After a public hearing, multiple written comments and some give and take between board members, these are some of my initial observations from last Thursday’s board meeting on the 2024 Agency Budget.

- Only .02% of 1% was reduced in the final budget of $385.7 million by the board from the initial staff amount.

- No discussion of why the Office of Information Serves (i.e. computer support) depends on contractors for 71% of its operations totalling $44.5 million.

- A 16.4% in the federal credit union operating fee when the Operating Fund’s cash on hand now would almost cover a full year’s expenses. Or why the $24 million “carry forward” from 2023 (unspent amounts collected) is not returned to credit unions, but “reallocated” to 2024.

- Why only four new charters justifies a 18% increase and 41 staff in the office of Credit Union Resources and Expansion(CURE); also when the industry’s total numbers declined by almost 170 credit unions.

- Most curious was the increases in staff to a total of 23 and 20% budget raise to $6.4 million in the Asset Management and Assistance center when the total reported losses to date in the NCUSIF are just $1.0 million. The remaining corporate AME’s are to be disbursed soon. The office is spends more on staff than on the assets it oversees.

- The CLF’s $2.2 million budget is nothing more than an effort to transfer NCUA’s overhead expenses to another set of books which credit unions fund separately. The CLF’s 4.62% third quarter dividend was at least .75% below what credit unions could earn in the overnight market, meaning NCUA requires members to subsidize this inert operation.

There are multiple other expenditures that appear with no specific goals or outcomes. The board discussions were general observations. Credit unions deserve more coherent and specific details to have confidence in how their funds are used.

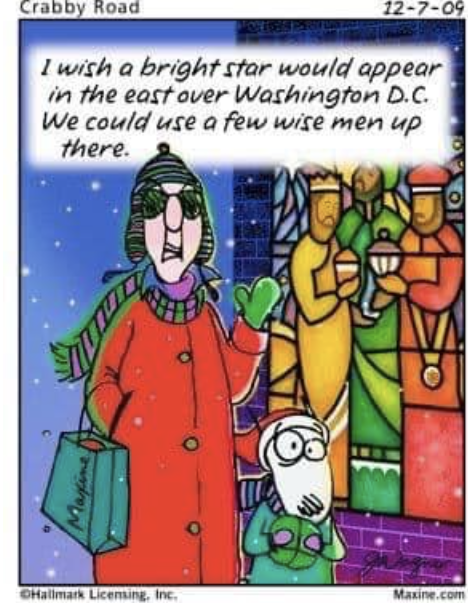

In the spirit of the season, this cartoon caught my eye. It summarizes NCUA’s budget review from a credit union perspective.