In an 18-page complaint filed August 7, Victor Webb filed suit against the board and supervisory committee of the failed CBS Employees FCU seeking over $40 million in recoveries for members.

According to press reports the loss was first discovered on March 6, by an employee who raised questions about a $35,000 check the CEO, Rostohar, had made out to himself.

NCUA’s audit as of February 28, 2019 said the loss could be as high as $40.5 million for an embezzlement scheme that Rostohar admitted carrying out over two decades. In the credit union’s last call report as of December 31, 2018, it reported $21 million in assets, $2.6 million in capital and 2,798 members.

A Member Acts

The federal credit union was chartered in 1961 to serve CBS employees and related companies. In the complaint Webb stated he joined the credit union in 1970 while a CBS employee. He remained a member until the credit union was liquidated in March, although he retired from CBS in 2014.

His suit names the board and supervisory committee members at the time of liquidation and prior members who served in similar capacities during the two decades of defalcations.

As a class action, Webb seeks damages of $40 million on behalf of all members, by stating that the benefits of membership were devalued by this amount which should have been available so members could benefit from lower fees and loan rates or higher dividends—that is the lost benefits of credit union ownership.

“A Fiduciary Relationship”

The core argument for suing the Board and supervisory committee members is summarized as follows:

“By reason of Individual Defendants’ positions with CBS Employees (FCU) as members of the Board of Directors, they are or were, at all times herein relevant, in a fiduciary relationship with Plaintiff and other CBS Employees (FCU) members and owe them a duty of highest good faith, fair dealing, loyalty, as well as a duty to maximize member value.” (Page 3)

The fiduciary responsibility of directors and committee members is well documented in NCUA regulations and letters, but rarely is their conduct formally challenged by a member. But this is a case of extraordinary loss equal to almost 10% of the last reported assets, or $2 million per year, for over two decades. Both the amount and length suggest a complete breakdown in both internal and external, regulatory oversight.

How Could This Happen?

This suit focusing on the fiduciary duties of the Board and Supervisory committee could be a very important milestone in cooperative governance and oversight.

How NCUA’s reported audited shortfall of $40.5 million in a $21.3 million asset size credit union could occur is hard to fathom.

