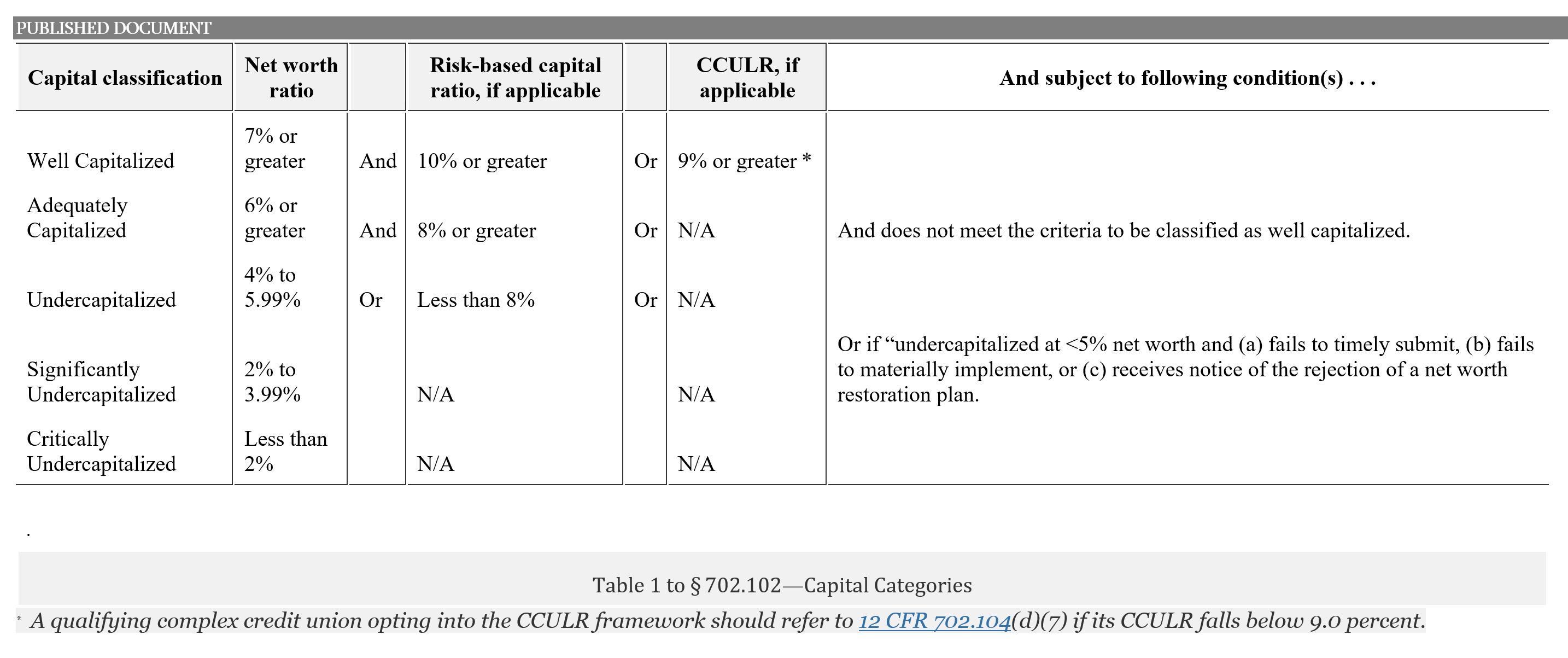

The direct immediate impact of the new CCULR/RBC rule requires credit unions to hold between $30 to $40 billion more in reserves. These funds cannot be used for daily operations such as expenses to increase member value or lower fee income or loan rates.

A major portion of these newly restricted funds is in credit unions that follow the 9% CCULR minimum required reserves versus the RBC option. The $24.3 billion CCULR “off ramp” means these funds are unavailable for operations but required to stay in reserves.

This is from the December 16, 2021 Board Action Memo:

Of the total 680 complex credit unions as of June 30, 2021, 473 have a net worth ratio greater than nine percent and would be well capitalized under a nine percent CCULR standard. Of those 473 credit unions, the Board estimates that all of them meet the qualifying criteria, and are thus eligible to opt into the CCULR framework.

Under the CCULR, if all 473 credit unions opted into the CCULR and held the minimum nine percent net worth ratio required to be well capitalized, the total minimum net worth required is estimated at $111.8 billion, an increased capital requirement of $24.3 billion over the minimum required under the 2015 Final Rule. This additional capital would strengthen the system’s ability to absorb any future financial losses and economic shocks.

(Note: the 493 credit unions over $500 million and 9% net worth or greater, held $1.340 trillion in assets at yearend 2021. Therefore, when NCUA raised their net worth well capitalized requirement from 7 to 9%, the rule placed a total of $26.8 billion in restricted retained earnings. These extra funds are no longer available for credit unions to use as they choose-or else lose their CCULR option.)

