. https://www.becu.org/members-matter/about-membership/becu-history

BECU Today

With the deposit of 50 cents from each founding member, today the credit union is $25.7 billion in assets. It serves 1.3 million members and employs over 2,405.

The founders’ vision was to help fellow workers during the depression buy the tools necessary for a job at the Boeing Aircraft Company. Their plan was cooperative self-help, a vision that is still the foundation for this billion-dollar cooperative.

Every credit union rests on this same foundation. All start small relying on sweat equity and the communal impulse to aid one another. A few will grow large, most will not. But all demonstrate the power of a vision that inspires and creates legacies benefitting future generations.

From thousands of small seeds, tall trees may grow.

Today’s challenge: are these seeds still being planted? See following blog for why this founding spirit still provides a vital example for today.

The Pervasive and Invasive Power of Social Media

In September Netflix released the film The Social Dilemma.

The documentary portrayed the ever expanding influence of social media platforms focusing on Google and Facebook. These services track everything we do online. They store our activity, use AI to create individual profiles, and use algorithms to influence our future behaviors.

Your time on their sites is converted into advertising dollars for marketers, politicians, and influencers seeking specific consumer interests or needs.

The film builds its credibility with interviews from many individuals who worked on the inside of these companies as well as examples showing real world impact. Fake news, for example, spreads six times faster than true stories. One result is growing disinformation and conspiracy falsehoods.

The message is how the computer power in your pocket is changing your behavior, even to the point of addiction.

The film should make a viewer more aware of the manipulative and darker potential of our dependence on technology.

A Close To Home Example

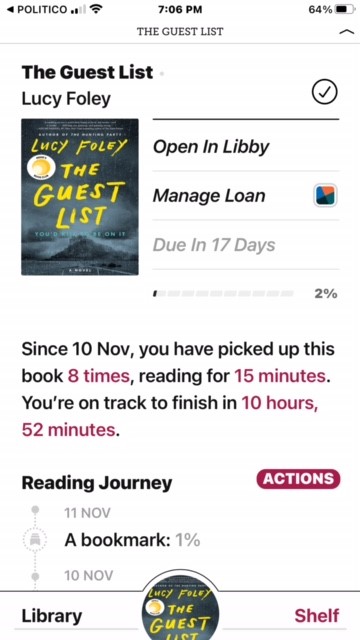

Platforms using AI to inform or influence are not limited to social media. My wife belongs to several book clubs, Her preference is to read books online versus hard copy.

The public library is her fist choice as e-books are free even though time limited in check out.

Recently she received he following email updating her most recent on line borrowing:

A Benefit or a Concern?

She showed the email to me and asked my reaction. The idea the library was monitoring her reading activity raised concern. Meant to be informative, it also demonstrated how a third party can tell you something about yourself that you may not be aware of. What else might the library be tracking and who has access to this data from a public institution?

Every day credit unions store data on their members’ activity that they analyze to better serve them individually and collectively. How members perceive this proactive use of their information can help build or undermine the trust foundation essential in all relationships. Even if intended to be a positive, helpful suggestions can raise concerns. Fr example, how did you know I was laid off?

One way to enhance trust is to be transparent by announcing in advance how you will try to add value beyond traditional transactions. My wife’s concern was due in part because she had no knowledge this reading summary was available. Would your members be surprised by any of your communications that rely on the selected knowledge you compiled about their financial activities?

Revisiting NCUA’s Mission Statement

With a new leadership team on the horizon, might a first task be to review the NCUA’s Mission Statement?

As now worded:

“Provide, through regulation and supervision, a safe and sound credit union system, which promotes confidence in the national system of cooperative credit.”

Proposed Reframing: Putting Ends First

Promote a national system of cooperative credit by chartering and supervising a safe and sound credit union network.

Thoughts?

Wisdom from the Field

When you label your peers competition and fear them as such you are on the road to simply going it alone.

My confidence comes from the fact that traditionally “competition” is defined by two players racing in the same race.

I have no competition. For the race I am running is my own- my communities – our own reward.