Bylaws require every credit union to hold an annual meeting. The agenda includes reports by the Chair, CEO, other timely updates and the election of directors for open seats on the board.

In many credit unions this event is purely administrative and perfunctory. It is merely a compliance task, carefully managed to end quickly, and to avoid any real member dialogue.

Such an approach this year could be the most costly political mistake a credit union could make with its members. Here’s why:

The future of the federal regulatory system is being overhauled for greater efficiency, simpler design and more direct White House control. No more independent agency policy making. One example of a question being raised is whether the government should have two separate deposit insurance funds.

Influencing Political Outcomes

Credit unions, like most industries, have deployed traditional lobbying capabilities to counter political risks to their operations. These common tactics include raising more PAC dollars, hiring lobbyists with ties to those in office, funding PR campaigns, etc.

Credit unions will never outspend or out-hire their opponents. Money is not the source of their political influence in DC or in their respective states.

Consultant and former OCC examiner Ancin Cooley offers this assessment:

In reflecting on the history of the credit union movement, one fact stands out: our strength has always been rooted in our members and communities. . .While political wins and advocacy play a role, we must never lose sight of our true source of standing. . .our focus should be on empowering our members and meeting their needs.

Activating Member-Owners

People’s voices and votes are the ultimate power in a democracy. The first call to action with members should be in the upcoming annual meetings. To make this event a rallying cry, the traditional approach must be rethought. However, this is not a new challenge.

In March 2023 Silicon Valley and two other banks failed in quick succession as the Federal Reserve increased interest rates. Many credit unions instantly changed their meeting’s scripts. In one I attended, the CEO after summarizing the prior year’s performance, pivoted to explain why her credit union and the industry generally did not have similar problems.

The message was to assure members their funds were safe. Do nothing and trust your credit union.

This time the message is quite different. The challenge is to educate members about changes being considered and ask them to act, not just stay the course. Member-owners contacting their congressional representatives, en masse, is the most powerful influence on political behavior.

1998-The Year of Member Action

In 1998 the Supreme Court ruled in favor of a banking challenge to changes NCUA made in its field of membership regulations in the early 1980’s. If implemented, the decision would have limited credit unions to their original, or a single, field of membership. The law the Court interpreted had to be changed and fast.

