On January 26, 2022 I wrote a detailed analysis of the transfer of $10 million of members’ capital to a non profit organized by the CEO and Chair of the merging Finance Center Credit Union. My position was that this was an improper taking of funds owned by the members, but asked, “You be the judge.”

This is a followup analysis since the October 1, 2021 merger and funds transfer.

Synopsis: Part I summarizes previous events and questions raised about the money transfer. Articles provide principals’ various explanations in a CU Today story.

Part II presents the new Foundation’s data subsequent to the merger and former CEO Duffy’s activities as recently as January 2024.

Part III asks what happens now?

Looking Back at the Merger Issue

Stockton’s (area code 209) Need for Credit Union Services

In the words of the CEO of a local community food kitchen for the needy, “Stockton is not a destination city.” Its population of 322,000 residents is 42% Hispanic, 24% Asian, 19% non-Hispanic white and 13% black. It is one the most racially diverse large cities in America, according to a U.S. News analysis based on 2020 census data.

It is not a wealthy city. Median household income is $71,612 and per capita, $29,095. (2022) The poverty level is 15.6%. And only 18% of the population over 25 years has a college degree.

The Stockton record summarized the city’s variable reputation in a November 2023 article:

“Stockton has topped another list and this time it’s not a bad thing.

“While Stockton’s long had a reputation of being one of America’s most miserable cities (thanks, Forbes), U.S. News & World Report is shining a positive light on Mudville.

“In its most recent report, Stockton ranked among the best places to live in California. It ranked number thirteen, one spot below Visalia and one spot ahead of Bakersfield.”

Stockton was nationally recognized as one of the first cities in the country whose finances collapsed due, in large part, to unaffordable defined-benefit pension obligations. This threatened its ability to deliver basic services like police protection.

The city is the ideal opportunity for a locally focused credit union. The member needs are many. And until October 1, 2021, this was Financial Center Credit Union’s (FCCU) long time home market. On that date the CEO and board transferred via merger all the credit union’s savings, loans, members and operational direction to Valley Strong CU whose main office is in Bakersfield, a city approximately 250 miles and a four hour drive away.

Setting Up the Transfer

On June 25, 2021 Chair Lopez and CEO Duffy of FCCU registered a non profit in California named FCCU2. Forty two days later Chair Lopez signs the official Members’ Meeting Notice to merge FCCU into Valley Strong. The Notice includes the transfer of $10 million to this newly established corporation, one of several merger disbursements members were asked to approve in the merger vote.

To my knowledge this transfer of member capital to the sole control of the former CEO and Board chair had never occurred. It appeared to be a “taking spoils” from the event. The amount, the singular nature of the transfer and the credit union’s prior five year downtrends under CEO Duffy raised the question of whether this money grab was proper.

CEO Duffy and his Sister Nora Stroh had been the senior executives at the credit union since 1993. At the merger date, the credit union had served the Stockton community for 66 years with Duffy as CEO for the final 22. In the years prior to the merger, the $635 million credit union recorded these trends:

- A decline in loans outstanding from $176 million in December 2016, to just $102 million at the merger date. This is an annual negative growth of 10.3%.

- Total members declined by 2,900 from December 2016 to the merger, a fall of over 2% per year. These declines in loans and membership were the exact opposite of the growth gains reported by all other segments of the credit union system.

- Even with this decline in risk assets, the credit union continued adding to reserves from earnings. The result was a net worth (capital) ratio of 20% at December 2018 and 17% in December 2020, nine months before the merger. During this five years, the credit union at times reported a net worth/asset ratio of more than 100% of the loan/asset ratio.

- In the IRS 990 filing for 2018, the three highest reported salaries of Duffy, CEO; Nora Stroh, COO; and Steve Liega, Accounting and Finance were a combined $3.1 million or 46.5% of all compensation for a staff of over 90 employees.

During this period of decline in members and loans, CEO Duffy maintained a high profile public image. The credit union reported numerous local and statewide political donations and grants to area non profits in its annual 990 filings.

The Critique

In the years leading up to the 2021 merger, CEO Duffy operated with the form, but not the substance, of a cooperative charter. It was run as a family business promoting the public visibility of the CEO, versus the well-being of members.

My January 2022 post was called A Theft of $ 10 Million or Just Spreading Goodwill? I provided multiple data points about the credit union’s loan and member decline, million dollar executive salaries, and net worth sometimes greater than 100% of the loan to asset ratio.

