There are financial deserts in towns and cities across America; there is also an absence of new credit union charters.

Since December of 2016, the number of federally insured credit unions has fallen from 5,785 to 4.780, at yearend 2022. This is a decline of over 165 charters per year. In this same six years, 14 new charters were granted.

Expanding FOM’s to “underserved areas” or opening an out of area credit union branch, is not the same solution as a locally inspired and managed charter.

Obtaining a new charter has never been more difficult for interested groups. Through its insurance approval, NCUA has final say on all new applications whether for a federal or state charter.

Today, credit union startups are as rare as __________ (you fill in the blank).

At this week’s GAC convention an NCUA board member announced the agency’s latest new chartering enhancement: the provisional charter phase. This approach does not address the fundamental charter barriers.

Could an example from the movement’s history suggest a solution?

The Chartering Record of the First Federal Regulator

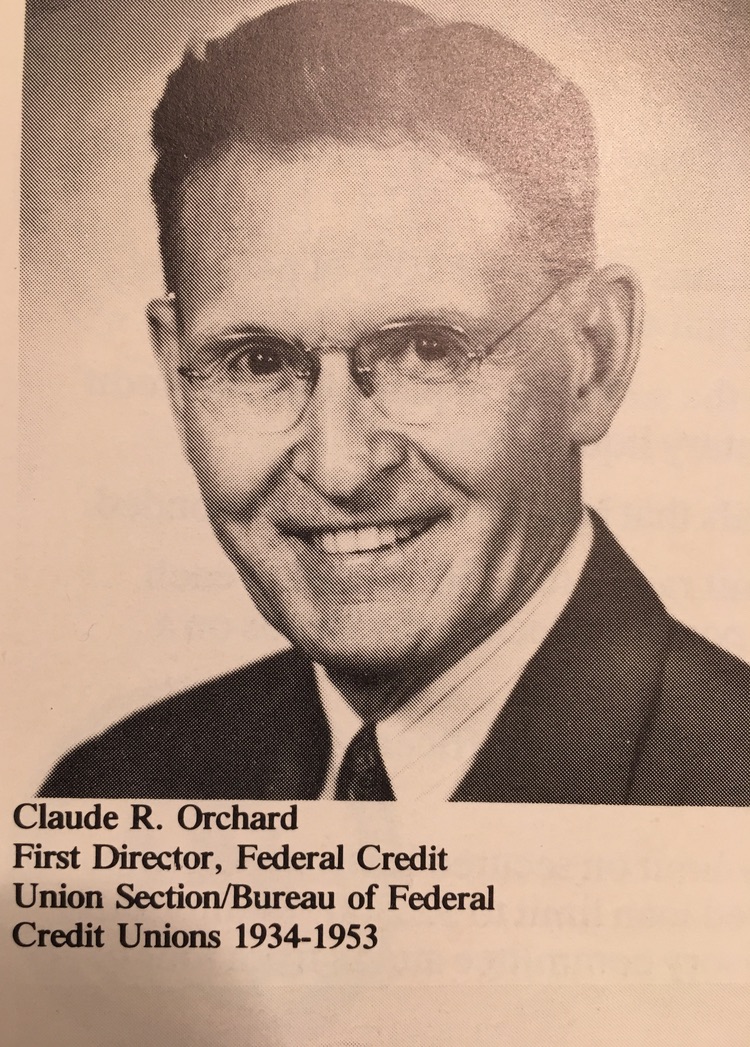

Looking at the record of Claude Orchard demonstrates what is possible for an individual government leader. He was the first federal administrator/regulator managing a new bureau within the Farm Credit Administration to create a federal credit union system. He was recruited for this startup role by Roy Bergengren, who along with Edward Filene, founded the credit union movement.

The story of how and why he was chosen is told here. Bergengren nominated Orchard because he had “the proper credit union spirit.” This had been demonstrated by his efforts to charter over 70 de novo state credit unions for his employer Amour.

Orchard accepted this government role in the middle of the depression using borrowed FCA staff. The state chartered system was the only model of how to create a federal option. That experience and belief in the mission is what Orchard brought to this new role.

Unlike the banking and S&L industry there was no insurance fund for credit union shares/savings. The coop model was based on self-help, self-financing and self-governance. Self-starters provided the human and social (trust) capital; no minimum financial capital was needed. Credit unions tapped into the quintessential American entrepreneurial spirit to help others.

Orchard’s critical tenure as the first federal regulator is described in a special NCUA 50th Anniversary Report published in 1984:

“He emphasized organizing as much as supervision. ‘I think in general we tried in the beginning to avoid paperwork because it seemed to me like that was a waster of effort. After all what we were out for was to get some charters and get some organizational work done.’