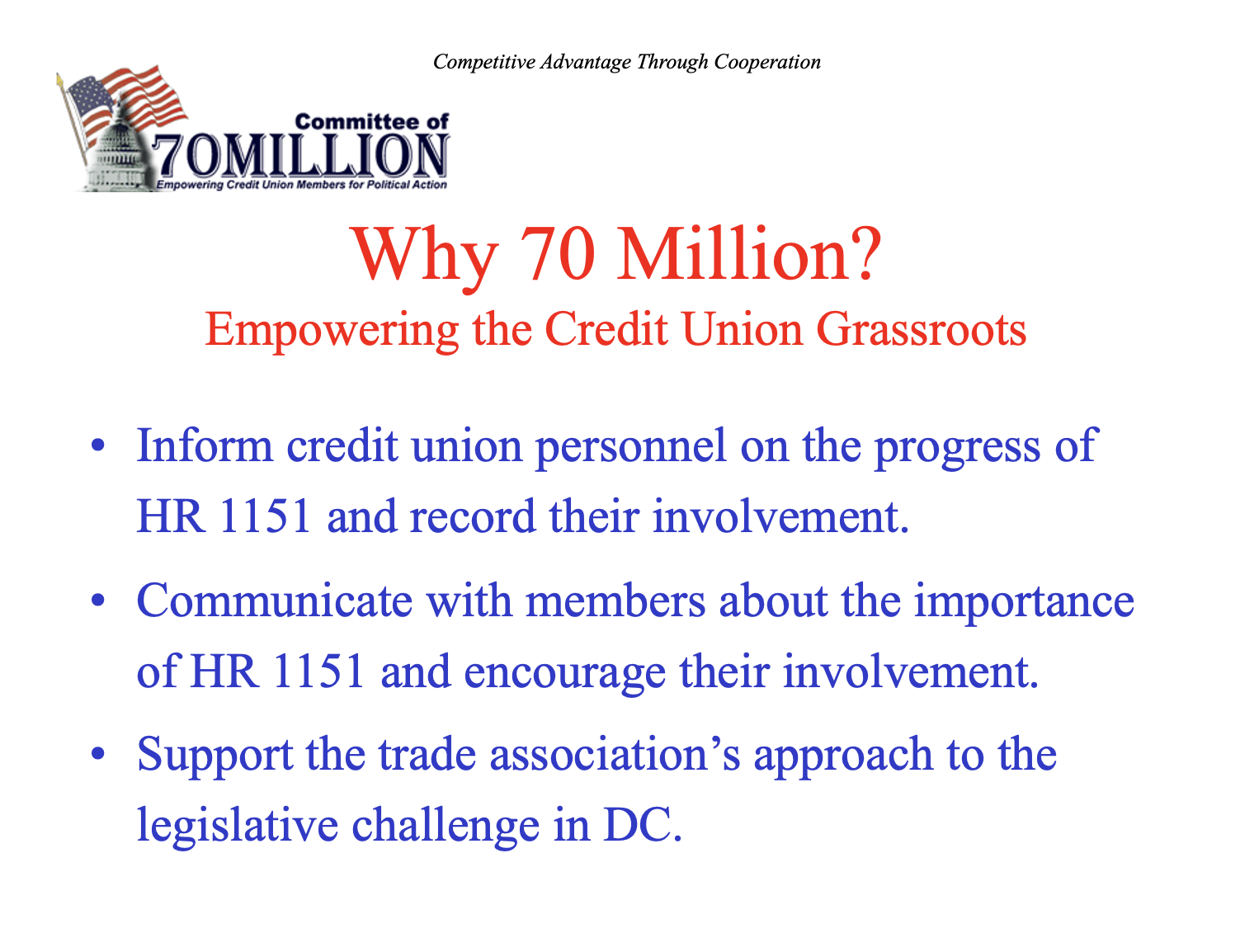

One of the means to both engage and empower members was a newly created website called The Committee of 70 Million. The name was an echo of Revolutionary War grass roots organizations.

