Freedom and democracy. Most believe these two concepts are inseparable. How could any society be considered free if the people do not have a real say in how they are ruled?

Government operationalizes these two ideas. There are multiple theories (conservative, liberal, libertarian, et al) and personal views on government’s role and authority.

Combined these foundational ideas are both powerful and fragile. However, current and historical events demonstrate the need for “eternal vigilance.”

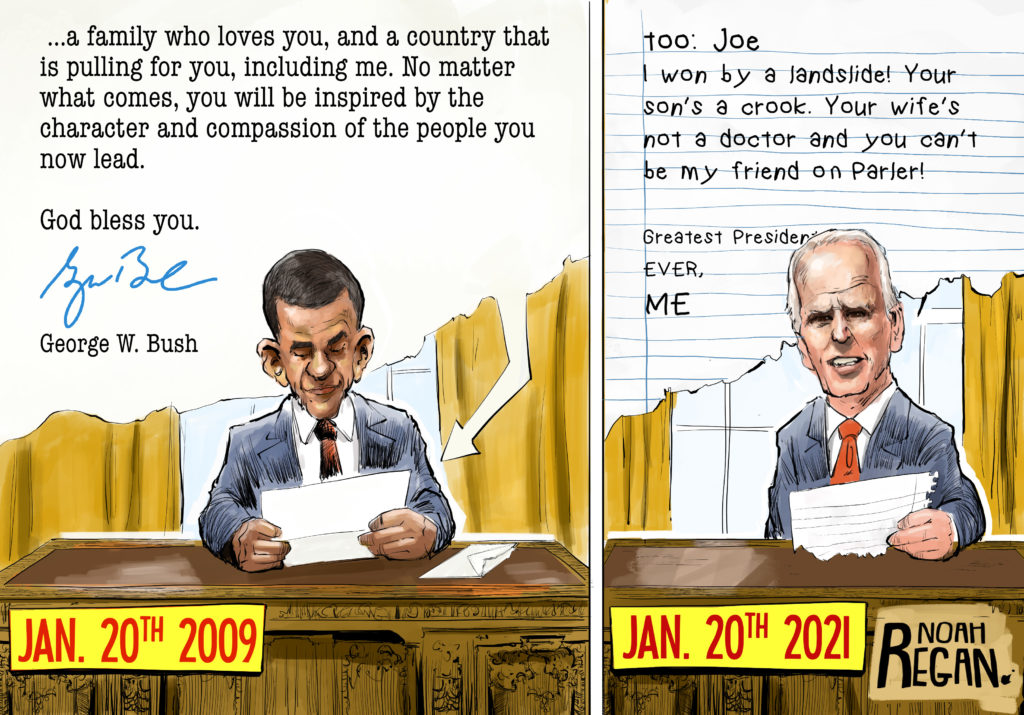

The ritual of inauguration, the peaceful transfer of power and leadership changes, is the outward sign of the democratic covenant between citizens and their government.

Credit unions were conceived on these two foundations. Freedom means the opportunity to control one’s resources in community, to enhance economic opportunity. Especially in a market economy dominated by large private firms pursuing their financial self-interest, not the consumers.

Democracy is how this collaborative alternative to private wealth creation is to be governed. One person, one vote, with leaders chosen from and by the members.

A Credit Union Crossroad?

As many countries have shown, economic progress can occur without democratic government. China is a current example. Democracy is not just a set of bylaws or regulations that automatically self-execute. It is a process administered by those in authority. That oversight can be faithful to the concepts or manipulated while all the time professing democratic values.

America’s credit union system is at crossroads in democratic governance. For annual elections are frequently nothing more than exercises in self-selection by incumbent boards. Voting in mergers is a process manipulated to discourage informed choice let alone active member engagement.

The result is that many large credit union boards govern like self-perpetuating “trustees” as for a hospital, university or other not-or-profit organization. Access to leadership positions is tightly controlled. Institutional and individual success supersede the role of member-owners. Accountability is simply executing member transactions safely.

Recently two long standing credit union members exchanged emails on this erosion of cooperative democracy. One’s concern was the absence of board elections; the second member had just experienced the unanticipated downsides of a merger.

Two Members’ Thoughts on the State of Credit Union Democracy

I was copied on their exchanges which are edited for length.

One Member’s Critique of Board Elections

If the credit union directors were challenged, each would probably explain that anyone can serve on the Board of Directors and that is true. A nomination requires a petition signed by 500 credit union members; a completed application packet (with materials only available on request for a short period of time) and the approval by a “Nominating Committee” whose names cannot be disclosed.

