At the September 17th NCUA board meeting, the three members responded with misleading statements, false comparisons, and dire warnings about the June 30, 2020 financial update of the NCUSIF. Their dialogue materially misrepresented the state of the NCUSIF currently and in the future.

All three implied the fund will need more money and new, FDIC-like flexibility in assessing potential premiums. Mark McWatters even suggested that the 1% NCUSIF deposit was double counting this credit union asset, unlike the FDIC which has no deposit base.

Before addressing the mischaracterizations, it is important to recall how the current NCUSIF, redesigned in 1984, still depends upon a most important innovation–the cooperative movement’s democratic foundation.

“It Is Your Fund”

As NCUA Chairman Ed Callahan stated in NCUA’s 1984 Annual Report (pg. 18) describing the NCUSIF’s restructuring: “We’ve said all along that it’s a better way, but it is also unique. . .It is unique because really it is your Fund.”

While much comment is properly focused on the radically changed financial structure of the NCUSIF from a premium to a deposit-based fund, often overlooked is the fact that the NCUSIF is a credit-union-owned fund. The redesign was built on cooperative principles. The fund is not “owned” by the NCUA or even the federal government. Rather, members send 1 cent of every deposit for its capital base, just as member shares are the basic capital of every credit union.

This democratization of the NCUSIF also entailed responsibilities that any member-owned institution requires. In the same 1984 article, Chairman Callahan laid out these duties: “It means you have an investment in your fund. . .Can you forget about it? Well do you ignore your other investments, or do you monitor them?”

He listed the safeguards created to monitor NCUA’s management of the fund. These included the withdrawable option of the deposit; the 1.3% cap above which a dividend must be paid; the monthly report by the NCUA board to track expenses and losses; and the annual external audit, as just some of the new guard rails.

He closed: “Don’t set it up and forget about it. It’s unique. It’s a better way. But just as important, it’s yours to monitor—it is your responsibility to keep it working—because if you don’t, it’ll go just like anything else the government touches. When government gets more money, it wants to spend more. Our goal is to spend less. You have to hold us to that promise.” His message is timelier than ever: that a democratically formed fund requires ongoing engagement, not passive acquiesce.

The industry supported legislative changes made in 1984 are still in place. NCUA’s commitments of self-restraint, transparency and responsive oversight that made this common effort possible are also still binding.

Before this congressionally approved redesign, the statutory NOL was 1%. NCUA had only premiums as its primary income. These premiums were not subject to credit union review or even consent. The new cooperative restructuring created checks and balances and institutional commitments so that NCUA would be accountable to the fund’s owners and the common good of the credit union system.

The NCUSIF Is Not the FDIC

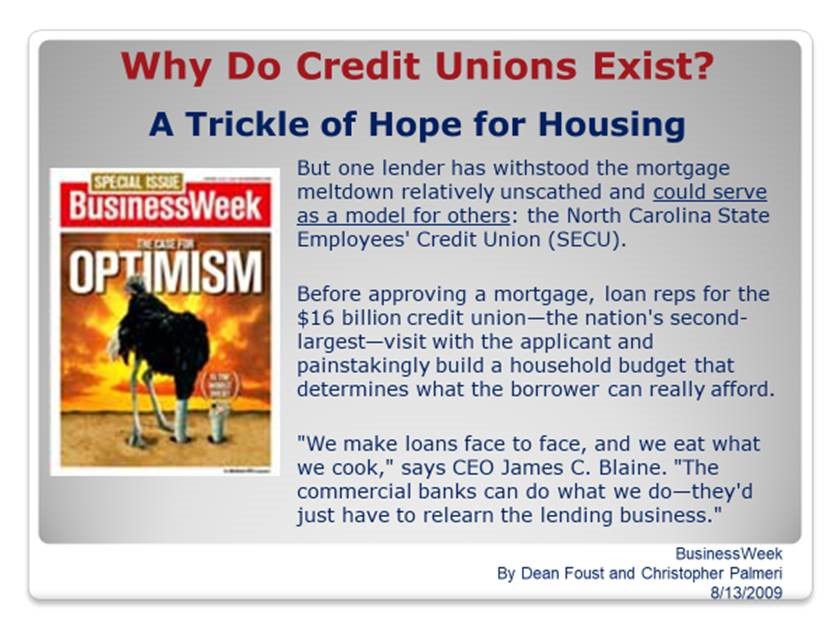

The insured savings coverage of the FDIC and NCUSIF are the same. But that is where the similarity ends.

The two funds serve very different financial segments. The NCUSIF is for not-for-profit member-owned cooperatives based on self-help; the FDIC, profit making institutions. FDIC is a stand-alone insurance provider; NCUSIF is one aspect of a tripart regulatory structure. Reflecting the different purposes and “capital” options of the organizations served, the two funds have unique financial structures and constraints.

Finally, their histories and roles have evolved from very contrasting circumstances. The FDIC was created in 1933 in the middle of Great Depression and a national banking crisis; the NCUSIF in 1971 as a recognition of a vital economic role that warranted an option for a federally managed fund alongside the banks and S&L’s.

