Every evening feels like Friday night. Every morning, like Saturday.

A Critical New Data Tracking Need

Now that the recession is 100% certain, we know the traditional performance dashboard will light up with all the downward trends. These include rising delinquencies and net charge offs, falling or negative ROAs and capital levels.

Most credit unions expect these trends. They are using their capital to show that the credit union is there for members even in the most pressing of economic circumstances.

The Analytics of Recovery Tracking

Data analytics routinely captures on an ongoing basis hundreds of facts about members’ activity, product/service utilization, credit/debit transactions, and in some cases next most likely financial need.

But the numbers that will really tell the story of credit unions’ role in this crisis are the underwriting of member recoveries.

The data analytics challenge is to identify the segment of members most at risk during this crisis. Once established, then to focus assistance programs to help them return to a stable financial position.

If one third of American households are credit union members, and the unemployment rate hits 20%, it is reasonable to assume a high percentage of members will immediately suffer loss of income. Monitoring assistance and recovery trends of these members could include:

- Number of members who were laid off, unemployed-and their work return over time;

- Number who received unemployment-and then returned to employment;

- The number and amount of loans rewritten to reduce payments-by loan type;

- The $ amount of fee reductions extended;

- The $ of new, low cost loan advances to navigate changing economic fortunes;

- Foreclosures and repossessions halted; recovery status of these members;

- The $ refinancings of loans at other firms to lower the members’ rates and payments.

Many of these individual situations are recorded in the traditional financial reports. But that hides the member impact. It makes the focus institutional financial health, not the members.

Credit union contributions to food banks, community foundations and other corporate forms of assistance are necessary and admirable. From the members’ perspective the real test of a credit union, regardless of size or resources, is were you there when I was most in need?

A Stronger Common Bond

At some future time, the complete cycle of current economic events will be chartered. The credit union system will have survived. The cooperative story should be about what we did for members in their time of crisis. For our institutional recovery depends on members’ achieving and sustaining financial well-being.

The message is that members are better off being part of a credit union. We must back that up with the facts and examples of going the extra mile. Then the rhetoric will be believable and appropriate.

Most important is that the we will have come out of this crisis with a stronger common bond.

Are Negative Interest Rates In America’s Future?

With all interest rates at historic lows, the policy option of negative interest rates is being discussed openly. The President and economists have opened to the discussion.

CNBC market analyst, Kelly Evans, summarized pro and con positions in a May 12 post excerpted below:

I had *just* gone through a whole thing about the relative merits of the Fed’s corporate bond-buying program versus negative interest rates, when the landscape has shifted again in favor of negative rates.

David Zervos of Jefferies this morning wrote, “If they go negative, they go big.” Zervos is “increasingly sympathetic to the idea” that the Fed will cut interest rates below zero and Congress will support it–why? In part because suddenly the “cost” of interest on our ballooning federal debt goes way down, freeing up money to be spent elsewhere, and who in government doesn’t want that?

I remain highly skeptical. Several countries which have tried negative rates have either reversed it (Sweden*) or stopped at relatively shallow levels, like -0.1% in the case of Japan.

The point of negative rates is to lower borrowing costs–especially for hard-hit companies–and keep the financial system from tightening. But for starters, even with negative rates, the Fed’s corporate bond buying is still necessary–and may prove sufficient–to spur investors to take on credit risk.

The Fed is shrinking the spread between its fed funds rate and corporate borrowing rates already to such an extent that having “negative” official rates may not be necessary. . .

The health of the banking system–along with the viability of insurance companies and large pension funds–is truly at risk here and that’s not a good thing. Here’s how The Wall Street Journal last year described Europe’s experience with the negative rates: “The negative-rate policy’s ineffectualness is a sign of just how weak Europe’s economic engines are, and how vulnerable. The policy threatens pensions, creates the risk of real-estate bubbles and doesn’t fully quell the specter of deflation. European banks struggle with weak interest income and thin margins on loans, putting them behind American peers in profitability and making it harder for them to finance the economy.”

