In September Netflix released the film The Social Dilemma.

The documentary portrayed the ever expanding influence of social media platforms focusing on Google and Facebook. These services track everything we do online. They store our activity, use AI to create individual profiles, and use algorithms to influence our future behaviors.

Your time on their sites is converted into advertising dollars for marketers, politicians, and influencers seeking specific consumer interests or needs.

The film builds its credibility with interviews from many individuals who worked on the inside of these companies as well as examples showing real world impact. Fake news, for example, spreads six times faster than true stories. One result is growing disinformation and conspiracy falsehoods.

The message is how the computer power in your pocket is changing your behavior, even to the point of addiction.

The film should make a viewer more aware of the manipulative and darker potential of our dependence on technology.

A Close To Home Example

Platforms using AI to inform or influence are not limited to social media. My wife belongs to several book clubs, Her preference is to read books online versus hard copy.

The public library is her fist choice as e-books are free even though time limited in check out.

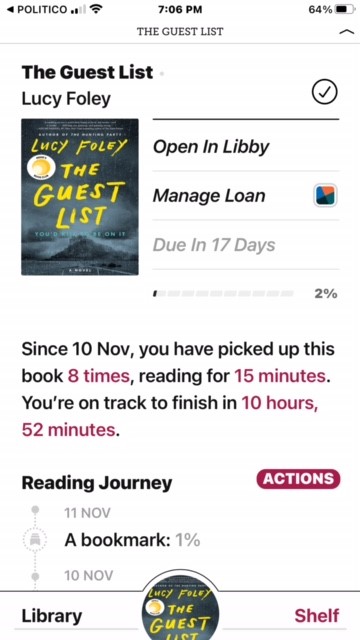

Recently she received he following email updating her most recent on line borrowing:

A Benefit or a Concern?

She showed the email to me and asked my reaction. The idea the library was monitoring her reading activity raised concern. Meant to be informative, it also demonstrated how a third party can tell you something about yourself that you may not be aware of. What else might the library be tracking and who has access to this data from a public institution?

Every day credit unions store data on their members’ activity that they analyze to better serve them individually and collectively. How members perceive this proactive use of their information can help build or undermine the trust foundation essential in all relationships. Even if intended to be a positive, helpful suggestions can raise concerns. Fr example, how did you know I was laid off?

One way to enhance trust is to be transparent by announcing in advance how you will try to add value beyond traditional transactions. My wife’s concern was due in part because she had no knowledge this reading summary was available. Would your members be surprised by any of your communications that rely on the selected knowledge you compiled about their financial activities?

Chip,

My wife and I watched the film and then made the kids watch it. They got it, but they don’t get it. They think it’s all a game. I personally do not subscribe to any social media platforms and find what Joan experienced a total invasion of privacy and frightening. Since the pandemic started, we have bought most everything from food and wine to toilet paper on line. I wonder if somewhere there is an algorithm measuring our food intake vs our toilet paper usage.- Good luck to them!

Belated Happy Thanksgiving

The shark has jumped the ship. As we quickly approach a cashless society our spending and buying habits are 100% traceable. The government issues prepaid debit cards for unemployment, workers compensation, disaster type FEMA aid, etc. 100% traceable. FEMA aid for Katrina New Orleans by way of prepaid debit cards disclosed most of the aid was spent at strip clubs, and bars. Again, 100% traceable. Hilarious! Consumer financial activities are already being 100% traced. Hello Big Brother. A new world order.

Editor’s Note: Here are links to articles on Hurricane Katrina and debit cards:

Did Katrina Victims Really Spend Their Relief Money on Gucci Bags and Massage Parlors https://www.theatlantic.com/business/archive/2012/10/did-katrina-victims-really-spend-their-relief-money-on-gucci-bags-and-massage-parlors/264377/

‘Breathtaking’ Waste and Fraud in Hurricane Aid – The New Times https://www.nytimes.com/2006/06/27/washington/27katrina.html