This is a true story. The lead characters are the CEO’s and boards of the two merging credit unions, NCUA’s Regional Office, CURE in DC and the California Department of Financial institutions.

The facts are from documents sent members, IRS 990 filings, FOIA data and public statements by those involved. I give my point of view. You can decide what your interpretation of the information would be.

The Story Begins

The first step was for the actors to draw up their scheme, include a lot of financial “chaff” around the theft and then decorate the proposal with positive sounding future rhetoric about “empowering people and economies of scale.”

Next, submit this draft proposal to NCUA’s Regional office for their OK.

No surprise there. NCUA approved the plan, detailed below. Now it is full speed ahead.

With the regulator’s green light, the next step was to form a California based non-profit with initials mimicking the credit union’s name: FCCU2 Foundation. The stated purpose is to “support charitable and educational activities for the betterment of the Stockton area.” Despite the name, it is neither a foundation in traditional meaning nor tax exempt.

The two executives responsible for this new “charitable foundation” are the credit union’s CEO, Michael Duffy and the Board Chair Manual Lopez. The organization was registered on June 25, 2021 with Lopez the CEO and Duffy the agent. These two are also members of the five-person credit union board which approved these actions.

On August 6, or forty-two days after registering FCCU2, Board Chair Manual Lopez signs Financial Center Credit Union’s Notice of Special Meeting announcing the intent to merge with Valley Strong Credit Union. Voting will end on September 23.

The Notice contains required information about the transfer of credit union reserves to this just created organization including:

- the $10 million “capital distribution” to the newly formed non-profit FCCU2;

- a new job for CEO Michael Duffy as Chief Advocacy Officer for the continuing credit union, Valley Strong;

- Valley Strong Credit Union CEO Nicholas Ambrosini’s commitment to provide “an additional $2,500,000 to the FCCU2 Foundation over a term of ten years.” The wording is unclear whether this is $2.5 million in total or $2.5 million per year ($25 million) for ten years.

Other mandatory disclosures in the notice detail the additional financial benefits four of the five senior managers will gain from the merger. A special dividend will be paid to members if the combination is approved in their vote.

This special dividend is feasible because the merging credit union’s net worth, over 16%, is double the 8.7% at Valley Strong. The proposed dividend will be determined by a complicated proposal based on member tenure, most recent 12 month share balance with a maximum cap on the share balance. The estimated payout is “approximately $14,973,948.00” in the Notice-an unusually precise number, suggesting a very detailed plan.

Members were given 48 days to cast their vote. On September 23, 2021, the called special meeting took place. 38 members attended in person. Thirteen voted in favor and zero opposed. 2,667 members mailed ballots with 383 opposed and 2,284 in favor.

The final tally was 86% of members for and 14% opposed. Only 9% of the credit union’s 29,672 members voted on this request to give up their charter.

Financial Center’s Final Bottom Line

The merger was formally completed on October 1, 2021, seven days after the vote.

The financial results of the merger are reported in Financial Center’s last call report as of September 30, 2021. The loss for this final nine months of the credit union’s 66-year life span is $23.7 million. This is due to the $10 million “capital distribution” to FCCU2 and recording the special dividend of approximately $15 million.

This one quarter’s loss reduced the credit union’s net worth ratio, accumulated over seven generations, to 12.4% from 17.2% one year earlier. That ratio was still 4% points (50%) higher than Valley Strong’s net worth at the same date.

Faking It Till You Make It

Recent events in California have highlighted the ethos of self-enrichment, especially in Silicon Valley startups. A phrase used describing these unproven business ideas is: “faking it till you make it.“

This is the practice of promising future bold success even though past results do not support the vision. When there is little or no objective evidence that a concept could succeed, a hyperbolic sales pitch is necessary to continue fund raising and keeping the effort going.

Michael Duffy has worked at Financial Center since 1993, the last 21 years as CEO. His sister, Nora Stroh, also joined in the 1990’s. She was Executive VP and COO, the number two position, all the time Michael was CEO. In the 990 IRS filing for 2018, each reported total compensation of over $1.0 million.

