Yesterday (August 29) a press release from the North Dakota Credit Union League described NCUA’s turning a deaf ear to their request for their credit union members’ $10 million pro rata share of US Central’s AME surplus.

The final total may actually exceed $12.7 million based on NCUA’s March 2022 AME projected US Central distributions.

The NCUA’s Claim receipt states: Upon final liquidation of the USC liquidation estate, this claim receipt will enable you to share in the net proceeds, if any, to the extent of your PIC and MCA balances as of the record date. No further action is required on your part to file or activate a liquidation claim.

The Dakota League’s title says it all: Time for NCUA to Do the Right Thing. Its release points out Iowa credit unions are in the same situation. One might also ask how are all the corporate member shares of credit unions who were merged before AME payouts began being distributed? (example, Constitution Corporate)

Moreover, all credit unions are still waiting for an update on the remaining $451 million of the reported $846 AME surpluses as of March 31, 2022.

These are just the most recent examples in which NCUA seems indifferent to its responsibilities to put credit unions and their members’ interests first. This “me-first” approach is not lost on credit unions’ own activities.

Members’ Best Interests No Longer?

Lacking a cooperative policy framework, NCUA claims it is powerless when obvious conflicts of interest and direct subordination of fiduciary responsibilities by boards occur. The members’ best interests becomes a forgotten standard.

For example, consultants overtly market “change of control” clauses for CEO’ contracts, a perverse interpretation of its real intent since coop CEO’s are the ones who initiate their own mergers. The most recent example is a $750,000 payment in the merger of Global Credit Union. CEO contracts are a board responsibility.

A CEO and chair transferred $10 million of member equity to a private foundation they alone created upon merging. The foundation is to be financed by another $2.5 million from the ongoing credit union-a clear conflict of interest. NCUA routinely approved this diversion of members’ equity to private party’s control.

Without a cooperative policy framework, the NCUA’s only test of a credit union’s sustainability is financial. This is the “safety and soundness” mantra.

That standard is similar to saying that a person’s character and contribution is measured solely by their wealth. That is the value-agnostic success criteria that animates much of the capitalist system.

This policy vacuum undermines the unique advantages of the cooperative model and its long term safety and soundness. Members become customers with profitability profiles. A credit union’s resilience is nothing more than a quarterly tracking of net worth trends.

Soundness requires continual investments in members’ best interest, not merely fulfilling management’s personal ambitions. A regulatory framework for cooperatives should be a collaborative effort. It is not an NCUA internal task responsibility alone, like a budget, to be put out for comment.

Policy would address current operational issues that threaten the system’s character and integrity. It will entail provocative conservations about current topics such as:

- mergers of sound credit unions

- the regulatory hurdles and lack of new charters

- the suppression of members’ ability to vote for directors

- the absence of member transparency on consequential decisions such as buying banks or adding ten-year debt/capital notes

- reducing real regulatory burdens and enhancing NCUA transparency

- the roles of CLF and NCUSIF-distinctly cooperative institutions reliant on credit union funding.

- Increasing required disclosures for all credit unions including salaries for all federal credit union’s senior executives as is now required for state charters.

One outcome might even be a cooperative scorecard which would assess each credit union’s use of their charter’s unique abilities.

Not Perfection, but Setting Directions

A policy framework does not mean all the resulting regulatory judgments or approvals will be uniform. A regulatory framework should encourage better decisions supported by objective data as well as the cooperative and legal documented processes of fiduciary oversight and care. Conflicts of interest should be called out.

Experience suggests policy outcomes may be like the biblical parable of “weeds and wheat” grown together. That’s a risk but less so than the “anything goes” practices today.

Credit unions are and always will be a combination of good intentions and variable performance. They are run by human beings. Not all choices will be perfect. This mixed bag is the reality of freedom.

Both credit union leaders and regulators make mistakes. It is acknowledging when that happens. Then learning from the event, not defending the errors.

This mixed reality doesn’t mean regulators and credit unions can avoid the diligence and accountability that should characterize credit union decisions. It’s not okay for self-interest to be the dominant standard for an action.

All are free to make mistakes and sometimes fail, but that does not mean there are no standards to be followed.

Cooperative assessments are important for another reason. Credit unions, unlike their competitors, are not subject to the market’s daily judgments of management’s actions. Coops lack bank’s external check and balance on institutional performance whether through daily stock price fluctuations or the oversight of private ownership interests.

