At the October 11, 2022 members’ Annual Meeting, SECU CEO Jim Hayes had been in his role since August 2021. He arrived with 25 years of senior credit union and NCUA leadership experience. He succeeded Mike Lord who in turn took over from Jim Blaine in 2016.

All the persons involved were obviously aware of Hayes’ “outsider” status. The hiring decision must have reflected a desire for a fresh look, and/or strategic change.

Here’s how SECU’s chief culture officer, Emma Hayes, explained the board’s choice in a talk to the AACUC conference in September 2022 in a CUToday report:

“We hired someone not only from outside the organization—there had never been for 85 years an external hire for CEO—but also someone who came from the wrong coast (the former Wescorp in San Dimas, Calif.) by way of somewhere up north (Andrews FCU in Maryland) to come down to North Carolina to lead the second-largest credit union,” explained Hayes, drawing laughs from the audience. “The strategy for SECU for 85 years had been to grow talent from within. They had done that and done it well. Now they decided to open the organization and take a peek and see if there is someone out there.

‘Never Been Heard of Before’

“SECU runs like a well-oiled machine,” she continued. “But (Hayes) had new ideas for how to do things. One of the first things he did was send an email to all staff. In 85 years, no one who sat in that seat ever sent an all-staff email. In that email he says, ‘Let’s get rid of our ties.’ Imagine the shock and awe! Nobody believed this was real, like someone had hacked into his email address. We don’t take off our ties. We sleep in them. We go to the gym in them. It was unheard of! But Jim was like, ‘Let’s do something a little different.’ He then said, ‘I’d love to hear from you. Send me an email.’ People stared emailing him and he responded back. With his own hands he typed out messages! This also had never been heard of before!”

Shaking Things Up

The result, said Hayes, was word began to spread in the state of North Carolina where SECU is a highly visible and well-known brand that the new CEO was “shaking things up.”. . She said the changes created a “little rumble” within the organization and community.”

Those little rumbles culminated in the two resolutions , described yesterday, that members approved in the October 2022 Annual meeting

The 20 Credit Union Paladins (not a video game)

