Bon Mots for Friday

We do not learn from experience. We learn from reflecting on experience. John Dewey

I often tell people that many of the things we do don’t always make sense to business students– but I believe that’s part of our secret sauce. While data is important, people are more important, and our formula has always been based on taking care of people. Doug Fecher, Retired CEO, Wright-Patt Credit union

An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today. Laurence J. Peter, Canadian writer

We tell ourselves stories in order to live. Joan Didion

Didion also asks, sometimes implicitly, sometimes explicitly, what happens when you can’t trust the narrator? How do you know whose story to believe? What happens when all stories are both believable by some and unbelievable by others? What happens to that community storytelling creates when the members no longer agree about their story? Dr. Andrew Roth

There’s a difference between a procedure update and a process improvement. A procedure update might edit step nine in a 10-step sequence. A process improvement reconsiders why there are 10 steps at all. Jimmy Lovelace, Senior Vice President, Community First Credit Union of Florida

A writer annoys his readers by writing too much.

For weekend reading: It’s Time to Remind Members They are Owners, by Henry Wirz, Retired CEO, Safe Credit Union

Managing the NCUSIF-Is It too Late to Act?

What should credit unions do when the regulator who makes the rules, does not follow its own rules?

Yesterday the consumer price increase for calendar 2021 was reported as 7%, the highest in 40 years. This was not a surprise. Concern about increasing inflation and the Fed’s response had been growing since the summer of 2021.

Interest rate risk is not a new topic. NCUA first proposed adding an S for sensitivity to the CAMEL rating in 2016. In October 2021, the board approved a rule adding this “S” with Chairman Harper saying:

The NCUA’s adoption of the CAMELS system is good public policy and long overdue. Separating the liquidity and market sensitivity components will allow the NCUA to better monitor these risks within the credit union system, better communicate specific concerns to individual credit unions, and better allocate resources.

The agency’s description of interest rate risk was straight forward:

The sensitivity to market risk reflects the exposure of a credit union’s current and prospective earnings level and economic capital position arising from changes in market prices and the general level of interest rates. Effective risk management programs include comprehensive interest rate risk policies, appropriate and identifiable risk limits, clearly defined risk mitigation strategies, and a suitable governance framework.

Ignoring its Own Rules

However Just six days prior to this, those responsible for managing the NCUSIF’s portfolio invested $1.0 billion (5% of the portfolio) at an average weighted life of 5.95 years and yield of 1.19%.

These investments actually extended the portfolio’s overall maturity from the month before.

This was a continuation of the robotic process the NCUSIF investment committee had followed since market rates had fallen to near zero in 2020.

In December 2020 question were raised about these investment decisions: What Is NCUSIF’s IRR Investment Policy? Is this a Gap in NCUA Board Oversight? The article pointed out NCUSIF’s most recent investments included a 7-year fixed rate yielding only .45%. Would any reasonable person make this investment at this point in the cycle of historically low rates?

In August 2021, the NCUSIF continued its market tone-deaf investing by placing $1.2 billion at an average weighted yield of .943% and life of 5.7 years. The analysis pointed out that these decisions were hurting credit unions. One immediate decision that month cost credit unions $4.2 million in foregone revenue over the next 7 years before it matures.

At the same time, credit unions in contrast, reported keeping 53% of their record level of investments in overnight funds.

Who Makes These Decisions?

The NCUSIF has an investment committee of four people including the Chief Financial Officer, the Director of E &I, the chief economist and the head of the Capital and Credit Markets division.

NCUA preaches interest rate management, but does not practice it. One doesn’t have to run a stress test to see the devastating results of these recent decisions. The NCUSIF’s monthly data documents the decline in portfolio value as rates began rising over the past 12 months.

In September 2020, the $17 billion NCUSIF reported a market gain of $586 million. In October 2021, the latest report available, this had fallen by 97%, to just $16.2 million on a portfolio $20.3 billion. Large portions of the most recent investments are now worth less than their purchase price. These low yields will hurt the NCUSIF’s performance for years to come.

Who Is Responsible for this Performance Failure?

The NCUA board receives a monthly report on the NCUSIF and a quarterly in-person update.

In questions about investments as recently as December’s meeting, staff’s response is they are just following Board policy. In the September’s 2021 board meeting the CFO agreed to make public this investment policy. It didn’t happen. Several meetings later, he explained the policy was under review and would not be released until that was completed-at some indefinite time in the future.

The Board unanimously approved the new interest rate sensitivity rule in October 2021, which was first published in March. It receives the monthly report showing the robotic investment activity and steadily falling portfolio values. The board’s words and deeds are far apart when it comes to IRR.

The Costs to Credit Unions and NCUA

When the agency’s highest professionals show an inability to manage the agency’s largest asset, the $20 billion NCUSIF, in accordance with its own rules on interest rate sensitivity, fundamental questions are raised.