If cooperative standards are not part of the movement’s culture, then credit unions will tend to become just another financial option increasingly indistinct in a crowded marketplace. This will lead Congress to ask why this system should retain the tax exemption that would appear to be their only defining advantage.

The cooperative framework should enhance the never-ending task of credit unions becoming better cooperatives. Nobody is perfect. But reducing regulatory oversight to a standard that says 7% versus 14% net worth is better at meeting members’ needs is shallow and unhelpful.

Developing a Cooperative Policy Framework

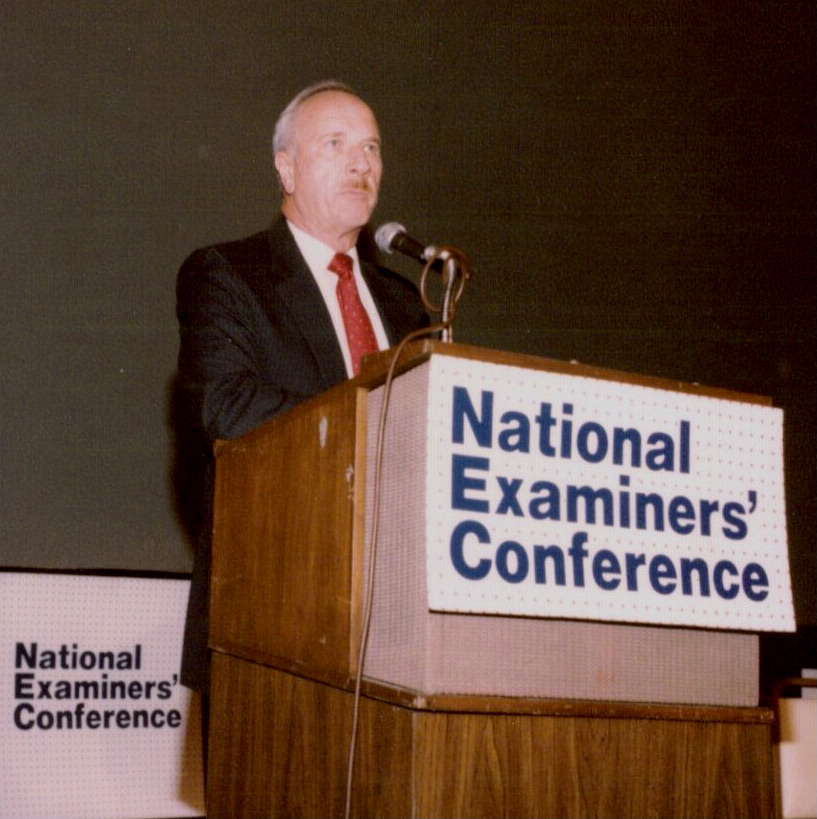

In 1984 the credit union system redesigned its share insurance fund following 18 months of study, comment, and public dialogue about future options. The recommended changes then required congressional approval.

This success was the product of extensive collaboration and interaction at every level of the credit union system. This effort was described in this brief introduction of NCUA’s implementation video by then chairman, Ed Callahan:

(https://www.youtube.com/watch?v=YjD0y6WRzOo)

A cooperative policy process should be collaborative, transparent and yes, controversial. It should be democratic, public and seek consensus on shared interests. Policy must encourage credit unions as communities of possibilities, not conformity.

