The Wall Street Journal headline and subtitle suggested something very bad was going on in the credit union system:

Lenders Loosen Lending Standards, Increase Exposure to Longer-Term Assets By Ryan Tracy June 5, 2014

The following lead paragraphs cites NCUA as the primary source:

“Credit unions in search of higher returns are loosening lending standards and piling into longer-term assets, exposing the firms to potentially significant losses if interest rates rise and worrying regulators in the process.

Such moves are raising concerns at the National Credit Union Administration, the sector’s regulator, which said a rise in interest rates could make loans and investments unprofitable. Some analysts also said credit unions likely are unaware of the risk they are taking on because they largely avoided the housing downturn. That has raised worries that lax underwriting standards could fuel another bubble.

“I am concerned that the message [about rates] is either not getting through, or it’s getting through and they are just choosing not to do anything about it,” said Debbie Matz, chairman of the NCUA, who has long sounded the alarm about the industry’s exposure to interest-rate risk.

“Credit unions’ net holdings of long-term assets, a measure of exposure to rising interest rates, rose to an all-time high at the end of 2013 to 35.85% of total assets, according to the NCUA. The increase comes as some credit unions are adopting lax standards for mortgage and home-equity loans and lines of credit reminiscent of those leading up to the financial crisis, according to interviews. Credit unions also are extending the duration on investments like mortgage bonds, regulatory data show.”

The Backstory

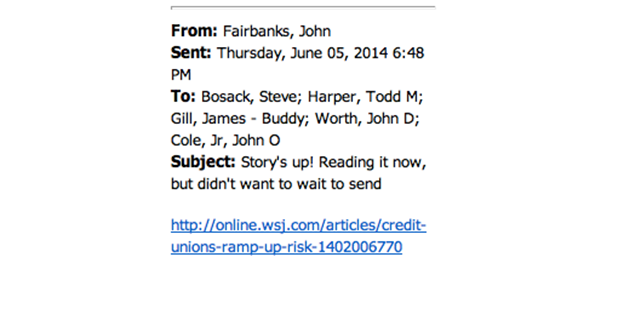

In response to the regulator’s alarming and authoritative outlook, Jim Blaine printed an internal NCUA document in which senior staff celebrated, in an email high-five, this external PR coup. The full blog can be found here under the ironic title, NCUA Ramps Up Risk. A brief excerpt follows. Reader comments to the post provide even more context for this PR exercise:

|

| “Story’s up!…” |

Seems that “a bunch of the boys” over at the Agency were breathless with excitement, waiting for the WSJ article to appear!

An interesting little group spending their Thursday evening [6/5/2014 – the day before publication!] playing with matches, waiting to read this little firestorm-creating, napalm piece.

NCUA Misleads the Public

Further down the Journal article is a calming quote from a Callahan executive:

“Jay Johnson, executive vice president at Callahan & Associates, a firm that advises the sector, said credit unions are prepared for a rise in interest rates because they have to hold capital against potential losses, and they also are holding short-term assets that could provide cash in a pinch, including more than 40% of investments in short-term holdings that mature in less than one year. “For the most part, I would say that [credit unions] are extremely ultraconservative,” he said.”

Contrast this NCUA created assessment in the Journal with the official portrayal of the real state of credit unions by Chairman Matz in her opening paragraph in the agency’s 2014 Annual Report:

“In 2014, the U.S. credit union system also had one of its strongest years in recent memory. Membership continued to rise, reaching 99.3 million members. Delinquencies and charge-offs continued to fall, and the overall credit union system had its best year-over-year loan growth in nearly a decade at 10.4 percent. Federally insured credit unions also had aggregate net income of $8.8 billion, the best performance ever. As a result, our country’s federally insured credit unions ended 2014 with a healthy net worth ratio of 10.97 percent and more than $1.1 trillion in assets.”

Banging the Drums of Fear

This PR misinformation effort occurred at the same time NCUA had to withdraw and rethink its first risk-based capital RBC rule proposal. Over 2,050 comment letters (the most ever on a rule) were submitted, all with substantive criticism.

As a result, the agency backed off and said it would make significant changes in what became the RBC-2 proposal.

Forecasting a future of doom and gloom or hyping a present crisis is unfortunately an all-too-frequent regulatory temptation. Predicting negativity creates an aura of expertise. It elevates the power of the regulator. Crises enable overreach of authority.

There is no downside to predictions of future problems especially by regulators. If nothing happens, then the warning worked, everyone feels OK and no-harm-no foul for an erroneous judgment. If there is a downtrend, then one can claim prescience and proven expertise about the future.

An example of this crisis-hyperbole was trotted out in the March 2020 NCUA board meeting. The staff provided “background context” to the 2008-2009 corporate crisis. They opened by stating there was a $50 billion difference between the book and market value of corporate investments at some point in the Great Recession. They proclaimed that if the agency had let those corporates fail, then this “loss” would have caused thousands of credit unions to also liquidate.

That possibility was never an option, but a wonderful story to justify any and all subsequent actions. In fact the agency’s auditor presented the collective corporate TCCUSF potential deficit at yearend 2009 as $6.9 Bn in the firm’s opinion released in early 2010. By dramatically exaggerating risks in an event, NCUA avoids addressing its mutual responsibility for the state of affairs.

Banging the rhetorical drums is a political tactic unfortunately tempting in a democracy. When those in authority say things are bad and can get worse, it legitimizes the exercise of unbounded and unexamined power. Due process is not an option. For the ‘house is on fire” echoing Blaine’s metaphorical critique.

The person with the responsibility for Congressional and Public Affairs when this article placement occurred was Todd Harper, current NCUA Chair.

I will next look at a continuing policy priority he has championed, the immediate implementation of the final RBC rule on credit unions. NCUA cited FDIC as the precedent for this rule in 2014. Yet the FDIC completely eliminated this standard of capital adequacy for banks under $10 billion three years ago stating it was so ineffective to that even collecting the data was no longer necessary.