The author of a lengthy Business Journal article on SECU’s competing future visions wrote a brief follow up to his original story that began:

The North Carolina State Employees’ Credit Union is such an integral part of our state that it’s often taken for granted.

There’s nothing like it across the nation, I learned, while studying the $53 billion dollar enterprise for a story in the February Business North Carolina. In the ninth-most populous state, SECU dwarfs peers nationally other than the national Navy Federal Credit Union. . .SECU is a maverick.

When viewed in a broader context, this local controversy is more than competing approaches to a business model.

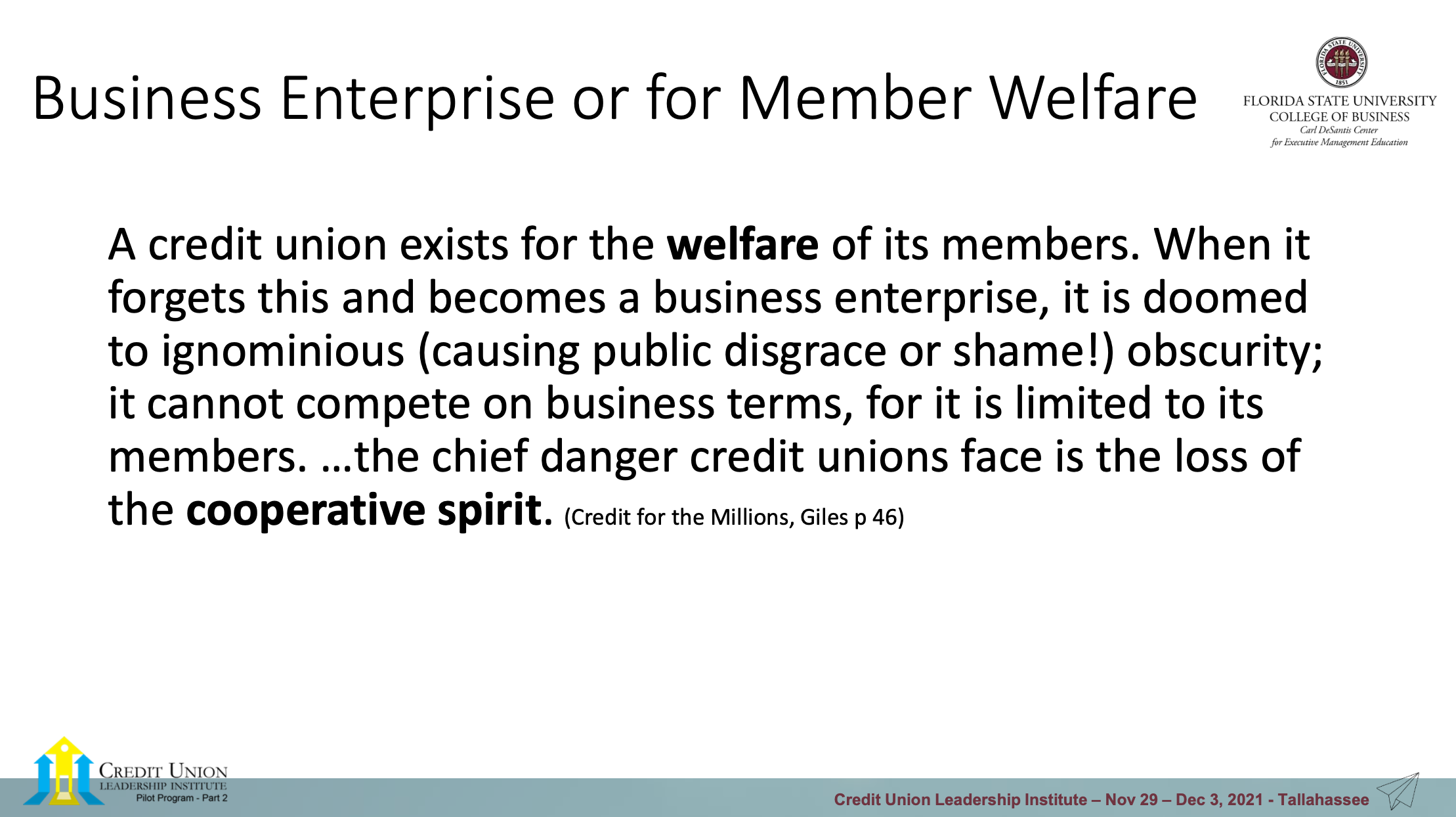

In many large credit unions today there is a growing distance between member priorities and institutional ambitions. A number of credit union leaders aspire to an ever-expanding role in the financial services marketplace. Organic growth is insufficient, too slow. Executive strategies such as whole bank purchase and aggressive courting of merger partners everywhere are embraced, two initiatives often enabled by external sources of capital.

