A colleague sent me this report from the IBM Institute of Business: “COVID-19 and Future Trending Insights”

It summaries five ‘epiphanies’ from multiple surveys of leading executives.

“Our research suggests five key discoveries for the post-pandemic business landscape offering new perspectives on digital transformation, the future of work, transparency, and sustainability. Together, they provide a playbook for proactive leaders who understand that old ways of working are gone.”

My take away for credit unions

The fourth epiphany is the one that could be most relevant to coops.

“Epiphany 4: Some will win. Some will lose. But few will do it alone.”

The conclusion on page 6 reads:

“Within sectors, expectations are growing that broader reach will help define winners. Our data also point to greater reliance on platform business models and partner networks, with 70 percent of executives planning significant partnering activity inside their industry and 57 percent looking outside. Either way, they expect such participation to grow more than 300 percent over the next two years compared to two years ago.”

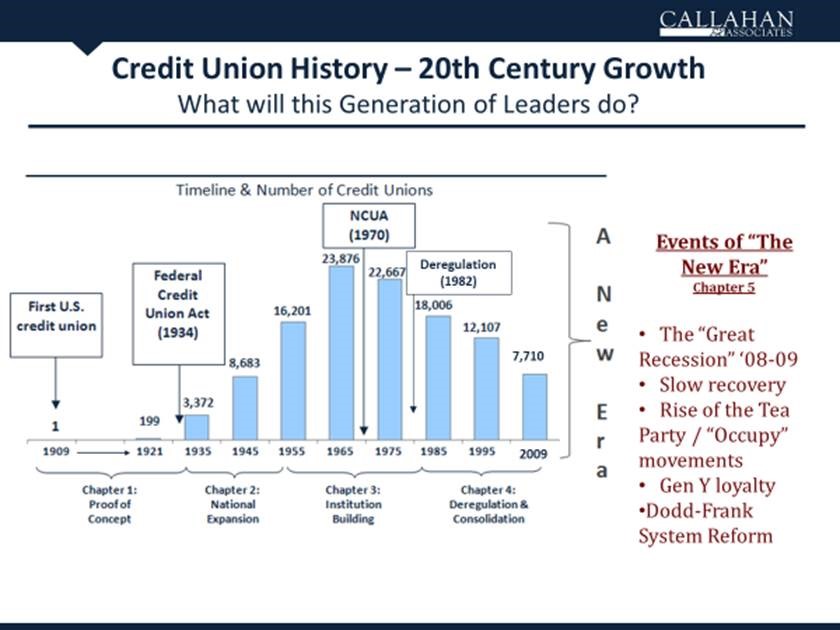

The graph illustrating this executive intent is headed as follows:

“Businesses are partnering up

Executives say they plan to participate in platforms, ecosystems and partner networks significantly more in the future than before or during COVID-19.”

The strategic question for credit unions: Who are the “partner networks” that are critical to your future?

One CEO phrases the challenge this way: “As we face the future, you cannot make the mistake of dreaming about going it alone as the next step. The next step is always best served by your faith to go at the edge through collaboration.”