Are senior staff competent for this task? Are these investments what the Board really intends with policy? Is no one in the agency, staff or board, able to see the damage this causes to the fund’s revenue and its financial soundness?

Good judgement comes from experience. And experience? That comes from bad judgement. How many more bad judgements does the board need?

More than the NCUSIF’s future is at stake, as important as that is. This year-long example of failure to respond to the changing economic conditions in managing the funds, begs the question: Is the agency capable of overseeing this issue in credit unions? The IRR monitoring of the NCUSIF is simple. In most credit unions the issues are much more complex.

Both the NCUA board and senior staff are letting credit unions down. Sooner or later the bill for this failure will come due. A simple portfolio yield of just 2% on $21 billion is sufficient to cover the normal financial expenses in the fund. When these investment decisions lock in rates of 1% or less for 5 or 6 years, a premium may be required to pay for the damage caused by poor management.

If this failure is the outcome for the simple management of the NCUSIF’s IRR, the bigger issue is whether the agency has the grasp to properly monitor the industry through the coming rise in the interest rate cycle.

The first test will be what the leadership does about their responsibility for the NCUSIF. Will the board and senior staff continue to kick the can down the road, blind to the consequences of inaction, or make a difference now?

Situational Awareness, Leadership and Looking Ahead

As leaders celebrate the known wins in the books for 2021, there is also the need to anticipate what lies ahead in the New Year. Will it be better or worse? More of the same, or changes planned?

One approach to this forward-looking exercise is situational awareness, sometimes abbreviated SA.

The concept was developed primarily by the military. It is a skill to improve one’s ability to identify potential threats, be more ‘present’ and aware of your surroundings in combat.

The term has also been used to analyze danger in various worker environments where the potential for accidental injury is great. Some even apply the concept to personal safety where one might be at risk such as traveling in an unfamiliar neighborhood at night.

Situational Awareness in Sports

A frequent reference to this ability to react in a situation is sports competition.

Success does not always go to the strongest or fastest athlete, but to those that have a superior “feel for the game.”

My son-in-law played offense tackle for Stanford when the team was coached by Bill Walsh, a former NFL coach, considered a master offensive tactician.

Walsh would always script his team’s first offensive drive with 6-8 set plays so that he could see how the defense reacted. Based on what he learned would determine how he then approached the overall game plan previously drawn up.

In basketball one of the elite players at every level was Bill Bradley who played at Princeton, for the New York Knicks as well as being the only collegiate player selected for the 1964 US Olympic team in Tokyo.

A description of his extraordinary sense for the ever-changing dynamics of the game is described in A Sense of Where You Are, the story of his senior year at Princeton and his preternatural feel for the game.

In choosing the title, the author quotes Bradley:

“When you have played basketball for a while, you don’t need to look at the basket when you are in close like this,” he said, throwing it over his shoulder again and right through the hoop. “You develop a sense of where you are.”

At one point the author takes Bradley to a Princeton ophthalmologist to see if his skill is due to an expanded range of peripheral vision versus a normal person’s. The tests show he has both greater horizontal and vertical range. But that does not explain the instinctive way he applied his talent. That analysis takes the rest of the book!

For many their first experience of situational analysis is when a teacher claims to have “eyes in the back of her head” so you had better be careful what you do.

Situational Analysis Applied in Business

The Wharton Business school offers an online course which applies the theory and practice of situational analysis to business and political leadership. The initial lecture and course description is here.

The course extends the concept beyond its military and industrial origins to understand what happens in organizations. How do critical elements in the environment change over time?

Many neglect this analysis because they’re so focused on a particular plan or task that they take for granted essential factors in projecting the near future.

It’s a mindset of not paying attention to one’s surroundings. Or as the British writer George Orwell observed: “People can foresee the future only when it coincides with their own wishes.

Increasing Awareness

Situational awareness identifies the elements in the environment that are important, changing and create greater uncertainty about the near future. No matter one’s experience in a role, understanding the total environment in which the organization functions is critical for effective leadership.

This analysis is front and center in New Year predictions. Or necessary anytime a future course is being planned.

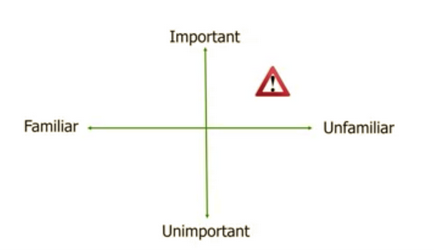

The Wharton program suggests using a four-quadrant model to identify situations that are important and unimportant, and familiar to unfamiliar.

The critical events are those that are important and unfamiliar, the upper right quadrant below. The goal is to be more aware of these challenges and take care to understand variable risks, uncertainty, what is moving around, and how to respond.

What to Place in the Critical Quadrant?

My list of evolving situations that the credit union system may need to consider differently from their 2021 experiences includes:

- Increase in inflation and the inevitable rise in market rates.

- The growing divide between well-to-do members and those living only on each paycheck’s income.