During the final five years of their leadership, the credit union’s loans declined every year, from a peak of $176.5 million at December 2016 to $102 million at the merger date. This is an annual growth of -10.3% (negative). Total members fell by 2,700 or almost 2% per year in the same time frame.

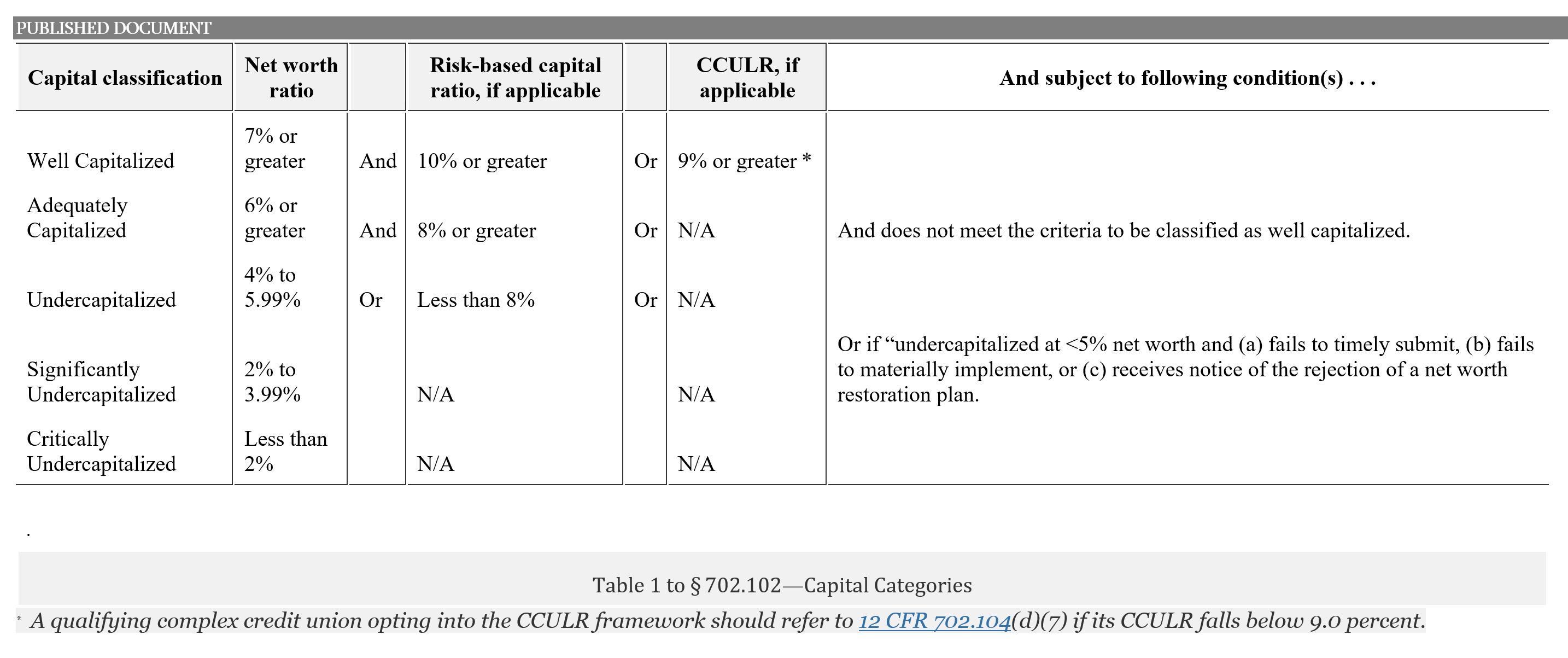

However, the credit union continued to increase its net worth ratio reaching a peak of 20% at December 2018, before falling to 17% one year prior to the merger. Until January 1, 2022, regulators considered credit unions well capitalized with 7% net worth.

As net worth rose, falling loan balances resulted in the loan to asset ratio declining from 39% to 16% at the merger date. As these risk assets fell, the credit union continued adding unnecessary reserves, reaching almost three times (300%) the well capitalized standard. This resulted in shortchanging members on their savings returns and/or charging higher loan rates than necessary for a safe operation.

