Callahan’s Trend Watch industry analysis on February 15 was a very informative event. It was timely and comprehensive.

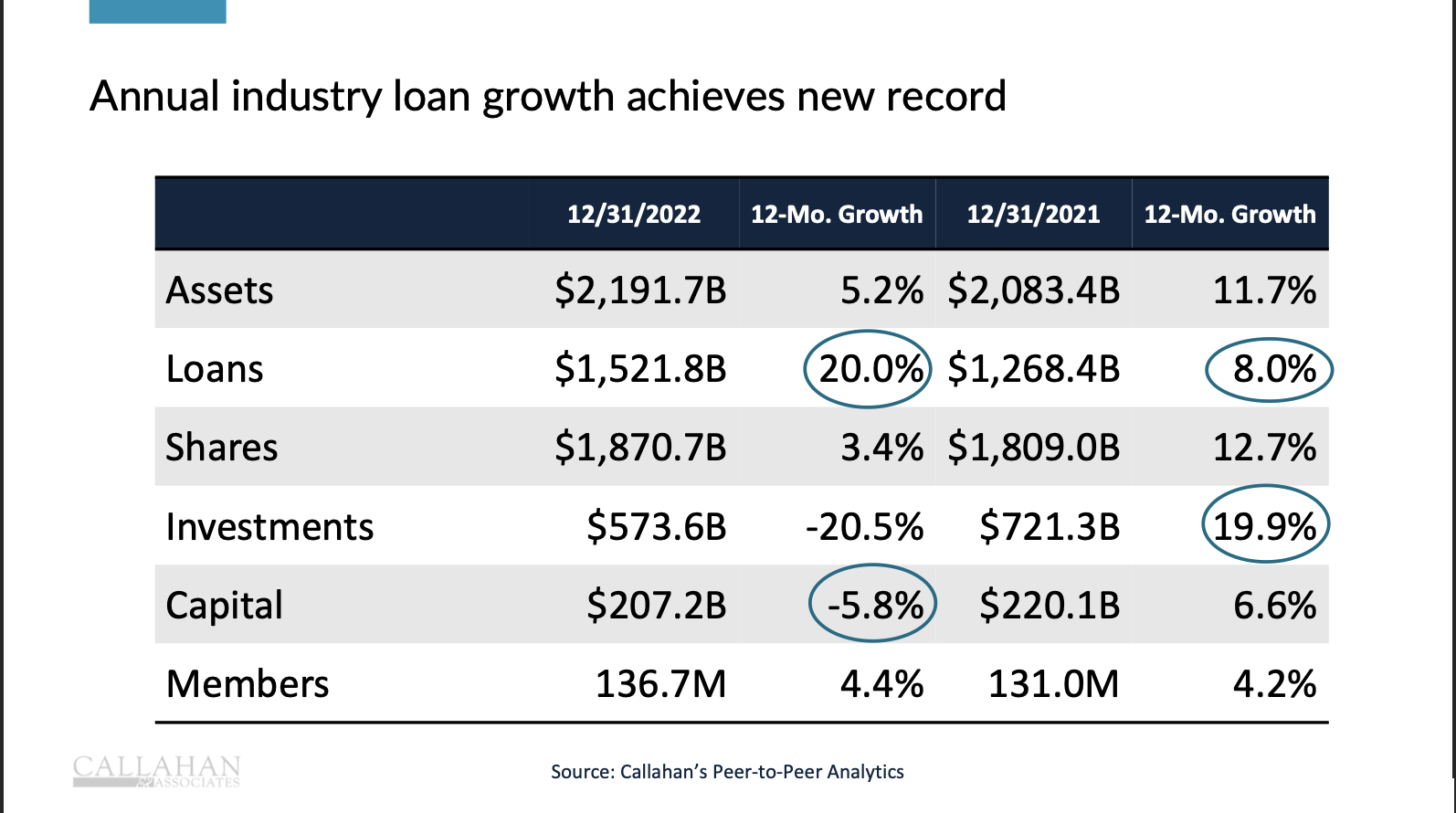

Here is the industry summary slide:

The numbers I believe most important in the presentation are the 3.4% share growth, the 20% on balance sheet loan growth and the ROA of .89.

The full 66 slide deck with the opening economic assessment and credit union case study can be found here.

The Theme of Tighter Liquidity

A theme woven throughout the five-part financial analysis was tighter liquidity and the increased competition for savings. Slides documented the rising loan-to-share ratio, the drawdown of investments and cash, the increase of FHLB borrowings, and the continuing high level of loan originations, but lower secondary market sales.

These are all valid points. However liquidity constraints are rarely fatal. It most often just means slower than normal balance sheet growth. That is the intent of the Federal Reserve’s policy of raising rates.

Credit Unions’ Advantage

I think the most important response to this tightening liquidity is slide no. 24 which shows the share composition of the industry. Core deposits of regular shares and share drafts are 58.3% of funding. When money market savings are added the total is 80%.

