On a recent trip I talked with a CEO to find out how the credit union was responding to four events: Covid, interest rate hikes, liquidity and the regulatory environment. Here are my notes.

On Covid

CU still on hybrid work model. Employer sponsor went all remote, but is now back in person, with little remote. The community around the head office, especially retail shops, became a ghost town. Kept all branches open, but back office staff is still mostly remote.

Expect hybrid work to continue. Commute for head office is a minimum of 30-60 minutes. Labor market extremely tight especially for retail.

Have re-evaluated every customer facing position including salaries, variable incentives, paid lunches and increased job tiers.

Interest Rates

The 30-year fixed rate mortgage is now at 7.5%. Member interest has evaporated and don’t see it coming back until late 2023. Increase in second mortgage demand.

Member spending is still strong and credit card volume has surpassed pre-pandemic levels. Will recession hurt consumer spending? Labor market great for employee, but creates inequities with current staff.

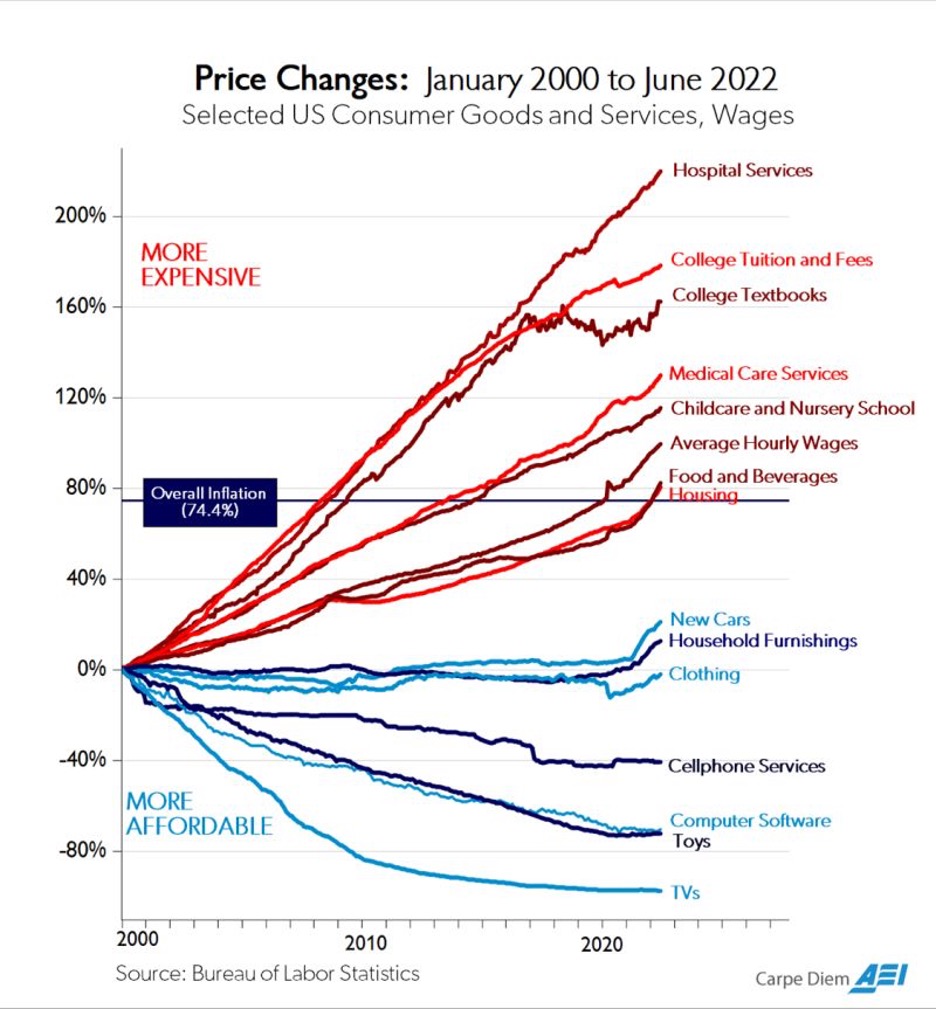

Biggest concern is inflation’s impact on costs and operating expense structure. Large increases in vendor contracts which have the ability to pass through costs based on a CPI index. In some cases this will be 8.5% to as high as 15%. Fortunately, we have caps in our contracts but many credit unions do not.

We are a unionized shop with approximately 70% of employees covered under a labor contract. Sponsor negotiates contract and we will have to see what happens to those costs.

Liquidity

Have difficulty selling to secondary market. Rates are extremely volatile day to day. Our mortgage pipeline is down 60%. Refinancing has all but stopped.

In ’20 and ’21 had share growth of 20% and 13%. Money stayed with us. This year members feel it’s time to spend. Grown only 2% in shares so far, but may end up flat at the end of the year.

Even though originations are lower, loans are staying on the balance sheet because there is no refinancing.

Paying up for CD’s: 11 month at 3.25% and 15 month at 3.5% with a minimum of $5,000.

Actively monitoring our wholesale funding sources. FHLB is about 100 basis points more expensive than CD’s. Also have brokered CD’s with SimpliCD.

So far this year ROA is at 80 basis points down from 92 bps in 2021. But for our 28 state peers over $500 million, the average is closer to 50 basis points.

Our top operational priority will be managing expenses.

Regulatory Environment

State chartered. All exams remote. The beginning of the year I was really concerned about the NEV test that would put us in the extreme risk category. But they have backed off with just a “high” rating.

Definitely a different level of NEV risk now and more pressure on liquidity.

Looking past current events there are two items. Should we move beyond our sponsor’s brand and FOM to open up markets for further growth? We have several special loan programs, credit card and provide financial literacy events. Sponsor brand is ours as well. So not a simple issue.

Secondly, we have always been a state charter; would a federal charter be an option for the future?

However our biggest challenge going forward is to control operating costs.