*From the FT article linked above, which offers a good review of Sweden’s experience: “Research published last year by Princeton University economists Markus Brunnermeier and Yann Koby found that many of the benefits of negative rates are front-loaded — such as gains in asset prices on bank balance sheets — while the corrosive side-effects last longer.”

Credit Union Executives Explore the Prospect

An email chain:

From: Exec One

Question-if interest rates move into a negative territory will our dividend calculation process compute based upon a negative interest rate? Meaning my members would pay our Credit Union a dividend for the safety and security of having their money insured by the NCUA.

Pretty extreme—

From: Exec Two

So I saw today on the news that trump is urging the Fed to allow interest rates to go negative.

From: Exec Three

Interesting…….and ludicrous. But on the other hand, an experiment in the development of solutions for very, very, very low probability events. Who knows this may lead to some new schemas for American credit union consumers. Get out the specs for when hell freezes.

From: Exec Four

It just makes lending that much more important. In any event investments going forward will earn only .25 bps or less.

From: Exec Five

Not ludicrous from a certain perspective. Trump as a commercial developer loved leverage. He’s now CEO if the world’s biggest debtor. Loves leverage and salivates over negative rates. Good public policy? Hardly.

Most of us individually are savers, investors, creditors. Trump got rich as a net debtor. From the perspective of the USA as a debtor entity, carrying costs of the debt at a rate of zero is a good thing.

Regardless of whether we agree with it (and I don’t) we will see negative rates sometime soon. I don’t think it necessary to develop ability to calculate negative rates as cus can accommodate via various fee programs.

From: Executive Six

Agree, not likely to happen, but …… credit unions better be the last bastions for the model that doesn’t charge Americans to hold their money in safekeeping if it were to happen. Let’s commit to build strategies that differentiate us from the for-profit competitors. It’s a bold vision, but imagine the market share shift that could occur if CU’s are the only retail and small business deposit option that didn’t go negative. Could we create a new cooperative business model that could successfully manage a shift of billions of dollars of deposits? On the other side of the balance sheet isn’t that what non-bank fin tech lenders have done in just a few short years? Just another case of turning a challenge into an opportunity. Can we hold to our principles and take advantage of a negative interest rate environment or do we just cave in following the crowd?

To be continued. . .

Essential Workers and Essential Work

On the Front Lines

Every day essential workers show up so the rest of us can stay home. We are in this together does not mean we share the same experiences.

On the front lines are those vital to sustaining our individual altered world realities. These workers include delivery drivers, postal workers, police, fire and EMT, garbage handlers and those who maintain public transportation. Most critically are the many health care workers that battle the disease daily, in-person, patient by patient.

Everyone owes them the respect and enhanced standing in society that should accompany these new roles of national service in a crisis.

On the Home Front

For the 30 million-plus who have been laid off, not to mention those home bound but still employed, does that mean our role is not essential? Is virtual education merely a stage of life to be transitioned to? Is work from home just an altered venue of normal employment? Are the contributions of the retiree and volunteer communities momentarily paused only to be restarted where they left off like a Netflix movie?

