Organizations succeed by what they accomplish externally for their owners, not because of superior internal cultures or unique strategies.

As Peter Drucker, management consultant, educator and author, stated, “all results are on the outside,” meaning that the true measure of an organization’s success lies in the outcomes it achieves externally with its customers. In credit unions these are the owners.

Berkshire’s Annual Meeting Celebration

Warren Buffett, the founder of Berkshire Hathaway, has overseen a 28% increase in the stock (BRK B) price over the past year. However, whatever the company’s return to shareholders, there is a weekend celebration inviting all owners to Omaha to hear from the founder directly.

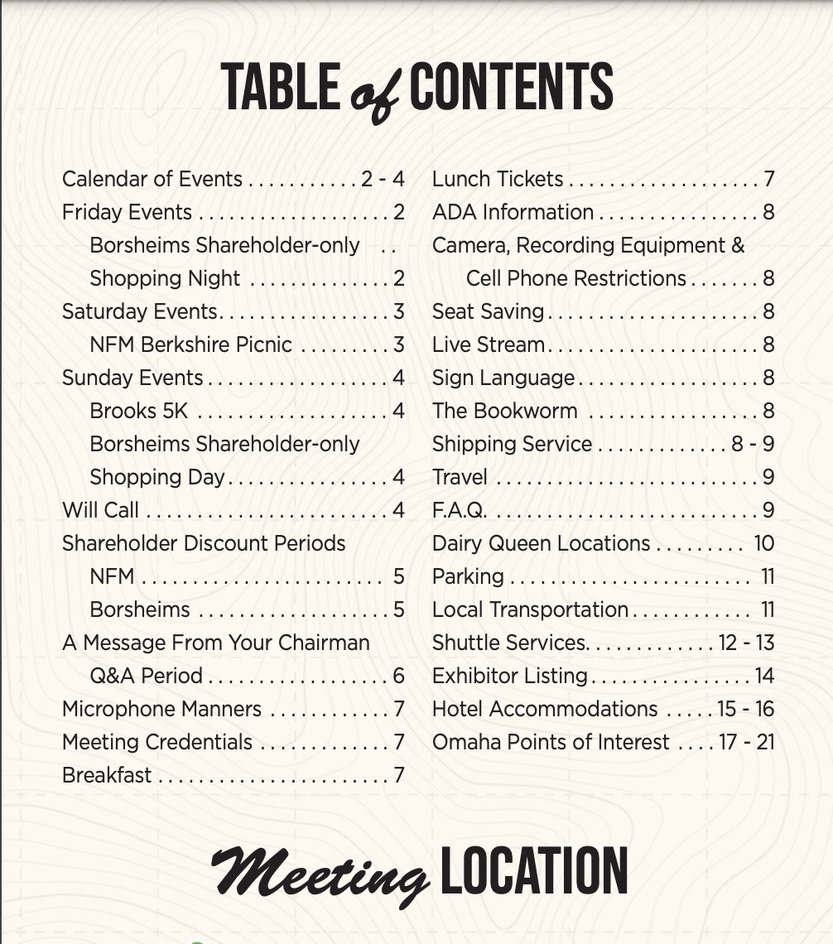

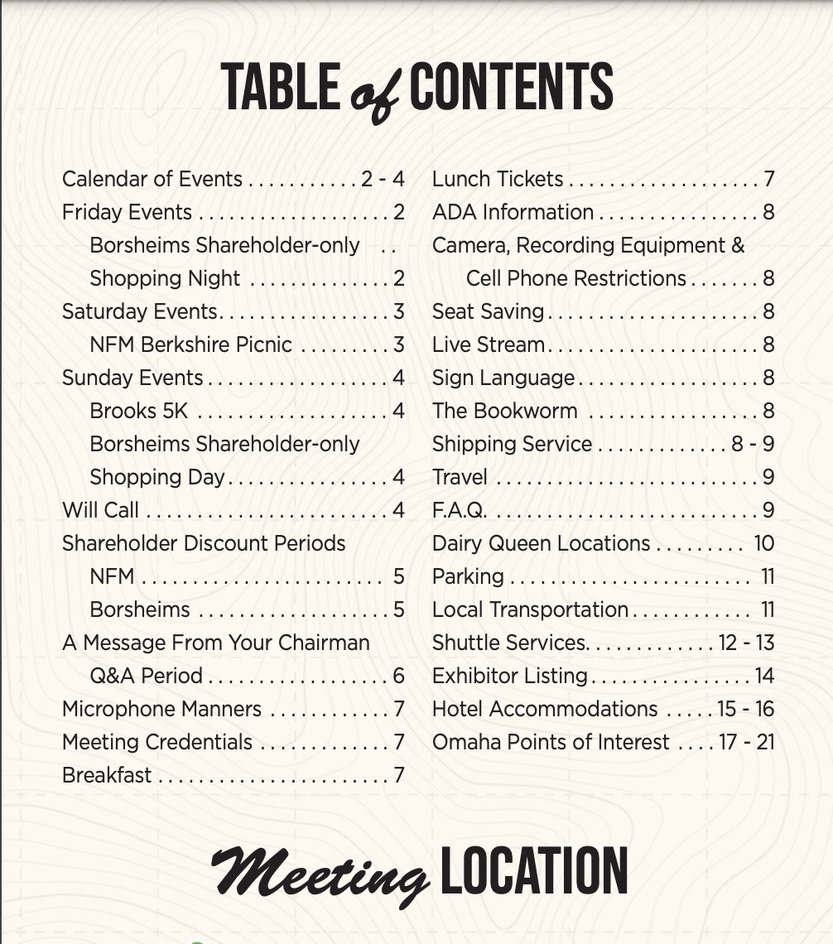

The event is much like a credit union conference complete with an exhibit hall full of Berkshire- owned vendors. Here is this year’s Guide to the festivities:

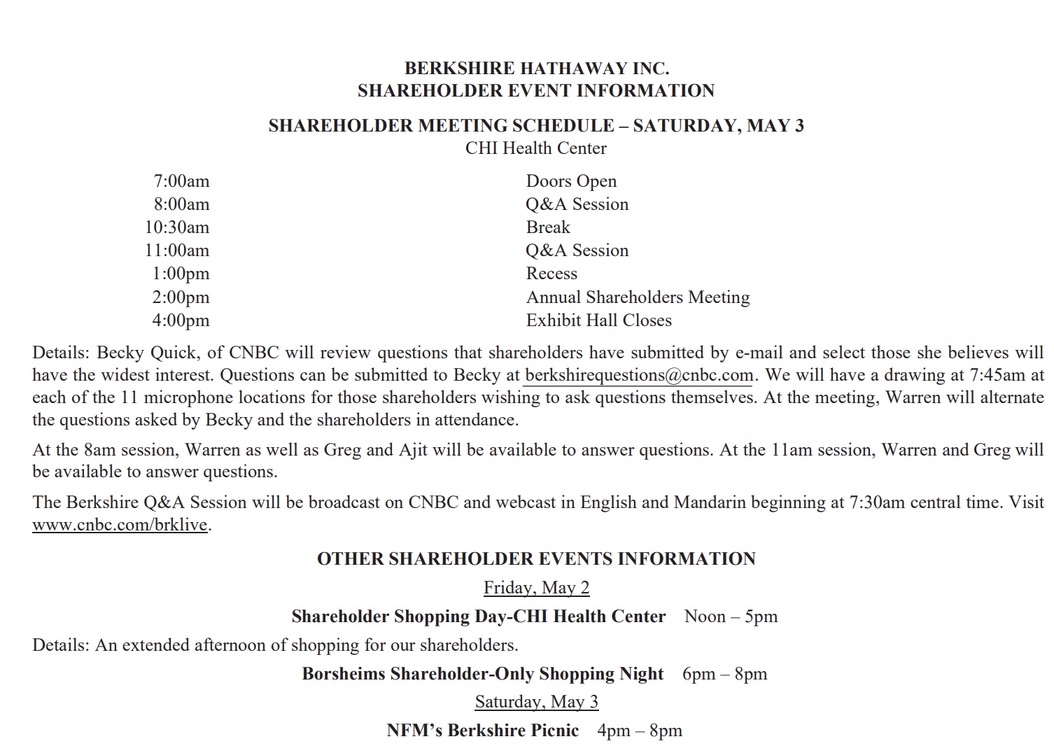

The 27-page guide includes an invite to a 5K race, the location of all Dairy Queen restaurants in the area, plus numerous other sites and information for navigating the three days of events:

