Have you been born again? As a PK (preacher’s kid) I would occasionally get that question. If affirmative, the follow up query, is when did it happen?

This view of spiritual life requires an awakening experience. Preferably with a specific time and place. A new starting point; a before and after event.

Renewal, Not Replanting

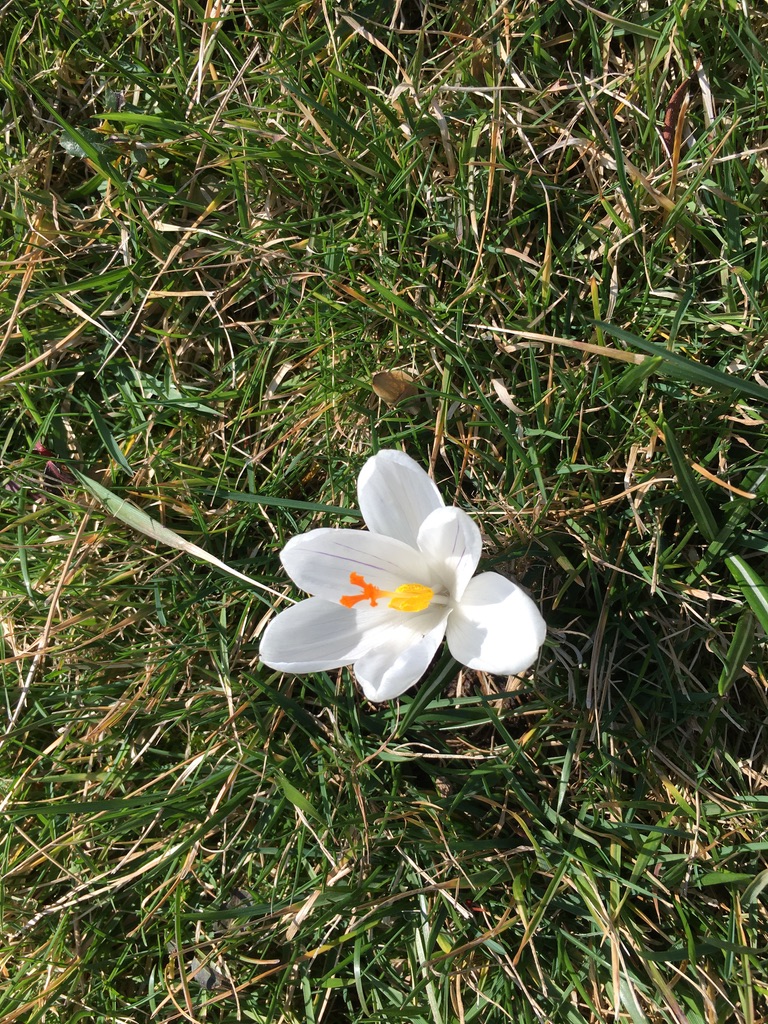

My understanding is that awareness of the sacred in life is an every day possibility. A parallel example for this reawakening is spring.

Plants are coming to life almost a month early this year. Each flower has its own timetable with daffodils and crocus first- followed by tulips, camellias, alliums and many varieties of lilies and iris.

This reemergent beauty occurs in a sequence depending on the sun, how much rain falls, and of course the temperature. All the conditions in February were favorable for an early spring flower show. The impact of nature’s role on timing will vary; but the flowers seem to adapt naturally to whatever conditions occur.

Importance of New Beginnings

Both organizations and plants operate on cycles. In credit unions it is usually the annual plan with the yearend results showing the “flowering” of an organization’s purpose. These outcomes could be making money, growing a key metric, expanding service or products, or in rare instances, just coming through a difficult economic or leadership transition intact.

Following the annual report is a new forecast, a renewal or a focused extension, not starting from scratch all over. Similarly one can add plants to a garden but most will come back naturally.

In credit unions, the required Annual Meeting can both celebrate past results and promote new directions. It is an opportunity to gain members’ support, both in board elections and with thoughtful presentations about the credit union’s direction.

For cooperatives, the annual meeting should be a special occasion to report and honor the owners.

Woodstock of Capitalism

Berkshire’s annual gathering in Omaha is an example of an Annual Meeting event in the private sector. The press calls the event attended by tens of thousand Berkshire stockholders, the “Woodstock of Capitalism.”

As a prelude, the firm releases its Annual Report. The most talked about aspect is not the company’s yearend financials, but CEO Warren Buffet’s introductory letter about the firm’s direction and his bits of elderly wisdom.

The Report for 2022 was released last week. It contains discussions that credit unions might consider emulating. The following excerpts reflect company updates and principles Buffet follows. (I added some emphasis)

The opening: Charlie Munger, my long-time partner, and I have the job of managing the savings of a great number of individuals. We are grateful for their enduring trust, a relationship that often spans much of their adult lifetime. It is those dedicated savers that are forefront in my mind as I write this letter. . .

