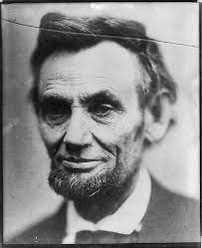

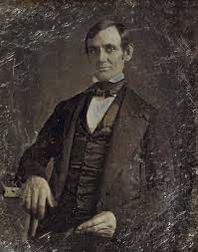

In the Gettysburg Address Lincoln summarized the ever-present challenge of keeping alive the spirit of a revolution’s original intent.

Dr. Eva Braun’s essay describes Lincoln’s grasp of the declining motivation of later followers in his Gettysburg speech:

From Dr. Braun’s analysis: Lincoln begins, “Four score and seven years ago.” “Four score,” With its long oh’s, sounds a more mournful, solemn note than could the words “eighty-seven years,” but the choice of the phrase is not only a matter of sound; it also carries a special meaning. It is the language of the Bible, as in Psalm 90:10:

The days of our years are threescore years and ten; and if by reason of strength they be fourscore years, yet is their strength labour and sorrow; for it is soon cut off, and we fly away.

With the psalm in mind the phrase implies: just beyond the memory of anyone now alive, too long ago for living memory.

Now, we know that from youth on Lincoln was concerned with a peculiarly American danger: the death of sound political passion. In his speech on “The Perpetuation of our Political Institutions,” of 1838, Lincoln drew a clear parallel with the early community of Christians, whose danger lay in the fact that the generation of disciples and eye-witnesses had been followed by a second generation which had only heard by word of mouth, by a third which had only read of Christ, and by a fourth which had begun to forget.

So in the American community; the scenes of the revolution, he said, “cannot be so universally known, nor so vividly felt, as they were by the generation just gone to rest.” The men who had seen the Revolution, who were its “living history” are now gone.

“Beginning to Forget” A Peculiarly American Habit

Remembering the contributions of earlier credit union founders is vital. Last week Jim Blaine described the legacy of Ralph Swoboda. As CUNA General Counsel and then President, he helped transform the movement through two system-wide challenges: business modernization and deregulation.

While leading NCUA in the early 1980’s, Ed Callahan and Bucky Sebastian in their presentations promoting deregulation would cite the original practice of common bond going back to the early years of state chartering. They pointed out that some of the first fields of membership were often city-wide. The intent was to be inclusive, not limiting, for those who sought a cooperative financial choice.

But this reference to the spirit of the cooperative founders, where purpose surmounted existential challenges, can dissipate as the “living history” passes on.

We cannot resurrect those who have left the playing field. But we can certainly rekindle passion for member advocacy in all its cooperative possibilities. And in the process keep the “movement” alive.

The Current Challenge

When a motivated popular movement aligns itself with another cause to promote its agenda, the hybrid effort can pervert its primary purpose.

An example is the tying of Christian nationalism with white nationalism. Christianity becomes less about faith and more about political power.

A parallel confluence of activity is occurring in credit unions. Since the imposition of PCA in 1998 through the Credit Union Membership Access Act, NCUA has increasingly equated credit union oversight with banking practice.

The latest effort is the imposition of RBC/CCULR completely incorporating the full bank regulation in its rule. This embrace of banking models, a frequent standard cited by Chairman Harper, also includes the promotion of external capital. It neglects the unique capabilities of cooperative design.

Collaborative institutions include the CLF and NCUSIF, both under NCUA management. CLF’s role is moribund. As for the NCUSIF, NCUA has converted the insurer into an open-ended funding draw for the agency’s daily operations.

Another example of cooperative diminution is NCUA’s lockdown of the corporate network, especially its services for smaller credit unions.

Credit unions have read the regulatory signals. “Treat us like banks, and we will follow that industry’s lead.” Mergers, not collaboration, become a priority growth strategy. Bank purchases, paying premiums to bank owners with credit union member capital, is promoted as an immediate expansion opportunity. In other words, “If we can’t beat ‘em, let’s just buy ‘em.”

The regulators are silent. As long as credit unions’ financials mirror bank’s, everything is OK. Mergers, bank purchases and novel (SPAC) growth tactics are just the free market at work. Even when a CEO and Chair transfer $10 million of members’ funds to their control following a merger.

Let me be clear that these are not the actions of the majority of credit unions, but they dominate the headlines.

Losing Faith

The credit union system’s unique capacities are simplified to safety and soundness, defined by ROA and net worth with a dollop of growth thrown in. Purpose becomes dressed as creative public relations campaigns and promotional branding efforts.

An example of this waywardness is VyStar Credit Union. A member forwarded their most recent assessment of its recent flawed digital channel conversion:

In regards to VyStar, we have decided to move our account to another credit union.

Facebook posts (https://www.facebook.com/VyStarCU) have certainly slowed down. I do not know if it is due to apathy or is X number of people who have just gone to other financial institutions.

Login online has greatly improved. There is little to no wait time.

They updated the mobile app on June 26th. Many people had difficulty getting on the app, especially the android version.

Getting a hold of someone in customer service is very difficult at best. Very long wait times on the phone (in excess of two hours). You can log into chat, I had almost an hour wait the other day. While they have now added internal transfers, you still cannot do member to member (linked account) transfers (like to other family members). You can only transfer funds internally within your savings, checking, MMA, etc.

You still cannot see any account history prior to 05/13/2020 which was the day they shut down the system they used prior to the current one.

You no longer get copies of your checks written online as before.

I see no “Improvements” or new features in the new system whatsoever. The new bill pay is cumbersome and not user friendly. I filled in the bill payees into our new credit union with ease, it is almost exactly what we used to have at VyStar before this poor unsatisfactory installation.

Lastly, and most disappointingly, is the fact that the CEO has still not addressed the members directly. I know of no statement to the press since about May 23rd.

I have no idea how many members have left and I am not sure we will ever know. I hate leaving but, I have lost faith in them.

A Two-Way Street

The fundamental flaw in VyStar’s strategy is not a bungled conversion. Many conversions have temporary problems. Rather it is VyStar’s strategy that credit union membership is a one-way street. Members just transact and are viewed as customers, not owners. There is no respect for members’ “faith” which is the primary foundation for any credit union’s long-term success.

A two-way street means the owner’s role is understood, honored and continually enhanced. The primary means is seeking to expand the multiple ways value is created for members, especially those who have the least or know the least.

A Member Advocate

The credit union model is foremost an advocate for members’ well-being. That was the original intent.

The vibe at VyStar is all about the institution and its size. This is a sentence from an April 2022 merger announcement before the digital debacle: VyStar, which has more than 800,000 members and over $12 billion in assets, will remain the 14th-largest credit union in the country by asset size.

When the member relationship is always front and center, the owners return much more than transactions. They give their loyalty, patience when necessary, and word of mouth endorsements with friends and family.

That was how the credit union movement achieved their current $2.3 trillion position while serving the fourth or fifth generation of members. Members’ contributions are paid forward to benefit future members.

For the founding members’ spirit of purpose to prevail, it must be constantly renewed in the words and actions of those leading cooperative charters now.