On February 13, 2023 NCUA posted the December yearend audits of its four managed funds.

Publishing this audited information plus the interim monthly financial updates is an important resource for credit unions to monitor the Agency’s financial performance.

Today’s NCUA board meeting will include a public discussion of the NCUSIF, the largest and most critical report because it relies on the credit unions’ 1% capital deposit as its funding base.

General Audit Observations

Three of the four funds are presented following GAAP accounting standards. These three financial statements and footnotes are easy to follow. However the NCUSIF is presented using Federal GAAP accounting. There are fundamental differences in presentation and transparency between these two approaches. I’ll address these below.

Total NCUA expenses in its three main funds (NCUSIF, Operating and CLF) total $ 332.1 million, an increase of $14.5 million (4.6%) from 2021. The NCUSIF paid 63% of this expense total. It should be noted that all NCUA’s revenue is from credit unions and interest on their funds held by the agency.

The smallest of the four, the community Development Revolving Loan Fund does not have allocated expenses and has minimal activity-only $1.5 million in “technical assistance grants.”

The NCUSIF’s Audit

The Board meeting is only discussing the NCUSIF today. It is the most consequential for credit unions in terms of credit union impact and support.

The NCUSIF had a stable year. Total expenses rose to $208 million or 4.5%. Net cash losses were just over $10 million. However $33 million additional expense was added to the reserve account raising its total by $ 23 million to $185 million. That reserve balance equates to 1.1 basis points of insured shares, a ratio greater than the most recent five years net cash loss rate.

Several very important issues are not directly addressed in the audit. But hopefully will be raised by Board members.

The first is the Federal GAAP presentation that uses completely misleading terms for a non-appropriated government entity. Fed GAAP has no accounting concept of retained earnings, but rather presents “cumulative result of operations.” This number includes any changes in the market value of the fund’s major asset-treasury securities as of the audit date.

Other accounting categories such as intragovernmental assets, exchange revenue, public liabilities, net position and order of presentation are completely foreign concepts for standard GAAP financial statements. They obscure understanding of financial performance. Even NCUA staff converts the information to a standard GAAP format for the board.

The accounting term “cumulative results of operations” which replaces “retained earnings” shows a decline from $4.8 billion to $3.2 billion due to the $1.6 billion difference in market and book value of the NCUSIF’s investments. Also the fund’s total capital which includes the 1% deposit shows a fall from $20.6 billion to $20.2 billion.

This is how the balance sheet is reported even though the NCUSIF had a positive bottom line of $185 million using standard GAAP accounting. Any reporter or other user of this statement would be left with a very negative impression of the Fund’s balance sheet financial position from this presentation.

Also Federal GAAP considers all AME and NCUSIF managed estates as “fiduciary” and therefore not part of the NCUSIF’s balance sheet. As a result only the net amount of the corporate and natural person combined AME numbers is shown in footnotes. Expenses are netted against income. Tracking the reasons for increases and decreases in “net liabilities” is impossible as only totals are provided.