The Disruptive Spread of the New Red Line

The new rule in theory applies only to the 83% of credit union assets with over $500 million. However, this 29% higher CCULR option will not be available to approximately 210 credit unions with $386 billion in assets. Before this rule they were considered “well capitalized.” And only three of the 210 would have been below the 7% well capitalized level.

All now fail the revised “well capitalized” ratio. The immediate regulatory sanction is to subject them to RBC, an entirely different more complicated process under the never implemented rule.

All these, 24% by assets (30% by number), of this $500 million class are in an RBC never-never land of capital measurement. However the immediate impact is much broader than these 210 below the new 9% red line.

RBC’s Shadow Extends Beyond 9%

Every credit union over the 9% threshold is now on notice that any short term run-up in assets could result in their ratio falling below this new minimum.

As an example, there were 70 credit unions between 9 and 9.35% net worth at yearend. Any time their asset growth exceeds the capital growth, the ratio will fall.

Historically, the highest amount of share growth occurs in the first two quarters. If a credit union has 9.3% at the beginning of a month and grows 3% in assets, the net worth ratio falls to 9.0% by month end.

Since capital increases only through retained earnings, at an average of 1% of assets per year, every credit union between 9 and 10% faces a dilemma: either limit growth or increase ROA by amounts above traditional returns.

There are 173 credit unions in the 9-10% net worth range that will be in a state of unending compliance uncertainty as their ratio moves up and down in monthly variations.

CCULR’s Shadow Hovers Over Those Below $500 Million

Many credit unions below $500 million must now closely monitor their growth and capital because when they cross this size threshold, the old 7% well capitalized rating no longer applies.

An example: At 2021 yearend there were 119 credit unions in the $400-500 million asset segment. They managed $52.7 billion in assets. Forty-five of these, with $20 billion in assets, reported net worth below 9% and would not be CCULR eligible when passing $500 million.

Assuming this entire segment grows by the industry’s long-term average of 7%, then 13 credit unions with $465 million assets (or higher) at January 1 this year will be over the $500 million threshold by yearend. They must monitor and calculate three capital measures simultaneously: the current 7%, the new 9% CCULR minimum, and failing that, the arcane rabbit hole of RBC.

An estimate of the total number of these three groups of credit unions that must immediately put net worth at the top of their business priorities is over 502, holding approximately 35 to40% of total industry assets.

This sudden new financial priority will turn upside down established business plans, pricing initiatives, and investments in new service capabilities.

Credit unions are being forced to turn away from serving their members to complying with NCUA’s needs.

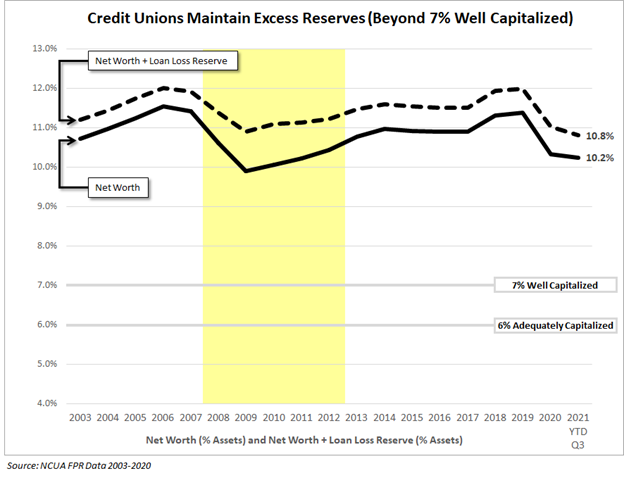

To this point in time, the industry’s average 2021 yearend capital ratio of 10.6% would be evidence of prudent capital management. That ratio is 360 basis points (3.6%) above the long standing well capitalized 7% benchmark. (see buffering discussion below) Financial uncertainty now permeates every business decision where there was none before.

The Tens of Billions Taken Away from Member Value

It is the members who will pay the cost.

To comply with this new capital standard, credit unions have two broad options. First, closely limit all growth. NCUA’s habitual approach to capital restoration plans is to require “downsizing” of assets to fit the available capital.

The second option is to ask members to pay more: no more over draft or other fee reductions, higher loan rates, or accept lower savings than would be the possible under the long standing 7% standard.

If the choice is downsizing, fewer members will be served with fewer loans and services. If the choice is to require members to pay more, the direct additional costs are easy to calculate.

The 210 credit unions not in compliance with the 9% CCULR minimum, are collectively $2.7 billion short of capital under the new standard. That shortfall assumes no growth in assets. Before the 7% benchmark was eliminated, these credit unions collectively maintained a margin of 1.31% above that old standard.

