Preface:

This is a long blog, so I will summarize the main points for readers.

- Four senior employees and one newcomer of 121 Financial Credit Union will receive a minimum of $9,416,600 in future guaranteed salaries and benefits for merging their credit union with VyStar. The required disclosures were less than a tenth of this number.

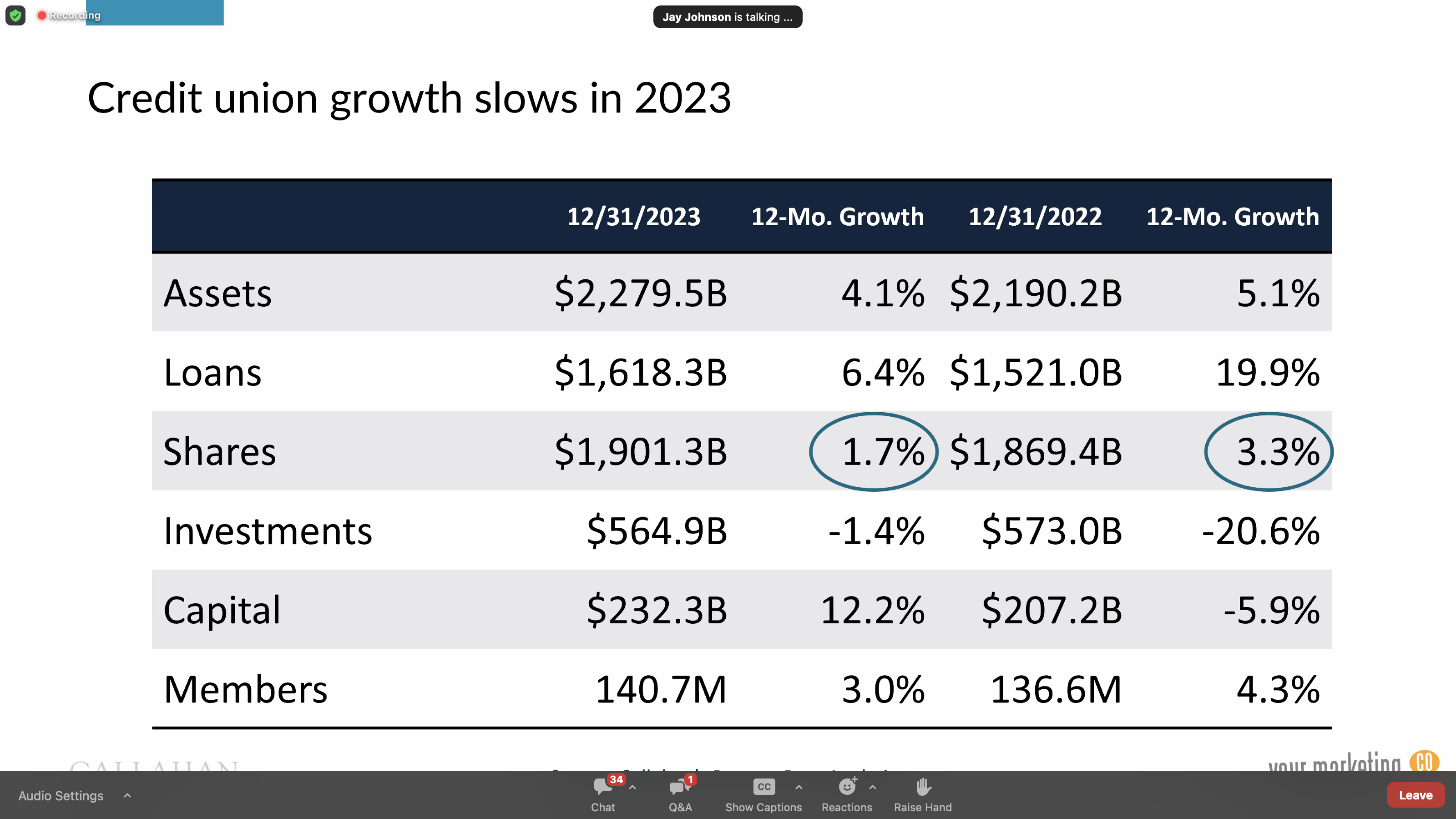

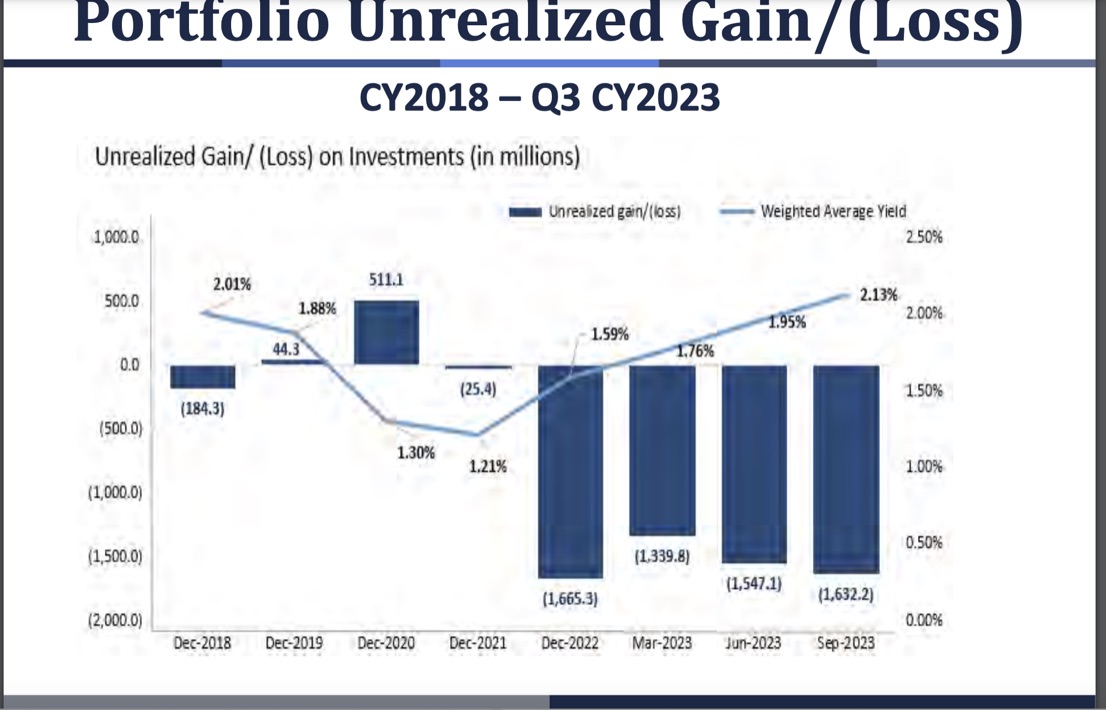

- VyStar is a credit union in a financial stall. Peak shares occurred in the first quarter of 2022 at $11.2 billion; at yearend 2023 they were $10.1 billion. At that point, VyStar reports total borrowings over $2.6 billion including $200 million (corrected from earlier billon) in subordinated debt to boost its capital ratio. It bought a $280 million Florida bank in 2019 creating $28 million in goodwill, which suggests a price of approximately twice book value. It announced its intent to purchase HSBI in 2021 for approximately 1.8 times book. The transaction was cancelled in mid 2022 for failure to “receive timely regulatory approval.”

- In this merger, Vystar eliminates its very effective local competitor that has managed to secure 38% of its members who also have VyStar accounts. And it gets paid $65 million in new capital versus giving cash to the credit union owners, as would be the case for bank owners, at multiple of their book value. At year end 2023, VyStar’s ROA was .18% and its ROE 2.6%-both in need of this instant boost from this free gift of $700 million in assets.

- Other than the five employees listed, the remaining 130 are guaranteed nothing as they become a very small part of an organization which has 2,260 employees and whose locations will overlap some of 121’s existing branches.

