One of Austrian-American economist Joseph Schumpeter’s descriptions of capitalism was called “creative destruction.”

This refers to a competitive economy’s relentless efforts to innovate for advantage and market dominance. He described the process as: “the old way of doing things is constantly getting destroyed or supplanted as it is replaced by a newer, better.”

Some would suggest that business failures in a competitive economy are an inevitable and necessary event, even when they cause local hardship or dislocations.

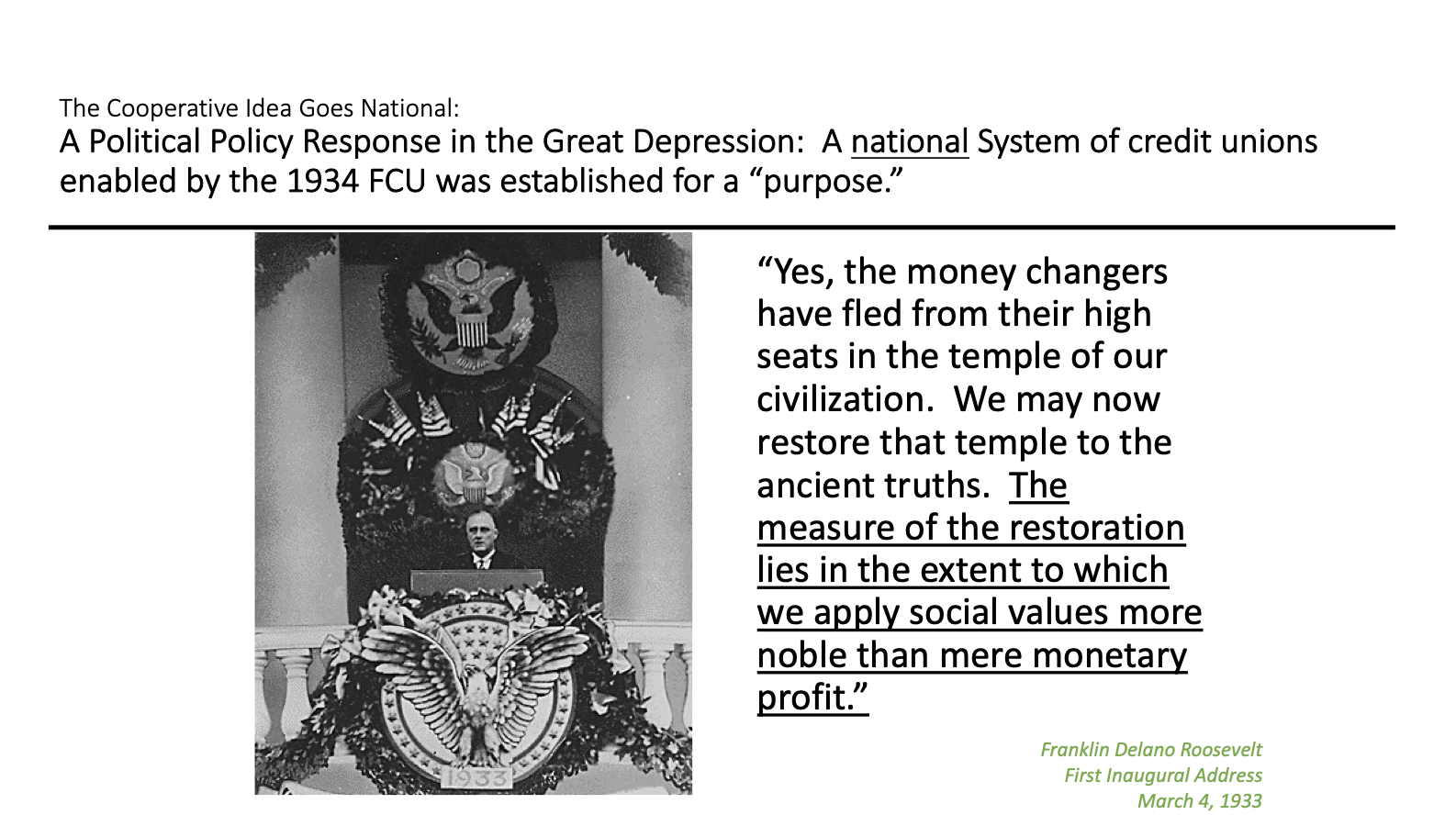

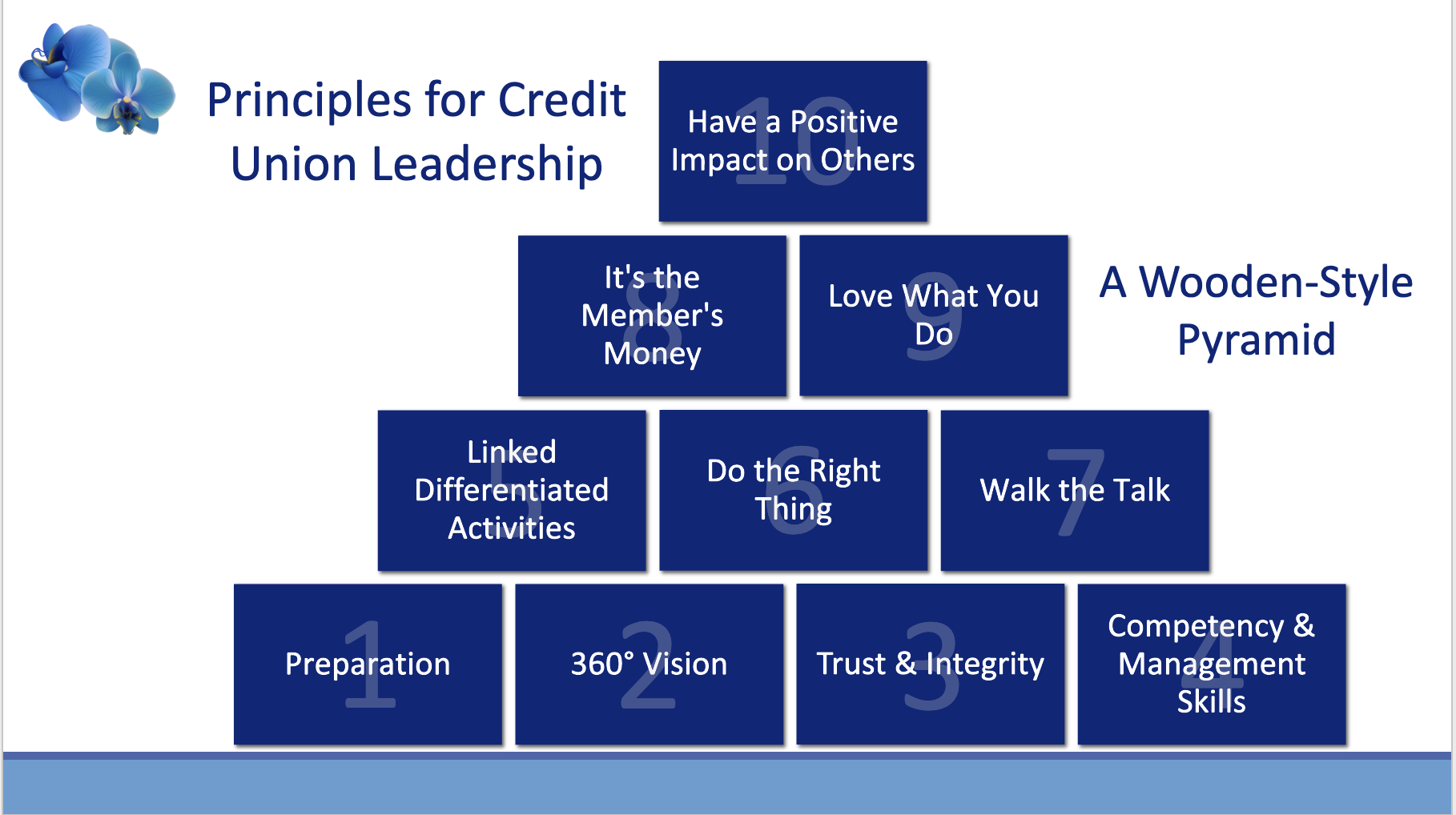

The cooperative system is supposed to be immune from some of these economic forces. Credit unions are owned by their users, they have no traded stock, cannot be bought and sold as private firms, and reflect the values necessary for a communal, versus for-profit, enterprise. Their founding, focused on a ”local” constituency with a common bond, is intended to improve the welfare of a community, not just individuals.

Local Destruction Where Dreams Become Reality

One example of this “creative” process is in neighborhood across the street where I live. There is no home sold for less than $1.5 million and when offered, most list for at least twice that amount.

Even with this going-in price tag, Edgemoor is not a place for old homes. No matter the asking price, every purchase becomes a tear down. Here is an example from across the street this past week.

The builder, entrepreneur, risk taker and innovator.

The destruction phase.

The front view.

This home built during the depression was sold as is for $2.0 million. About five or more large white oaks were cut down before the demolition started. The land and location are so valuable that the builder will put up a mac-mansion of enough square feet to justify a new sales price at least double his cost.