- The system’s absence of new entrants/entrepreneurs: the ratio of charter cancellations to new charters, is at 50 or 100:1 depending on the year selected.

- Effective investment of surplus capital-buying banks or mergers versus organic growth to benefit the members.

- Finding and developing the best employees when 40% of the work force wants to change jobs.

- Overcoming the gap between regulatory actions and credit union priorities to design a mutual approach to cooperatives’ future.

How any team completes this exercise depends on their role in an organization. For those at the top, this analysis is most critical.

Bureaucracies by design are bound by organizational processes. When complacency and habit replace vigilance, that is how an organization gets into trouble. Situational awareness is critical to counterbalance this self-approving tendency.

Tomorrow I will provide an example of one credit union’s pivot in response to some of the factors above. I will also share a classic example of robotic performance damaging a critical cooperative institution.

A Finnish Co-operator’s Suggestion for U.S. Credit Unions

The following observation is from Leo Sammallahti, Marketing Manager for the Cooperative Exchange. He follows cooperative enterprises in Finland, Europe and the United States. His article suggests a specific investment credit unions can make to help another cooperative effort in the US.

“There are many examples of new legislation seeking to help cooperatives. But first we in the movement should try to find ways to utilize the existing legislation better. Before illustrating this existing opportunity, I want to present something extraordinary happening in Iowa City.

Taking on a FinTech

In 2018, the local food delivery app in the city was bought by Grubhub, which already controlled more than half of the market in the US. They doubled the delivery commission from 15% to more than 30%, wreaking havoc among the local restaurants.

John Sewell was one of those restaurant owners, but he had also worked in organizing purchasing cooperatives and similar arrangements for rural hospitals. He started an initiative that grew into Chomp, a cooperative food delivery app owned by the local restaurants. Chomp takes a modest commission and distributes any surplus generated back to the member restaurants.

By the end of the year, it had outcompeted Grubhub with twice as many restaurants on its platform. It became a sort of mass movement with the majority of the residents using it. Rather than a global monopolistic rent-seeker, it transformed the model into a local democratic institution creating community wealth.

Typically, each local market has one delivery platform that with a leading market position – most likely Grubhub. Restaurants join the platform with most customers and customers join the platform with most restaurants.

These “network effects” drive platform businesses models like food-delivery apps towards a “winner takes all” outcome. These kinds of monopolies and monopsonies are exactly one of the market failures cooperatives counter and fix.

Once a for-profit company app gains a dominant market position, its incentive is to extract as much value from the restaurants for the shareholders as possible. However, for a restaurant owned cooperative platform, the incentive is the opposite. If it gains a dominant position, it has no motive to extract monopolistic “rents” from the restaurants.

Rather it can use economies of scale to lower costs. set lower prices or pay higher dividend rebates. By doing this the monetary benefits go back to the restaurants which pay the delivery commission. If the cooperative kept the money for itself, the restaurants could elect a new board of directors.

The Credit Union-Cooperative Opportunity

This cooperative food delivery option is now being replicated in seven cities (1)– one in Jersey City, New Jersey. This is one of only eight states where state chartered credit unions can make direct equity investments in other cooperatives.

Only one credit union in the country, Vermont State Employees Credit Union, is actually using this legislation to invest in other cooperatives. This authority is an example of a very useful but underutilized legal tool.

An immediate example where this option could be especially useful is helping local restaurants in Jersey City who are creating a platform delivery cooperative to keep money circulating locally and more equitably.

Supporting Local Economies Via the Members

However, there is much any credit union could do besides investments. It’s common for credit unions to provide retail discounts for their members, for example, 30% off on movie tickets.

Restaurant cooperatives promote themselves with discounts sending a coupon code for a free first delivery. Credit unions could distribute this discount for a free first delivery in the six cities where a restaurant owned delivery platform cooperative is being formed.

These discounts provide a tangible benefit in the everyday life of a credit union member. It would align credit unions with the wider cooperative ecosystem generating community benefits and social capital. It would help the restaurant delivery coops reach a mass audience quickly and inexpensively.

It reduces the uncertainty of the startup and avoids the costs of big tech ad intermediaries like Facebook or Google. Instead, credit unions could directly reach around one-third of adults, on average, who are credit union members.”

(1)The six additional cities are:

KNOXVILLE, Tennessee

OMAHA, Nebraska

RICHMOND, Virginia

LAS VEGAS, Nevada

TAMPA BAY, Florida

LOS ANGELES, California

Asset Bubbles and Credit Unions

During his time as Vice Chair of the FDIC, Thomas Hoenig challenged the agency’s implementation of risk-based capital requirements. He questioned both the theory and practice, pointing to the lending distortions which contributed to banking losses during the Great Recession.

I became aware of his views when in 2014 NCUA began the process of imposing the same flawed system on credit unions. Hoenig believed the best capital indicator was a simple leverage ratio, the credit union model for 110 years, until December 2021. Then NCUA dictated a complex, three-part capital structure, CCULR/RBC, to replace this century long capital standard.

