The current generation of students is attracted to business and social startups. Many major universities now offer competitions encouraging students to design and launch new business and non-profit ideas.

These efforts are so widespread that there are now multiple rankings of the leading programs at colleges and universities across the country. Here is one showing the top 20 competitions.

One of the leading forums is at George Washington University, here in DC. The results of its annual New Venture Competition were just announced.

In their 2023 contest, 417 participants spread across 161 teams participated. Judges awarded $357,200 in prizes, including $163,000 in cash to the winners.

Twelve finalists received a minimum of $5,000, across four tracks: Business Goods and Services, Social Innovation, Consumer Goods and Services and Healthcare and Life Sciences Tracks.

Participants represented nine of the 10 GW schools resulting in a diverse range of innovative startup solutions.

GW President Mark S. Wrighton commented on the outcome: “If this is an indication of the next generation of problem solvers, then we are all in good hands. It is extraordinarily impressive to hear about the diverse set of new businesses.”

The full profile of all winners in all five tracks and their ideas can be seen in this listing.

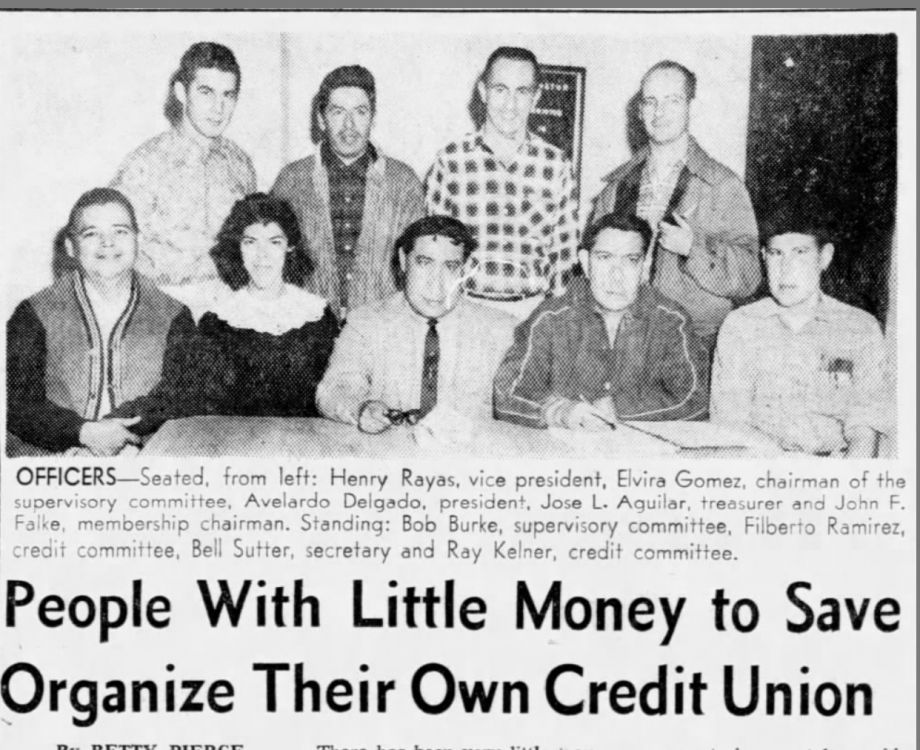

A Credit Union Winner

In April 2018 three GW freshman from different academic schools devoted much of their first year in college to this competition. They reached the finals and were awarded $10,000 to continue implementing their project.

Their new venture proposal was to charter a credit union for the GW students and community. I recorded their five minute “pitch” on my iPhone from the audience.

Their words provide the promise that every credit union offers including the need and importance of financial literacy, member ownership and direction, online delivery, better rates, and strengthening the community with a firm “run by students for students.” Their slides are in the background on stage.

https://www.youtube.com/watch?v=s_xCpDe9a3U

(https://www.youtube.com/watch?v=s_xCpDe9a3U)

What Happened?

Dozens of students volunteered their time to complete the charter application, the group raised over $100,000 in donated capital and recruited an experienced advisory board of credit union professionals and GW faculty.

NCUA has twice rejected hundreds of pages for the charter applications. The agency has requested updated market surveys, revised financials, and numerous other shortcomings, all the while hinting that more capital would be desirable.

Meanwhile the three freshman who devoted a significant part of their college career to this effort have graduated; however two still serve on the advisory board. New student volunteers have persevered to carry on the founders’ original concepts.

NCUA has not assisted but rather stalled this six- year effort.

This status occurs despite the words in the February 28 presentation by NCUA’s Vice Chairman, Kyle Hauptman at this year’s CUNA’s GAC conference:

Our society isn’t the best at getting people to save and invest. This is where credit unions come in, with financial literacy and savings programs that improve their members’ financial wellness.

Financial wellness can save relationships. Financial wellness is a great product that we only buy if we value it more than all the cool ways to spend money. Credit unions help people achieve financial wellness. . . Financial issues can be a dry topic, but it’s not about the money itself – it’s about living your best life.

My three personal priorities for my term are:

- Revamping the de novo chartering process. . .

I’ve good news on all three fronts.

On the issue of de novos, we’ve revamped and streamlined the chartering process. We will be rolling out a provisional credit union charter that fixes the chicken & egg problem, whereby a potential credit union wants to get its initial capital from a CDFI but can’t get that capital until we’ve issued them a charter. Still, we wouldn’t issue the charter until that credit union has the capital.

I’m proud of these improvements – I think it’s a part of facilitating true financial inclusion. I love seeing announcements about new charters. . .

Except this streamline chartering process does not exist. When asked about this “improvement” and the “provisional credit union charter”, there is no response. That effort, like credit union chartering, is stillborn.

Instead of supporting the next generation’s startup energy and goals to serve their community via coops, the NCUA is teaching potential supporters about the age-old witticism, “I’m from the government and here to help you.”

Apparently even board members cannot accomplish their priorities. How can de novo credit unions overcome the bureaucratic obstacles that even NCUA’s leadership is unable to move forward?

New credit unions are an endangered species. The future of the coop system is at risk. Not because the billion dollar segment which manages 75% of assets will disappear.

Rather it is because this generation of student entrepreneurs is unable to overcome government impediments. The result is that these motivated, creative individuals will find their opportunities for the benefits presented in the “pitch” above through other creative organizations. I suspect they will be called FinTechs.