Obviously, whoever buys this new home will believe this is progress, just what they were looking for. This is the free market at work.

Credit Union Destructions

We can debate the social and political implications of tear downs to build back bigger and more expensive homes, office buildings or condos. But the example is not limited to real estate. It happens in credit unions. It is called mergers.

The key question is whether mergers are helping or hurting the credit union system–to be more precise, the mergers of sound, well capitalized long standing credit unions which have served their markets for generations.

Everyone undertaking a merger believes their new creation will be bigger and better. Any downsides will be temporary. Mergers are just a way of getting to the future faster especially when asset size is believed to be THE essential for competitive competence.

No Creativity, Just Destruction

Now to be fair, the house across the street had not been well maintained. The owners had lived there for four or five decades. The yard and landscaping were totally neglected. The 80 foot tall oak trees made the property look like an unkempt urban jungle.

So whatever goes up after this tear down, will certainly be a visual and living enhancement-except for the missing trees.

Similarly, some sound credit unions have not been well maintained. Leadership is just holding on until retirement; the board has given up leadership responsibility. Selling out looks like an easy way to take care of members when the motivation has gone.

It becomes time for a new generation of leaders to take over the credit union’s legacy and continue serving members in the future.

An Existential Vortex

These easy-exit examples are becoming more numerous. Personal advantage, not member value, appears to be the motive.