This local, consumer-based funding strategy is credit unions’ most important strategic advantage versus larger institutions. Those firms rely on wholesale funds, large commercial or municipal deposits and regularly move between funding options to maintain net interest margins. These firms are at the mercy of market rates because they lack local franchises.

In contrast, most credit unions have average core deposit lives from ALM modeling of over ten years. The rates paid on these relationship based deposits rise more slowly and shield institutions from the extreme impacts of rapid rate increases. In fact the industry’s net interest margin rose in the final quarter to 2.86% (slide 56) and is now higher than the average operating expense ratio.

Rates are likely to continue to rise. There will be competition at the margin for large balances especially as money market mutual funds are now paying 4.5% or more. If credit unions take care of their core members, they will take care of the credit union.

The February NCUA Board Meeting

The NCUA Board had three topics: NCUSIF update, a proposed FOM rule change, and a new rule for reporting certain cyber incidents to NCUA within 72 hours of the event. The NCUSIF’s status affects every credit union so I will focus on that briefing.

We learned the fund set a new goal of holding at least $4.0 billion in overnights which it is projected to reach by summer. Currently that treasury account pays 4.6%. With several more Fed increases on the way the earnings on this $4.0 billion amount alone (20% of total investments) would potentially cover almost all of the fund’s 2023 operating expenses.

Hopefully this change presages a different approach to managing NCUSIF. Managing investments using weighted average maturity (WAM, currently 3.25 years) to meet all revenue needs, versus a static ladder approach, means results are not dependent on the vagaries of the market.

At the moment the NCUSIF portfolio shows a decline from book value of $1.7 billion. This will reduce future earnings versus current market rates until the fund’s investments mature, a process that could take over three years at current rate levels.

Other information that came out in the board’s dialogue with staff:

- Nine of the past thirteen liquidations are due to fraud. Fraud is a factor in about 75% of failures;

- More corporate AME recoveries are on the way. Credit unions have been individually notified. The total will be near $220 million;

- If the NOL 1% deposit true up were aligned with the insured deposit total, yearend NOL would be about .003 of lower at 1.297% versus the reported 1.3%. Share declines in the second half of the year will result in net refunds of the 1% deposits of $63 million from the total held as of June;

- Staff will present an analysis next month of how to better align the NOL ratio with actual events;

- The E&I director presented multiple reasons for NCUSIF’s not relying on borrowings during a crisis, but instead keeping its funds liquid;

- The E&I director also commented that the increase in CAMELS codes 3, 4, 5 was only partly due to liquidity; rather the downgrades reflected credit and broader risk management shortfalls;

- NCUSIF’s 2022 $208 million in operating expenses were $18 million below authorized amounts;

- The funds allowance account ($185 million) equals 1.1 basis points of insured shares. The actual insured loss for the past five years has been less the .4 of a basis point.

Both the Callahans Trend Watch industry report and NCUA’s insured fund update with the latest CAMELS distributions suggest a very stable, sound and well performing cooperative system.