The Sept. 17th NCUSIF update mischaracterized the fund’s financial situation in emphasizing the decline in the operating level from 1.35% to 1.22% at June 30, an apparent fall of 13 basis points. This reduction appears close to the 1.2 lower limit, below which the Board is required to develop an eight year “restoration plan.”

This ratio calculation recognized all insured shares as of June 30 but does not include the required capitalization deposit contribution from credit unions’ net increase of shares as of the same date. This accounting receivable is only recognized “when invoiced” thereby creating an artificial lag in presenting the fund’s actual financial position.

As stated by staff when questioned, when invoices are sent in October the fund’s ratio will be 1.33% due to the added $1.5 billion in required capitalization deposits. The ratio is nowhere near the 1.2% floor. The headline portrayal of a precipitate decline in the ratio is significantly misleading. Moreover, staff forecasted that even before considering this accounting lag, the fund will be around 1.32% at year end.

Faulty Analysis and Comparisons

The NCUA’s board oversees the three legs of regulatory responsibility: chartering/supervision, liquidity, and insurance. FDIC is only an insurer. OCC (or state regulators) and the Fed have the other roles. The combined regulatory functions in NCUA should increase efficiency of operations. Instead, as shown on the enclosed spread sheet, NCUA has increasingly used insurance fund income to pay its agency-wide fixed costs of operations.

The FDIC and NCUSIF have totally different financial structures. FDIC is a premium-based fund. Its reserves come from charging banks an expense, plus the minimal revenue it earns on investments, to build its capital base.

This premium-based revenue stream has repeatedly been insufficient to align the fund’s base with fluctuations in insured deposits, unexpected loss events or even changes in interest rates. This was the same result for NCUSIF’s early “premium-based” years and why “a better way” was implemented in 1984.

The NCUSIF is a deposit-based fund which aligns its growth with credit union insured savings. This 1%, which is 80% of the 1.25 of the normal operating level’s midrange (NOL), increases the fund’s size automatically, every six months.

The FDIC reliance on premiums to keep pace with deposit growth means that

at an average annual fee of .08% of assets, approximately ten years would be needed to increase the FDIC’s balance to maintain its NOL ratio. By contrast, the NCUSIF’s structure accomplishes this increase in fund balances semi-annually with the 1% capital deposit adjustment.

The stability of the NCUSIF’s asset base means that both earnings and liquidity are more dependable than the premium-revenue model of the FDIC. Because its revenue is fee dependent, the FDIC requires a much longer time period to increase its core assets (unless fees are raised). This fact underscores the urgency for FDIC ‘s restoration plan when it falls below the Congressionally mandated 1.35%.

For the NCUSIF, the normal operating level is a range between the floor of 1.2 and cap of 1.3%, or 10 basis points of insured shares. The NCUA, using flawed logic, “temporarily” raised the NOL to 1.39% in 2017 when merging the TCCUSF. The board then failed, despite Chairman McWatters’ promise, to review these “temporary” justifications as the NOL came up for review in the following two years–most recently in December 2019.

We’ve Been Here Before

Board Member Harper asked staff if there was a precedent for the extraordinary share growth during COVID. He called it a “black swan event which we haven’t seen before or even thought about.” That assertion is dead wrong. For the three years following the 1% deposit restructuring in 1984, credit unions experienced double digit share growth. Not only did the fund stay in the 1.2-1.3% NOL range, there were no premiums.

The advantage of a range with a floor and a cap as the normal operating level means there is a surplus always available, apart from current income, to meet any extraordinary needs.

Today that 10 basis point range totals over $1.4 billion and grows proportional with the credit union insured base. There has never been an insurance loss that comes close to this NOL range. The NCUSIF’s historical loss rate for the past 12 years is just 1.727 basis points off for each $1 of insured shares or over 5 times this 10-basis point variation.

This 12-year analysis shows insured share growth of 5.6% CAGR. To maintain the NCUSIF’s NOL at 1.25% of insured shares with this long-term growth rate and also cover the average known loss rate (1.727 basis points), the fund must earn 1.14% on its investments. Today the NCUSIF’s yield in 2020 is 1.63% with an average weighted life of investments exceeding three years. There is over $620 million in unrealized gains on these investments. Given the Federal Reserve’s low interest rate policy, these gains should remain for years to come if needed to generate additional current income.

The Real Issue–Uncontrolled Spending

The misleading discussion of the NCUSIF’s resilience and the suggestion that legislative adjustments are needed should alarm credit union owners.

When asked to support the fund’s restructure in 1984, credit unions’ most worrisome concern was their open-ended 1% capital base funding obligation. How do we know NCUA won’t just spend the money, they asked again and again? There were built-in protections to ensure that members’ money was prudently managed. In addition to those listed in NCUA’s 1984 Annual Report, these included:

- The elimination of special premiums;

- An annual premium could not be charged to raise the fund above 1.3; rather an increase in the ratio can only come from retained surplus.

- Monthly board reports on the NCUSIF’s condition;

- Control of operating expenses, and especially the overhead transfer rate used to partially pay for NCUA’s operations

It is not insured losses that use up the NCUSIF’s revenue. In the last 12 years, NCUA has charged the NCUSIF $1.968 billion in operating expenses, while incurring cash insurance losses of only $1.888 billion. (see spread sheet) To increase these charges, the overhead transfer charges were raised from 33% in 1984 to 61% in the most recent calendar year.

