A Birthday Observation

Timeless Wisdom When Serving Members in a Crisis

“Our movement does not exist because it was created from the top down. Rather, it was created from the bottom up . . . We did not tell Congress we wanted to be “safe and sound” institutions. We always knew that if we were lending to our members there was risk involved. Serving came first; safety and soundness was a means to the end of serving.”

– Ed Callahan, May 1999

Timeless Wisdom in “Troubled Times”

One Societal Benefit of the COVID Pandemic

Virtual Insight from Alexa

Amazon’s oral concierge speaker, Alexa, is a ready source for all kinds of factual information. I can ask the time, weather, latest news or sports scores, and even call up blog podcasts. Recently I added a subscription to play any kind of music imaginable, from “calming classical choruses” to John Denver or Taylor Swift’s entire catalogue.

As with all forms of virtual interaction, one presumes the creators are always striving to improve responsiveness through artificial intelligence (AI) programmed learning.

This means Alexa’s “knowledge” is more than being a verbal avatar for a Google inquiry. One can ask Alexa to tell jokes or ask what kind of day “she-it” is having. A seeming dialogue is underway.

Alexa and the Presidential Election

So, I decided to query whether Alexa had a preference in the upcoming election.

Q: Alexa, who will you vote for in the upcoming Presidential election?

A: Well frankly, I don’t think bots should influence elections.

I don’t know your reaction to this response. But the three words that struck me as significant were “I don’t think.” This is just a negative way of saying: “I think bots should not be. . .”

My query now is how or who is doing Alexa’s thinking?

Tracking FDIC’s Insured Deposit Trends in Your Market

Once per year using June 30 data, the FDIC publishes the total deposits per branch for every bank.

This Summary of Deposits (SOD) report includes an easily searchable database that enables any user to find the totals by any market segment: city, SMSA, county, ZIP code or state.

The tool can be accessed from the FDIC website.

Grand Rapids, MI, FDIC Insured Deposit Report for June 30, 2020

I tested the program by searching all FDIC branches for the city of Grand Rapids.

The repost lists the 22 FDIC insured institutions serving the market in order of deposits. These total $15.4 billion in the 102 branches in the city.

Fifth Third Bank, Ohio headquartered, leads with a 26.5% market share. Seven banks have only one branch in Grand Rapids, all with less than $100 million in deposits.

Where Can I Get Credit Union Data?

For almost a decade Callahan has combined this annual FDIC report with credit union data. This Branch Analyzer database shows all the branches in a selected market. More importantly the analysis provides two year trends in the defined market, changes in market share by institution and even maps showing the geographic layout for all the branches.

Credit unions do not file a branch deposit report like the FDIC. Callahan’s searchable program approximates the deposits at each credit union branch by dividing a credit union’s total shares at June 30 by its number of branches.

The latest edition of Branch Analyzer can be found here: https://www.callahan.com/market-analysis/

“Naming Rights” for Chapter V of The Credit Union Story

Winston Churchill wrote: “The farther backward you can look, the farther forward you are likely to see.”