- The members no longer have a choice of credit unions. This matters. In 2023, 21% of VyStar’s funding was from borrowings and $10 billion (79%) in member shares. However when expensing the funding, the credit union paid 53% of its costs to the lenders and only 47% to the members whose savings are provided 80% of funding VyStar is in thrall to external funding.

In contrast, 121 Financial has borrowings equal to 14% of its funding liabilities. However, it paid 60% of its funding costs to members and 40% to lenders. Members no longer get to choose the better deal which is why these combinations are accurately described as anti-competitive.

- NCUA is mentioned twice in the merger document. First as a place to post comments “to share with other members”– a digital and street address is given. And again when “NCUA regulations require merging credit unions to disclose certain material changes in total compensation or benefits” the implication is that the regulator has reviewed the disclosures and announcement and that everything is being done according to Hoyle.

That is not the public rhetoric of Chairman Harper, who sees himself as an exemplar of consumer protection. Just last month in a credit union conference in Hawaii he talked forcefully about the need for credit unions to reexamine their overdraft fees (over which the agency has no authority) and reduce them when they unfairly charge members for the service.

The new board member Otsuka is a lawyer and has worked at the FDIC. She should understand what the “slow walking” by regulators of an application, for example to buy a bank, means. Also the fiduciary standards of directors for the “duty of care” and “duty of loyalty.”

An Election with No Vote Tally

Both may hide behind NCUA’s standard position, “well, the members voted for it.” However when members who opposed the merger asked to watch the votes as they were counted, the answer was no. When they requested the final tally, the answer from staff was the vote would not be released and the ballots had been destroyed.

Once again democracy, in this case, credit union cooperative democracy goes to Florida to die. Abetted by those appointees who champion the rights of consumers.

Why I am Writing about This

After the vote was announced I received two calls in early February from 121 members who were very, very angry. They had put up spirited opposition including a website Stop the Merge and spent their own money on advertising. They claimed to have been threatened in their employment if they continue to speak out after the vote. All of their results from a mock online poll showed members opposed.

They had spoken to NCUA before the vote and had calls returned, but not any longer. Their anger was palpable; they trusted no one; they did not have the ability to make their own case rationally.

They saw this event as a breach of trust by the credit union officials and the governmental oversight system that was supposed to protect them. Neither caller had first hand knowledge of the credit union system or its press. All they wanted from me was a lawyer’s name because they said a local firm wanted $25,000 to investigate and perhaps take up their case.

Was I a lawyer? No, a blogger. “Oh, so you just want to make money off our story.” I had to shout back to get them to start a dialogue, but said I would look into it. The result was my blog Are Credit Union Members “American Idiots’?

These two members believe, and I think rightly so, the democratic system that they tried and supported has let them down. They played by the rules. No one will listen to their cause, and it is hard, because they are very exasperated; perhaps a little paranoid. They certainly feel alienated from the powers that be. And they are right to feel this way.

Information about the two credit unions continues to come in, but here is what we know so far.

The Rest of the Story

What follows is details to support the summaries above.

Who would not be attracted to a credit union whose mission statement is:

Growing together, prospering together.

To empower our team to deliver innovative solutions through one-to-one service by focusing on he unique value of every member.

To ensue organizational stability and financial wellness in our community since 1935.

Their home page video promises members they will be “a credit union for life.”

https://121fcu.org/about-121/

But its 89 year-long role as “Jacksonville’s hometown credit union, dedicated to delivering highly personalized financial services that benefit our members and community” is about to end on March 1 when the merger would be consummated.

In April 2023 the executive team of 121 Financial Credit Union first announced the credit union would merge with VyStar Credit Union, also headquartered in Jacksonville.

Rarely do members join a credit union based on size, which is the prime difference between these two organizations. Members choose based on convenience, price and service. When they see and experience a local institution that expresses their hopes, as in the mission statements above, they become believers. In this case for 89 years.

Many 121 members who were especially loyal strongly opposed the plan to end the charter. They took action and talked to NCUA about the process. A number put up a website, Stop the Merge, complete with local advertising and publicity urging members to turn down the plan finally disclosed in the formal Member Notice Mailed dated November 30, 2023.