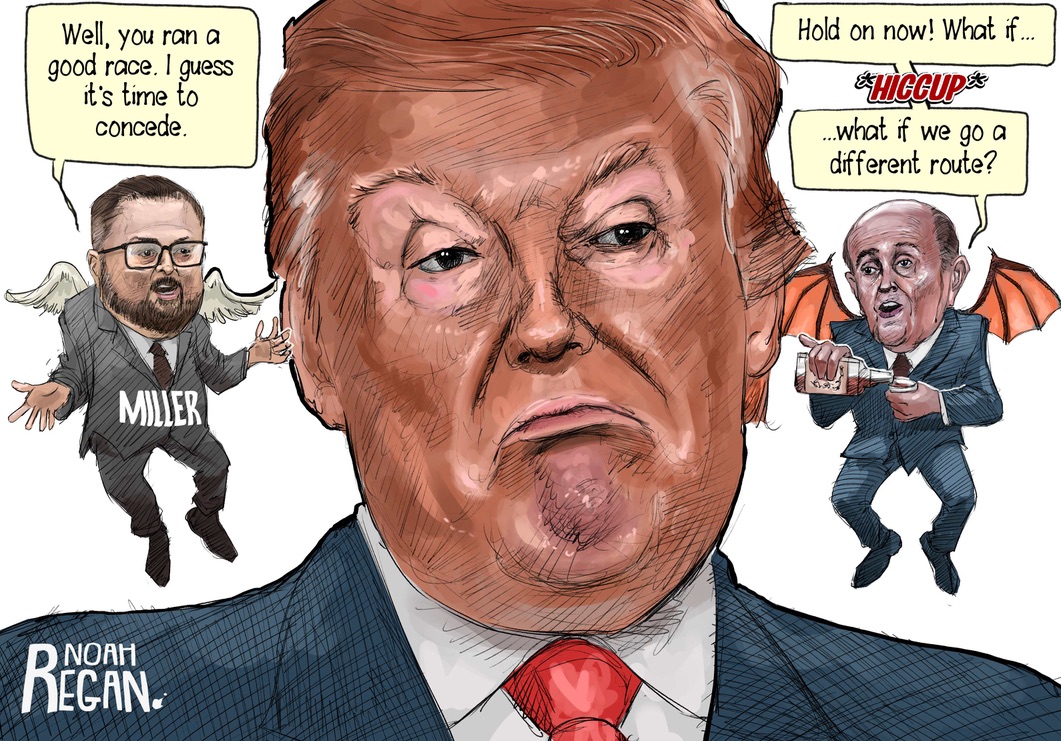

An Alternative Path?

Without this policy framework, continuing examples of a “race to the bottom” business practices may put all credit unions on a path similar to the S&L industry with no turning back.

That does not mean credit unions (taxed or not) will disappear. But it does suggest their separate regulatory apparatus will be absorbed by the FDIC, OCC and the FED. This is where the 602 institutions and $1.5 trillion savings industry is now regulated.

Why have a separate NCUA cooperative regulatory system if all it does is mimic the banking model?

Chip,

I’ve been waiting for people smarter than me to comment… I know they’re out there!

My observation is that if you do the Seven Cooperative Principles right, DEI feels like it’s already built in. Raising DEI as an Eighth Principle seems like we need a collective kick in the butt for not getting the first seven properly implemented!

Far from dismissing the idea, I see this as a challenge we need to take on. If anyone, either within the movement, or on the outside, isn’t feeling it, then it MUST be raised up – but not as a revolutionary new principle for us to debate, but as an EVOLUTIONARY opportunity to fix what’s already in place.

Too many people are feeling disenfranchised these days, and the view from my soapbox is that credit unions specifically, and cooperatives generally, are the best way to restore power back in the hands of the people.

By all means, credit unions should raise the DEI issue – not as a “checklist” item – “here’s our position in response to this issue” – but as a challenge to their own leadership, their staff, their members, and their communities, to GET INVOLVED.

Our grounding principles are solid. If we erred in the how we built on them, we need that diversity and inclusivity to drive our evolution.

P.S. I recommend the writings of Ray Dalio (don’t settle for watching him on the financial channels; really dig in to his 3 “Principles” books). I’m also a fan of Israeli historian Yuval Harari (3 books), as well as French economist Thomas Piketty for his work on participative socialism, and Thomas Hobbes for his ideas on the social contract… he was too late to save the heads Charles I, or Cromwell, but Charles II learned a few things.

We seem to have lost that social contract, and have allowed a much larger Leviathan to form.

Leo, may I recommend a book to you – “Jesus and the Disinherited” by Howard Thurman. It’s a short read and don’t be put off by the title if you’re not religious. If you’re black you should read it, if you’re white you must.

But, it is far more than just another sermon about race relations in the U.S. It is about the often dehumanizing psychology underlying any relationship between those with power and those without – an “unbalanced” equation which, in the economic world, credit unions were created to address.

So many of our cooperative leaders seem to have loss sight of that original thought, that original principle. A financial cooperative with a social purpose is not a bank, nor should it be. Without a social purpose….?

“Life is not the way it should be, it is the way it is”… with our task growing larger daily, perhaps we shouldn’t rest on our laurels – nor our principles.

Hope you will take a look at what Howard Thurman has to say about all of us, including you and me…and credit unions.