Hoenig’s Other Regulatory Dissent

Hoenig was a career regulator. He began as an economist in bank supervision at the Kansas City District Federal Reserve Bank an area of the country where he had grown up. In the 1970’s during a period of unprecedented double-digit inflation, he saw first-hand the impact on lenders and their borrowers whose relationships were underwritten with collateral-based loans. The security was believed to be ironclad during this decade of ever-rising prices for farmland and commercial real estate.

Hoenig’s story is told in a new book, The Lords of Easy Money, and a summary article in Politico. The article describes how he became the lone dissenting vote in November 2010 on the Federal Reserve’s Open Market Committee. He opposed extending the monetary policy called quantitative easing beyond the Great Recession to jump start the economy.

His opposition was based on his early Midwestern regulatory experience, as the Fed tried to get inflation under control. From Politico:

“Under Volcker, the Fed raised short-term interest rates from 10 percent in 1979 to 20 percent in 1981, the highest they have ever been.

“You could see, Hoenig recalls, that no one anticipated that adjustment.” More than 1,600 banks failed between 1980 and 1994, the worst failure rate since Depression.”

But the banking failures and borrower bankruptcies were not the primary reason for Hoenig to oppose Fed Chair Bernanke’s continued quantitative easing.

The “Allocative Effect” of Asset Bubbles

When borrowing rates are effectively negative, as now, this fuels inflation with surplus liquidity looking for places to go. Too many dollars chasing too few goods. With funding costs near zero, any reasonable investment looks like a sure thing.

As asset prices rise quickly, a feedback loop develops. Higher asset prices today drive tomorrow’s asset prices ever higher. Especially when those assets are pledged to support more borrowing.

For Hoenig, his greatest concern with this low interest rate policy is the distortion or “allocative effects” of the additional wealth created by this monetary stimulus.

As summarized in Politico:

“Quantitative easing stoked asset prices, which primarily benefited the very rich. By making money so cheap and available, it also encouraged riskier lending and financial engineering tactics like debt-fueled stock buybacks and mergers, which did virtually nothing to improve the lot of millions of people who earned a living through their paychecks.

Hoenig was worried primarily that the Fed was taking a risky path that would deepen income inequality, stoke dangerous asset bubbles and enrich the biggest banks over everyone else. He also warned that it would suck the Fed into a money-printing quagmire that the central bank would not be able to escape without destabilizing the entire financial system.”

The Economic Consequences Hoenig Warned About

Those distortions are here now. One need only look general stock market levels as well as individual company valuations that are unhinged from performance to see examples that don’t compute.

In a January 7 essay “A Stock Market Crash is Coming and Everyone Knows It” the writer notes wild stock valuations: The price earnings ratio for the S&P index of stocks historically averages 15. Today the ratio is 29 times; Amazon’s ratio is 60 and Tesla’s 330.

This disconnect between stock prices and a company’s financials is most visible in meme stocks, IPO’s and SPAC’s often with no history of positive net income. These new offerings and crypto-currency asset hype are explained as harbingers of a newly emerging digital-metaverse economy. Predictions of these asset bubbles bursting go back at least two years. Because it hasn’t happened yet, doesn’t mean the Fed’s changed policy won’t be disruptive.

The Credit Union Impact

Credit unions are creatures of the market. Co-ops whether by design or neglect that have become distant from their members, are even more dependent on market sourced opportunities.

Approximately 80% of all credit union loans are secured by autos, first and second mortgages, or commercial assets. Before asset bubbles burst, decisions about new loans and investments look straightforward, easy to project future returns.

The most frequent example today of this financial euphoria is credit unions buying whole banks, frequently in new markets. When the cost of funds is .25- .50 basis points, paying a premium of 1.5 to 2.0 times book value for a bank looks like a can’t lose opportunity. Even when the bank’s financial performance is being supported by the same low cost of funds and its underwriting secured by commercial loans with continuously appreciating assets.

GreenState Credit Union in Iowa, Hoenig’s home state, is so eager to take advantage of these current opportunities that it is buying and absorbing three banks simultaneously, all operating outside its core markets.

In North Carolina, Truliant Federal Credit Union announced in December that it had raised $50 million in an unsecured subordinated term note at a fixed rate of 3.625%, The purpose reported in the press: “Truliant has primarily grown the credit union’s loan portfolio organically, however management is open to acquisitions in the $500-$750 million asset range.”

The announcement is a public invitation for brokers to bring their deals to Truliant’s table.

When funding looks inexpensive and asset values stable or rising, what could go wrong?

The short answer is that the Fed’s inflation response will disrupt all asset valuations and their expected returns. The larger question is whether buying businesses whose owners believe now is the time to cash out, and whose results were created by a very different model and charter, will even match a credit union’s capabilities.

