Today is the one-year anniversary of an attempt to overturn the 2020 presidential election by mounting a physical assault on Congress’ certification of the electoral college vote.

There have been and will continue to be newly researched and passionate reporting about the day’s riot and events before and after.

One well-reasoned analysis is a short essay entitled A Day of Infamy, a year later.

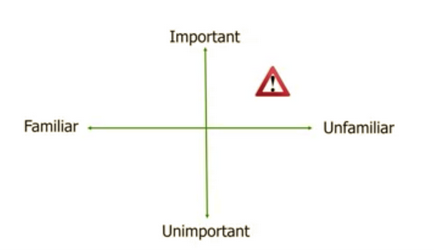

I agree with this viewpoint but want to suggest another lesson. Does a latent January 6th gene potentially exist in anyone in authority? Or are required formal processes and structural checks and balances sufficient to inhibit such leadership temptations?

Everyone Experiences Authority

The crime of Trump and his followers was an attempted coup to overturn legal and fiduciary norms of governance and accountable behavior.

Most Americans have or will occupy positions of authority by election, selection or demonstrated merit. For example, most households have a dominate wage earner; sports teams-a chosen captain; each church or non-profit–volunteer boards; and coops led by elected directors.

Every public employee, whether by employment or election serves a constituency to which they should be responsible.

Positions of public authority can bring out the best or sometimes, the worst in people.

Bucky Sebastian and Ed Callahan’s decades long relationship showed the vital role of a leader with the right complementary partner. Ed was an educator, football coach, administrator and powerful motivator–a person skilled in the arts of leadership.

One of Bucky’s important adjunct roles was to be Ed’s “counter-ego,” able to challenge his too emotional reactions to people or situations. When Ed was tempted to counter someone using direct authority (as a football coach might call out), Bucky would confront him urging he should change his approach versus blaming the other.

Every leader needs a Bucky-like figure when inclined to follow their autocratic instincts in exercising power.

Many adults will achieve authority in an organization through personal ambition and effort, whether that role is paid or volunteer. Once achieved, there is a natural belief in the correctness of one’s judgments whether based on vision, factual analysis or using the rationale-that’s why I was chosen (or elected).

The Unique Role of Public Servants

This is especially true in governmental employment. Trump’s authoritarian excesses and public delusions are consequential because of the ultimate power and responsibility of the Presidency. Many believe he subverted the very premise of American democracy with his lies about the 2020 election outcome.

He ignored traditional formal processes. There were no longer guardrails the public could rely upon.

Whether elected, appointed or selected through competence, public responsibility is always paired with assumed and/or explicit authority.

From parking enforcement, collecting taxes to setting rules and overseeing them, public roles are different in character from private employment. There is an implied common duty, but often accountability is diffused or lacking.

Regulators of Cooperatives

I believe the Jan. 6th gene is ever-present, latent much of the time, but always ready to be activated in regulatory actions.

The symptoms include unilateral policy diktats, dismissal of inconvenient facts, neglect of administrative oversight, lack of transparency, and most critically, an unwillingness to work mutually with the credit union system.

This authoritarian impulse is most easily seen when those new to the organization first experience the culture. Mark McWatters joined the NCUA Board in August 2014. He described Chairman Debra Matz’s leadership of NCUA during in a public speech several months later:

“NCUA should not treat members of the credit union community as Victorian era children—speak when you’re spoken to and otherwise mind your manners and go off with your nanny—but should, instead, renounce its imperious ‘my-way-or–the-highway’ approach and actively solicit input from the community on NCUA’s budget and the budgetary process. With the strong visceral response within the agency against budget hearings, it seems that some expect masses of credit union community members to charge the NCUA ramparts with pitchforks and flaming torches to free themselves from regulatory serfdom. I, conversely, welcome all comments and criticism from the community.

Regulatory wisdom is not metaphysically bestowed upon an NCUA board member once the gavel falls on his or her Senate confirmation.

NCUA should not, accordingly, pretend that it’s a modern day Oracle of Delphi where all insight of the credit union community begins once you enter the doors at 1775 Duke Street in Alexandria, Virginia.” (source: CU Today May 19, 2015)

McWatters is a very conscientious individual, courteous in manner with a rational temperament. He approached decisions using detailed legal and logical analysis. His reaction to Matz’s autocratic style only corroborated what credit unions had experienced for years, since the Great Recession and unilateral liquidation of corporates.

The irony is that when McWatters became chairman in January 2016, the agency’s “Stockholm syndrome” effect had overcome this initial misgivings. In 2017 he merged the TCCUSF surplus into the NCUSIF to pay for natural person credit union losses, despite explicit congressional wording against this. When explaining the action, he also admitted circumventing the FCU Act’s limits on premiums.

My immediate concern is that Chairman Harper, who was Matz’s Senior Policy Advisor and protege, also embraces her view of leadership. He has shown by temperament, in board meeting exchanges, and prior actions as senior advisor, that he is not a person who should be leading the cooperative regulatory agency.

His primary justification for policy is because that is how the FDIC functions. I have described these positions with his own words in several articles.

At a time when credit unions are transforming their roles with members due to Covid, Harper’s top priority imposed the hoariest and least relevant of all rules, a 28% immediate increase in minimum capital requirements. Unlike McWatters when confronting the same issue, the current board members blinked and approved this regulatory tax on members and their credit unions.

The Jan 6th Gene and Credit Union Democracy

NCUA’s performance matters because it regulates one of the unique features of cooperatives—the industry’s democratic, member-owner governance.

The concept that credit unions are democratically governed is misleading. Few boards are elected today; most continue through reappointment and renominations when terms expire. Members’ involvement is not sought or encouraged. The idea of a contested election with more nominations than open seats is scary for incumbent directors.

Members are routinely requested by CEO’s and managers to give up their charter via merger for a rhetorically better credit union that members do not know and have no part in choosing. These same “votes” frequently approve significant monetary handouts to departing senior staff who arranged these sales. In one case over $35 million of self-funding was set up by a former CEO who continues working at the merged institution.

Even the hint of an external director nomination by petition can cause a credit union to change its bylaws to prevent such an occurrence. Pentagon FCU did this immediately after a successful at large nomination.

Credit unions in these actions are following the unilateral leadership style they see at NCUA.

Democratic Practice in National and Local Arenas

Leadership responsibility does entail authority and explicit processes to function. How that authority is implemented is fundamental to the sustainability of the enterprise. Whether that is the American democratic political experiment, or a cooperative charter founded generations ago.

The fate of America may feel bigger than any one individual can influence. But democratic norms and duty are not limited to the Congressional and Presidential elections. It is a skill each can hone whenever we participate in an organization’s governance or membership

The first place to ensure democracy remains meaningful is in the arena s of our participations, no matter how great or how small the organization.

As I consider the January 6th assessments, my hope is that anyone who might carry a gene of this kind, will keep it dormant by exercising democratic efforts in those local and national arenas we care about.