Why Did Management Choose to Give Up their Charter?

The Notice has not a single example of a better rate (savings or loan), fee or product that would benefit 121 Financial members. There is lots of rhetoric about a bigger organization with a list of VyStar branches.

121 Financial is capable of offering the same system benefits VyStar promises. In examples of community support, the much smaller credit union features its alliance with the local Jumbo Shrimp, a Triple-A minor league affiliate of the Miami Marlins.

Why This Merger is Occurring

I believe that when the full amounts of payments guaranteed to the five senior leaders in the form of salaries, bonuses, severance, and retirement are added together, the answer is simple: personal greed. These five give up all their current credit union leadership positions, which they had held for less than five years, in return for “special project” roles. The remaining employees are guaranteed nothing.

The members lose everything they spent 89 years building.

$9.5 Million in Guaranteed Payments

But wait—doesn’t NCUA require that “certain material changes in total compensation and benefits of 15% or more of the five most highly compensated employees have received or will receive in connection” to be disclosed? That is the literal requirement but obscures the full payoffs management has negotiated for itself when leaving their positions of responsibility.

David Marovich, CEO, appointed full time CEO in March of 2020. In a press interview (below) said he began merger discussions with the board in the fall of 2021. The disclosures list a five year contract with a $16,000 salary increase, 2 first year bonuses totaling $245,00 and a supplemental retirement plan (SERP) for five more years at 40% of his final year’s salary.

Using the credit union’s IRS 990 filing for 2022 for these senior salaries, the minimum total payments for this work and SERP is a minimum of $3,209, 600.

Paul Blackstone, COO since January 2020. Receives a five-year contract with a $95,000 salary increase and two first year retention bonuses totaling $252,500, and a SERP that pays 35% of his final year’s salary for five years. The minimum of these payments is $3,867,908.

Cyndi Koan, CFO since December 2019. Receives a three-year contract with two first year retention bonuses totaling $70,000. Total minimum payments $1,168,102.

Cathy Hufstetler, Senior VP Lending since September 2019. Will continue through conversion then retire and receive a one year severance of $273,000 and two first year bonuses totaling $56,000. Total minimum payments $602,000. She began at 121 Financial (Telco) in June 1991 and is the longest serving of the five employees listed.

Nichole Le Blanc, Executive Assistant to the C suite. No start date given but her previous experience listed in the Notice, leads one to believe it to be very recent. Receives a five-year contract with a $5,000 salary increase and two first year retention bonuses totaling $18,000. Estimated minimum payments $569,000.

The total (salary data is from 2022) of these five guaranteed positions is a minimum $9,416,600.

In addition It should be noted that in 2022 the credit union began a SERP plan for the four senior positions that will fully vest all earned benefits upon merging. In addition they will also receive all other retirement benefits that all employees of 121 Financial will vest upon the charter closing. This is why Hufstetler, above, has no retirement benefits from the merger. because of her 121 benefits package.

The Remaining 121’s Staff

The 121 website lists 17 employees (out of 140) in leadership positions. Only the five most highly compensated are required to be disclosed according to NCUA’s rules. So the others may have received a temporary incentive other than vesting 121 benefits. It is not clear why Le Blanc, the apparent newcomer, was included in the guaranteed benefits given her relatively brief time at the credit union.

The average salary and benefit for VyStar and 121 Financial employees is the same for both credit unions at $97,000. According to the notice VyStar committed to retain all 121 employees but for how long and under what work responsibilities will be determined. For all seven 121 Financial locations, the only promise is that all “will remain open for a period of time” which does not sound very permanent.

Given the logic of acquisitions and the need for VyStar to turnaround its deteriorating performance, often the quickest savings is from employee attrition. The 121 employees may have other job opportunities, but they will lose their earned and established professional agency in joining an organization of 2,260 employees.

Will Members Get A better Deal?

A review the financing and business strategy of the two credit unions shows one is hellbent on geographic expansion in FL and GA with more branches-or acquisitions. The other is Jacksonville’s home grown institution.

