Even though NCUA’s public board meeting yesterday had a minimal agenda of two items, comments completely scripted, and outcomes pre-determined by design, there is still much to be learned from the live session.

As one NCUA Board member stated, all who are subject to the board’s authority can see if it is carrying out its “fiduciary duties” in a thoughtful manner.

Were the presentations documented with relevant and timely information? Were key issues raised? How knowledgeable were staff and board with the subjects?

While reports of the prepared remarks or occasional comment are helpful, there can be much more to be seen from the public “performance.”

The Context for the Meeting

The two agenda items were the quarterly NCUSIF update and a proposed change to the charitable deduction accounts (CDA’s).

However the external context was especially relevant. In addition to the continuing economic and financial uncertainty there is the current government debt ceiling political impasse. Would the many government employee focused credit unions be affected by a temporary halt of payments? This topic was not raised.

The Good News

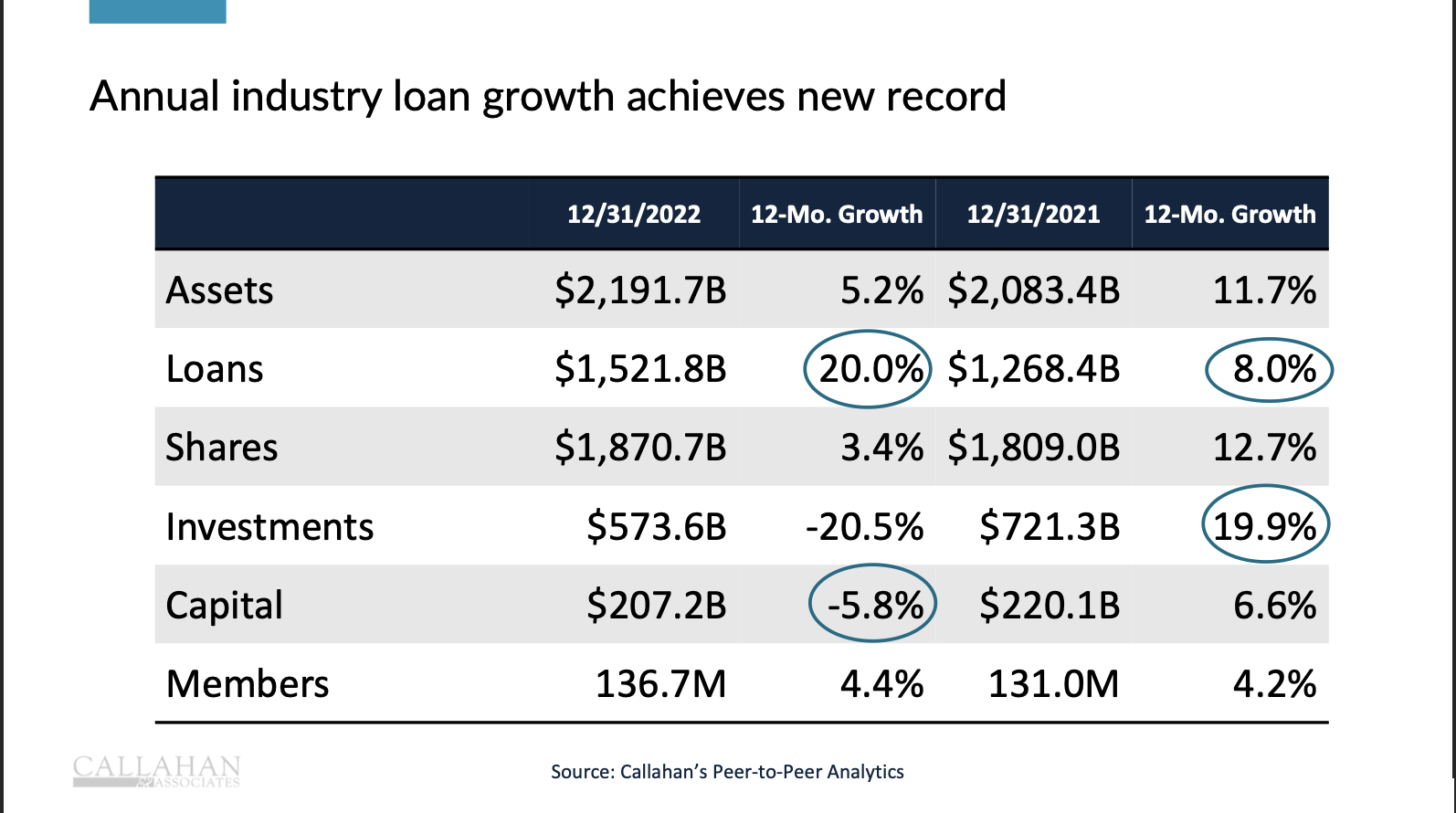

Despite political and financial uncertainties, NCUA’s field examiners reported the lowest percentage of code 4 and 5 rated credit unions in decades: just .29% of insured shares.

How did this happen? Are credit union leaders just better managers than their competitors? NCUA a more effective regulator? Or credit unions just lucky at this moment? What one board member cryptically called the “calm before the storm.”

Only Hood provided an analysis for the current state of the system:

Our public financial postings and disclosures and credit union performance highlight the unique character of the cooperative system—a system that was the basis for rejecting the FDIC premium models in years past and still in use today and designing a uniquely cooperative approach. The credit union system is a unique financial system, and our regulatory and Share Insurance Fund framework should reflect this.

Certainly the data summarized is great news in the current context. But end of story? No. A number of explanations and data points offered were unexamined. Questions would have demonstrated a better grasp of several critical areas of NCUA board oversight.

Issues Left open and Questions Not Asked

CFO Schied’s fund NCUSIF update was a literal reading of numbers from ten slides with no accompanying analysis.

