In the October 2021 Board meeting, NCUA approved adding an “S” to the CAMEL examiner rating system.

In announcing this action Chairman Harper stated: “The NCUA’s adoption of the CAMELS system is good public policy and long overdue. It will allow the NCUA to better monitor the credit union system, better communicate specific concerns to individual credit unions, and better allocate resources.”

The rule’s effective date is tomorrow, April 1. I have been critical of some agency actions in the past. But, this rule is imaginative, even revolutionary, in its implications.

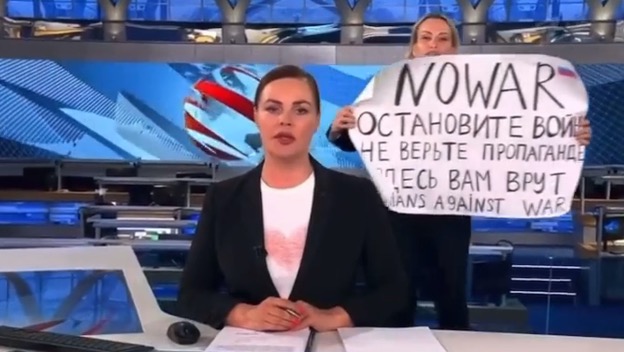

However, its significance may have been lost do to the recently implemented RBC/CCULR, on January 1, with the first calculations due as of March 31. External events such as cyber alerts, the Ukraine war crisis, growing inflation and the run up of interest rates also divert attention.

Special Training for Examiners

The rule’s innovative “S” component required extensive examiner training. As announced in its 22-CU-05 March 2022 Supervisory letter: NCUA staff will receive training on how to evaluate the new ‘S’ component and the updated system. In addition, the training will be made available to state regulators’ offices, for those that elect to use the CAMELS rating system. There is also an industry training webinar planned for credit unions, which seeks to provide a greater understanding of the updates to credit union stakeholders.

Some credit unions may have missed the agency’s transparency efforts, so a brief summary is provided below.

The Imaginative “S” for CAMELS-A Seven Part Analysis

This innovative “S” approach will have significant benefits for all stakeholders—members, other credit unions, regulators, even the public. The questions include safety and soundness criteria that align with cooperative principles. The final ratings are fully comparable with every other credit union regardless of asset size.

Each of the seven “S” criteria are scored independently. These scores are then added for a Grand Total.

Part 1 is traditional. It reviews a credit union’s field of membership process and how open and valued members are. Market demographics and FOM strategy are assessed.

Parts 2 and 3 look at members’ financial participation, how capital is deployed for their benefit, and members’ involvement in credit union governance and volunteer roles.

Two critical safety and soundness factors are next. Part 5 reviews the credit union’s education and training for staff and members. It documents external certifications, degrees and recognitions earned (Best Place to Work). The cooperative section appraises the credit union’s role in CUSO’s and other organizations, such as fintechs, to build a stronger financial system.

The final section 7 reviews all aspects of a credit union’s Concern for Community. Community is more than geographic boundaries. It includes partnerships with organizations which “share common goals or opportunities and who choose to work together for everyone’s success.”

Objective, Comparable and Fully Transparent

The overall “S” 1 through 5 rating is determined by the Grand Total Score. As shown on page 11, a score of over 100 results in a CAMEL 1. The scores are intended to be shared industry-wide and can be posted in the credit union with the monthly financial statement.

In his March 5, 2022 Supervisory letter cited above, Chairman Harper encouraged dialogue:

The NCUA’s policy is to maintain open and effective communication with all credit unions it supervises. Credit unions, examiners, and regional and central office staff are encouraged to resolve disagreements informally and expeditiously.

As with any change in a supervisory approach, we understand credit unions and other stakeholders will have questions.

Long Overdue

This “S” addition breaks new ground. It is “long overdue.” A copy of the entire 11 page form with descriptions of each section and the individual scoring components is here. It is interactive and can be completed online now.

Achieving a high CAMEL”S” score should not be any burden for most credit unions. Service has been an integral part of the credit union model from the beginning.

Most importantly, the “S” highlights the cooperative difference. It documents how credit unions are poles apart from banks. I believe credit unions should applaud NCUA’s alignment of its examinations with credit union purpose.

For additional information, NAFCU has also posted this brief, more prosaic analysis of the rule.