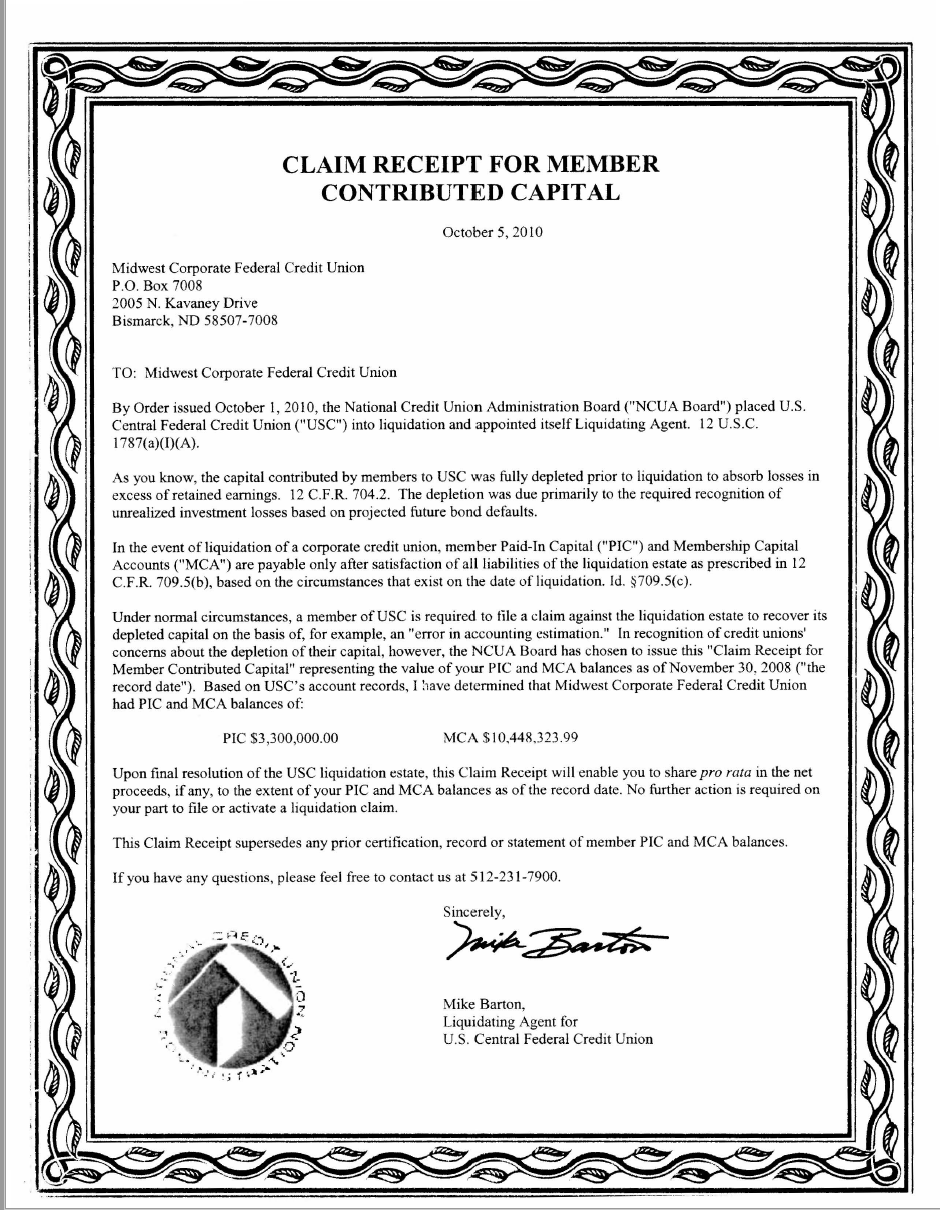

This off-balance sheet accounting means the corporate AME’s and NPCU estates are not part of the monthly NCUSIF updates. Their revenue and expenses are not reported. And the amounts under management are large, in the hundreds of millions for the Corporate estates, that are still owed credit unions.

This is a situation ripe for error and mismanagement. Timely and full disclosure of these off-balance sheet funds are material to understanding the fund’s actual performance.

The All Important NOL

The most important yearend result is the NOL calculation. A footnote reports the “NCUA’s calculation” as 1.3% or below the board’s 1.33% cap.

This is a ratio composed of the June 2022, 1% capitalization balance, an audited retained earnings (note the switch to GAAP) at December 2022, and an unaudited insured shares total as of February 10, 2023. Two different accounting dates are used in the numerator (June 30 and December 31) and an unaudited total in the denominator. The result is a misleading NOL ratio.

