A Song for Joy Opens the New Year

Celebrate the New Year with the Silent Monks “signing” Handel’s Hallelujah Chorus. When times are unprecedented, there are no experts just, innovators.

It’s NOT a Wonderful Life or Can Miracles Still Happen?

On December 28th, the Monday after Christmas, the 85-year, $35 million Post Office Credit Union (POCU) in Madison may come to an end. The savings and loans of its 3,196 members and their abundant reserves (22% net worth) will be transferred in due course to the $26 billion PenFed Credit Union in Virginia. Their new financial “partner” is 850 miles distant and 742 times larger. They would join an already existing membership of over 2 million.

Why should credit unions care? After all UPS, Federal Express, DHL and even Amazon can fill the needs if the local Post Office itself were to close. Same with financial options–aren’t there plenty?

Member-owned cooperatives fill a special niche in every community. The members pool their savings to provide loans to members and businesses with local control and leadership. Founded during the Depression, POCU serves member needs with services guided by familiarity and circumstance. Especially in a pandemic.

It’s Madison, Not Bedford Falls

But alas, Madison is not the Bedford Falls of the Christmas film It’s A Wonderful Life. No Clarence, or guardian angel, has appeared to “ring a bell” asking for a public hearing. Or to demonstrate what the future for members and the community will be without POCU.

And there is no George Bailey to stand against Potter’s acquisitiveness. For the CEO of POCU will choose between receiving a five-year $650,000 sinecure or immediate cash severance of $437,000 while turning over his leadership responsibility to another firm via merger.

Will there Be a Rerun?

Three generations of members have supported POCU to be always present for them. But no rerun of It’s A Wonderful Life may happen next year.

Unless there is an unexpected intervention. Do I hear a bell ringing signaling another angel’s presence? A real life Clarence to help members see life without POCU?

Such an event would fulfill the spirit of this timeless movie. Except it would be a real-world “Madison miracle” this Christmas time.

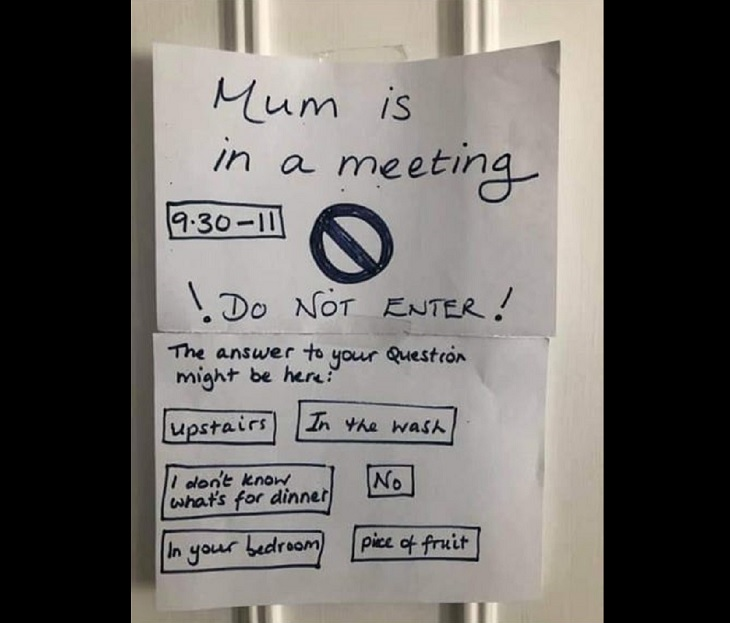

From the Field: Working Efficiently at Home

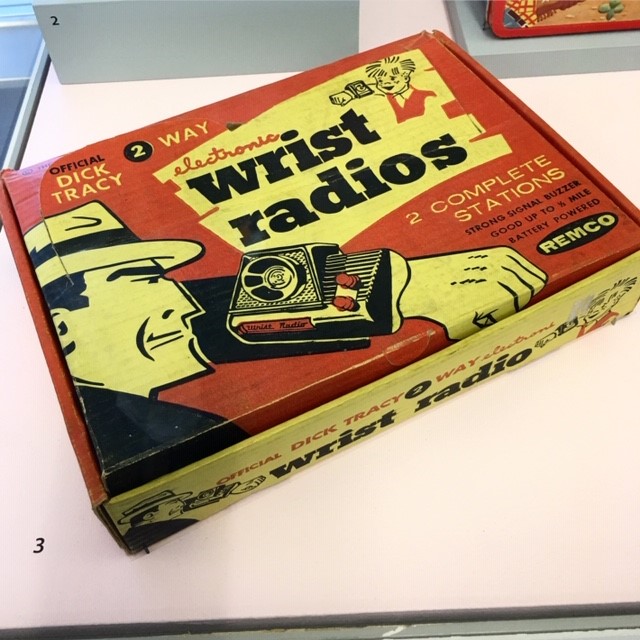

Innovation: Beating Apple’s Watch by Over 50 years

New Credit Union Charter Germinates After Eight Years

From the new credit union’s announcement:

On Wednesday, August 14, the National Credit Union Administration (NCUA) approved charter number 24915 for Maine Harvest Federal Credit Union. This approval was announced publicly in an NCUA press release:

https://www.ncua.gov/newsroom/press-release/2019/ncua-charters-maine-harvest-federal-credit-union

Maine Harvest FCU become the first regulated, deposit-taking financial institution with a mission to promote a local food system by lending to small farms and food producers. At Maine Harvest FCU, we hope to see the impact of our mission in stronger rural economy, a cleaner environment, increased soil fertility and improved public health.

Maine Harvest FCU becomes the first new credit union in Maine in 30 years and only the second credit union chartered nationally in 2019.

The process took eight years and required $2.5 million in donated, startup capital.

Since starting the chartering process with NCUA’s required survey (seen below), there have been eight crop harvests. How many small farms and start up efforts were frustrated in the interim?

Which is harder: being a small farmer or a credit union organizer?

Potential Member Survey (2012)

The potential member survey was fielded at MOFGA’s Common Ground Fair in 2012. This two-page survey was based on a template from the National Credit Union Administration and is an important part of the credit union chartering process. The goal of the survey was to gauge the level of interest in the proposed credit union and to get an idea of potential deposits from prospective members. 258 responses were received and consistently indicated a high level of interest in joining the CU and with substantial potential deposits. (Source Maine Harvest web site)