He did point out that the number of NCUSIF insured had declined by 59 in the quarter. In contrast the board complimented staff on granting a new charter.

However no board member spoke to the critical question. Is this rate of annual decline of over 200 credit union charters acceptable? For any industry opening 1-3 new locations a year while shutting down 200 which existed for decades, raises the question: is the system sustainable?

Some would respond that this trend is OK because these are mostly smaller mergers and total credit union members keep growing.

However from the member-owners’ perspective, these are 200 charter failures. Suggesting a chairman’s award for a new charter or two would seem a miss-focus compared to the oversight of 200 charter closures. Reducing charter cancellations would seem to be the first priority; getting a new one is a multiyear ordeal.

The CLF and Credit Union Liquidity

All three members mentioned the need for Congress to again restore the CLF’s temporary Covid era authority. This has been supported by the assertion that over 3,000 credit unions under $250 million now lack CLF access. A status only Congress can fix.

I believe this constant tossing the ball to Congress’ lap for CLF coverage overlooks NCUA’s primary responsibility for the situation:

- For four decades all credit unions were CLF members under existing legislation that is still in place. It was NCUA’s actions that closed down this solution.

- There has been no credit union borrowing from the CLF since 2009. That borrowing was via the NCUSIF for US Central and WesCorp.

- Today smaller natural person credit unions rely on two primary sources: the corporate system and FHLB. Even when the recent banking liquidity crisis occurred, there was no CLF effort to match the Fed’s Bank Term Funding Program (BTFP) which offered all comers loans up to one year in length.

The CLF has been missing in action for two decades. The NCUA has not collaborated with corporates or credit unions to design a CLF that credit unions would see as vital and relevant. The FHLB system, a cooperative model, has done this well. The CLF’s liquidity design is not a Congressional legislative issue. It is an NCUA leadership and management responsibility.

The NCUSIF’s Performance

The single most critical aspect of NCUSIF performance is the management of its investment portfolio, its primary revenue source.

For the first quarter revenue grew by 49% versus the year earlier. However the YTD yield was only 1.75% or roughly 3% below the first quarter’s overnight rate. In November 2022 NCUA staff announced it was pausing its ladder strategy until overnight funds reached $4 billion. There was little information how this amount was determined and why?

The critical topic is what has NCUA learned during this ongoing rate cycle that would affect how it approaches future activity. When asked about this, CFO Shied said the fund followed a SLY investment policy. After the $4 billion level is reached it would then go back to the 10-year ladder.

When asked how long it would take the fund to achieve par value in the current rate environment, he replied three years. He listed the required cash flows of $400 million, $700 million and $1.0 billion in that period. That corresponds to the current wighted average life (WAL) of 3.0 years.

Should the current rate situation become a new normal, then NCUSIF revenue will have recorded below market returns for over four years since the Fed began raising rates in March 2022.

Every 1% of below market yields costs credit unions $200 million annually on the NCUSIF’s $21 billion portfolio. The current 3% under market yield results in a $500-600 million annual revenue shortfall that will continue until rates normalize and the portfolio reprices.

This revenue gap is twice NCUA’s total annual budget. It is a performance shortcoming keeping credit unions from reaping the returns from their fund 1% underwriting. This revenue shortfall is a safety and soundness concern that affects the system’s overall stability. It is not a design flaw, but a management responsibility.

Managing IRR risk, and related fund revenue, is the NCUSIF’s top responsibility. It should be guided by two questions:

- How soon will I need the money? Ans. There is no way to know this, which means there should be a bias toward more, not less liquidity, whatever the interest rate outlook.

- What is the earning’s goal for the portfolio? Ans. We know from the fund’s loss history, long term rate of share growth and budgeted operating expenses, that a yield of 2.5-3.0% would maintain a 1.3% NOL in virtually all scenarios.

Moreover in years of low losses the Fund should pay a dividend. That was the mutual commitment for credit unions to support the NCUSIF’s perpetual underwriting with a 1% deposit.

The essential NCUSIF management skill is IRR monitoring. Compared with a credit union’s ALM challenge of managing the two sides of a balance sheet and forecasting net interest income or the economic value of equity, the NCUSIF responsibility is a straight forward. How should the WAL be adjusted given the two questions above and rate outlook?

The Fed’s rise in rates was announced in advance. The speed and amount may have caught many portfolio managers flat footed, but the take away should be to enhance IRR, not revert back to a rote formula that is costing credit unions hundreds of millions in lost revenue.

To not address this critical aspect of NCUSIF performance and just accept the intent to go back to the old ways of doing things once the $4 billion goal is reached, is an oversight failure.

The CDA Proposal’s Data Omission

The second board item was one page long. It was a proposal to add more eligible organizations for CDA donations beyond 501 C 3’s. The specific suggestion was 501 C 19, nonprofit groups serving veterans.

The proposal would seem reasonable. However the discussion was made in a vacuum. There was no information provided about this ten year old incidental power to know the scope of the policy decision. How many credit unions have this account? How much do they contribute? What data indicate this authority is actually working as intended?

The 5300 quarterly report has some data. At March 2023 there were 278 credit unions holding $1.4 billion in CDA accounts. Seventy-four credit unions had added this account during the past year, and thirteen had dropped it. Total balances had increased by $85 million or 6.5%

When asking for public comment, it is important to provide data relevant to the issue at hand. How is this authority benefitting members?

One board member stated the rule’s intent was to provide higher returns by allowing investments not authorized for the credit unions to use in their own portfolios. The theory was that the expected higher return would allow credit unions to make donations without impacting their net income. Is that what is happening?

In making policy recommendations there should be a data context, especially when information is easily available, so that commenters can know the impact of what is being discussed.

Next week I will return to the most important discussion that didn’t happen with the NCUSIF.