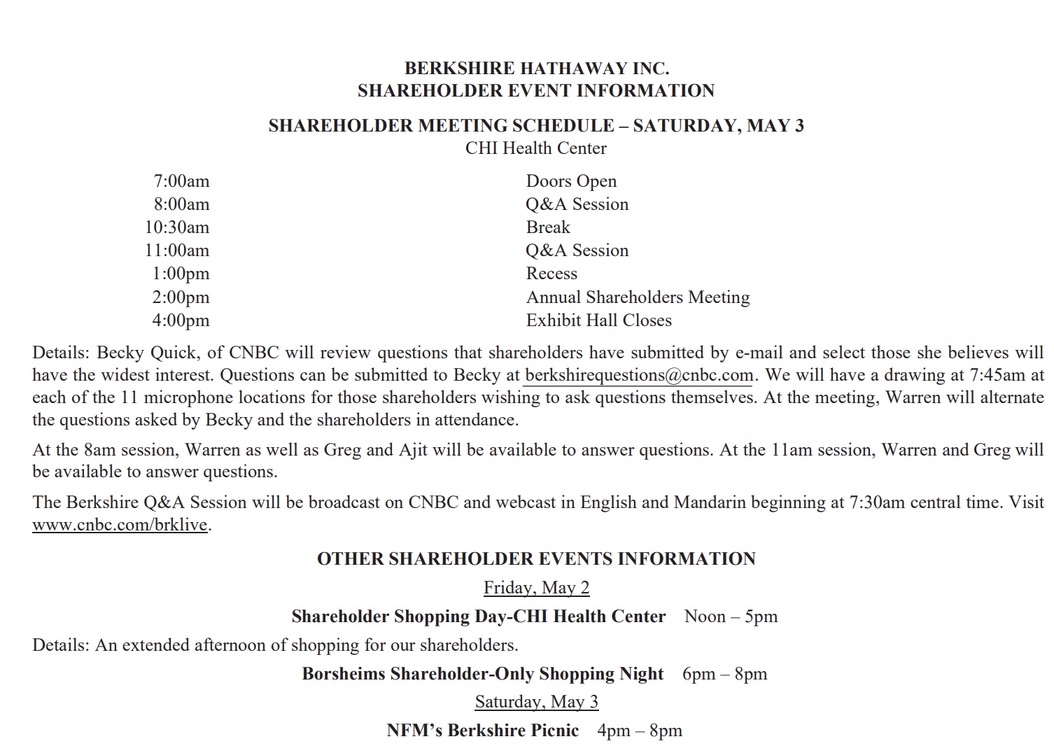

The formal annual meeting in the CHI Convention Center is the main event on Saturday. It begins with four hours of open Q & A questions from the live audience and from viewers on CNBC’s live broadcast. Buffett, and maybe one or two of his senior staff, will respond to all queries.

The formal meeting with votes on motions starts at 1:00 PM. But the owners have their say first.

This meeting is a demonstration of Berkshire’s commitment to put its owners’ interests first. It is a long standing tradition with shareholders attending year after year. It is a capitalist feast of business successes and company good will that creates long lasting relationships with the company’s individual shareholders.

Can member-owned credit unions find a better example of trust, leadership and pride in our movement? What if Navy FCU or SECU decided to celebrate their success in a similar manner with workshops on personal finance, examples of member owner businesses and a meeting where members had their say?

Such an occasion would be noteworthy for the institution, but more importantly, it would be an example of the cooperative movement having its “Woodstock Moment.”

Giving Member-Owners Choice

A second example that credit unions can learn from is a recent innovation from the Vanguard mutual fund family.

Vanguard is a pioneer in low cost, index fund investing. Warren Buffett’s advice to young investors singles out Vanguard’s approach as the easiest and most likely successful way to financial wealth accumulation for every day folks.

A second unique feature of the firm is that the company that manages the funds is owned by each of the individual funds. In other words it is a mutual coop, not a public or privately owned investment company like T. Rowe Price or Fidelity.

It has recently offered a unique way for individuals who own their funds to directly exercise their proxy voting preferences in the companies in which their fund’s invest. This is a description of Vanguard’s new “Voting Choice for Member Owned Stocks.”

” It provides a way for you to participate in the proxy voting process by choosing a proxy voting policy that will help direct how your shares in select Vanguard equity index funds are voted on shareholder matters at the companies held in those funds.

Public companies hold shareholder meetings where key issues—such as electing the board of directors and executive pay—are presented to a shareholder vote. Proxy voting enables shareholders to cast their votes without attending a specific company’s meeting.

Investor Choice currently offers five policy options that reflect a broad range of approaches to proxy voting that you may choose to apply to your participating Vanguard equity index funds.”

One example would be Company Board-aligned Policy.

At the end of 2024, Vanguard had $10.4 trillion under management of which 82% were in index funds.

Vanguard serves over 50 million clients globally. What kind of technology support must have been developed to allow an individual investor to cast their tiny share of a company’s voting proxy in line with each investor’s preferences?

In the past Vanguard has followed its Investor Advised Funds Policy, a single option.

The Credit Union Takeaway

If Vanguard can empower their individual investors to exercise their minute share of corporate governance, should credit unions be exploring options to enhance member-owner preferences? This is more than greater product choices for credit card or varied savings plans.

Some credit unions now give members options for charities to which they can direct interchange income. But what are other ways members might be willing to participate in options such as funding affordable housing for seniors or first time home buyers? Is it possible for members to have a say in prioritizing community ventures and partnerships?

Vanguard, a $10 trillion firm with 50 million clients, returned the owner’s proxy voting power back to the individual. Might credit unions find a way to engage their owners in how their savings and credit extensions are being directed? Or, as in public company voting, to approve senior executive compensation? Or even in buying a bank?