Members become merely the means to further institutional prominence. The rhetoric continues about serving members, but often these expansion efforts offer little or no member benefit.

There is a parallel example in current religious practice. Some well-known and successful preachers promote faith with a vision of what is called the “prosperity gospel.” It is little more than capitalism in ecclesiastical garments. The equivalent happening in credit unions is full out banking strategies dressed in cooperative clothing.

There is a spreading “cooperative anemia” circulating in the credit union system. Its basic symptom is the separation of institutional priorities from members well-being.

A Model that Transcends

The SECU which Jim Hayes joined as a leader in 2021 had been able to transcend these constant temptations to alter cooperative design into a proto-banking model. Instead it became increasingly viewed as a “maverick” by credit unions.

The persons who invested most of their professional lives building this contrarian approach developed a certain stubbornness. They both authored the effort and produced unprecedented results. They continue to have a sense of stewardship, even as they become “just a member. “ As one writer has observed “some of the best founders are difficult people.”

When institutional leadership is transferred to managers in today’s selfie world, there is an understandable perception that “me” is being put in front of membership.

A Path Forward: Investing in Members’ Ownership Responsibilities

Leadership of any institution is first and foremost a political task, not a business model problem. The concerns about changes in business direction, labelled “rumbles” by SECU staffer, have now morphed into public and opposing camps.

One side is represented by a person who self describes as “often wrong, but never in doubt.” The other camp has retreated to their bunkers of incumbency, and adopted a tactic I call “brute legalism.” This means “we’re in charge (with member approval), so we don’t have to accommodate contrary points of view.”

The coop process for resolving this debate is supposed to be democratic. An autocratic rejection of member concerns, may lead to increasing displays of public opposition. It certainly makes CEO Jim Hayes’ leadership much harder.

If the separation of credit unions and member priorities is the core of the problem, then embracing the owners’ democratic engagement may be the solution.

Cooperative democracy is more than electing directors at the annual meeting. Often this voting function has been reduced to an administrative formality as nominations by the incumbents just match the number of open seats.

Democracy depends on choice. Real choice is more than putting more names on the ballot. It requires continuous transparency, open communication, and ongoing dialogue with every internal and external level of the organization. This habit is more than press releases or marketing messages.

Cooperative democratic design is more than good governance, that is accountability to the owners. It is how trust and confidence in the leaders’ decisions are created.

The motions at the 85th Annual meeting were unusual but a proper exercise of member-owner rights. It has opened up conversations about decisions that have major member impact but little visibility.

Blaine’s motions were an act of courage and member duty. He took the step of “walking to the front of the line” to find out who might be with him. There is no more democratic act than members speaking out.

A Democratic Ampersand

Cooperative design is at its strongest when an ampersand is added to the member & owner role. Otherwise the owners end up as being viewed as just customers. Keep them satisfied, find more like them, and allow the “elected” leaders to shape the credit union’s future.

Many credit union managers believe they choose their members, especially encouraged by the regulatory concept of the common bond. Nothing could be further from the truth. It is the members who choose to join, support, or leave the coop.

In the American economy, it is called “consumer sovereignty.”

Member loyalty cannot be acquired in a merger or bank purchase. That just cheapens any relationship. Rather it is hard earned over generations. When well done, the result creates the most important business and political advantage a movement could want.

A Public Purpose

Coop democracy is more than a process for accountability and acknowledging the owners’ roles. It is core to credit union’s purpose. That purpose is extending economic opportunity for all Americans, especially those at the mercy of for-profit providers.

Economic equality is vital to the continuation of the capitalist system. It is critical that all striving for financial security ( especially those living paycheck to paycheck) can have an institutional option that is fair and just, not discriminatory, in their transactions.

SECU’s board and leadership are in a unique moment for affirming the credit union’s continued commitment to furthering America’s promise of economic justice. This credit union will be fair to all who join SECU as members-owners.

Achieving that outcome will require more conversations and crafting additional business options. Without this effort member uncertainty and market forces will slowly erode the credit union’s position in its key markets and nationally.

A lesson from events to date is that sometimes it takes heading in the wrong direction in order to find the right one. Now is the time for SECU to make real the promises of coop democracy–in multiple ways.

No one has a monopoly on insight. Being a maverick is tougher than jumping into the financial mainstream. Old and new members sitting down together offers a better chance of SECU sustaining its transcendent credit union performance.

As Robert Frost might counsel in the final verse of The Road Not Taken:

I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I—

I took the one less traveled by,

And that has made all the difference