In an earlier analysis of credit union whole bank purchases I raised these issues:

As credit unions pursue whole bank acquisitions, are they buying “tired” business models built with different values and goals? Are these credit unions giving up the advantages of cooperative design and innovation attempting to purchase scale? Will combining competitors’ experiences (and customers) with the credit union tax exemption create an illusion of financial opportunity that fails to prove out when evaluated years down the road.

The Discipline Required of the Co-op Model

The co-op member-owner model protects credit unions from some of the rough and tumble accountability of constantly changing stock market valuations. This difference requires strong management and board discipline to remain focused on the people (members) who respond to and need a credit union relationship.

Buying into new markets and customers through financial leverage, versus winning them in competition, is a new game for credit unions. Organic growth builds on known capabilities and experiences, not externally purchased originations.

Hoenig’s critiques offer a third lesson relevant for these leveraged buyouts. The financial consequences of public policy changes can take years for their consequences to be found out.

It took seven years for the FDIC to recognize there was no cost-benefit outcome with RBC. And eleven years to understand the full economic impacts from when he first opposed quantitative easing as the primary tool for the fed to keep the economy growing.

Credit union success is not because they are bigger, financially more sophisticated, or even led by superior managers versus banks. They win when their capabilities align with member needs. Members join based on their choice, not because their account was bought from another firm.

The beginning of a significant economic pivot, long forecast by the Fed, seems a very suspect time to use member capital to pay out bank owners. The bank owners are asking for members’ cash, not the stock that other bank purchasers would offer, to protect these sellers from valuation uncertainties.

Credit union leaders buying banks are betting (paying premiums) that they can manage the bank’s assets and liabilities for a higher future return than their for-profit managers were able to do.

Rather than compete with a superior business design, buying banks intending to run them more effectively, feels like surrendering to the opposition.

A CEO for All Seasons

Dayton Ohio is most commonly known as hometown for aviation pioneers and inventor-tinkerers, the Wright Brothers. The local Wright-Patterson Air Force Base was named after them.

On that base in 1932 workers at Wright Field decided to chip in 25¢ a week to help an ailing co-worker and his struggling family. It was this shoebox of money that evolved to become today’s $7.0 billion Wright-Patt Credit Union.

The credit union was planted in this southwestern community of Ohio where inventiveness, hard work and the belief that people take care of each other were long standing values.

Doug Fecher and Wright-Patt Credit Union were made for each other. He grew up in this culture and was reared on its values. His strength, life-long connections and character are rooted in places where he saw people taking care of each other in times of need.

His capabilities perfectly matched the Wright-Patt community when he became CEO in 2001 after the sudden death of his predecessor.

His career did not start with the ambition to become a CEO. After high school, he left for Chef school, thinking academia was not his forte, and where his mother had paid tuition. Changing diection, he then enrolled in the University of Cincinnati and eventually graduated while nurturing curiosity and eclectic interests that made him a lifelong learner.

He began his credit union career as a teller, a short-lived position because of the challenge in balancing out each day’s activity. He then moved on to business development and marketing before joining Wright-Patt as VP of Lending in 1995.

In each phase of life, he developed lasting friendships. At his retirement celebration he recognized grade school friends with whom he had gone scuba diving later as adults, a high school science teacher whose course he barely passed, three generations of his family as well as many professional colleagues. He named each while recounting stories of the positive experiences he gained from these relationships.

His Leadership as CEO

His twenty years as CEO spanned unexpected and the most consequential challenges any leader could ever confront: the attacks on 9/11 which kept the US at war for 20 years; the Great Recession of 2008/09; a decade of historically low interest rates; the national economic shutdown of March 2020 resulting in the steepest one quarter drop ever in GDP, and the on-going COVID-19 pandemic.

These were not classroom MBA case studies. They were real-time events requiring immediate actions. The responses affected every person who depended on the credit union to do the right thing for them. In each of crisis, Wright-Patt met every challenge being there for members in spontaneous and creative ways.

When severe economic downturns occurred, he stepped up lending to members for home refinancing or ownership and for car purchases. Fees were waived. The credit union reached peaks in market share as other lenders hunkered down and withdrew in the face of economic uncertainty.

How Doug navigated these times is even more remarkable than Wright-Patt’s continued financial soundness. He believed an organization’s culture, the performance of the entire staff, was what made strategy successful.

He instilled an expectation of unparalleled and consistent member service. Credit unions were founded so people can take care of each other. The model is simple: members entrust their funds to you to use for others who need financial assistance.

He took a fundamental human value and made it new every day. He designed the three-stakeholder model-the staff, the members, and the credit union-to allocate resources fairly and most productively.

His intense focus on service as the ultimate differentiator, helped him avoid shiny objects, such as mergers, bank purchases or personal notoriety, that drew in other CEOs.

Member relationships were rooted in a saying he quoted from his dad, “Son, just remember to take great care of the people around you, and they will amaze you in return by taking great care of you”.