The credit union’s leadership failed year after year in its most critical member service: making loans. However, it piled up reserves relentlessly, until the leaders decided to bail out. And take some of the surplus reserves with them.

Maintaining a Positive Public Profile

During this same period of decline, the credit unions maintained its public relations in high gear. According to the 990 filings for 2017 and 2019, the credit union made political donations from members’ funds for local political campaigns, such as Stockton city council and mayor, and for statewide office, Newsom for California Governor. Political donations in 2019 went to ten campaigns and $25,000 to the California Credit Union League Pac.

Maintaining the positive image was important for Duffy. On June 1, 2020, the credit union announced a $1.0 million donation by the Michael Duffy Family Fund and the employees of the credit union. An enlarged symbolic check to Stockton’s COVID-19 Response Fund was given by Duffy to the mayor, recorded for TV broadcast, and later published on social media.

The same press release also stated that the credit union had developed a Loan Holiday program to “alleviate financial burdens for its members.” Whatever the program’s intent, outstanding loans at the credit union fell by $40 million in 2020 from the prior year.

In the many years leading up to the merger, the credit union had been operating with the form but not the substance of a cooperative charter. It was run as a family business, promoting the public profile of the CEO, not the well-being of members.

In contrast with the nationwide member and loan growth in the industry, Financial Center’s data shows it had ceased serving members as its primary activity. Instead, it added to a bigger and bigger reserve nest egg to dip into down the road. In other words, faking it till you can take it.

A Change of Perspective

Michael Duffy’s public announcement of the merger intention at the end of May, 2021, was accompanied by uplifting logic and his recent strategic insight:

“As the CEO of Financial Center Credit Union for the past 21 years, my perspective on mergers has evolved just as much as our industry has in that same time period. As credit unions built by select employee groups (SEGs) increasingly partner with community credit unions, I have marveled at what credit unions of today’s scale can accomplish when they join forces with their Member-owners and communities chiefly in mind.

In a financial services sector that is constantly evolving, this merger is a true embodiment of the credit union industry’s cooperative mind-set. At its core our partnership with Valley Strong represents us selecting the best credit union partner to help us achieve our goals faster than we could duplicate on our own.

The phrase ‘Growing Together,’ is a perfect adage, as this merger represents a strategic partnership between two financially healthy, future focused credit unions committed to providing unparalleled branch access, digital access, and amazing service for the Members and the communities they serve.

After three decades of leadership of the credit union, Duffy has concluded that the institution he led can no longer serve its members because it is not big enough ( “scale” )or “fast” enough. His reward for this insight and merger endgame is a new position as Credit Union Advocate at Valley Strong. He gains control of $10 million funded by the credit union, a firm no longer able to keep up with the times under his leadership.

It is more than self-dealing hypocrisy. It is pilfering the members’ money.

Brain Dead Regulatory Oversight

One member who saw through this charade posted a comment on the NCUA’s member-to-member web sight, reviewed by NCUA’s CURE. He urged a No Vote stating in part;

If Financial Center Credit Union is so flush with cash that it wants to give away $10 million, then that amount should be distributed to members. I’ve written to FCCU twice asking for the rationale for giving away $10 million. They have failed to answer me, obviously because there is no rational reason for giving away $10 million from its member-owners.

However, this brazen appropriation of members’ funds was condoned by the regulators-at every step.

NCUA’s multiple levels of review as well as California’s Department of Financial Protection and Innovation must have been braindead when reviewing this diversion to the control of Duffy and his board Chair, the two founders of FCCU2.

The magnitude of the grab and the cover story of good intentions diverted multiple regulators from their public responsibility. Especially when accepting these future plans by leadership that had conned their members for years.

NCUA is fully aware of the self-dealing possible in mergers. It posted some of its concerns when explaining its new merger regulation approved in June 2018. The following are some of the reasons in the Board Action Memorandum supporting this updated rule:

“The Board acknowledges, however, that not all boards of directors are as conscientious about fulfilling their fiduciary duties (in a merger) . . .

The Board also confirms that, for merging FCUs, the NCUA’s regional offices must ensure that boards and management have fulfilled their fiduciary duties under 12 C.F.R. § 701.4.