A Disappointing NCUA Response

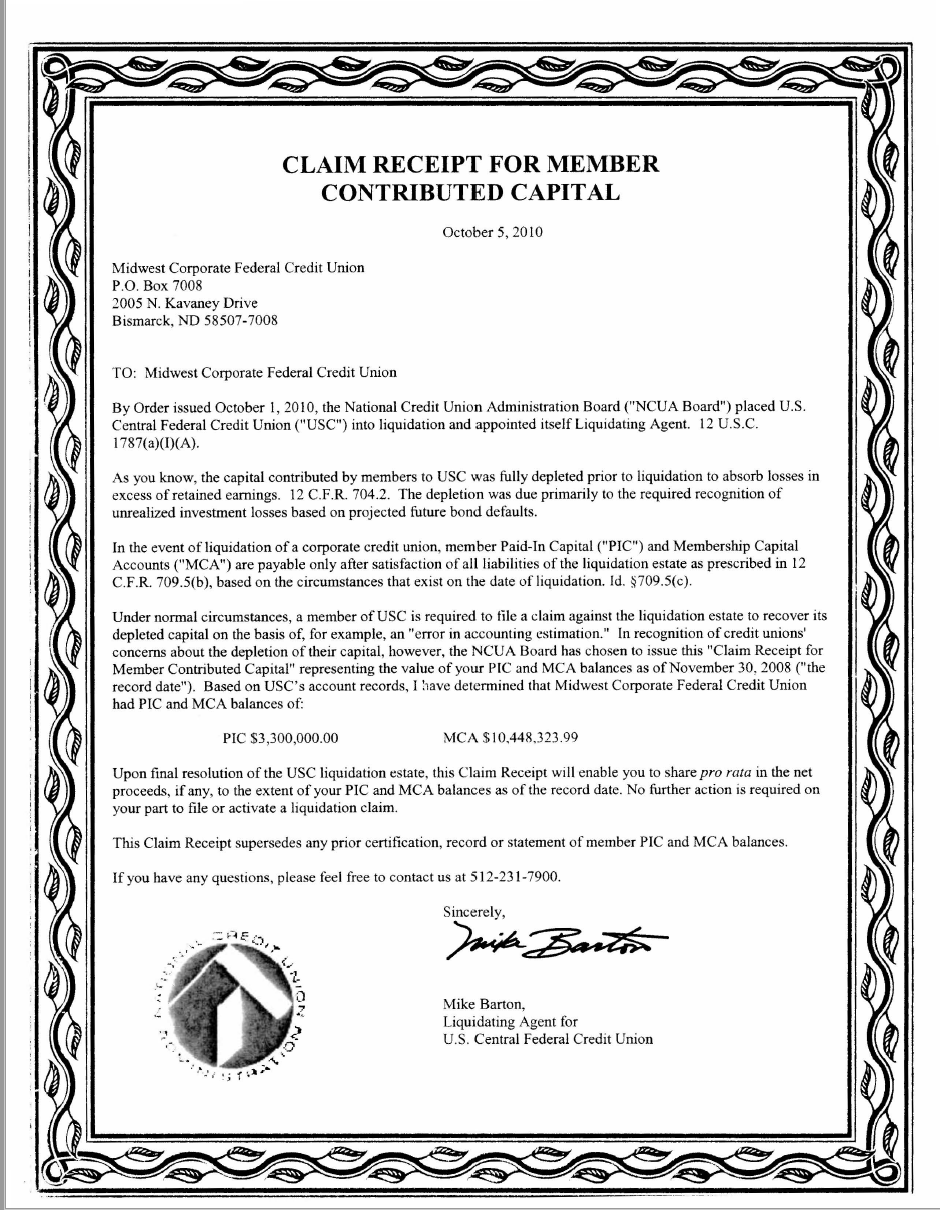

Against this positive news, is a February 15 release from the Dakota Credit Union Association. It stated NCUA had denied claims of 28 North Dakota credit unions for their $13.8 million of US Central recoveries from their corporate’s PIC and MCA capital accounts.

These credit unions were the owners of Midwest Corporate which placed these member funds in the US Central’s equity accounts, a legal requirement for membership. The NCUA claimed that the owners of Midwest Corporate had no rightful claim, even though a claim certificate for these assets was provided by NCUA.

Nothing in this certificate says that the claim is no longer valid if a corporate voluntarily liquidates.

Under the corporate stabilization program corporate owners were forced to choose between recapitalizing after writing off millions in capital losses in 2009, merge with another corporate, or voluntarily liquidate.

Both the Iowa and Dakota corporates chose to voluntarily liquidate versus facing the prospect of further corporate capital calls.

The NCUA oversaw the liquidation of both Corporates in 2011. The NCUA’s liquidating agent knew that claim certificates were issued, that there was no wording that voluntary liquidation would negate future recoveries for the corporates’ owners and that NCUA’s legal obligation is to return recoveries to the credit union’s owners, whether in voluntary or involuntary liquidation.

The claim receipt specifically states: “No further action is required on your part to file or activate a liquidation claim.” Yet that is just the opposite of what NCUA is now saying the credit unions must do.

For example NCUA continues to pay recoveries to the owners of the four corporates who were conserved and involuntarily liquidated by the agency.

According to Dakota League President Olson, NCUA has failed even to inform the league in what accounts these funds are now held. Are they being distributed to all other US Central owners? To the NCUSIF? Or held in escrow?

“This is a clear case of obstruction through bureaucratic hurdles and complicated language where the process is the punishment, and does not provide justice,” stated Olson.

These funds ultimately belong to the member-owners of these credit unions The NCUSIF is in good shape. This is not a legal issue. It is common sense.

NCUA controlled all the options for every corporate through through its stabilization plan. It took total responsibility for returning funds-no further action required. No one will critique returning members’ money. But failure to do so undermines trust in the Board ‘s judgment, its leadership of staff, and its fiduciary responsibility for credit union member funds.

The NCUA board should do the “right thing” for these credit unions and their members.

The NCUA should do the “right thing” – are you serious? That will never happen. The “right thing” would be for the NCUA to contract out to KPMG or any other accounting audit group with the capacity to engage in audits. The NCUA has outgrown its usefulness. The complex nature of credit unions today exceeds the capacity at NCUA.

It is an independent federal agency of government civil servants. The sheer number of credit union failures and liquidations they supervise from TaxiMedallion CU, to USCentral, WesCorp, MembersUnited, Telesis never ends. Never Shocked. Just Disappointed. 75% of failures are due to fraud. NCUA misses them 100% of the time? At least they are consistent. And the folks missing the fraud? It’s a great design defect.