The dramatic drying up of market liquidity since the Fed launched its fight on inflation earlier this year has been multidimensional.

The 16.2% surge in credit union loan demand in the first two quarters was the highest this century. Cash on the balance sheet fell by $66 billion in the second quarter alone. Investments are 30.5% of the system’s assets, totaling $655.5 billion. Only 42.6% of this total was under one year maturity at June 30.

Most of the remaining portfolio over one year, would be underwater, that is with book value less than current market. These funds could be converted to cash only at a loss.

Consumer savings previously buoyed by COVID relief plans, fell to 5% in June, and are at a lower level than historical norms.

Finally market competition for funds is increasing. The SEC 7 day yield on government money market funds is 2.75%. Online banks such as Marcus are offering one year CD’s at 3% and higher for longer terms.

Credit union’s are responding with multiple balance sheet straggles, such as CD specials, loan sales for cash, higher pricing to slow loan demand, and looking at borrowing and other funding strategies.

Two Credit Union Created Liquidity Options

Credit unions have created two system options to assist with managing liquidity. One is industry managed, the corporate network owned SimpliCD, a CUSO. The second is the CLF, created by Congress in 1977.

Both partner with remaining corporates as one option for access. Credit unions can also go direct as regular members of the CLF or by calling the CUSO, Primary Financial, directly.

Even though both were created by credit unions and both rely on the corporate network for broad coverage, the results of both efforts could not be more different.

A CUSO’s Results

SimpliCD has posted its activity through the June quarter. With almost 3,000 credit union investor agreements, the CUSO reported $2.9 billion CD’s placed at June 30. The current largest outstanding was for $239 million and 228 credit unions report current funding.

President Chris Lewis says the market is the tightest he has seen in his 30 years with the industry. Some credit unions are making early withdrawals from purchased CD’s or sell at a discount for cash. Finding credit unions to invest in CD’s is getting harder. Credit unions generally seek funds in the 1-3 year maturities.

SimpliCD’s advantages include a centralized way to access CD funding, quickly, in whatever amount needed. Most of the top ten credit unions have used the service in past with the largest placement at $400 million. Twenty million can be raised in just a couple of hours.

The funds are unsecured and structured so that the $250,000 NCUSIF insurance covers all issuance. If the transaction is done via the credit union’s corporate account, all monthly interest payments or receipts are automatically settled with confirmations provided to the credit union.

Two current examples: A billion dollar credit union placed two CD’s as of September 30th via their corporate, $5.0 million for 182 days at 4.1%, and a second $5.0 million for 272 days at 4.15%.

A $150 million dollar credit union placed a $1.5 million 182 day CD for 4.05% at September month end.

The October 3rd rates for secured FHLB Boston advances for equivalent six and nine month maturities are 4.29% and 4.37%.

The CUSO was originally founded by Corporate One in 1996 and converted to corporate wide ownership in 2004. In addition to the speed and ease of one stop funding, the CUSO has earned the trust of its credit union users who range in size from the very smallest to the largest.

Lewis comments that the other advantage of SimpliCD is that credit unions can “keep their borrowing powder dry” for use as secondary liquidity.

The CLF Today

Opened in 1978, the CLF was intended to be the third leg of the regulatory structure which added share insurance in 1971 to NCUA’s initial chartering and supervision responsibilities.

Last week I received this query from a colleague:

Today, as interim CEO, something came up, and I immediately thought of you. It’s the CLF. While we are managing liquidity well, but don’t have the FHLB currently – I put it in process – I thought I read that the CLF was broadened in scope through CARES ACT and was more user friendly.

I contacted the Corporate CU, as we are just under $250M, and asked about it, and they said no one is using it. I thought that response was very odd considering the drain on the system of over $80 billion from March.

Seems from what I was told that the CLF doesn’t have much value. Do you believe this is true? Am I missing something here?

Any advice would be greatly appreciated.