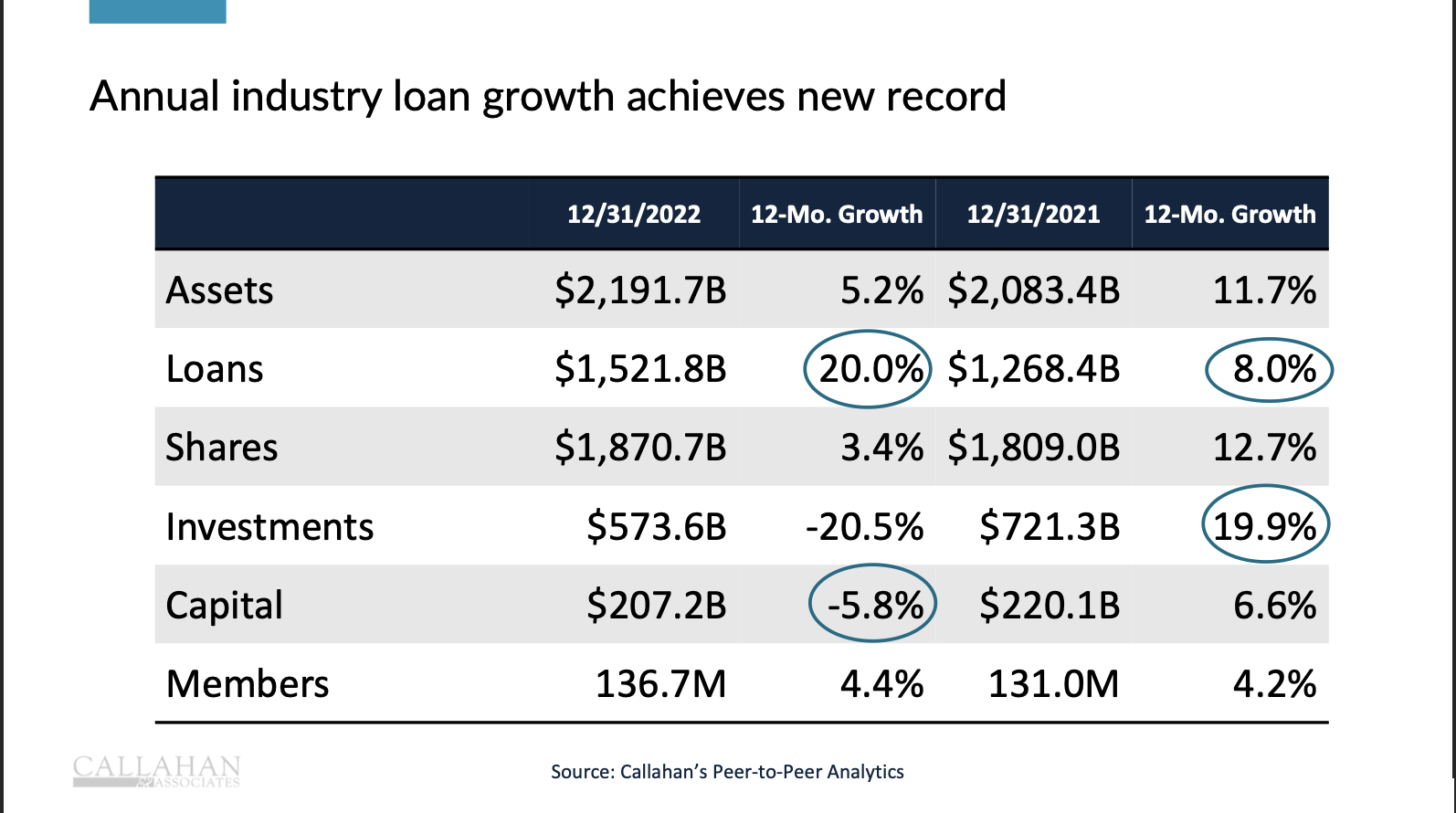

As of December 2022, twenty credit unions reported assets over $10 billion. This threshold subjects them to the scrutiny of the CFPB, reduces their debit card interchange, and includes special oversight by NCUA.

These twenty manage 23% of the industry’s assets, 24% of its loans and serve 23% of credit unions’ total reported 137 million members. But they are just .4% of all 4,495 credit union charters.

Their roles in the movement make them objects of emulation. They are also, at times, examples of unveiled ambition. Overseeing billions can sometimes lead to feelings of “cooperative triumphalism” and unlimited growth aspirations.

Their business models vary widely. Several have bought banks, sometimes more than one. Others have programs to acquired other credit unions across the country. Some have defined FOM’s; others say anyone can join.

Operating expense ratios vary widely: Star One reported a 1.11% and Alaska USA 3.67% for 2022. SECU’s was 2.16%.

SECU’s Rare Accomplishment

There are as many models in this group. However another factor distinguishes SECU’s performance.

There are state employee field of membership credit unions in almost every state. These charters share the same member economic profile of stable employment and a range of member demographics. The motivations of state and local employees closely align with the not-for-profit service culture of credit unions.

But only SECU, the second largest credit union, achieved the market dominance serving this common employment group.

How Did SECU Become So Consequential?

SECU combined a unique strategy and culture which for some observers claim is grounded in the 20th century. It developed over decades. The elements were highly integrated and carefully chosen. Among the factors were these:

- A limited North Carolina operational FOM with a branch in every county, and a statewide ATM network.

- Branches were assigned local responsibility and accountability: for example, loan originations and collection, advisory boards for visibility in the community, local employment and personal service including routing member calls to their local branch;

- A product and service profile that serves each member equally: same loan rate for all members (no tiered savings, no risk based pricing or indirect auto loans);

- Staff receives only salaries, with no commissions or incentives for performance. Promote as much as possible from within.

- Be low cost with a simple financial model: 3% net interest margin, 2% operating expense ratio and 1% ROA. Minimize member fees. No paid advertising. Rely on word of mouth and the earned publicity from SECU’s Foundation grants.