So far in 2020, the NCUSIF has spent $94.1 million on operations and $34.5 million on loss reserve expenses. The core concern of credit unions addressed by Chairman Callahan decades ago has occurred. Absent management and supervisory effectiveness, the natural impulse of government is to implement oversight by just spending more.

In the September 17th NCUA insurance presentation, staff showed that the total amount of code 3, 4, and 5 CAMEL rated credit unions had declined. The one liquidation year-to-date was largely due to “fraud” and resulted in a minimal loss. This is the best measure for supervision responsiveness and creativity, not the amount of NCUSIF’s reserves.

Board members uniformly congratulated themselves for increasing the fund’s NOL to 1.38, a figure that has never been factually explained. All expressed apprehension about probable future losses. Each suggested a “restoration plan” needs to be anticipated, even though this has never been a close event in the fund’s almost 40 years since financial restructure.

Board members failed to mention that the fund might help credit unions transition through this downturn by providing temporary capital assistance. The NCUSIF is more than a fund to cover loss. More critically it is a source of supplemental capital, an historical activity inherent in its cooperative structure. In credit unions, unlike banks, no private owners’ investment is being saved, nor is “moral hazard” risk present. Both of these severely limit FDIC’s open bank assistance efforts.

Not a Money Issue, But a Time for Leadership

As shown in the spread sheet attached, the resources of the NCUSIF have always been more than adequate. It is disheartening to hear board member McWatters congratulate himself for creating a “sizeable safety net of reserves” when raising the NOL to 1.39% on erroneous data. He then opined that FDIC gets to count 1% as its own funds and that the 1% credit union deposit is double counting. He appears to have no knowledge of either fund’s accounting basis or an understanding of how the NCUSIF structure aligns with the cooperative self-help credit union funding model.

As evidenced in recent, unprecedented insured losses, the board also seems to think that problem resolution means holding fire sales to for-profit firms of member loans as fulfilling the agency’s obligation to member-borrowers.

Board Member Harper referenced the FDIC and its multiple options that he would like to incorporate in the NCUSIF’s oversight. These changes would require Congressional legislation. If adopted, they would destroy the remaining checks and balances credit unions relied upon when they agreed to an open-ended, perpetual capital funding commitment of the NCUSIF.

Harper’s view that we are in the “calm before the storm” and “we” should initiate legislation to put the fund on a “counter-cyclical” footing, is a misunderstanding of the NCUSIF’s fundamental financial structure. The semi-annual 1% deposit is an inherently counter-cyclical self-funding model. Unlike a premium system, it ensures resources are readily available at all times to assist credit unions.

The NCUA board referred the FDIC’s recent decision to initiate a restoration plan to restore its required 1.35% level (now 1.3%) after seeing the same double-digit run up in bank insured deposits. What each board member failed to note is that the FDIC board, based on an analysis of the environment and its staff’s recommendation, made no changes in its current assessments. As stated by the Chair Jelena McWilliams at the September FDIC board meeting:

In establishing a restoration plan, we explored a range of reasonable estimates of future insured deposit growth and future potential DIF losses. Based on these estimates, we project the reserve ratio would return to a level above 1.35 percent without any increase in the deposit insurance assessment rate schedule.

Mobilizing Cooperative Democratic Engagement

Hopefully, Chairman Hood will show the same confidence in the NCUSIF’s resilience (and NCUA’s supervisory capabilities) as the FDIC board demonstrated in assessing its fund’s outlook in the current environment.

Given the NCUA Board’s public dialogue, credit unions must mobilize their cooperative courage and assert their concern to keep the financial integrity and institutional commitments Congress and NCUA made in 1984. With the Board’s track record of unrestrained spending and alarmist projections, the necessity for credit unions to monitor their common investment in the NCUSIF could not be more urgent. That involvement, just as in 1984, is the key to this unique democratic fund’s survival.

Comments on Spread Sheet attached

Source: NCUSIF Audited Financial Statements 2008-2019

- Compound Annual Growth Rate (CAGR) insured savings: 5.6%

CAGR: NCUSIF Operating expenses: 8.06%

- Cumulative NCUSIF Insurance loss rate per each dollar of insured savings:

12-year average: 1.727 basis points

One-year High: 6.95 basis points (2018)

One year Low: .127 basis points (2016)

- December Year End NOL level: Fund equity to insured shares

Low 1.23 (2009)

High 1.39 (2018)

- Overhead Transfer (OTR) as % of total NCUSIF Operating expenses: 92.5% twelve-year average

OTR low rate: 52% (2008)

OTR High rate: 73.1% (2016)

Twelve-year numerical average OTR 62.01%

- Fiscal Year End allowance Loss as a % of following year’s actual cash loss

Low year 117% (2017

High year 1,349% (2014)

Numerical average of year end allowance divided by following year’s actual cash losses: 570% or the loss account expense is funded at a level almost six times the following year’s actual cash losses.