One relies on outside borrowings, the other on member funding. With 38% of 121’s members also with VyStar, they have elected to have a choice. Now that is ended.

Moreover there is a question as to how this data was obtained. Consumer privacy regulations would normally prohibit either credit union from accessing this information from public sources no matter which credit union ran this comparison.

What Kind of Credit Union is VyStar?

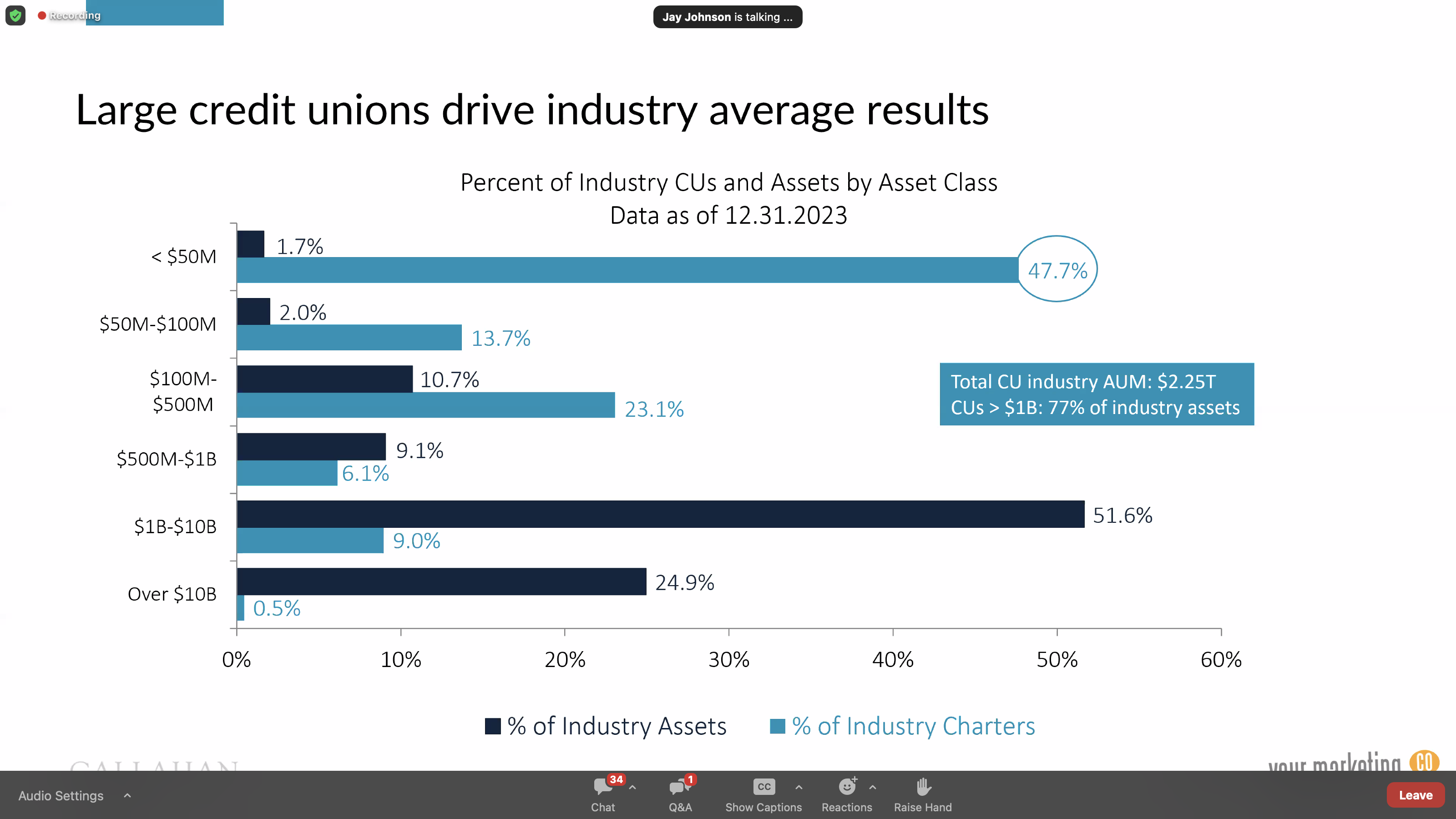

VyStar’s business model is the antithesis of 121 Financial. It is the country’s 13th largest with $13.6 billion in assets or twenty times the size of 121. Both credit unions report very similar financial performance ratios at yearend 2023 with 121’s net worth and ROA running slightly above the larger credit union.

