Dayton Ohio is most commonly known as hometown for aviation pioneers and inventor-tinkerers, the Wright Brothers. The local Wright-Patterson Air Force Base was named after them.

On that base in 1932 workers at Wright Field decided to chip in 25¢ a week to help an ailing co-worker and his struggling family. It was this shoebox of money that evolved to become today’s $7.0 billion Wright-Patt Credit Union.

The credit union was planted in this southwestern community of Ohio where inventiveness, hard work and the belief that people take care of each other were long standing values.

Doug Fecher and Wright-Patt Credit Union were made for each other. He grew up in this culture and was reared on its values. His strength, life-long connections and character are rooted in places where he saw people taking care of each other in times of need.

His capabilities perfectly matched the Wright-Patt community when he became CEO in 2001 after the sudden death of his predecessor.

His career did not start with the ambition to become a CEO. After high school, he left for Chef school, thinking academia was not his forte, and where his mother had paid tuition. Changing diection, he then enrolled in the University of Cincinnati and eventually graduated while nurturing curiosity and eclectic interests that made him a lifelong learner.

He began his credit union career as a teller, a short-lived position because of the challenge in balancing out each day’s activity. He then moved on to business development and marketing before joining Wright-Patt as VP of Lending in 1995.

In each phase of life, he developed lasting friendships. At his retirement celebration he recognized grade school friends with whom he had gone scuba diving later as adults, a high school science teacher whose course he barely passed, three generations of his family as well as many professional colleagues. He named each while recounting stories of the positive experiences he gained from these relationships.

His Leadership as CEO

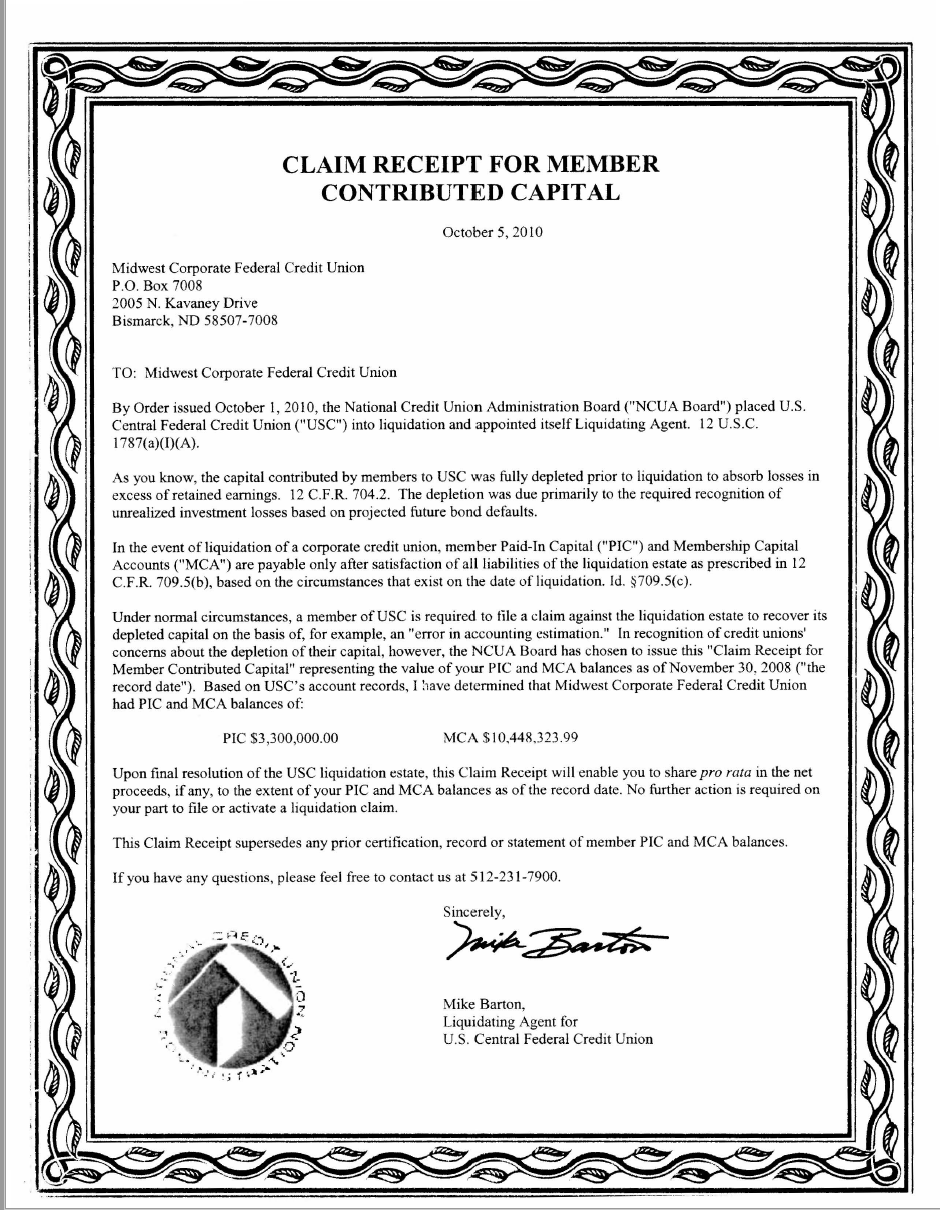

His twenty years as CEO spanned unexpected and the most consequential challenges any leader could ever confront: the attacks on 9/11 which kept the US at war for 20 years; the Great Recession of 2008/09; a decade of historically low interest rates; the national economic shutdown of March 2020 resulting in the steepest one quarter drop ever in GDP, and the on-going COVID-19 pandemic.