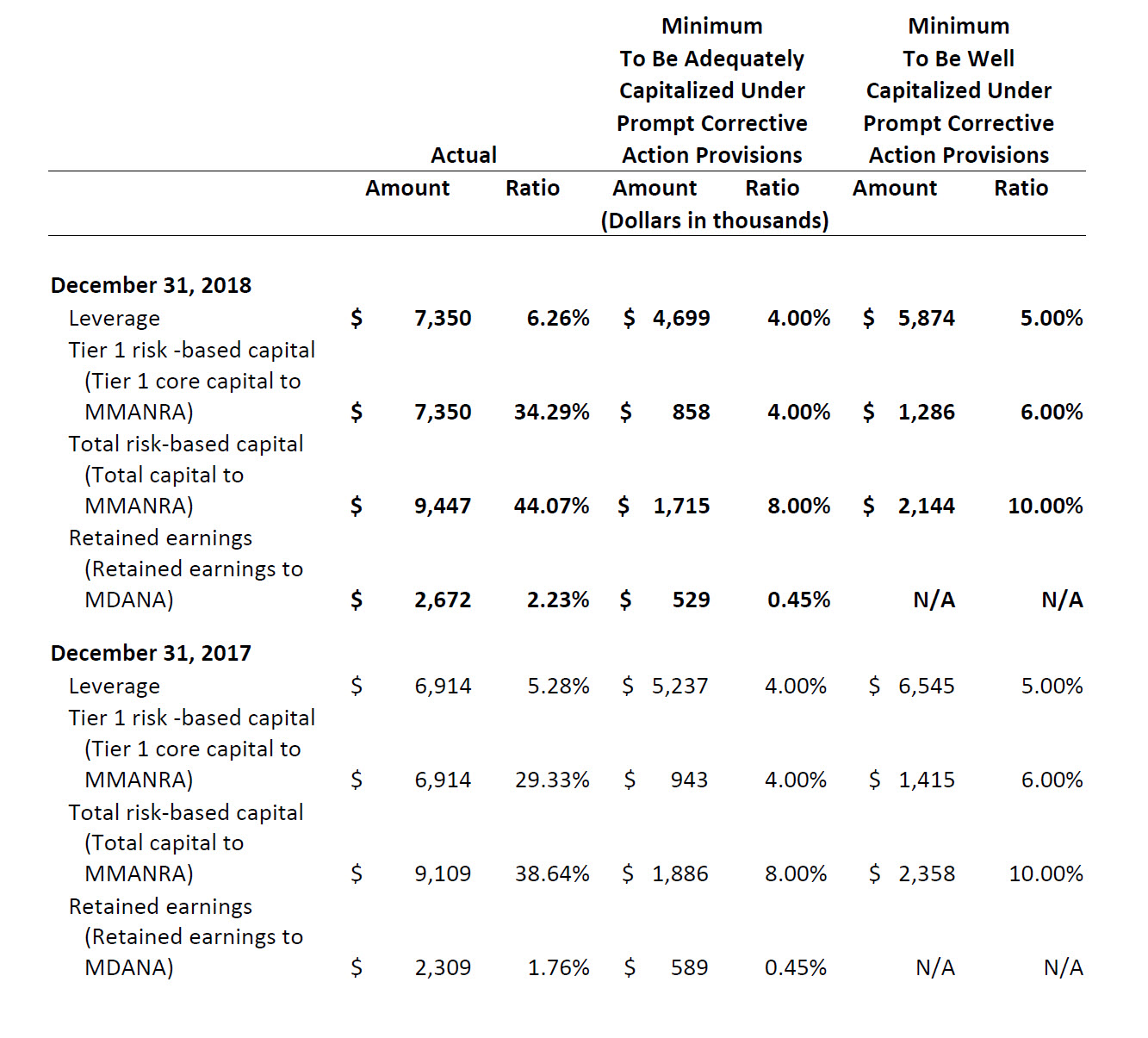

The credit union’s December 2018 call report shows $18.4 million in shares for 2,798 members, resulting in an average share balance of $6,576. The credit union’s assets consisted of $14.7 million of investments and $6.1 million in loans with a reported delinquency of only 0.33%.

The credit union’s $18.4 million in member shares would seem to be more than adequately covered by the $21.2 million (with $2.6 million net worth) in easily verifiable assets if a liquidation were ever necessary.

Internal processes to monitor the credit union’s management are mandated in both bylaws and by rule and reg.

Every federal credit union is required to complete an annual audit under the auspices of its Supervisory Committee. Such an audit, whether internally conducted or outsourced, would entail a verification of member accounts, selected confirmations of investments and loans, and a review of internal controls. The results are reported to the Board.

The Regulatory Review

Additionally, NCUA has conducted annual audits of every FCU since the 2008-09 financial crisis. This review would review the credit union’s own supervisory committee’s audits, including member confirmations, plus a complete examination of investments and loans. In addition, the examiner would review all settlement accounts against the latest bank statements to ensure up to date postings and that the credit union’s general ledger is in agreement with external financial confirmations.

If the assets reported by the credit union are correctly reported, then that would mean the total loss caused by the CEO’s fraudulent activities would be the $40.5 million shortfall plus the $2.6 million in net worth for a total of $43.1 million.

NCUA’s obligation to member shareholders is to pay up to the $250,000 per account insured limit. A $43.1 million payment on top of the $18 million in reported shares would mean that over 6,500 more accounts (using the average share balance from reported members) would have been kept in a second set of off-the-book records.

There are only two explanations for NCUA’s reporting a $40.5 million loss after its February 28,2019 audit:

- The reported asset values were widely inaccurate, which raises the question, what kind of annual regulatory examination was done; or

- The assets are properly recorded, which means that from $40.5-$43.1 in off balance sheet shares were being managed by the corrupt CEO.

If the second option is the explanation, this suggests the CEO was running a shadow credit union with almost three times the number of members and shares as the reporting credit union. How could this activity be hidden from employees, the directors or supervisory committee, since these members must have received statements and conducted business transactions regularly with the credit union?

If the reported assets are phony, which would account for half of the loss, the only question is what type of annual exam had NCUA conducted over the two decades that this theft occurred?

Time for a Real Accounting

I salute member Webb for standing up and asking that responsible parties be held to account. This is more than sending the former CEO to jail and then covering the tens of millions shortfall out of NCUA’s “rainy day insurance fund.”

All the public evidence suggests that the problems are much more extensive than a corrupt CEO and a hoodwinked and a deleterious board and supervisory committee. The regulatory oversight that is supposed to assure the industry’s safety and soundness through onsite examinations would appear to have been negligent as well.

When a member takes a stand against ineptness, self-serving conduct and dereliction of duty, the whole democratic movement will benefit. Cooperative governance requires that fiduciary duty have real meaning, not just good intentions. Hopefully this suit will bring out the full story and create a much-needed precedent along with a correction of examination shortfalls.

I salute Victor Webb and say with him, “Enough is Enough.” Stop paying out losses, let’s correct the problems letting these occur.