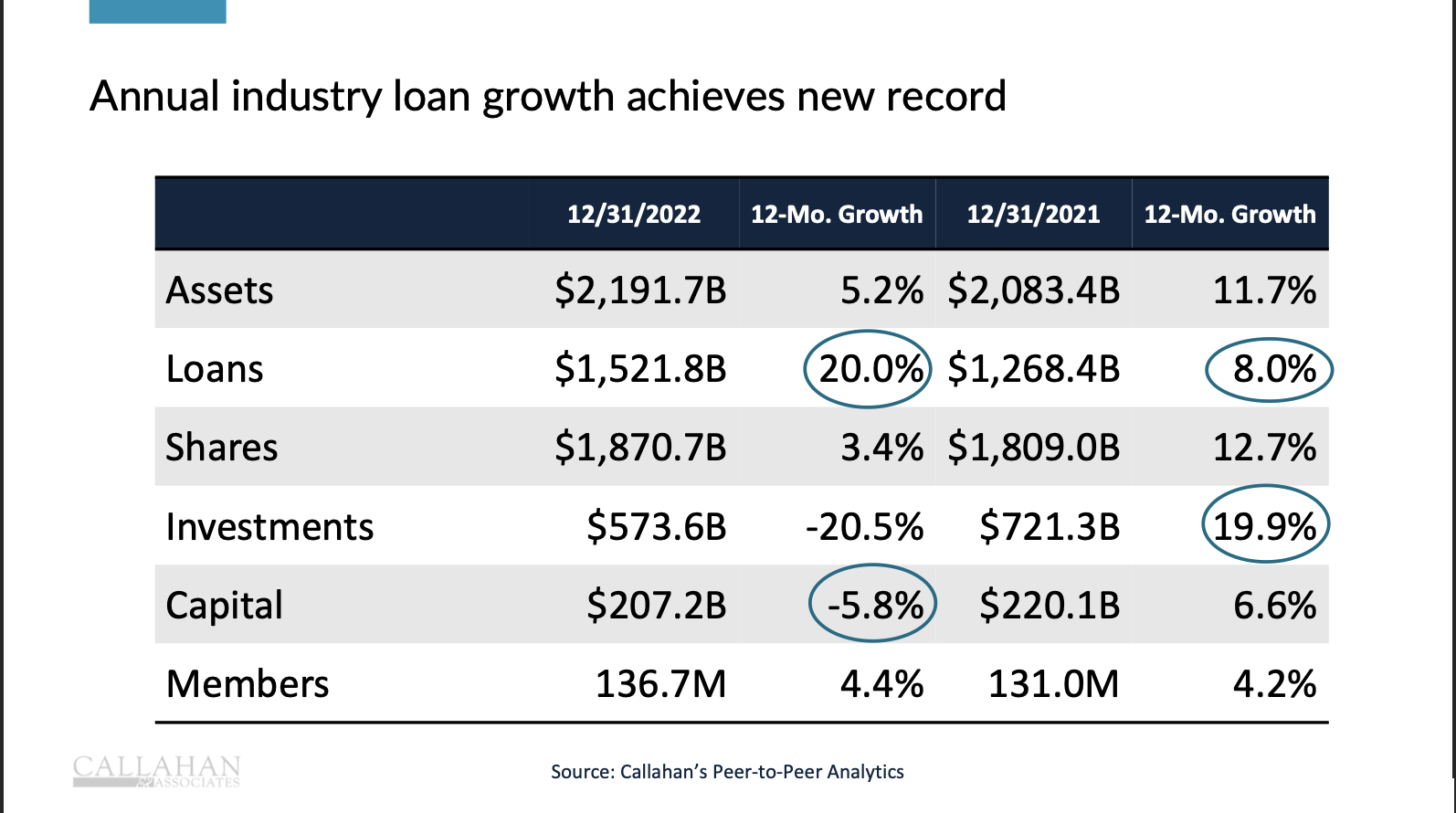

Share growth in 2023 was just 3.4% with credit unions reported lower total insured shares at December 31 than at June 30. However the larger June 1% deposit number is used in the denominator even though net deposit refunds will be sent from this total. In essence the actual NOL is slightly overstated.

Moreover, It is easy to estimate what credit unions’ 1% deposit net liability is. Just take 1% of the denominator’s total for insured shares. That is how private GAAP would present the ratio—and how the NCUA did the calculation until 2001. As a consequence this ratio misstates actual NOL and potentially, dividends due to credit unions.