Each Federal credit union director has the duty to:

- Carry out his or her duties as a director in good faith, in a manner such director reasonably believes to be in the best interests of the membership of the Federal credit union as a whole, and with the care, including reasonable inquiry, as an ordinarily prudent person in a like position would use under similar circumstances;

- The duty of good faith stands for the principle that directors and officers of a corporation in making all decisions in their capacities as corporate fiduciaries, must act with a conscious regard for their responsibilities as fiduciaries.

“Several commenters questioned the NCUA’s authority to regulate credit union mergers, or suggested that the NCUA’s role is limited to safety and soundness concerns. These comments are inaccurate. . .

“In contrast to commenters’ assertions, the statutory factors the Board must consider in granting or withholding approval of a merger transaction include several factors related to safety and soundness, such as the financial condition of the credit union, the adequacy of the credit union’s reserves, the economic advisability of the transaction, and the general character and fitness of the credit union’s management. . .

“Another (commentator) suggested that members have no role in considering merger-related payments to employees. These comments are legally inaccurate and philosophically off-base. The net worth of a credit union belongs to its members. Payments to insiders, especially in the context of a voluntary merger where a credit union could choose to liquidate and distribute its net worth among its members, are distributions of the credit union’s net worth. . .

“Further, the fact that ownership of a portion of a credit union’s net worth is less negotiable than a share of stock in a public company is irrelevant at the time of a proposed merger transaction. A credit union in good condition has the option of voluntary liquidation instead of voluntary merger. . .

(Note: At June 30, 2021 the credit union reported $109.2 million in total capital. Cash on hand was $138.9 million. Net worth ratio was over 16%. If the credit union were liquidated this would have given the greater Stockton community this immediate cash benefit. The 29,000 Members could choose to join another credit union or use the funds for immediate needs. Instead the members received just 13.7% of their collective savings in a one time dividend. Even though this option is referred to in the rule, there is no indication this was ever considered.)

“The Board agrees that mergers should not be the first resort when an otherwise healthy credit union faces succession issues or lack of growth. . .

If these specific statements are insufficient for exercising regulatory judgment, the common law understanding of fiduciary responsibility is even more clear:

The duty of good faith is the principle that directors and officers of a company in making all decisions in their capacities as fiduciaries must act with a conscious regard for their responsibilities as fiduciaries. These include the duty of care, duty of loyalty and the duty to act lawfully.

Self-dealing is an illegal act that happens when a fiduciary acts in their own best interest in a transaction, rather than in the best interest of their clients.

“General Character and Fitness”

This misappropriation of $10 million of member funds by the CEO and Chair of Financial Center should bring the following actions by NCUA:

- the full amount of the $10 million diversion should be clawed back from FCCU2 and distributed to the members;

- the instigators at the board and in management who developed and implemented this scheme should be permanently barred from participating in credit union affairs;

- the minutes and all other documentation relating to the additional required contribution(s) of $2.5 million by Valley Strong to FCCU2 for ten years should be reviewed. If this commitment was a quid pro quo (inducement) in return for the merger, then all parties approving this payment(s) should also be barred from engaging in the affairs of a credit union-board and management.

Every person in the regulatory approval process of this merger should have their actions reviewed to determine if they should continue to be in positions of responsibility.

Every participant will have an excuse. The creator and enablers of this transaction will defend their role by saying NCUA approved it. Then they will point out that the members voted on it. NCUA staff will assert there was no safety and soundness basis to object-despite the many Board statements quoted above.

Citing deeply flawed processes to defend one’s conduct, does not make the actions proper.

In presenting these defenses, the parties involved merely demonstrate incomprehension of one of the oldest rules of society: Thou shalt not steal.

Were such excuses offered, it would confirm the absence of fiduciary awareness and protecting member interests by the parties to this transaction.

These failures are not due to a rule needing updating. Rather it is an example of persons who lack commonsense judgment about accountability.

If NCUA fails to claw back the funds and do nothing it will demonstrate that it has neither foresight nor hindsight when it comes to protecting members. However, this would not be the first time such blindness has occurred; only the latest example.

Ignoring this case will just create a new benchmark for the next merger personal enrichment effort. It’s time to halt these sham merger member deprecations.