The Standard for Success

The majority of Wright-Patt members live paycheck to paycheck. Superior service earns their trust and lifelong support. It also strengthens numerous local community institutions that serve these same 445,000 members, including auto dealers, realtors, home builders, and the many retail services and stores necessary to make communities vibrant.

This member loyalty propelled Wright-Patt’s standing from the 95th largest credit union in 2005 to number 40 at yearend 2021. This was accomplished even though the members’ average share balance $10,044 is below the national average of $10,402.

Doug and his team never chased asset growth. Instead, their success was measured by the number of people served and community impact. Today the credit union is present in one of every three households in its Dayton home market.

His oft-stated benchmark for tracking Wright-Patt’s relevance was to ask: If Wright-Patt did not exist today, would our members rise up and create us?

Temperament Undergirds Success

Doug is a lifelong learner. Success did not come because he had a better idea than other CEOs; rather it was his skill implementing the credit union’s priorities. Instinctively he understood leadership as a skill to be mastered. In sports terminology, he would be described as a “natural.”

He is an artisan in the craft of leading others. He took a traditional value-serving others-and made it every staff member’s purpose. In his perspective, credit unions are a movement of people, not money.

At the top of each monthly Partner Update he placed these words:

“Transparency” is an important part of keeping promises. I hope this update is helpful and makes your job easier. Thank you for your interest in how WPCU is serving its stakeholders

Integrity, openness, and honesty are his operating practices. He is eloquent, using member stories he received to make his points. The tag line at the end of every Wright-Patt email summarizes the credit union’s value proposition in six words:

“Save Better. Borrow Smarter. Learn a Lot”

His eloquence is enhanced by his temperament. He never appears angry; he persuades with logic and examples, not arguments. His presence fills every occasion with humor and goodwill, qualities that bring out the best in people.

Leadership Contributions Beyond the Credit Union

Doug and his team expanded Wright-Patt’s role throughout the credit union system. He organized, joined or founded numerous CUSO’s including myCUmortgage, CUFSLP, Credit Union Student Choice, Cooperative Business Services, CUSO Financial Services and many more.

He used the financial strength of the credit union to develop a short-term loan option that saved consumers hundreds of dollars in fees charged by payday lenders. This model was eventually adopted by over 100 credit unions sharing in a common loss reserve.

He and his team actively participate in state, national and CUNA leadership responsibilities.

He is a trustee on the Board of Wright State University which enrolls over 11,500 students. As Chairman he helped shepherd the university through the most important decision a board undertakes: a presidential leadership selection and transition.

I asked him to join the board of Callahan’s after the Great Recession, anticipating an upcoming CEO succession. Being a volunteer director in a group of peers is a very different role than the person of final resort as CEO. Developing consensus with other volunteers can, at times, be hard work.

His commitment was unwavering. His wise, perceptive counsel made our whole organization more aware of how credit unions approached their role with members, in the community and with each other.

A Self-Initiated Transition

Doug enjoys many other personal activities such as biking, skiing, motorcycles, playing in a rock group, scuba diving. He undertakes these “hobbies” for fun and as open-ended learning opportunities.

He left his CEO position at the top of his game, following the most successful year ever in the credit union, as measured by returns to the three stakeholders. A courageous choice by someone who sees life full of bountiful possibilities.

His parting was a straight forward announcement in response to my email:

From: Doug Fecher <dfecher@wpcu.coop>

“Thanks for your email. I am out of the office and will not be returning as I am retiring from WPCU after 26 years of service. I will miss this job and the people I’ve been honored to work with and am looking forward to the next chapter in my life.

A successor has been named – please welcome Tim Mislansky as the next President/CEO of Wright-Patt Credit Union. He begins his new role on Monday, January 3rd.”

Doug never forgot where he came from or the people whom he knew along the way—a person of conviction who gave hope and a way forward for others.

He ended a recent conversation with a student interviewing him for her paper on leadership with the offer: “Thanks for connecting with me – please keep my number and if there is any way I could help in the future, please call.”

Talent does an old thing well. Genius makes an old thing new. Doug did both.

A Reflection on the Anniversary of the January 6th Attack

Today is the one-year anniversary of an attempt to overturn the 2020 presidential election by mounting a physical assault on Congress’ certification of the electoral college vote.

There have been and will continue to be newly researched and passionate reporting about the day’s riot and events before and after.

One well-reasoned analysis is a short essay entitled A Day of Infamy, a year later.

I agree with this viewpoint but want to suggest another lesson. Does a latent January 6th gene potentially exist in anyone in authority? Or are required formal processes and structural checks and balances sufficient to inhibit such leadership temptations?

Everyone Experiences Authority

The crime of Trump and his followers was an attempted coup to overturn legal and fiduciary norms of governance and accountable behavior.

Most Americans have or will occupy positions of authority by election, selection or demonstrated merit. For example, most households have a dominate wage earner; sports teams-a chosen captain; each church or non-profit–volunteer boards; and coops led by elected directors.

Every public employee, whether by employment or election serves a constituency to which they should be responsible.