These were not classroom MBA case studies. They were real-time events requiring immediate actions. The responses affected every person who depended on the credit union to do the right thing for them. In each of crisis, Wright-Patt met every challenge being there for members in spontaneous and creative ways.

When severe economic downturns occurred, he stepped up lending to members for home refinancing or ownership and for car purchases. Fees were waived. The credit union reached peaks in market share as other lenders hunkered down and withdrew in the face of economic uncertainty.

How Doug navigated these times is even more remarkable than Wright-Patt’s continued financial soundness. He believed an organization’s culture, the performance of the entire staff, was what made strategy successful.

He instilled an expectation of unparalleled and consistent member service. Credit unions were founded so people can take care of each other. The model is simple: members entrust their funds to you to use for others who need financial assistance.

He took a fundamental human value and made it new every day. He designed the three-stakeholder model-the staff, the members, and the credit union-to allocate resources fairly and most productively.

His intense focus on service as the ultimate differentiator, helped him avoid shiny objects, such as mergers, bank purchases or personal notoriety, that drew in other CEOs.

Member relationships were rooted in a saying he quoted from his dad, “Son, just remember to take great care of the people around you, and they will amaze you in return by taking great care of you”.

The Standard for Success

The majority of Wright-Patt members live paycheck to paycheck. Superior service earns their trust and lifelong support. It also strengthens numerous local community institutions that serve these same 445,000 members, including auto dealers, realtors, home builders, and the many retail services and stores necessary to make communities vibrant.