The systemic risk is creating an “existential vortex” where all credit unions, not just the small, the poorly led or even the ambitious, are caught up in a system that is increasingly circling the drain.

There are no new charters. Industry assets are more concentrated. The leadership purpose is more and more institutional growth and success. The members, are not owners in any sense of the term, but merely customers used as the means to greater financial glory.

Credit unions competitive advantage has been collaboration and interdependence. This is how the cooperative system was created, their regulatory institutions were differentiated, and why purpose justified a tax exemption.

Creative destruction destroys legacies, whether buildings, companies or credit unions. New brands emerge. Old locations closed. New markets and business models tried.

Credit unions are not rebuilding on their old foundations. Instead large mergers are just the age-old, typical financial market strategy of buying up competitors to become more dominate and survive.

I don’t think the merging of well run credit unions is sustainable. It will take over two years before the new home is ready on the now demolished site and the new owners move in. This is also about the operational transition timeline of a large merger when members start to look for other options.

Unfortunately the creative destruction in credit unions is not putting new homes in place of the old; it is just moving all the occupants into the existing one.

Schumpeter believed that capitalism would gradually weaken itself and eventually collapse. Specifically, the success of capitalism would lead to corporatism and to values hostile to capitalism, especially among intellectuals.

In an historical irony, cooperatives intended as an antidote to the excesses of capitalism, are instead succumbing to the allure of free market takeovers.

Everyone wants to own a bigger house.