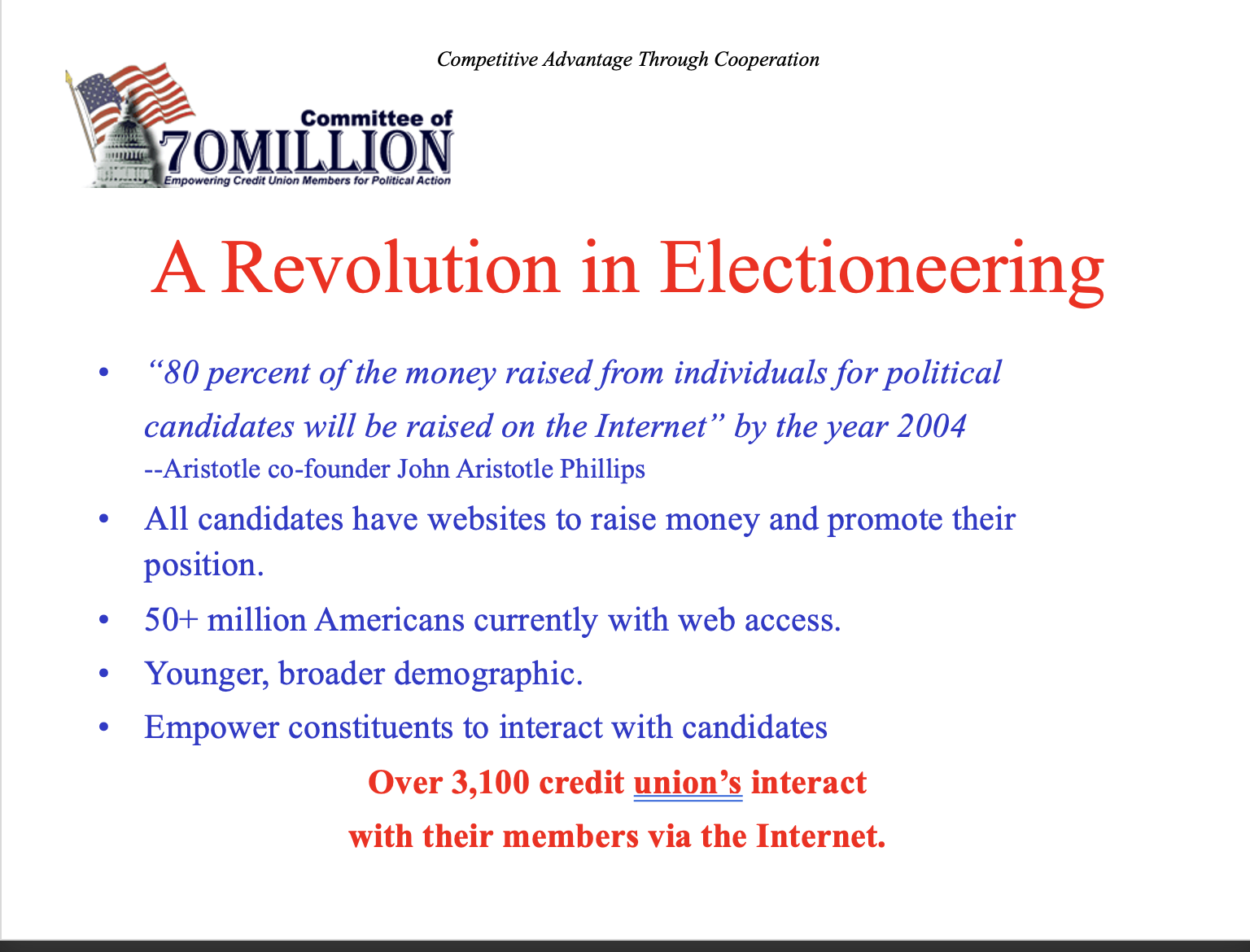

It was created by Scott Patterson, a recently hired techie at Callahan & Associates. Although the country and credit unions were in an early phase of the Internet era, with social media still unknown, this platform could be linked to every credit union on the Internet.

