From a September 2023 CEO’s team memo update:

Liquidity

“We remain laser focused on managing liquidity risk in this environment of aggregate decreasing money supply.

“We finally sold our $18 million pool of auto loans that we’ve been marketing for two months. As with all other loan sales, we will service the pool in order to maintain and grow member relationships. The transaction generated cash of just over $15.3 million.

“We expect to end the month at a loan to deposit ratio in the 102% neighborhood, down from a high of 106.41% in July. Our goal remains to reduce this ratio to no more than 100% by year end.

The best way to accomplish this is through acquisition of core deposits from our friends and neighbors in our primary market. We’re also marketing another pool of loans so that we don’t have to slow our lending origination machine any further.”

This not an isolated event. Yesterday’s Credit Union Times summarized auto loan securitizations by credit unions since 2019, with two totaling $501 million in this past week.

Economic Forces Drying Up Liquidity

Two factors have disrupted normal credit union ALM liquidity management over for the year ending June 2023.

The first is the 18 month long increase in interest rates by the Federal Reserve to reduce inflation. The process began on March 17, 2022. The Fed raised its overnight Fed Funds target from effectively zero to today’s range of 5.25-5.50%.

The Fed’s intent is to slow the economy, lower demand for financing and lower inflation to 2%.

The second was the sudden bank crisis in March of this year. Here is the cascading sequence of events from one summary report:

In the lead-up period to the crisis, many banks within the United States had invested their reserves in U.S. Treasury securities, which had been paying low interest rates for several years. As the Federal Reserve began raising interest rates in 2022, bond prices declined, decreasing the market value of bank capital reserves, causing some banks to incur unrealized losses. To maintain liquidity, Silicon Valley Bank sold its bonds and realized steep losses.

The first bank to fail, cryptocurrency-focused Silvergate Bank, announced it would wind down on March 8, 2023 due to losses suffered in its loan portfolio. Two days later, upon announcement of an attempt to raise capital, a bank run occurred at Silicon Valley Bank, causing it to collapse and be seized by regulators that day. Signature Bank, a bank that frequently did business with cryptocurrency firms, was closed by regulators two days later on March 12, with regulators citing systemic risks. . .

The collapses of First Republic Bank, Silicon Valley Bank and Signature Bank were the second-, third- and fourth-largest bank failures in the history of the United States.

The Fed created a new lending option to cope with the uncertainties resulting from these failures. To calm rattled financial markets and support banks, the Bank Term Funding Program (BTFP) began on March 13, offering maturity dates of up to one year.

The BTFP’s role was focused on firms that had large unrealized losses on their government bonds and potentially at risk of large-scale deposit withdrawals. The intent was to prevent losses from forced sales of underwater securities to fund deposit outflows.

The new program charges a higher rate than the discount window. One other important difference is that while the BTFP requires banks to offer collateral, it values the collateral at par, rather than on a mark-to-market basis.

The Credit Union System’s Borrowings at June 2023

Credit unions did not have the lending or deposit concentrations of the failed banks. But like all financial institutions, their term investments have declined in value.

Members were seeing very competitive savings rates in money market funds and CD specials. Share growth for the year ended June 2023 was just 1.4%. At June 2022, the 12-month growth was 8.1%.

Loans however are still increasing at double digit rates (12.8%). Short term liquid funds are declining.

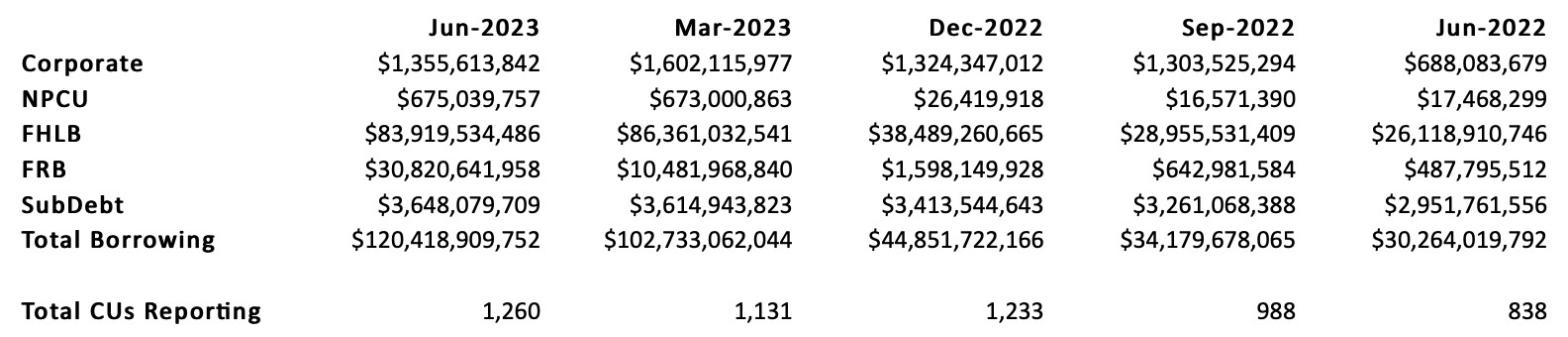

One response to tightening liquidity was increased borrowings. The table below shows the five most recent quarter-ending borrowing totals and their source for the credit union system.

Total Credit Union System Borrowings (June ’22 to June ’23)

Source: NCUA call reports

The trends from the data show:

- Total number of credit union borrowers grew 50% from 838 to 1,260 in one year.

- Outstanding loans increased by $90.1 billion or 300%.

- The Fed Reserve Bank (FRB) became a significant new source growing from 1.6% to funding 25.5% ($30.8 billion) of credit union borrowings.

- The largest lender was the FHLB system increasing from $26.1 billion (86%) to $84 billion (69.7%) of total loans.

Total borrowings of $120.4 billion are 5.4% of total industry assets (compared to 1.4% at June 2022) and 55% of June 2023 capital.

System liquidity is tightening. The second observation is that in the market uncertainty following the banking failures and continuing liquidity demand, the credit union funded facility, the NCUA-managed CLF still has zero borrowings.

The last CLF loans were paid off in 2010. There has not been a single borrowing in the thirteen years since.

The Federal Reserve loan window stepped up quickly and creatively to respond to events. The FHLB system expanded its traditional lending role. The CLF has the borrowing capacity and legal authority to match the needs being served by these two primary lenders. But it is “missing in action.”

Tomorrow I will evaluate what the CLF’s absence means for NCUA and the credit union system.