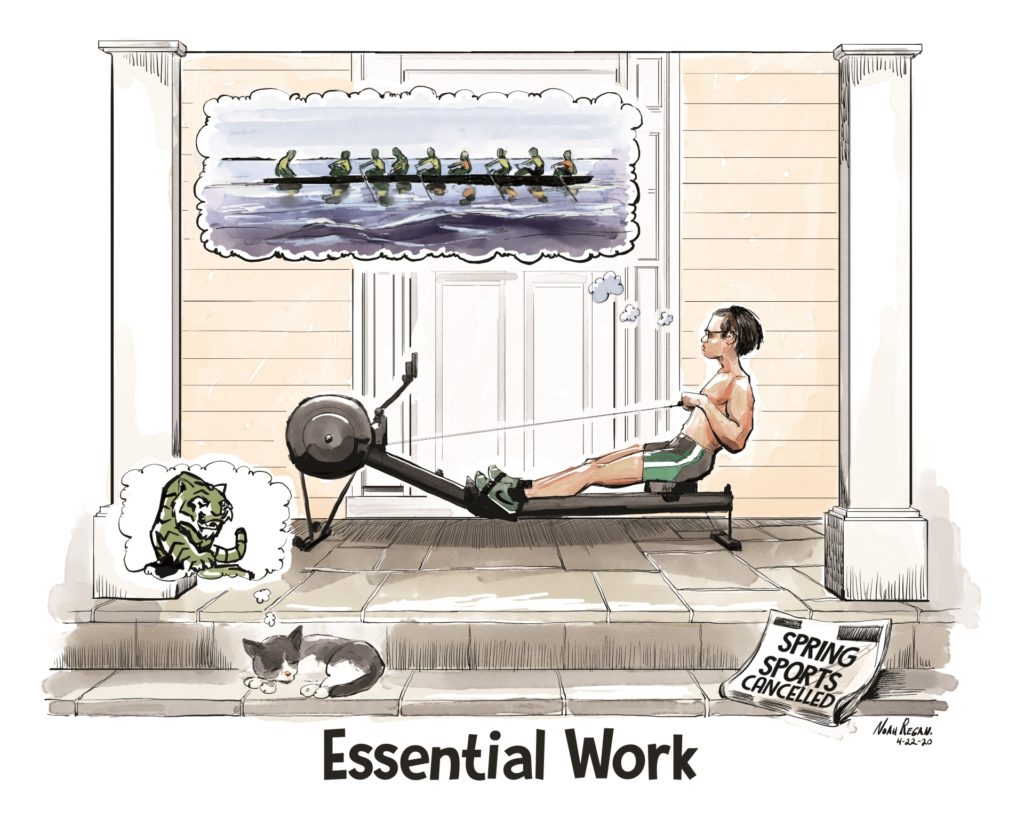

Or might there be a parallel contribution with those whose work takes them into daily confrontation with the pandemic? I believe the image above captures this opportunity for those of us not on the front lines.

Re-Imagining the Future

The illustration shows a Wilson High School (D.C.) junior working on an erg rowing machine after the spring competition in all sports, at every level, has been cancelled. Nothing deflates the rewards from sports faster than the elimination of competition. Not only have games (spring regattas) been cancelled but also the joys of daily workouts with peers and committed coaches are gone.

This individual circumstance represented includes a deeper disappointment as well. For in the 2019 regatta season, this rower had participated in the ultimate experience for which any competitive athlete could aspire. As a sophomore, he rowed in the varsity 8 boat which unexpectedly won the national high school Scholastic Rowing Association championship. To drop from the pinnacle of a sport to no competitions could shatter the basic motivation that inspires athletes.

However, he labors on alone, to lower erg times and maintain readiness for a reimagined, yet uncertain future. And that is the “essential” opportunity each of us has even though bounded in place by multiple circumstances.

Victory Gardens

In a handwritten change to a speech he was working on the day he died, FDR penned the following close: The only limit to our realization of tomorrow will be our doubts of today.

Each of us can do essential work that will help define the options we will have tomorrow. All, not just those deployed on the front lines, have the possibility to imagine the future they wish to see post-crisis.

The first step is to sow the seeds of our ambition. The victory gardens in WWII were planted to sustain us for an unknown period but were inspired by belief in our future together. Today, “victory” gardens, inspired by the current pandemic, are springing up in yards all over the country.

Sports can be a metaphor for life. Even though our game plans were cancelled this year, we can still prepare for tomorrow’s competition, whenever that moment comes.

One CUSO Board’s Decision on PPP Participation

In response to my Revealing Character blog, I received the following comment, used with permission.

Chip, just read your blog entry today about credit unions and government assistance. This is what I shared with my board a month ago. They unanimously agreed we did not want or need the money. Excerpts follow:

Board Members:

I am sure some of you are already aware of the governments $349 billion Payroll Protection Program (PPP) that was part of the CARES Act. The spirit of the new SBA loan program is to support struggling small businesses retain their staff and maintain ongoing operations over the coming weeks. For companies that do not materially change their payroll after 8 weeks, the loans will be forgiven. Essentially, the loan becomes a federal government grant for small businesses.

Based on analysis, the CUSO is likely eligible for the program and would be able to apply for nearly $XX mm in loans – equating to a little less than a third of budgeted 2020 net income. Given this would be a material sum, I feel it is important to engage the board on this decision and would appreciate your perspectives.