The details and application packet are only posted once a year in January and are removed from the credit union’s website in May. The materials must be submitted to the nominating committee 90 days prior to the annual election which is scheduled in May. This gives the applicant just weeks to prepare for a nomination. The nominating committee then determines the names to put “in nomination”. For years only one name per open seat has been recommended avoiding any elections. From 2004 through 2018 there were only three open seats.

By creating a path riddled with obstacles with no term limits, the Board of Directors has created a culture of exclusion that ensures these same seven individuals will be able to continue sitting as directors for their lifetime while controlling the process for those who may serve alongside them.

A Member’s Cites Athenian Democracy

Last night right after reading your critiques (of credit union board elections), something dawned on me. Would you be familiar with ancient Athenian democracy? I want to test an idea with you.

I was “browsing” – in an old store, in an old town, when I came across a volume entitled The Constitution of the Athenians, written by Aristotle. I remember, vaguely, learning about the ancient world in history class in high school.

I stood there flipping through pages when I came to the chapter on Aristotle’s constitution. I was immediately stunned by the most unexpected aspect of the Athenian democracy. Get this: They did not elect their leaders; they were selected by lot!

Yes, literally drawn by lot. I’m talking about shards of old pottery that were used as tokens to be drawn at random to select the 9 archons. Naturally, my first response was one of utter disbelief that just anybody could be the material of solid leadership for a nation, much less the one system of governance touted as the prototype for modern democracy.

I finally caught onto the idea that it might be safe to regard most people as competent enough to lead. Especially if a lot of other eyes are watching them in a transparent process.

Curiosity drove me to devour the rest of that constitution. Checks and balances were built into that system to prevent the sort of mayhem and corruption one might conclude would be the possible outcome of a system of leadership drawn by lot.

Archons only served certain weeks of certain months of the year, at randomized times. At the end of their one-year term of service to Athens, they were subjected to an audit. Every dime had to be accounted for, and every decision made had to be justified.

Here’s the bottom line: In some 2 centuries that Aristotle discusses he notes that there were only 2 very brief periods of corruption, largely due to these systems of controls which he lays out in exquisite detail.

So, I have to wonder… if such a system could work for centuries, where democracy was first tried out on live subjects, then could it work for a credit union.

How would a credit union apply these procedures?

An outside auditor would draw however many names to fill the board, all performed in front of a live membership audience (even by Zoom if necessary).

We would select persons for the board to serve for certain periods, but no one would know exactly who, when, or in what order. This would prevent anyone from taking deleterious actions, since other board member (also randomly picked) would be relieving them next, whose duty would be to check that everything was in order upon their taking their turn at the helm.

Each board member would be accountable, individually, by way of a public audit of their activities during their staggered and unpredictable periods of duty.

Any dealings with other organizations — such as potential mergers, e.g. — would be open to question and discussion at that time.

The key is that members of the CU could only serve ONCE, and only for a limited period of service.

Term limits would prevent endless manipulation and personal betterment on the backs of members of the coop. The end of endless terms. The end of non-diversity, since board members will be chosen at random from applicants desiring to serve. The end of unilateral and secretive decision-making without membership input. Those self-serving possibilities stand little chance this way.

I believe this model has a chance of working. At the very least, any alternative system to the current approach would be a welcome improvement.

PS As an interesting aside, recent research into Koine Greek seems to indicate that the word democracy does not mean “the people rule” as is often purported. It more accurately appears to mean “the power of the common people” — and note that the word common is essential here. The word democracy intends all-inclusiveness, and I strongly feel that this point is perfectly relevant to cooperative systems of governance.

The First Member Responds

The “bottom line” is simple…the credit union is not bound by anything, so the directors operate their credit union like the Politburo. The NCUA provides broad guidelines for elections that would provide each of the over 1 million members an opportunity to serve in a board position. Instead, the credit union has chosen an election path that makes it impossible for anyone, other than the incumbents to serve. Consequently, you have a board made up of individuals who have served for over 20 years and will never give up their seats. The most recent vacancies were a result of death and illness.

The Proponent of Cooperative “Athenian” Democratic Reform

You are right; perhaps the board is not required to perform its duties in any particular fashion. But what sort of model would one use to ensure that members will never again be abused the way they have been historically? My ideas are an attempt at implementing democracy, albeit in a manner unlike what passes for democracy in the world today.

Judging from the lukewarm response, I’ll take that as a cue to push this no further.

The First Member

My lukewarm responses are based on the fact that fighting this is an uphill battle. Personally, I will continue to push. The best way to ensure that members will never again be abused by a group of leaders who value their power over diversity and democracy. That’s my objective.

My Takeaway: Term Limits

By law NCUA board members are limited to one term, a maximum of six years. Or until a successor is appointed. All three board terms are staggered.

Is NCUA’s Board structure an application of Athenian democratic governance described above? Should term limits apply to credit union boards? What is the role of “common people” in a cooperative organization?