- Mortgage loans are the primary means for members to build financial security. 80% of SECU loans are first mortgages or real estate secured.

- Provide a complete menu of low cost financial services beyond traditional consumer banking products. These include life insurance, a broker dealer for access to no load mutual funds at Vanguard, a 529 program open to all state residents, tax preparation, trust services and even a CUSO for housing rehabilitation.

- Avoid mergers; instead provide help to smaller or struggling credit unions.

The result was a no frills, plain vanilla product selection (no rewards cards) and long term member loyalty. The focus was intentional—serve those demographic segments that have limited financial choices. More simply, those that know the least or have the least. Well to do members might find better loan or savings terms elsewhere.

By design SECU avoided imitating other financial providers. Its purpose was to create a unique cooperative alternative for middle and low income Americans. They wanted to avoid a strategy of becoming the competition to beat the competition.

The Issues Raised in the Annual Meeting

The six topics or business questions presented as the basis for the resolutions.

- SECU’s efforts to achieve an open field of membership.

- Merger discussions with Local Government Employees FCU, that would end a 40 year business partnership.

- Introducing risk-based lending for loans.

- Expanding business/ commercial lending.

- Elimination of the $75 per member tax preparation service.

- Regional expansion beyond North Carolina.

The full description of each topic is in the presentation. Blaine subsequently set up a web site blog which continues to expound on these points in almost daily posts.

Since the meeting, SECU has continued the ongoing implementation of the topics mentioned.

The tax preparation service has been discontinued. Changes in loan administration are on going shifting responsibilities from branch to more centralized oversight. The volunteer, non-employee credit review committee is no more.

Recently Local Government FCU announced its decision to go on its own and dissolve their partnership with SECU.

The credit union continues its technology overhaul with a priority on digital services.

The issue dominating subsequent Blaine communications to the board is risk based lending. These multiple messages cite a number of studies showing the disparate impact of FICO score based loan pricing.

The credit union conducted a series of dialogues with staff and advisory board members.

SECU’s December 2022 VisionPlan

Early in 2023 the credit union posted its Strategic Plan, “Leading with Care” fulfilling the second resolution’s request. It is 15 pages with four goal areas and key success factors. The goals are generic, like many plans, and primarily descriptive.

It is well written. Almost academic in structure. There is nothing controversial. Many current public themes are included such as environmental awareness, DEIB, affordable housing and investing in staff.

If it had been available at the 2022 Annual Meeting, the presentations of the Chair and CEO would have been much enhanced.

The plan could be a prototype for almost any billion dollar credit union. There is no market analysis or history of prior trends. No future financial projections were included.

The document has one statement referencing current events: Our commitment to embracing different perspectives creates the positive tension required to weigh business decisions and their potential outcomes.

It omits SECU’s traditional vision statement: Send Us Your Moma. And its former mission: Do the Right Thing. It largely ignores the policy issues raised in the Annual meeting such as a broader FOM and relationships with fellow credit unions.

The Plan presents settled decisions, such as the ongoing implementation of RBL, without any explanation of how this benefits members.

An Earnestness of Views

How do these different judgments about business strategy get resolved– Blaine’s dominating logical critiques versus incumbents’ asserting the power of position.

Continued public debate will cause cleavages in the 7,800 employees, and among advisory board volunteers, directors, and ultimately members. The credit union’s financial and market momentum could falter.

The internal dynamics of SECU’s decisions are unknown. Had the board a plan ready and then tell Hayes to move quickly? Or did he understand his remit as move fast and address priorities as he assessed them? Whatever the circumstances, did it consider the “wisdom of elders” as the plan was developed?

Or, is the fundamental difference in approach elsewhere? The new Plan states: “As a financial cooperative, we take to heart that prudent stewardship of our member’s money is of utmost priority.” Is that all a financial cooperative is about?

Can a solution or process accommodate both points of view? That’s the subject of tomorrow’s post.