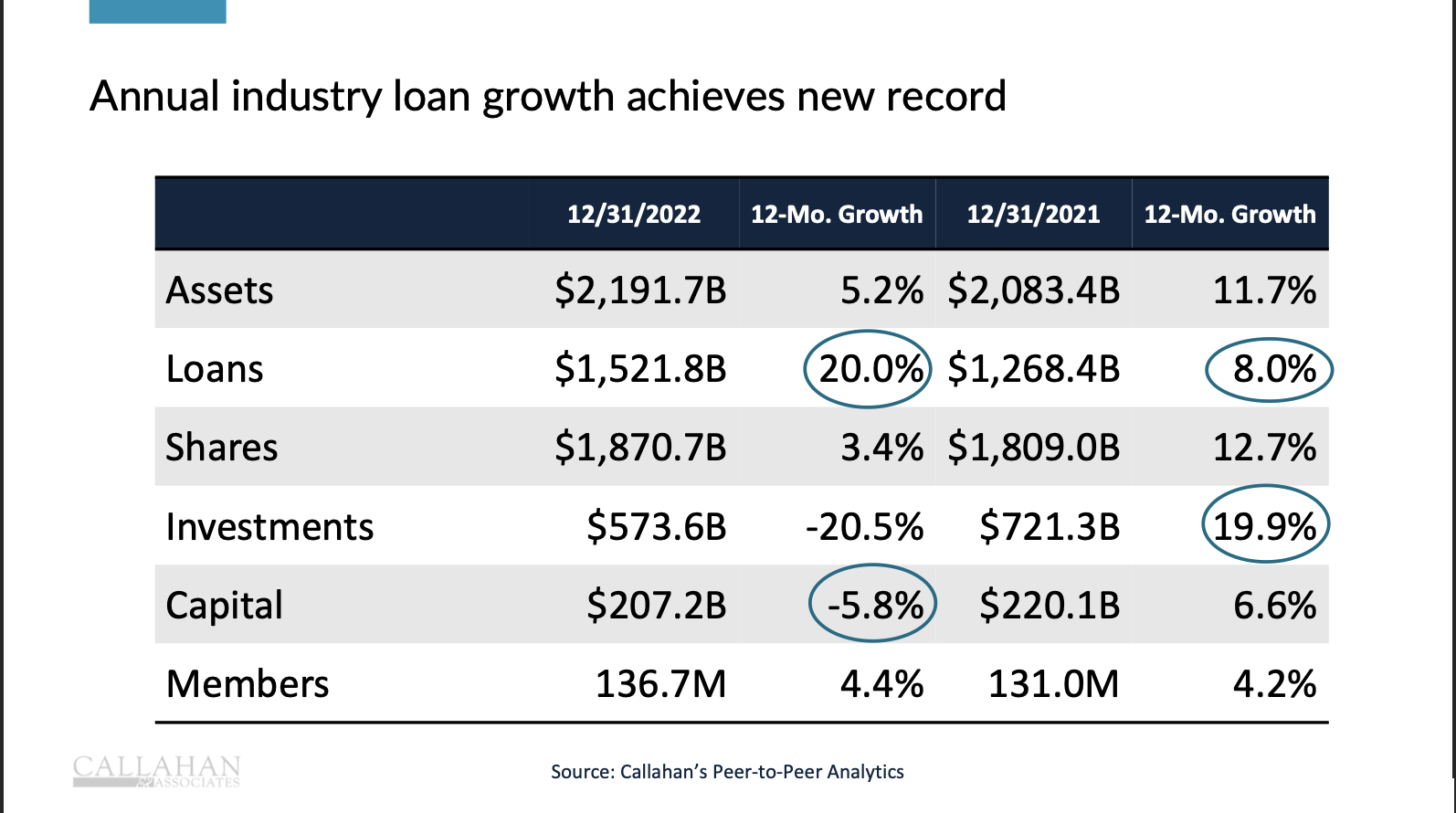

This member loyalty propelled Wright-Patt’s standing from the 95th largest credit union in 2005 to number 40 at yearend 2021. This was accomplished even though the members’ average share balance $10,044 is below the national average of $10,402.

Doug and his team never chased asset growth. Instead, their success was measured by the number of people served and community impact. Today the credit union is present in one of every three households in its Dayton home market.

His oft-stated benchmark for tracking Wright-Patt’s relevance was to ask: If Wright-Patt did not exist today, would our members rise up and create us?

Temperament Undergirds Success

Doug is a lifelong learner. Success did not come because he had a better idea than other CEOs; rather it was his skill implementing the credit union’s priorities. Instinctively he understood leadership as a skill to be mastered. In sports terminology, he would be described as a “natural.”

He is an artisan in the craft of leading others. He took a traditional value-serving others-and made it every staff member’s purpose. In his perspective, credit unions are a movement of people, not money.

At the top of each monthly Partner Update he placed these words:

“Transparency” is an important part of keeping promises. I hope this update is helpful and makes your job easier. Thank you for your interest in how WPCU is serving its stakeholders

Integrity, openness, and honesty are his operating practices. He is eloquent, using member stories he received to make his points. The tag line at the end of every Wright-Patt email summarizes the credit union’s value proposition in six words:

“Save Better. Borrow Smarter. Learn a Lot”

His eloquence is enhanced by his temperament. He never appears angry; he persuades with logic and examples, not arguments. His presence fills every occasion with humor and goodwill, qualities that bring out the best in people.

Leadership Contributions Beyond the Credit Union

Doug and his team expanded Wright-Patt’s role throughout the credit union system. He organized, joined or founded numerous CUSO’s including myCUmortgage, CUFSLP, Credit Union Student Choice, Cooperative Business Services, CUSO Financial Services and many more.

He used the financial strength of the credit union to develop a short-term loan option that saved consumers hundreds of dollars in fees charged by payday lenders. This model was eventually adopted by over 100 credit unions sharing in a common loss reserve.

He and his team actively participate in state, national and CUNA leadership responsibilities.

He is a trustee on the Board of Wright State University which enrolls over 11,500 students. As Chairman he helped shepherd the university through the most important decision a board undertakes: a presidential leadership selection and transition.

I asked him to join the board of Callahan’s after the Great Recession, anticipating an upcoming CEO succession. Being a volunteer director in a group of peers is a very different role than the person of final resort as CEO. Developing consensus with other volunteers can, at times, be hard work.

His commitment was unwavering. His wise, perceptive counsel made our whole organization more aware of how credit unions approached their role with members, in the community and with each other.

A Self-Initiated Transition

Doug enjoys many other personal activities such as biking, skiing, motorcycles, playing in a rock group, scuba diving. He undertakes these “hobbies” for fun and as open-ended learning opportunities.

He left his CEO position at the top of his game, following the most successful year ever in the credit union, as measured by returns to the three stakeholders. A courageous choice by someone who sees life full of bountiful possibilities.

His parting was a straight forward announcement in response to my email:

From: Doug Fecher <dfecher@wpcu.coop>

“Thanks for your email. I am out of the office and will not be returning as I am retiring from WPCU after 26 years of service. I will miss this job and the people I’ve been honored to work with and am looking forward to the next chapter in my life.

A successor has been named – please welcome Tim Mislansky as the next President/CEO of Wright-Patt Credit Union. He begins his new role on Monday, January 3rd.”

Doug never forgot where he came from or the people whom he knew along the way—a person of conviction who gave hope and a way forward for others.

He ended a recent conversation with a student interviewing him for her paper on leadership with the offer: “Thanks for connecting with me – please keep my number and if there is any way I could help in the future, please call.”

Talent does an old thing well. Genius makes an old thing new. Doug did both.