Positions of public authority can bring out the best or sometimes, the worst in people.

Bucky Sebastian and Ed Callahan’s decades long relationship showed the vital role of a leader with the right complementary partner. Ed was an educator, football coach, administrator and powerful motivator–a person skilled in the arts of leadership.

One of Bucky’s important adjunct roles was to be Ed’s “counter-ego,” able to challenge his too emotional reactions to people or situations. When Ed was tempted to counter someone using direct authority (as a football coach might call out), Bucky would confront him urging he should change his approach versus blaming the other.

Every leader needs a Bucky-like figure when inclined to follow their autocratic instincts in exercising power.

Many adults will achieve authority in an organization through personal ambition and effort, whether that role is paid or volunteer. Once achieved, there is a natural belief in the correctness of one’s judgments whether based on vision, factual analysis or using the rationale-that’s why I was chosen (or elected).

The Unique Role of Public Servants

This is especially true in governmental employment. Trump’s authoritarian excesses and public delusions are consequential because of the ultimate power and responsibility of the Presidency. Many believe he subverted the very premise of American democracy with his lies about the 2020 election outcome.

He ignored traditional formal processes. There were no longer guardrails the public could rely upon.

Whether elected, appointed or selected through competence, public responsibility is always paired with assumed and/or explicit authority.

From parking enforcement, collecting taxes to setting rules and overseeing them, public roles are different in character from private employment. There is an implied common duty, but often accountability is diffused or lacking.

Regulators of Cooperatives

I believe the Jan. 6th gene is ever-present, latent much of the time, but always ready to be activated in regulatory actions.

The symptoms include unilateral policy diktats, dismissal of inconvenient facts, neglect of administrative oversight, lack of transparency, and most critically, an unwillingness to work mutually with the credit union system.

This authoritarian impulse is most easily seen when those new to the organization first experience the culture. Mark McWatters joined the NCUA Board in August 2014. He described Chairman Debra Matz’s leadership of NCUA during in a public speech several months later:

“NCUA should not treat members of the credit union community as Victorian era children—speak when you’re spoken to and otherwise mind your manners and go off with your nanny—but should, instead, renounce its imperious ‘my-way-or–the-highway’ approach and actively solicit input from the community on NCUA’s budget and the budgetary process. With the strong visceral response within the agency against budget hearings, it seems that some expect masses of credit union community members to charge the NCUA ramparts with pitchforks and flaming torches to free themselves from regulatory serfdom. I, conversely, welcome all comments and criticism from the community.

Regulatory wisdom is not metaphysically bestowed upon an NCUA board member once the gavel falls on his or her Senate confirmation.

NCUA should not, accordingly, pretend that it’s a modern day Oracle of Delphi where all insight of the credit union community begins once you enter the doors at 1775 Duke Street in Alexandria, Virginia.” (source: CU Today May 19, 2015)

McWatters is a very conscientious individual, courteous in manner with a rational temperament. He approached decisions using detailed legal and logical analysis. His reaction to Matz’s autocratic style only corroborated what credit unions had experienced for years, since the Great Recession and unilateral liquidation of corporates.

The irony is that when McWatters became chairman in January 2016, the agency’s “Stockholm syndrome” effect had overcome this initial misgivings. In 2017 he merged the TCCUSF surplus into the NCUSIF to pay for natural person credit union losses, despite explicit congressional wording against this. When explaining the action, he also admitted circumventing the FCU Act’s limits on premiums.

My immediate concern is that Chairman Harper, who was Matz’s Senior Policy Advisor and protege, also embraces her view of leadership. He has shown by temperament, in board meeting exchanges, and prior actions as senior advisor, that he is not a person who should be leading the cooperative regulatory agency.

His primary justification for policy is because that is how the FDIC functions. I have described these positions with his own words in several articles.

At a time when credit unions are transforming their roles with members due to Covid, Harper’s top priority imposed the hoariest and least relevant of all rules, a 28% immediate increase in minimum capital requirements. Unlike McWatters when confronting the same issue, the current board members blinked and approved this regulatory tax on members and their credit unions.

The Jan 6th Gene and Credit Union Democracy

NCUA’s performance matters because it regulates one of the unique features of cooperatives—the industry’s democratic, member-owner governance.

The concept that credit unions are democratically governed is misleading. Few boards are elected today; most continue through reappointment and renominations when terms expire. Members’ involvement is not sought or encouraged. The idea of a contested election with more nominations than open seats is scary for incumbent directors.

Members are routinely requested by CEO’s and managers to give up their charter via merger for a rhetorically better credit union that members do not know and have no part in choosing. These same “votes” frequently approve significant monetary handouts to departing senior staff who arranged these sales. In one case over $35 million of self-funding was set up by a former CEO who continues working at the merged institution.

Even the hint of an external director nomination by petition can cause a credit union to change its bylaws to prevent such an occurrence. Pentagon FCU did this immediately after a successful at large nomination.