I have researched the program, consulted with those familiar with SBA lending, and contemplated this over the last few days. For mainly philosophical reasons, I currently do not feel we should pursue this program but recognize that this is a board-level decision. While we technically would qualify based on the very broad program definitions and limited documentation required, I do not feel this would be in the spirit of the SBA program — to support struggling small businesses that are contemplating staff layoffs/furloughs and in many cases their own continued existence.

This is a complicated and challenging decision. Nearly every business has had operations and plans affected in some manner by the pandemic and the future remains uncertain. Like your organizations, our CUSO has been impacted – but given our continued positive net income outlook across 2020 and broader balance sheet strengths, I feel confident we will weather this storm and there is no need to contemplate staff layoffs or furloughs in the foreseeable future. Additionally, while I have been told it is unlikely the SBA would publicly disclose the names of the companies that borrow, this is not the kind of headline I’d want to see in the trade press or used in anti-CU platforms.

Without a doubt, the money could be used for many purposes to support the business or further shore up our stability. For example, if we used the $XX mm loan to cover payroll for a period of time, we could choose to use the money we would have spent on payroll to create a fund to help struggling borrowers. But, then again, don’t we already have the capital resources available to deploy to go after $XX mm sized pressing needs or opportunities?

There are several different lenses one can look through to evaluate this decision. Another lens might be what our owners and other stakeholders might expect us to do (or not do)? While credit unions are apparently exempt from the PPP themselves, would they take the money if they were able to? I assume the answer is not binary across the industry, but it is interesting to think about in light of the decision we have to make.

Thank you in advance for your consideration and counsel on this matter.

Presenting the Right Message About Credit Unions in Today’s Crisis

The doomsayers are already at work. Commentators use the March 31 data to prove their theory that an economic Armageddon is just around the corner. The end of everything we value. Unless of course we adopt their solution: more government, reopen faster, etc.

This pandemic is a health and an economic crisis. However, the greatest danger may be a loss of confidence in the spirit of who we are. Anyone who understands what made America today and why credit unions were created, knows that we will persevere and sustain.

Avoiding Self-Fulling Prophecy

But we must be careful not to project ourselves into a self-fulfilling prophecy of demise. That occurs when short term numbers or the peak of a problem is assumed in models and presented as the “new normal.”

Persons with an agenda will use these scenarios to enhance their position, resources or reputations. This happened in the 2008-2009 crisis and we need to learn that lesson in this new one.

These kinds of forecasts are impossible to make with accuracy. For they ignore the capacity of leaders and organizations to change and create “new normals;” that is, their innovative capacity to change the core assumptions models employ.

The First Quarter Numbers: A Case in Point

The first quarter numbers for most credit unions will show declines in the traditional measures of financial performance. ROAs will fall or even be negative, loan loss reserves will go up. Growth may slow. Delinquencies will increase, but certainly not by as much as will be the case for the June 30 numbers.

So what do the numbers mean? The most important point is that credit unions are sharing the financial pain and uncertainty of their member owners. This is the basic fact that is creating these numbers.

Credit unions are stopping fees, lowering rates, offering skips pays, and many other efforts to help members transition the unanticipated immediate economic shutdown required to stop the COVID virus.

Unemployment will reach heights not seen since the Great Depression. On average over 16% of the labor force (over 30 million) lost work in just one month. Rent, auto and credit card payments will be slowed or missed.

The members don’t know what their future will be; neither does their credit union. The credit union goal is not to hit an ROA goal, but rather sustain member relationships.

A Transition in Thinking and in Financial Trends

Traditional financial performance can be a very imperfect measure for how credit unions are serving members. At this time the numbers that may be the most unusual could be those that show everything is OK using traditional measures. More relevant performance analysis should focus on how many members are being helped and in what ways. For the ultimate strength of any credit union is its members.

Today, leading credit unions are reimagining how their resources can be used for members whose financial circumstances changed outside their control. This requires patience, creativity and new ways to structure member relationships.

