Oscar Abello is the senior economic writer for Next City. His focus is community initiatives that bring opportunities to those left behind by existing financial options. New credit union charters are an area of special interest.

His latest story is A Long-Awaited Black-Led Credit Union Finally Gets the Green Light. The subtitle is “after eight years of work, Arise Community Credit Union just secured Minnesota’s first state charter in over two decades.”

The announcement of this new charter’s background has been reported by the credit union press. Abello’s story focuses on the difficulties of the process. Here are some of his observations:

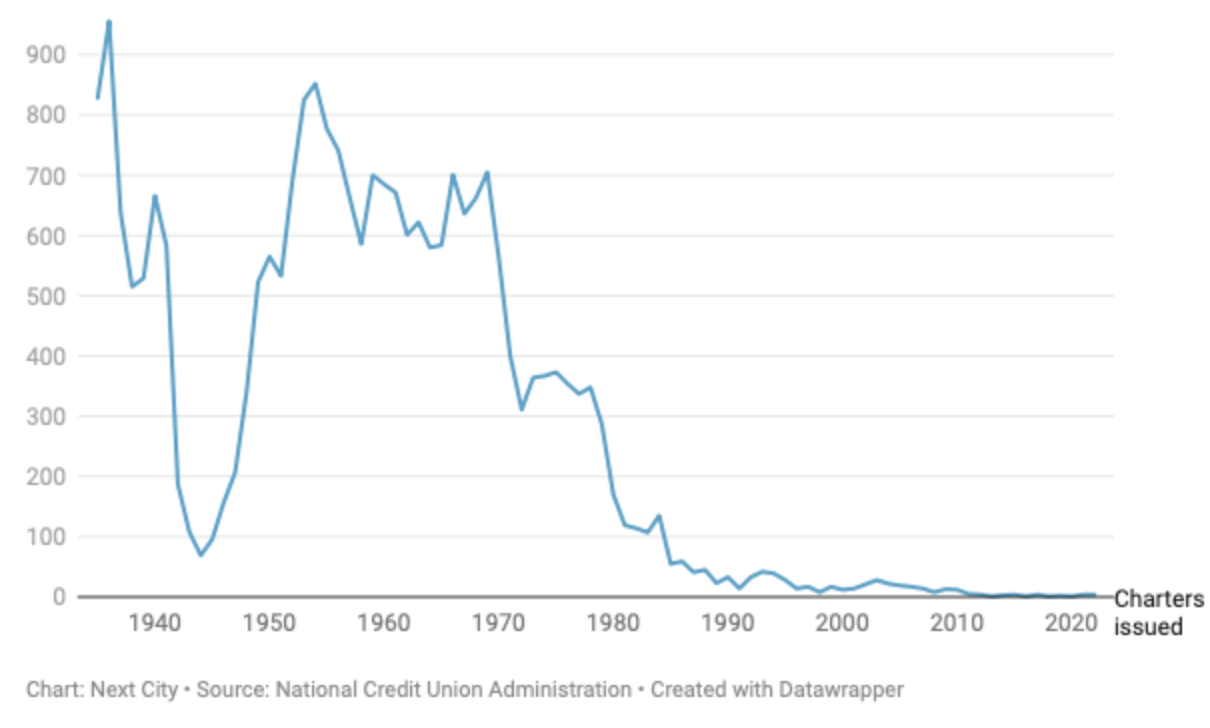

Chartering a new credit union today is like traversing a long-lost trail through the woods, one that used to be well-traveled but is now overgrown, littered with fallen trees and other obstacles no one has had to navigate in many years. Prior to 1970, there were 500 to 600 new credit unions chartered across the country every year. After a steep decline to near zero, the numbers have never recovered. Over the past 10 years, fewer than 30 new credit unions have been chartered across the country.

New Credit Union Charters

The annual number of new credit union charters issued nationwide by the federal government, as published in the annual reports from the NCUA.

According to Inclusiv, a network of credit unions that focus on community development, minority credit unions across the country are closing at the rate of one per week, making the new Arise Community Credit Union’s chartering even more urgent if that trend is to ever be reversed. (Editor’s note: all credit unions close at a rate of more than three per week). . .

Arise hopes to fill in the gap left behind by other more conventional banks and even other credit unions. Predatory lenders have jumped into the gap left behind by the retreat of the mainstream banking system from certain communities. African Americans are twice as likely to live within 2.5 miles of a payday lending storefront, compared with all Minnesotans. . .

Chartering a new credit union is a huge lift. It’s been nearly eight years of organizing for Arise, but it’s not uncommon for aspiring credit union organizers to take multiple years between initial conversations to raising startup capital to finally getting a new charter. The Association for Black Economic Power also had to deal with a leadership transition along the way — it’s now led by Debra Hurston. The new credit union has its own CEO, Daniel Johnson, who has deep family ties and professional ties to the Northside of Minneapolis.

It would have been easier — and quicker — for Hurston if her group just brought in an existing bank or credit union as a partner organization to provide access to credit and basic financial services to the Northside.

But Hurston says in surveys, town halls and just informal conversations over the years, the Northside’s desire for its own institution has only gotten stronger.

“The mistrust in the banking community, it’s not a small thing, and it can’t be fixed overnight,” Hurston told me last year. “We’re starting from the wrong spot…if I have to protest in front of you to make you treat me right. Something’s not right about that. So no one from our communities has ever asked me if we should just partner with a larger bank.”

Insight for Those Who Care

Abello’s reporting should be a boon to the credit union community. For as Robert Burns wrote of this ability to see what others may not:

O wad some Power the giftie gie us To see oursels as ithers see us! It wad frae mony a blunder free us, An’ foolish notion: What airs in dress an’ gait wad lea’e us, An’ ev’n devotion!

Music For Holy Week

Christ on the Mount of Olives, by Ludwig van Beethoven (1803)

(https://www.youtube.com/watch?v=5ZKWcn7bqsQ&t=41s)

These stories are so important to tell and yet we read about them in local publications, not from our National Trade Association (or at least I have not seen anything). Of course the movement gets zero credit for the formation of Arise Community Credit Union and yet it beautifully illustrates both the credit union difference and our commitment to serving the underserved.

Thank you for sharing this story in all its glory and pain.

At our peak in 1969 we had over 23,000 credit unions. Today, there are about 23,000 payday lenders, twice the number of McDonald’s https://www.cnbc.com/2021/02/16/map-shows-typical-payday-loan-rate-in-each-state.html#:~:text=There%20are%20approximately%2023%2C000%20payday,the%20number%20of%20McDonald's%20restaurants.&text=Over%20the%20last%20few%20months,these%20traditionally%20high%2Dcost%20loans.