Credit unions in these actions are following the unilateral leadership style they see at NCUA.

Democratic Practice in National and Local Arenas

Leadership responsibility does entail authority and explicit processes to function. How that authority is implemented is fundamental to the sustainability of the enterprise. Whether that is the American democratic political experiment, or a cooperative charter founded generations ago.

The fate of America may feel bigger than any one individual can influence. But democratic norms and duty are not limited to the Congressional and Presidential elections. It is a skill each can hone whenever we participate in an organization’s governance or membership

The first place to ensure democracy remains meaningful is in the arena s of our participations, no matter how great or how small the organization.

As I consider the January 6th assessments, my hope is that anyone who might carry a gene of this kind, will keep it dormant by exercising democratic efforts in those local and national arenas we care about.

Where the New Jobs Will Be This Decade

In an article using the US Bureau of Labor Statistics, the analyst presented the fastest growing and declining job categories in this decade.

The economic health of every community-rural. small town or major urban center-depends on its employment opportunities.

Most credit unions were chartered around places of employment. Corporations such as IBM or International Harvester had dozens of separate credit unions at their numerous work sites. Then when the layoffs, restructuring or even bankruptcies occurred, the credit unions had to change their focus or go out of business.

Employment prospects are critical for every member. Working from home versus commuting or being on the road is now of interest to more persons who have experienced this option during the Covid disruptions.

Credit unions are most critical for members when they first enter the work force, earning income and learning to be their own financial stewards. Some credit unions begin this relationship even earlier with student loan options.

The demographics of job growth affects every one, their communities and almost all organizations that depend on a vibrant economy.

The table below forecasts where the new jobs will be, their rate of growth, and median salaries. Each geographic area will have its own pattern. But this fundamental economic characteristic should be part of every credit union’s planning process.

| Occupation | Percent employment change, 2020–2030P | Numeric employment change, 2020-2030P | Median annual wage, 2020 |

|---|---|---|---|

| Wind turbine service technicians | 68.2% | 4,700 | $56,230 |

| Nurse practitioners | 52.2% | 114,900 | $111,680 |

| Solar photovoltaic installers | 52.1% | 6,100 | $46,470 |

| Statisticians | 35.4% | 14,900 | $92,270 |

| Physical therapist assistants | 35.4% | 33,200 | $59,770 |

| Information security analysts | 33.3% | 47,100 | $103,590 |

| Home health and personal care aides | 32.6% | 1,129,900 | $27,080 |

| Medical and health services managers | 32.5% | 139,600 | $104,280 |

| Data scientists and mathematical science occupations, all other | 31.4% | 19,800 | $98,230 |

| Physician assistants | 31.0% | 40,100 | $115,390 |

The full article includes graphs, a table of the fastest declining jobs (parking meter enforcement) and the implications for education and employer job structures.

Counsel for 2022

Several observations on entering the New Year; but first a poetic note of hope.

|

by Carrie Williams Clifford (1920)

|

The Right Attitude (by John Horvat)

As we enter 2022, we must face a “not-normal” world that shows no signs of returning to order. Having the right “improvise-and-dare” attitude will enable us to survive. It will allow us to exploit any good opportunities to act that come our way. It will mitigate the disasters that strike us.

The Dalai Lama

When asked what surprised him most about humanity, answered “Man. Because he sacrifices his health in order to make money. Then he sacrifices money to recuperate his health. And then he is so anxious about the future that he does not enjoy the present; the result being that he does not live in the present or the future; he lives as if he is never going to die, and then dies having never really lived.”

From a review of the Movie: Don’t Look Up (Netflix)

This December release starred Leonard DiCaprio and Meryl Streep. The story featured two Michigan State academic astronomers who identified a comet heading directly to earth–and the President and public’s response to this “environmental” crisis. One reviewer’s reaction:

I am alive. I exist. I don’t need to be told that humans will choose what feels good over what is right every time.

Honestly, I spent the movie rooting for the comet.

Shakespeare on Future Forecasts

Prophecy remains elusive, for who yet can answer Banquo’s “If you look into the seeds of time/And say which grain will grow and which will not/Speak then to me.” (Macbeth, 1.3, 58-60).

The Gift of Enduring Ideas

As we begin 2022, I am in awe of the remarkable year just past, and how members and communities across the country benefitted from cooperative efforts.

Credit unions from the earliest days of the pandemic stood tall with their presence, their passion and dedication to service. When the temporary normal returned, they opened up offices with enthusiasm, and understanding—and an unwavering belief in the transformative power of cooperative purpose.

Credit unions ended the year historically strong. They are ready for a new time of vital caring using their unique capacity to combine educational and transactional financial services.

I am eager to share what I hope will be “enduring ideas” with you in coming months. One writer described this need as follows:

Amid the present insecurity, endearing objects (read high net worth ratios) are not enough. Our desire for certainties must also be addressed by turning to the things that feed the soul. We must turn to enduring ideas to anchor us in the storms ahead.