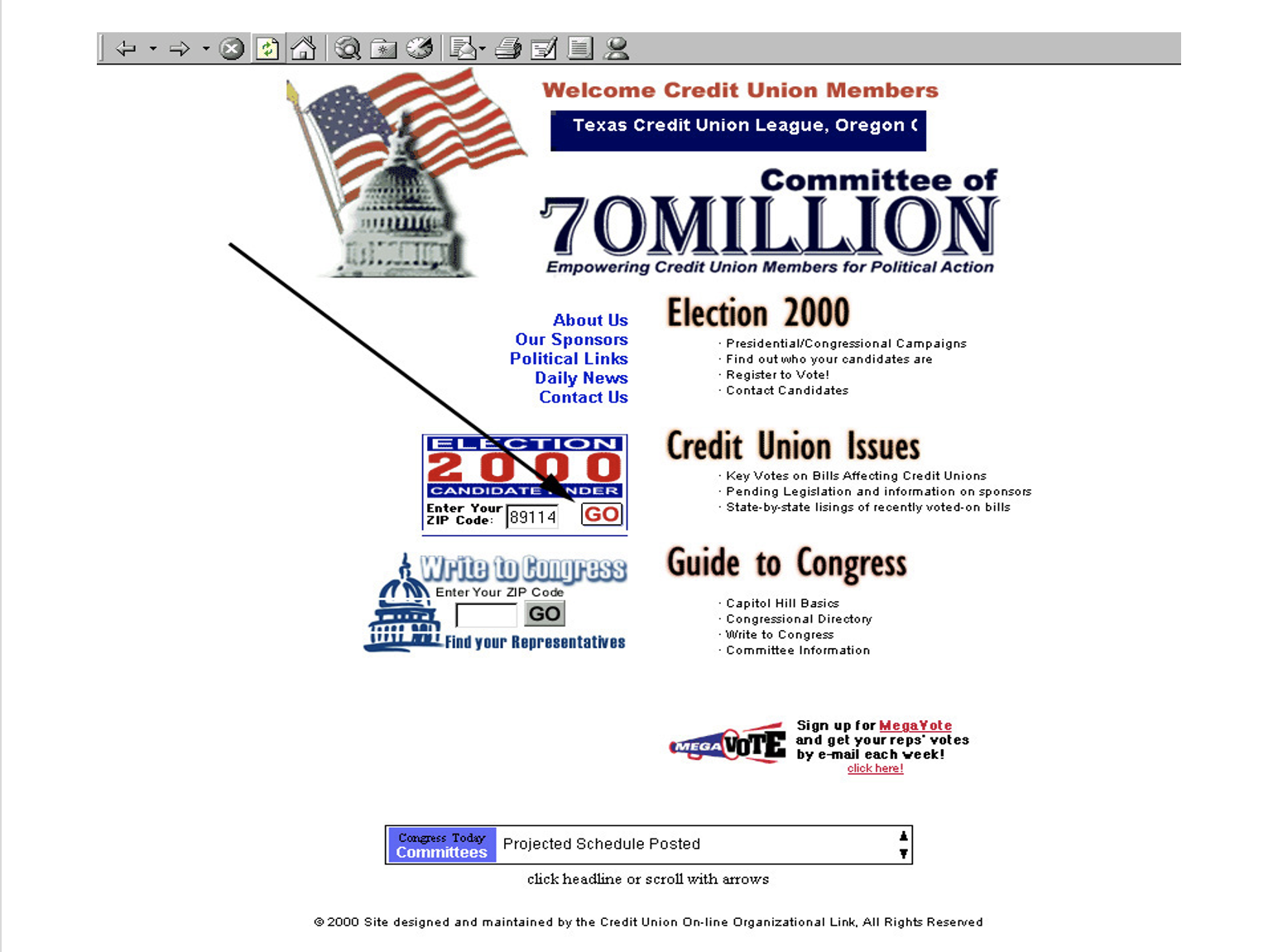

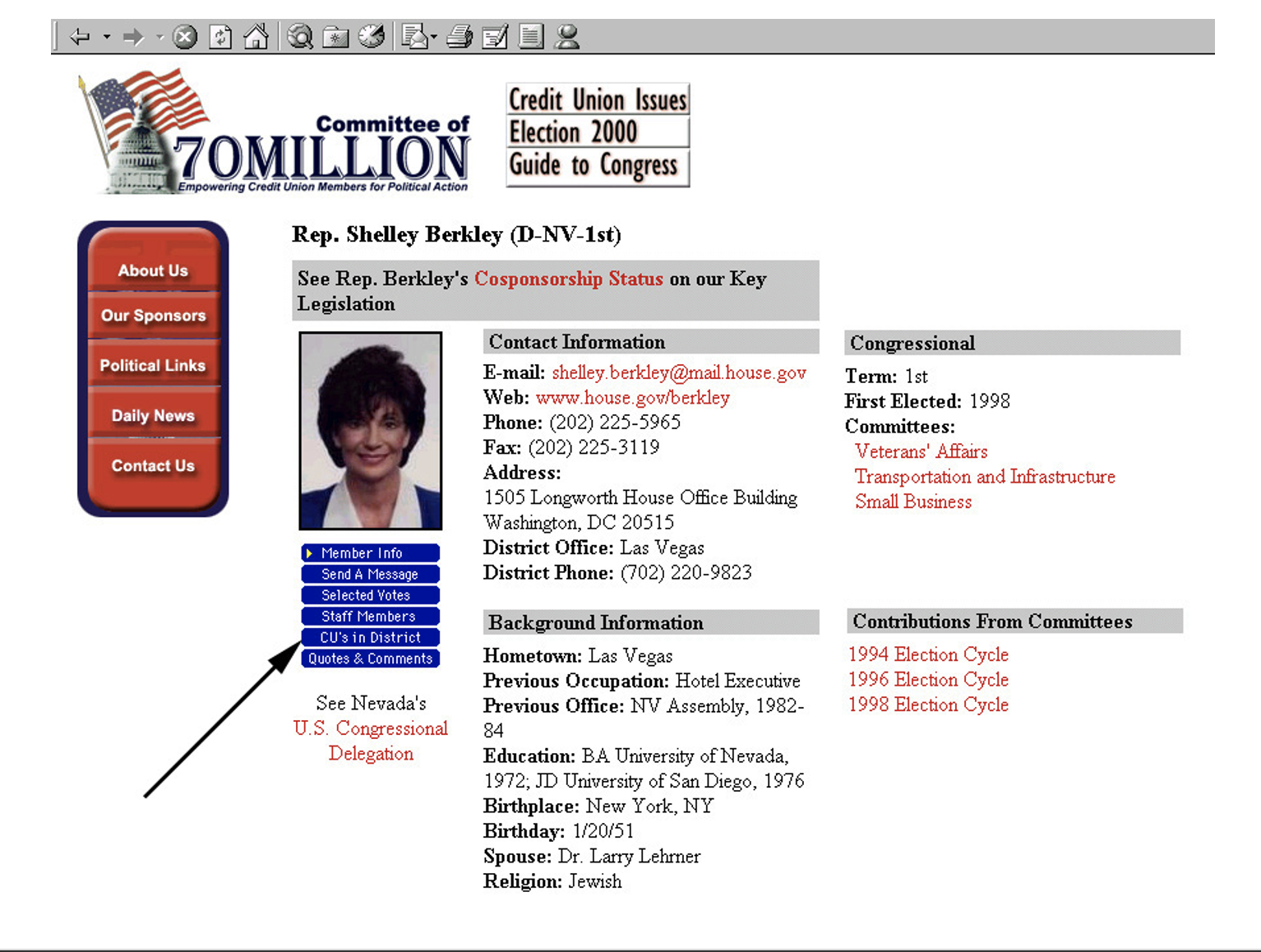

The site explained the what was at stake and suggested multiple ways members could reach out to their congressional representatives. Here are six slides from a much longer review in 2001 of the site’s options, information and impact.

The site was then adapted for voting in the Presidential election year 2000.

The Status Quo Is No Longer

Trump promised total disruption of the federal government bureaucracy. He is on course. Now is the time for mobilizing member-owners.

The annual meeting should be converted to a town hall format. This is an opportunity to connect and inform about the political changes. The members’ questions and reactions can be used to plan next steps. After all, it is likely 50% or more voted for Trump’s message.

Credit unions must gain members’ respect and trust for the steps you will propose. The most important message however, is that this is not just another political fire drill.

Note: To receive the full slide deck, contact Scott Patterson at spatterson@gmail.com.