This crisis is more than pivoting to virtual distribution, remote delivery and zoom interviews; the most critical innovation may be in the way credit is conceived. Loan terms may be extended, rates reduced, or payments based on whatever income is available. Outstanding credit may be restructured into A and B payment “tranches” in which the subordinate B tranche is the write-down needed to keep the member in the home or auto. It is the tranche that could be forgiven if the member cannot find work at previous income levels.

Monitor, Not Forecasting

Periodic reporting of the facts is important to ensure the industry’s collective resources are sent to the areas of highest need. Some credit unions will be more threatened than others because of the circumstances of their member base or community. The NCUSIF was constructed so that capital could be used to help these firms recover.

The greatest danger is not from the crisis itself, but how we respond. In both credit unions and government, competence, expertise and leadership ability is crucial. There is no prior road map to a new normal. Those in positions of authority must act with intelligence, recognizing lessons from the past. Credit unions have never lacked resources in a crisis, What is more important is wise stewardship of these mutual resources.

A Not to Be Missed Shareholder Meeting Online

I have tried several news channels during this stay-at-home era. The news presented on CNBC, Bloomberg Radio and TV, and Yahoo Finance channels focus on business economics. The interviews are with leaders in the trenches sharing their first-hand experiences and plans. Commentators are nonpartisan, seeking multiple views of current events.

On Saturday there is the opportunity to witness a program not usually open to the public. Because of the pandemic, Berkshire Hathaway’s annual shareholder meeting will be broadcast online. Anyone can tune in unlike the traditional in-person meeting where attendees must be shareholders.

The 2020 meeting on Saturday, May 2, 2020, begins at 3:45 p.m. central time. It will be live on the Internet from Yahoo with a pre-meeting show beginning at 3:00 p.m. central time. The address: https://finance.yahoo.com/brklivestream.

Warren Buffett, Berkshire’s CEO, and Greg Abel, Berkshire’s Vice Chairman-Non-Insurance Operations, will be physically present at the meeting. In addition to the formal business agenda, they will respond to questions submitted to three journalists. The questions, submitted in advance, will be chosen by the journalists according to what they deem the most interesting and important. Mr. Buffett and Mr. Abel will have no prior knowledge of the questions, but “they will not discuss politics or specific investment holdings.”

I’m tuning in. This will be an opportunity to see the leader of one of the most successful enterprises in America reporting to his owners. There could be some useful takeaways for credit unions, many of whom are conducting their annual meetings online.

Leaders’ Voices in National Crisis

In his 1936 acceptance speech at the Democratic national convention, Franklin D Roosevelt rallied the nation in the midst of the Great Depression with these words:

To some generations much is given. Of other generations much is expected. This generation of Americans has a rendezvous with destiny.

In today’s COVID crisis, the closing thoughts of a CEO to his board:

“What an engaging time in our history – credit unions and the country. What a chance to see the world change – adjust – evolve – and then decide what to do with it all. At 61, I am as engaged in my career and business design as I have ever been, but at the same time as curious about how life in America works as I have ever been. And that is a perfect place for a cooperative business to be; vested with my community’s future and busy looking to contribute on every level.

I hope you find yourself in the same place – for now is the time for people with a community-heart to engage their brains for solving the riddles ahead.”

Taking Time for Bipartisan Laughter

President Ronald Regan, House Speaker Tip O’Neill, and Senate Majority Leader Baker and their wives are sitting together in the front row of Ford’s Theater.

The comedic juggler Michael Davis is at his deadpan best. His timing and interactions with this high-powered front row are showmanship at its finest.

The most fascinating scene clips for me are the total joy shown by the three political families sitting together. One of the reasons they were able to work together in their political roles is because they could laugh together.

So, enjoy this 9-minute excerpt of a memorable performance, both on stage and off.

Words of Wisdom During the Pandemic

- I started life with nothing and still have most of it.

- In our house we have done so much walking that the dog has lost ten pounds.

- The stay-at-home orders are going to accelerate the digital revolution in society by at least ten years.

- The reason for my hope is the re-creation of an overriding common purpose.

- “We shall not cease from exploration, and the end of all our exploring will be to arrive where we started and know the place for the first time.” – T. S. Eliot