For these 210 with the $2.7 billion shortfall, setting a net worth goal just 1% above the 9%, would require another $3.9 billion. This $6.6 billion total for more capital just repositions them relative to where they were under the old standard.

How easy is this to accomplish? In 2021 the entire movement grew total capital by 6.7% to $221 billion. The $6.6 billion more to exempt these 210 credit unions from RBC requires an increase of 21% in their current net worth. This is roughly three times the growth rate of capital in the industry. And that assumes these 210 have no asset growth while they are building this new capital level.

Total Business and Financial Disruption Costing Members Tens of Billions

The other 292 credit unions above $500 million in the 9-10% net worth range, and the 119 credit unions in the $400-$500 million below the new red line, will face similar challenges to their business model. For example, in the $400 million plus segment, 45 are below 9% now by a total of amount of $195 million.

All these 502 credit unions face the same urgency of modifying previously approved business plans. Now they must either limit growth or charge members more. Either choice is done at the members’ expense.

Before this apocalyptic rule took effect, at yearend 2021 only six credit unions in the $400 million and above category were below the 7% well capitalized standard. And five were considered “adequately capitalized.”

By changing the rules of the game overnight, NCUA has created a perception of financial weakness. At the same time the regulator has prevented credit unions from using literally tens of billions in existing reserves in the manner boards think best to compete in the market. These funds were prudently set aside for the proverbial rainy day. But now are restricted from use.

The cooperative system has been called to a financial halt by NCUA. It reputation has been turned upside down in member and public perception in a mistaken effort to make credit unions appear safer.

The outcome will be just the opposite. The rule’s complexity and RBC uncertainty will just cause more sound, long serving credit unions to throw in the towel.

Capital is not and has never been the critical component of credit union success. It is the resilience of leaders. It was the founders’ passion that began these enterprises with no capital.

This newly imposed costly regulatory burden will lead current volunteers and professionals to feel they can no longer make the critical business decisions about how to best serve their members.

The government-NCUA-has now asserted by rule, that they know more than credit union’s leaders about how to manage business decisions.

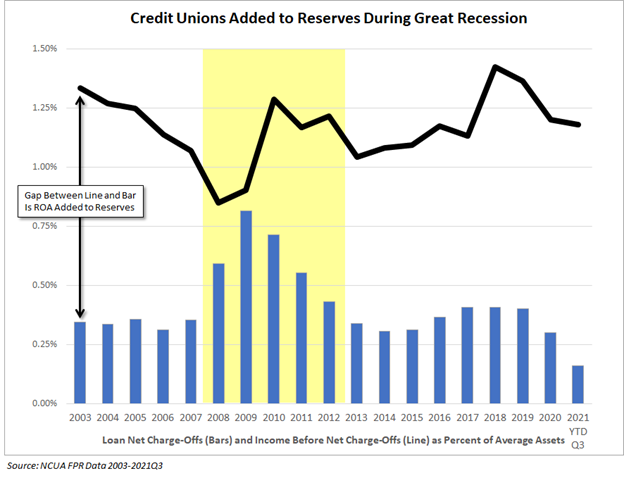

Appendix: The Buffering Mentality Will Raise the Member Costs Further

The $30-40 billion cost estimate in new capital requirements does not include the credit unions “normal” buffering behavior. Here is how Vice Chairman Hauptman raised the issue at the December board meeting.

Kyle S Hauptman: And we do know that . . .they keep a buffer of 3% right now, a little over 3%. Do you have any reason to believe they will not continue to keep a buffer of around 3% in the future?

Tom Fay(staff): I don’t think I could estimate that, Vice Chair.

Kyle S Hauptman: Okay, well, we can agree they do, now, have a ratio. All I’m trying to say is, when we say oh, no, this isn’t going to affect somebody because most of them, you know, if you already have 9.5%, you’re in the clear, but we already know that they like to have a buffer.

So, I think we just need to acknowledge that based on the way the credit unions operate, that being just above 9% does not mean you’re in the clear to meet our 9% CCULR because we know that they want to have a buffer for the reasons you just eloquently said. . .

. . we shouldn’t be doing this without acknowledging that we are making credit unions hold substantially more capital because they’re going to have a buffer.

You think it’s good to have a buffer; so do I. We are raising the standards for credit unions. I just think we need to be clear about that. We shouldn’t be disingenuous to say, oh, no, look how many of them have over 9%. They should be fine with CCULR.

Well, we already know they have a buffer, so there’s no reason to think the operations of the credit unions will suddenly change; and we are raising capital for the vast majority of these because they will have — that number of 10.2%, at least for those subject to RBC and CCULR. I’m happy to bet you that that number will go up because of what we are doing today.