When Mr. Orchard stepped down in in 1953, federal credit unions numbered over 6,500. During his 19 year he espoused a passionate belief in the ideals of creditunionism. ‘It seems to me that we have here a tool. If it can be made to really be responsive and to really be, in the end, under the control of the members, it can teach people in this country something about democracy which could be taught in no other way.‘

Deane Gannon, his successor at the Bureau of Federal Credit Unions said to Mr. Orchard on the 30th anniversary of the Federal Credit Union Act, ‘If it hadn’t been for you none of us would be here to celebrate anything.‘”

That last observation echoes today. How many charters will be left to celebrate the 100th anniversary of the FCU Act in 2034?

Alternatives Are Springing Up

For the credit union movement to remain relevant it will require modern day Claude Orchards. These are leaders who believe in creditunionism. And possess the passion to encourage new entrants to join the movement.

Regulatory process or policy improvements may help. But the real shortfall is leadership committed to expanding credit union options.

To address the continuing financial inequities throughout American communities, alternative solutions are being created. Many of these startups are outside the purview of banking regulators.

These community focused lenders are listed in Inclusiv’s 2022 CDFI Program Aware Book. The firm introduces its role with these words:

Access to affordable financial products and services is a staple of economically sound communities. Yet at least one quarter of American households do not have bank accounts or rely on costly payday lenders and check-cashing outlets.

In recent years, the lack of access to capital investments for small businesses and other critical community development projects has also led to increased need for alternative and reliable sources of financing.

Mission-driven organizations called Community Development Financial Institutions–or CDFIs–fill these gaps by offering affordable financial products and services that meet the unique needs of economically underserved communities.

Through awards and trainings, the Community Development Financial Institutions Program (CDFI Program) invests in and builds the capacity of CDFIs, empowering them to grow, achieve organizational sustainability, and contribute to the revitalization of their communities.

Of the total $199.4 million awarded to 435 organizations, only 176 or 40% were to credit unions. The rest of the field included 213 local loan funds, 43 banks and 3 venture capital firms.

Without credit union charters, alternative organizations will be created to serve individuals and their communities. These lenders may not put credit unions out of business, but will attract the entrepreneurs that would have added critical momentum to the cooperative system.

Credit unions can qualify for CDFI status and grants. But Inclusiv has a much broader vision for implementing Claude Orchard’s playbook.

In their listing of 2022 total awards and grants, every amount of over $1.0 million went to an organization that was not a credit union. A few were banks, but most were de novo local community lenders or venture capital firms.

Without credit union options, civic motivated entrepreneurs will seek other solutions, and slowly replace credit union’s role.

Today it is Inclusiv carrying out Orchard’s vision.

Should NCUA delegate its chartering function to those who have “the proper spirit” to secure credit unions’ future?

It will also result in “teaching people in this country something about democracy which could be taught in no other way.”

There is a group of volunteers leading a grassroots effort to address these issues. The http://www.cudenovocollective.org began a year ago to help start new credit unions. In our journey we also realized that if we don’t STOP the merger madness of small credit unions, we’re doomed. We believe there are three things that get in the way of starting a new credit union today:

1. The NCUA charter process. Cumbersome, laborious, but to be fair, they have made some improvements. Mainly automation, no more letter writing.

2. Start up capital. On average it takes about 1 million to get the charter approved. Unless you have a sponsor with deep pockets many have to raise it the old fashioned way. One bake sale at a time. This can take up to seven years.

3. Opening their doors. No credit union should ever go it alone. Back in the days when individual state leagues were created, their sole mission was to help create credit unions. Then league services corps. popped up to deliver the products and services these small credit unions needed to compete. Today that is no more. But a few years ago several leagues resurrected that model when they created the Plexcity CUSO. It’s the League Service Corp for Leagues! Sharing back office services costs to gain economies of scale. Hmmmmm…sounds like a good idea to help start and save credit unions. . . . a CUSO of CUSOs that offers the products and services small and de novo credit unions need at an affordable price.

From Clifford Rosenthal:

Chip –

I appreciated your piece about chartering and organizing new credit unions. A point on CDFI grants.

The emergence of non-credit unions is not new. Community development revolving loan funds began to appear in the 1980s, as I describe in my book. You note that “only” 40% of CDFI funding went to credit unions. In fact, that is the largest proportion ever. For years, I lamented the fact that as little as 10% (rarely, 20%) went to credit unions. Loan funds have always gotten the largest dollar share; from 1996–2016, as I note, 80% went to non-depository loan funds.