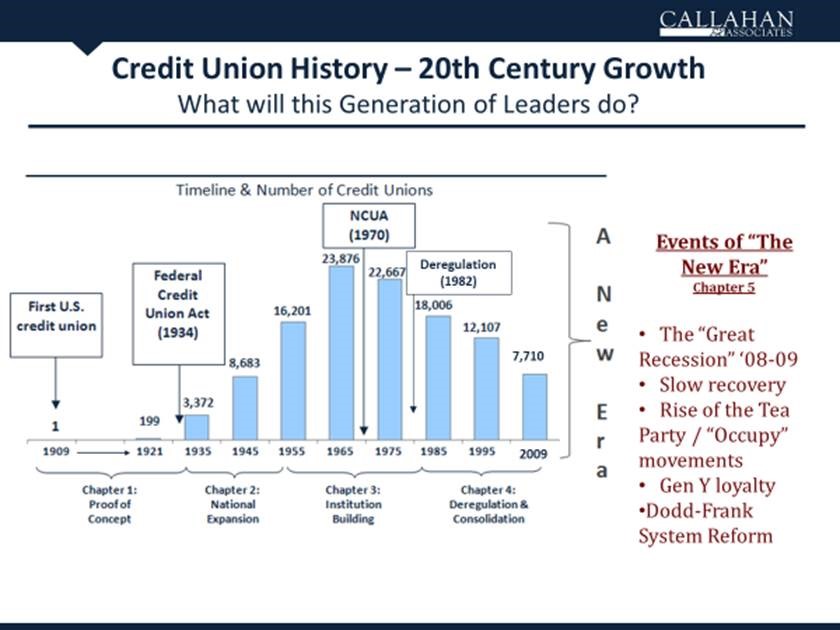

American credit union history covers almost five generations. The first four “eras” shown below established the modern credit union system. Each had a distinct theme. The amazing growth, and decline, of active charters is described on the bar graph.

What is the Current Era?

If the fourth chapter ended in 2008, credit unions are now halfway through the next part of their story. What will be the dominant theme from this generation of credit union leaders?

Some of the events so far are noted at right. COVID and related social crisis should certainly be added to this list.

How would you characterize the industry’s status at this interim stage? Some ideas might be:

- Consolidation, Concentration and Competition

- Regulatory Backlash

- Membership Passes the Century Mark

- The CUSO Era

- Maturing Coop Model Seeks New Growth Curve

- Etc.

The Value of Perspective

Seeing present day priorities through the lens of the past, can highlight what future outcomes might be.

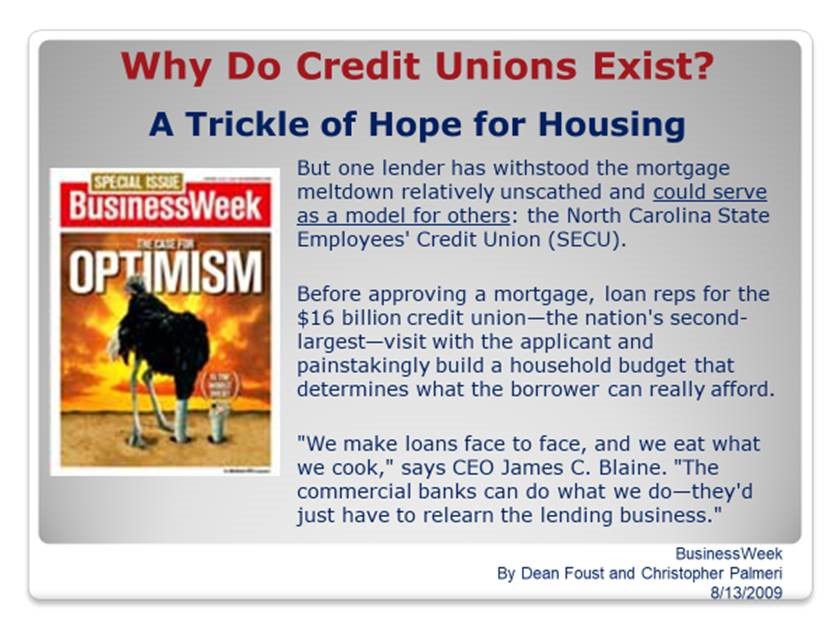

The outlook of many of today’s leaders has been shaped by the 2008/2009 financial crisis. This interrupted the momentum and confidence from a generation that mined the benefits of deregulation for members.

The current crisis is the second in a decade to engulf members. Can credit unions be masters of their destiny or morph into just another financial option?

Churchill also remarked: “History will be kind to me for I intend to write it.”

Naming the current era is one way credit unions can shape their history. Please send your suggestions for the title of the chapter we are creating now.

Timeless Wisdom: Small Is (Or Can Be) Beautiful

“Folks only jump if the oil platform is on fire. In other words, we are all incrementalists unless and only if we feel the flames licking at our backs. Then it is too late. If the small [credit unions] are just small, as most of us are, how do we turn that smallness into a strategic advantage — with real tactics attached? . . . Small connotes attributes other than just small. Small is (or can be) faster. Small is (or can be) more intimate with members. Small is (or can be) more urgent. Small is (or can be) higher risk takers. Small is (or can be) more personal.”

– A CUSO manager, February 2018