As of July 30, 2022, the CLF has $1.3 billion in total equity, all invested in treasury securities. Its total borrowing authority from the Treasury is $29.7 billion. The 10 corporate agent members, and the 349 direct credit union members cover approximately 26% of all credit union assets.

The CLF has not made a loan since the 2009 financial crisis. Its major activity then was to lend $10 million to two conserved corporates guaranteed by the NCUSIF. There has not been a loan extended since.

The CLF currently earns 1.39% on its portfolio and spends about $1.2 million to keep the CLF open. It currently pays 80% of its net earnings to its credit union owners. The CLF continues to add to its retained earnings of $40.5 million even though it has had no “risk” assets for over 12 years.

A Story of Two Systems

Both SimpliCD and the CLF were formed to serve credit unions. The CUSO managed by credit unions is active at every level providing financial intermediation, funding, and market options to almost two thirds of all credit unions. It partners with its corporate owners to market, inform about funding options and facilitate transactions. It is active in both good times and periods of stress. It continues to innovate, be present and evolve.

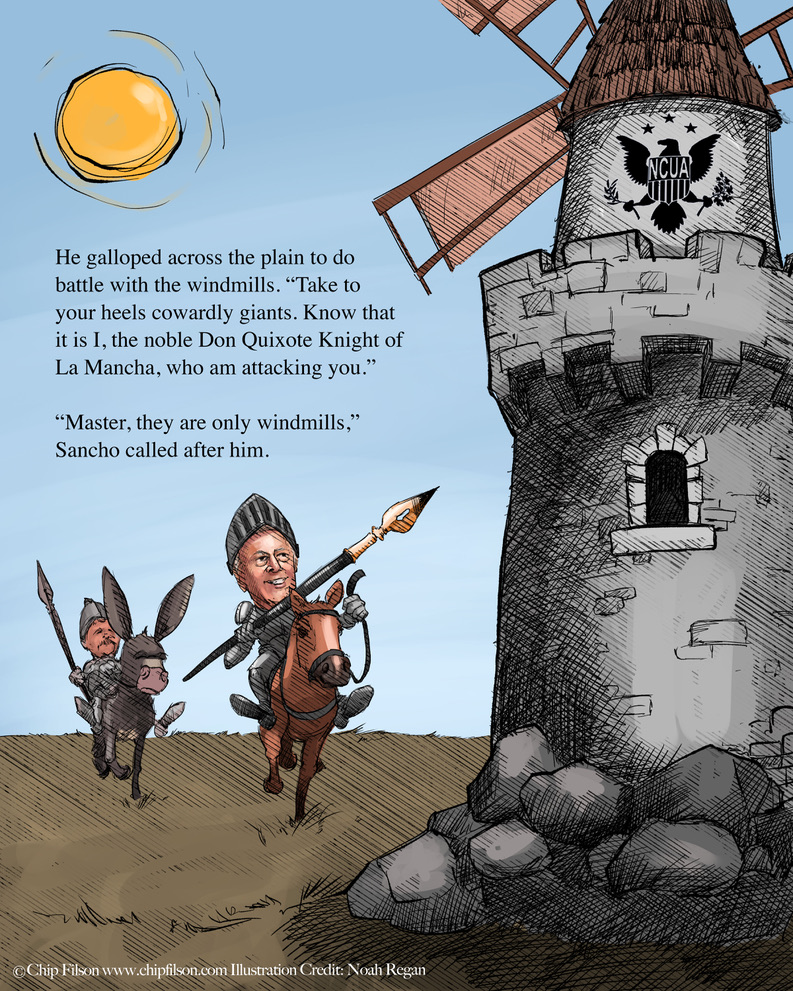

The CLF does not interact with credit unions. It has created no programs or options. Until the leadership of the CLF engages with its member-owners and the system to develop solutions relevant for them, it will remain unused, untried and without purpose. A vestigial regulatory organ frozen in bureaucratic time.