The NCUSIF’s Investment Management

The fund’s most important asset is its $21 million of treasury investments. The yearend audit shows a larger overnight cash position than in 2021. However the fund’s weighted average life of 3.3 years has been largely unchanged during the past 12 months of Fed tightening.

The portfolio’s decline in market value is almost $1.7 billion at yearend. This is important because the decline equates to over 10 basis points of the fund’s 30 basis point in retained earnings. This amount, on top of the 1% deposit, must remain at or above 1.2% or an equity restoration plan is required.

What is the fund’s interest risk management monitoring process? Why would the NCUSIF keep investing long term in a rising rate environment? Especially when there is an inverted yield curve?

As of Wednesday’s Feb 15’s market close, the one year treasury yield was 4.96% and the seven year was 1% lower at 3.94%. This inverted yield curve has existed for almost six months. All of the fundamentals suggest a shorter WAM for the NCUSIF’s portfolio.

The consequence of a 3.3 year weighted average maturity (WAM) is that NCUSIF investments will underperform market rates until the yield curve stabilizes at a new normal. If today’s environment were representative of the future, it would take the fund over three years to recover its market losses. During this adjustment, the NCUSIF revenue is shortchanged from current market returns. Credit unions will suffer the shortfall either in lost dividends or, in a worst case scenario, a fee to maintain the NOL.

So today’s meeting is an important opportunity to see what the board and staff take away from this year’s NCUSIF performance. The numbers are in, now what do they mean? How can the fund’s presentation and management be more transparent to its credit union owners? In short, how can performance be improved?

The Central Liquidity Facility

The CLF had a most interesting year financially as it reported $546 million in capital stock redemptions by agent corporates, partially offset by a $132 million increase in regular member shares. Total capital declined by a net amount of $400 million due to these stock paybacks and new purchases.

As has been the case since 2010, the CLF made no loans. It paid out 97.3% of its $20.7 million net income in quarterly stock dividends totaling $3.69 per $50 share over the entire year. That equates to a 7.4% annual dividend yield.

The CLF’s borrowing authority reverted to 12 times its capital and surplus with the expiration of the CARES Act temporary increase. As a result, and also due to the decline in total capital , the CLF’s maximum borrowing amount fell from $35.7 in 2021 to $17.5 at yearend 2022.

All the CLF’s revenue is from interest on investments, which are kept at Treasury., even though CLF has broader statutory investment authority than the NCUSIF. Income jumped from $4.5 to $22 million. Most of this increase was passed through as a dividend.

A point of inquiry would be why the liquidity facility had 7.6% of its investments in the 5-10 year maturity bucket. Or why it keeps almost 40% in the 1-5 year range. It would seem prudent that the CLF should place investments no longer than the limit the NCUA places on corporates, or two years.

Operating Holds Fund Balance Exceeding Annual Expenses

The Operating Fund had expenses of $122.8 after all internal transfers, a $5.3 million (4.7%) increase over 2021.

The Fund retained an equity surplus of $133 million or 108% of 2022’s total operating expenditures. Interest on this fund balance did grow from nil to $2.4 million as market rates rose.

Even though NCUA said it would reduce the credit union funds held by assessing a lower 2022 operating fee, the ending balance is still over three times the agency levels of earlier years. It is far in excess of any cash flow coverage necessary until the new year’s operating fees are received.

Transparency Only Matters if Credit Unions Pay Attention

One of the most important checks and balances credit unions requested in 1984 which NCUA committed to, was an annual external CPA (not GAO) audit of the NCUSIF in return for the open ended 1% deposit funding base.

In addition, monthly financial updates would help monitor the fund’s expenses, reserves and overall management.

However, if the reports are not used by credit unions and only the press releases are followed, then the reporting and transparency model will not work.

For credit unions used to monthly financial analysis, this responsibility should be a “walk in the park.” Take it.