The disposition of money unmasks humans. Charlie and I watch with pleasure the vast flow of Berkshire-generated funds to public needs and, alongside, the infrequency with which our shareholders opt for look-at-me assets and dynasty-building.

What We Do

Charlie and I allocate your savings at Berkshire between two related forms of ownership. . .

When large enterprises are being managed, both trust and rules are essential. Berkshire emphasizes the former to an unusual – some would say extreme – degree. Disappointments are inevitable. We are understanding about business mistakes; our tolerance for personal misconduct is zero. . .

Over the years, I have made many mistakes. . . Along the way, other businesses in which I have invested have died, their products unwanted by the public. Capitalism has two sides: The system creates an ever-growing pile of losers while concurrently delivering a gusher of improved goods and services. Schumpeter called this phenomenon “creative destruction.”

Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years – and a sometimes-forgotten advantage that favors long-term investors such as Berkshire. . .

The lesson for investors: The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders.

The Past Year in Brief

Berkshire had a good year in 2022. The company’s operating earnings – our term for income calculated using Generally Accepted Accounting Principles (“GAAP”), exclusive of capital gains or losses from equity holdings – set a record at $30.8 billion. Charlie and I focus on this operational figure and urge you to do so as well. The GAAP figure, absent our adjustment, fluctuates wildly and capriciously at every reporting date. . . The GAAP earnings are 100% misleading when viewed quarterly or even annually.

On Repurchases of Berkshire Shares

Every small bit helps if repurchases are made at value-accretive prices. Just as surely, when a company overpays for repurchases, the continuing shareholders lose. At such times, gains flow only to the selling shareholders and to the friendly, but expensive, investment banker who recommended the foolish purchases.

Almost endless details of Berkshire’s 2022 operations are laid out on pages K-33 – K-66. . . . These pages are not, however, required reading. There are many Berkshire centimillionaires and, yes, billionaires who have never studied our financial figures. They simply know that Charlie and I – along with our families and close friends – continue to have very significant investments in Berkshire, and they trust us to treat their money as we do our own. And that is a promise we can make.

Finally, an important warning: Even the operating earnings figure that we favor can easily be manipulated by managers who wish to do so. Such tampering is often thought of as sophisticated by CEOs, directors and their advisors.

That activity is disgusting. It requires no talent to manipulate numbers: Only a deep desire to deceive is required. “Bold imaginative accounting,” as a CEO once described his deception to me, has become one of the shames of capitalism.

The Last 50 Years

Thus began our journey to 2023, a bumpy road . . . America would have done fine without Berkshire. The reverse is not true. . .

We will also avoid behavior that could result in any uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses. Our CEO will always be the Chief Risk Officer – a task it is irresponsible to delegate.

Some Surprising Facts About Federal Taxes

During the decade ending in 2021, the United States Treasury received about $32.3 trillion in taxes while it spent $43.9 trillion. Though economists, politicians and many of the public have opinions about the consequences of that huge imbalance, Charlie and I plead ignorance and firmly believe that near-term economic and market forecasts are worse than useless.

Our job is to manage Berkshire’s operations and finances in a manner that will achieve an acceptable result over time and that will preserve the company’s unmatched staying power when financial panics or severe worldwide recessions occur.

I have been investing for 80 years – more than one-third of our country’s lifetime. Despite our citizens’ penchant – almost enthusiasm – for self-criticism and self-doubt, I have yet to see a time when it made sense to make a long-term bet against America.

Buffett’s Rule

I will add to Charlie’s list a rule of my own: Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says.

A Family Gathering in Omaha

Charlie and I are shameless. Last year, at our first shareholder get-together in three years, we greeted you with our usual commercial hustle. . .

Charlie, I, and the entire Berkshire bunch look forward to seeing you in Omaha on May 5-6. We will have a good time and so will you.

An Example for Credit Unions?

Buffet’s approach to his owners has multiple insights as credit unions prepare for their Annual Meeting. Can it be a time for renewal?

His comments are honest, open and written to inform owners and reassure their trust.

His leadership principles are clear. His business priorities are stated with conviction and promise.

His benchmark performance standard is the Report’s first page. It shows Berkshire’s stock return vs the S&P 500 for every year since 1965. For 2022, Berkshire gained 4.0% and the S&P had an 18.1% decline.

Member-owners will reciprocate management’s respect with loyalty. Virtually every credit union today, like Berkshire, has positive stories to tell members, both financially and enabling self-help. The message is not a marketing campaign or commercial. Rather the meeting is an opportunity to reaffirm who the credit is and renew the principles guiding leaders-as demonstrated in their own words.

This required process should be a moment of fresh hope, like spring flowers. It should be a time to present the best of what the credit union does; and to reaffirm the ongoing opportunities to serve one’s community.

Also imitate Buffet. Make it a fun, family gathering.