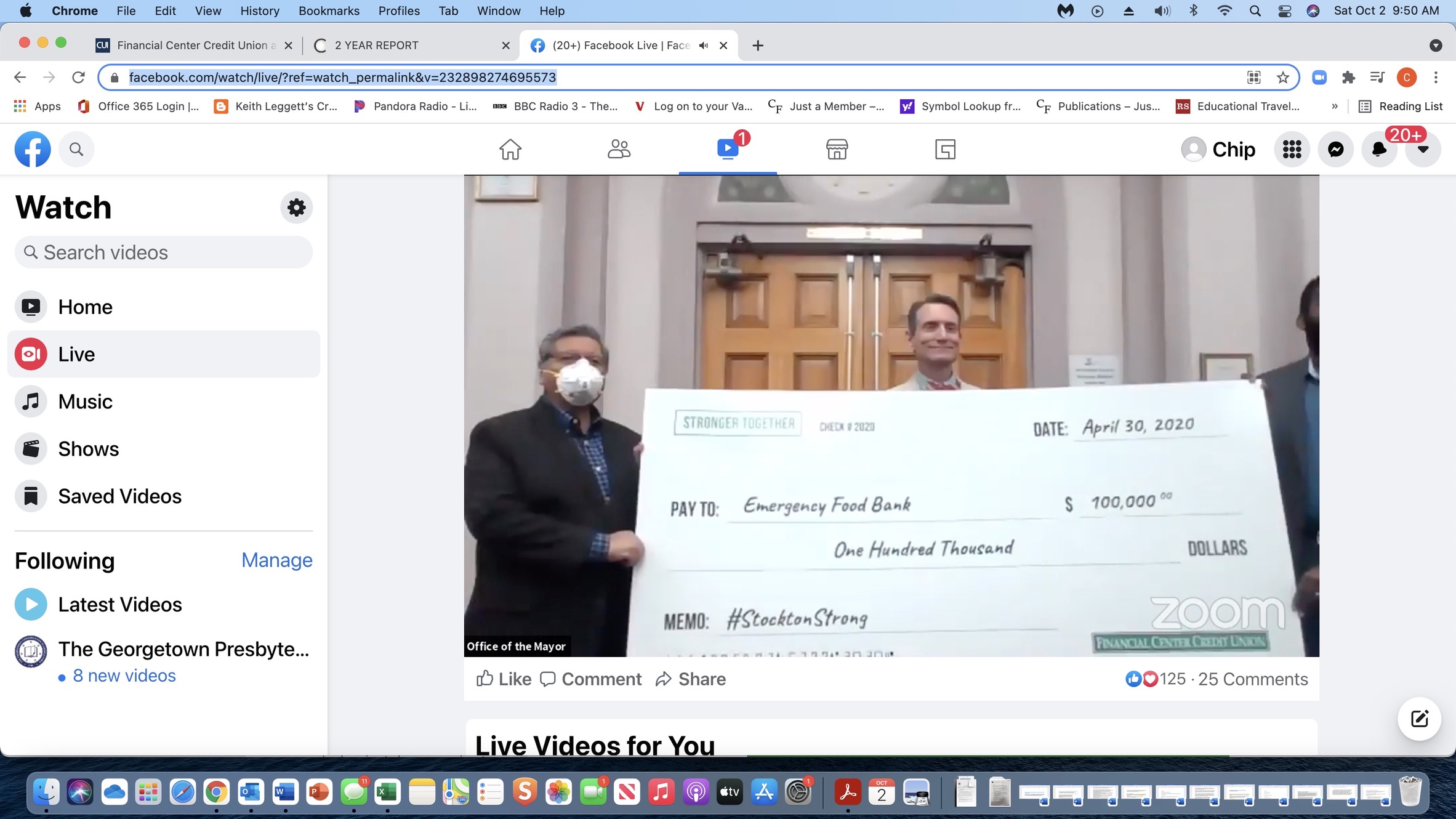

An example of Duffy’s personal PR efforts is a video from the Stockton Mayor’s office of a $1.0 million donation to Stockton Strong in 2020. The speakers state the money is from the “employees of the credit union and the Michael P. Duffy Family Fund.”

The only credit union employee in the eleven minutes is Duffy. The video shows two mock checks of $100,000 each to charities feeding food insecure residents. In the same year as this employees’ gift, the credit union’s outstanding loans declined by $40 million.

I can find no public reference to the Michael P. Duffy Family Fund in either California’s registrations or IRS 990 tax exempt filings.

CEO Duffy’s May 1, 2021 press release announcement of the merger included the following rationale:

As the CEO of Financial Center Credit Union for the past 21 years, my perspective on mergers has evolved . . . I have marveled at what credit unions of today’s scale can accomplish when they join forces . . . this merger is a true embodiment of the credit union industry’s cooperative mind-set. . . this merger represents a strategic partnership between two financially healthy, future focused credit unions committed to providing unparalleled branch access, digital access, and amazing service for the Members and the communities they serve.

There was no data or hard facts to support this sudden strategic insight. The only concrete future service promise in the Member Notice was access to Valley Strong’s 19 branch offices which were an average of 250 miles from the former Stockton headquarters.

Press Followup of the $10 Million Question

CU Today published an extended story following up the $10 million transfer to Duffy’s control. The story, Leaders from Merged-Out Credit Union Head New Foundation, provides the participants’ explanations as follows:

The individuals involved in setting up the arrangement say it was approved by the regulators and is designed to fulfill the new merged-out credit union’s mission, while state and federal regulators issued vague statements saying no laws were violated and that the creation of the $10 million foundation was “a business decision” on the part of the credit union.

Duffy’s specific defense of the $10 million was, ”It’s not a diversion, but rather an investment in the communities it serves. This ensures that the funds will be used in the manner in which it was intended: to advance and support the needs of the members”

When asked why it was not paid to members: “The board viewed its strategic decision through three lenses: members, team and community. . .It’s a symbiosis between the three and we wanted to continue the continuation while improving opportunities through cooperation vs competition.”

After Duffy’s twenty-eight years earning a living and achieving personal standing in Stockton, he initiates the transfer of $634 million total assets, $102 million in loans, 29,500 members and their $540 million of savings to another credit union’s control and leadership. Prior to merger related adjustments, this “free” transfer also encompassed the members’ $107 million of capital.

Duffy kept control of $10 million in his words, “to advance and support the needs of members.” After transferring all his leadership responsibility for managing $634 million of member assets out of Stockton and away from local control (but keeping his CEO level compensation) he arranges to hold back $10 million for his personal use. In order to serve the “needs of the members” he had just sold out!

Part II tomorrow will look at data and events since the merger.