Today is NCUA’s public hearing on its proposed $367 million budget for 2023.

Inflation is the number one topic on many people’s minds. An NCUA board member has presented numerous examples on LinkedIn of the impact of inflation on consumers. The posts include reporting on the price of beer in sports stadiums, the cost of a Five Guy hamburger and presenting the two decade chart below tracking price increases in various sectors of the economy.

His latest comment reads as follows:

Ouch. Average monthly payment for new cars hits $738. Throw in gas, insurance, registration and that’s $1000 a month just to drive around.

Now he is in a position to do something about his observations.

NCUA’s Spending and Price Increases in the Economy

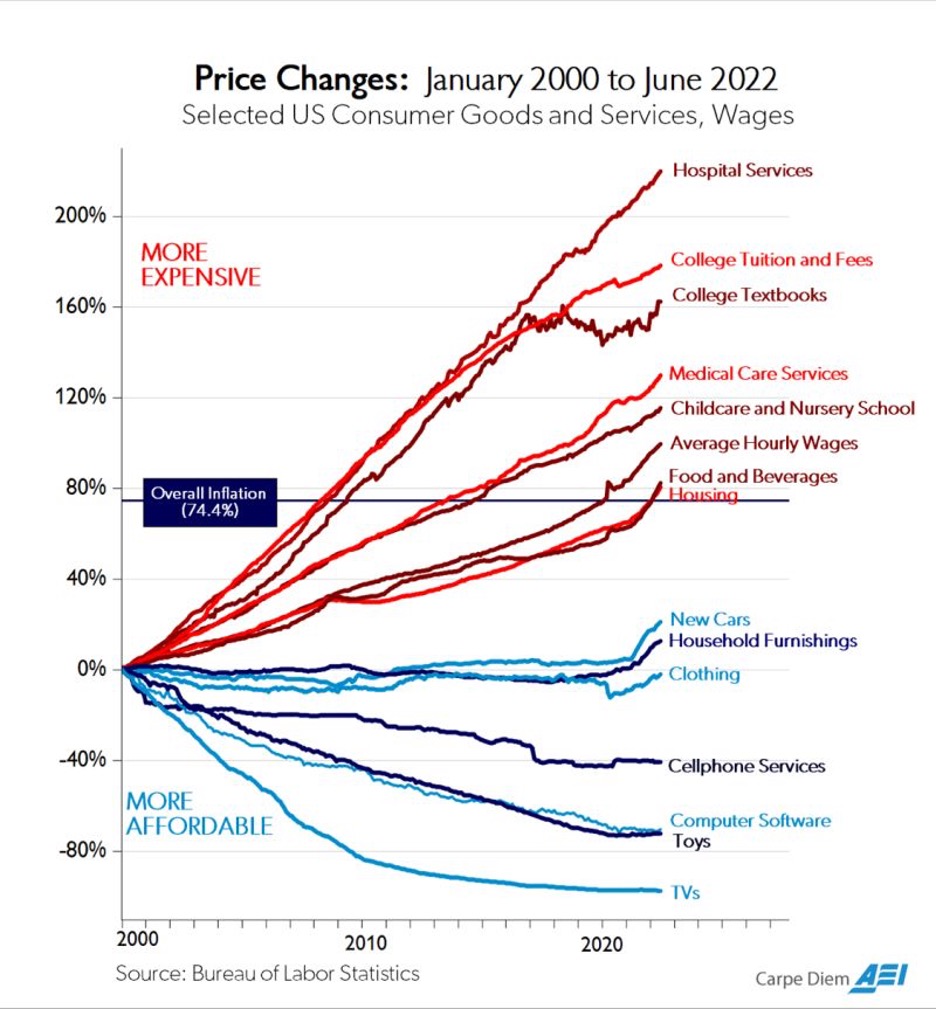

The Bureau of Labor Statistics chart below is a 21-year history of the price changes of various services and products from 2000 through June of 2022. The changes are compared with the average hourly wage increase.

Some services or products are “more affordable” as their price changes are less than the increase in wages. The “less affordable” group have seen prices rise faster than wages.

The overall inflation in the period is 74.4%. The highest increase in this 22 years is in hospital costs with a 240% price surge, just ahead of college tuition.

At the same time TV’s, computer software, and cell phones have become more affordable with price rises less than the increase in wages.

Where would NCUA’s ever swelling growth in total regulatory costs paid by credit unions be on this chart ?

NCUA is Number 1: What to Look for in Today’s Hearing

In 2000 total NCUA expenses for the operating fund, NCUSIF and the CLF were $129.9 million. For the 2023 budget NCUA proposes spending $367 million.

At yearend 2000, NCUA oversaw 10,316 federally insured credit unions. At June 30, 2022 the number was 4,853.

NCUA’s proposed new budget would result in a 283% increase for this 22 year period. This places the agency number 1, at the very top of the chart of price escalations across all sectors of the economy.

Inflation is the most urgent economic challenge facing the country. The only sure way dealing with this challenge is to reduce costs. Companies across the economy have announced hiring freezes and layoffs to control their ability to compete.

Even some credit unions are announcing layoffs especially in their mortgage lending personnel.

The issue for the NCUA board members is whether they just want to talk about inflation; or, will they have the courage and capability to do something about it in this area of their direct responsibility?

Once again the NCUA is showing behavior opposite to the purpose of credit unions. Taking from members, not serving them. Over the past 20 years the number of FICU’s (Federally Insured Credit Union’s) has declined over 50%. At the same time the NCUA budget has increased over 283%. Amazing how that happens.

And what benefit can we recognize from this massive increase? Has this exponential growth provided better audit examinations? If there was a real alternative to the NCUA monopoly, there would be no way they could continue to tax their prey by way of assessments; they would be out of business.

What is NCUA’s ROI to the credit union member? What is the ROI to the credit union? Recommendation: #1: NCUA should bill credit unions directly at the prevailing audit examination hourly rate. #2: If there were any shortfall, NCUA may request volunteer assessments and contributions from the regulated. Watch the response as a grade on the NCUA and its value back to credit unions. #3: Arrange internal auditors from the largest credit unions to review NCUA’s internal operations and processes to identify where costs savings could be accomplished and publish the results.One focus should be the ever rising technology expenditures which have become a black hole soaking up funds with no return.