With 926,588 members and 91 branches compared to 49,000 and 7, VyStar’s strategic priority is growth. Bank acquisitions and credit union mergers are one aspect of this effort.

In August 2019 the credit union announced:

VyStar received approval from the Florida Office of Financial Regulation (FLOFR) to significantly expand its field of membership by 27 counties – more than doubling the original 22 counties – to include all 49 counties of Central to North Florida. . .. In addition, VyStar received approval from the Georgia Department of Banking and Finance and the FLOFR to expand into four Southeast Georgia counties: Camden, Charlton, Glynn and Ware.

That same month VyStar announced the purchase and assumption of the $280 million Citizens State Bank in Perry, Florida. Terms were not announced. However, the credit union carries a $28 million goodwill intangible asset which occurs when an asset is acquired in excess of its book value.

In March 2021 VyStar agreed to purchase the $1.6 billion Heritage Southeast Bank (HSBI)in Jonesboro, GA, for an estimated $196 million or 1.8 times tangible book capital. This effort was cancelled a year later due to the inability to receive timely regulatory approval.

In 2022 the credit union announced the addition of 15 more counties in FL and GA to its FOM. In January 2023 it announced the merger with First Coast FCU, an $11.3 million firm.

Why This is a Great Deal for VyStar: The Art of the Steal

In April 2023 when VyStar and 121 Financial announced their merger intention, the American Banker used the headline VyStar Credit Union to Merge with Local Competitor.

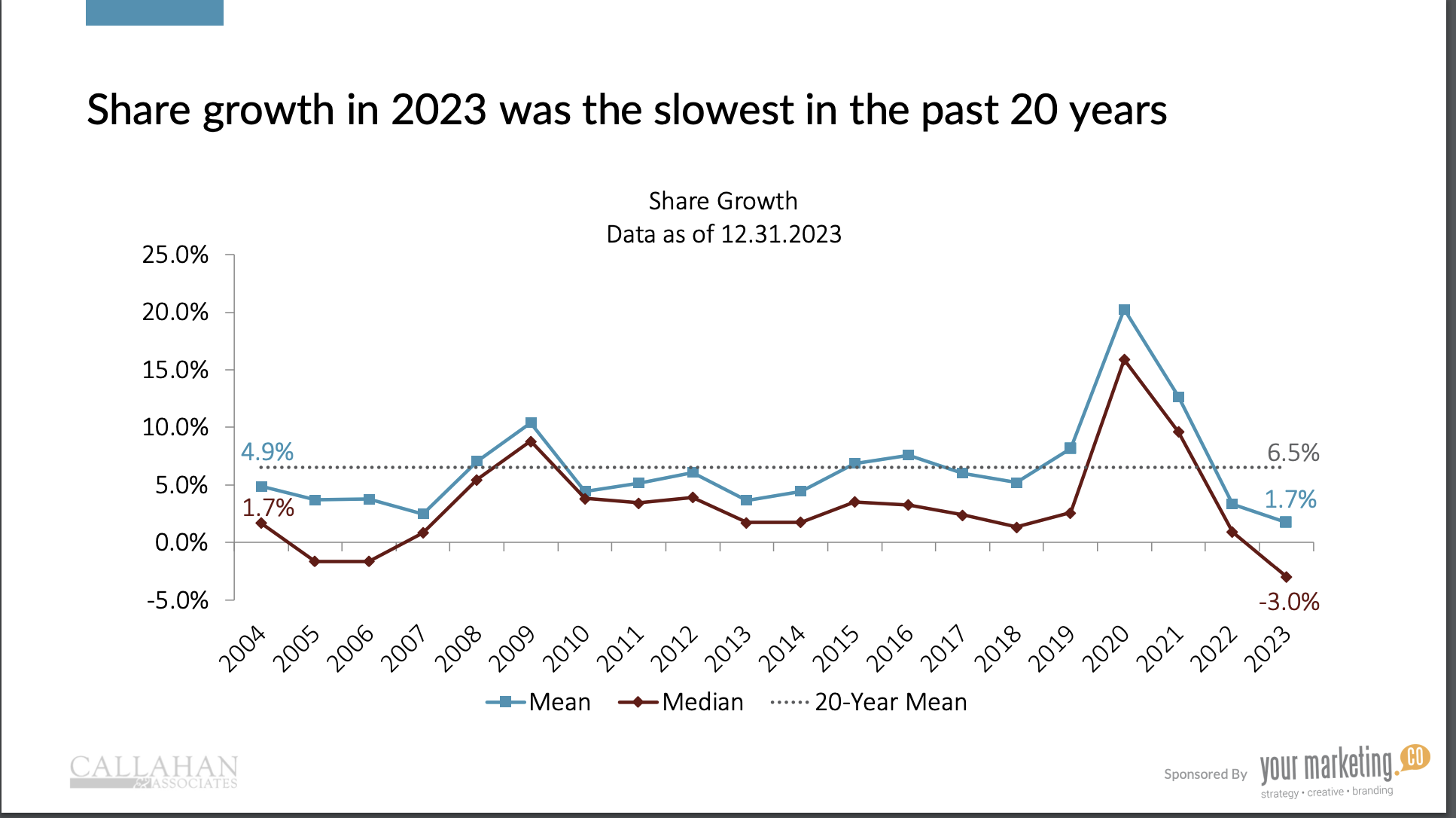

In addition to eliminating this local “home grown” competition, VyStar needed this $700 million to keep its growth ambitions going. For the three years ending 2023 VyStar has had zero share growth, marked by a decline of 5% in 2023. It has to do something so it turns to another acquisition to juice its growth.

In this way VyStar can instantly add $163 million in investments, $485 million in loans, $24 million in fixed assets (7 locations) and 50,000 member accounts. And the best part is it will get paid $63 million in member capital for taking this long time operating entity off the hands of its existing leadership.

If this had been a bank purchase, the amount that would have to be paid to the owners would have been at least 1.5 times book or over $90 million in cash payments. Why would a credit union ever buy a bank when you can steal a credit union? Just arrange a couple of new senior positions for the senior team. Can you imagine a bank’s owners giving their shares away free to another bank?

VyStar receives a free capital infusion and a $700 million operating entity. The credit union’s owners whose loyalty and financial relationships built this very successful organization, receive nothing. What’s worse, any member could have joined VyStar at any time they thought it was a better deal. Instead the evidence suggests VyStar members go to 121 Financial because they prefer its local focus.

Should Credit Unions Care?

The easy answer is to keep one’s opinion silent. This does not involve my members. But this and similar precedents will end up destroying the reputation of thousands of credit union leaders who try to do the right thing, in the right way. Because something is legal, does not mean it is right.

Note from two CEO’s joint press interview.

From an April 20,2023 article in the Jacksonville Daily Record by reporter David Crumpler: (Wolfburg is VyStar’s CEO)

Wolfburg said the merger “developed organically.”

He said the credit unions have long had a good relationship that existed when he joined VyStar in 2018 and was “started by our predecessors.”

Marovich said he and 121 Financial board members “have been working on this for about 18 months.

“I think our board felt that this was a good time (to think about a merger) and tried to determine who would be the best partners for this.”

The release said all 121 Financial members and its 140 employees will be invited to join VyStar.

“We do not want to disrupt the employees,” Wolfburg said.

“Those are employees who built that institution and who make the brand what is it, and have relationships with businesses and clients.”

There are no plans to make any decisions about keeping or closing branches over the coming year, Marovich said.

“VyStar has a good presence of branch locations, and expanded access was one of the things we’ve talked about,” he said.