This past weekend I learned about leadership at a rehearsal for the Messiah. No, this not a blog about harmony.

In Washington D.C. the National Presbyterian Church organizes an annual community choir to sing the Messiah’s Christmas story during the holiday.

The chorus has no auditions, entails five three-hour rehearsals and a full weekend of dress rehearsals and the public performance. This ambitious, one time assembly is led by the Church’s long time musical director Michael Denham.

This year’s chorus will number about 120. It includes people of all backgrounds, from different faith traditions and no church connection. They join together for the joy of singing Handel’s oratorio in this season.

In addition to the disciplines of the music, stresses on notes, cut offs for phrases, tempi and dynamic level Denham will explain the importance of the text. This past Saturday his description of what he was seeking musically has relevance to all of life.

The tenor soloist opens the Messiah with two arias. The words are from Isiah: Comfort Ye My People and Every Valley Shall be Exalted. The chorus then enters to affirm the prophet’s message singing: And the Glory of the Lord.

The chorus’s words, from Isiah, assert the truth of the Isiah’s prophecy: The glory of the Lord shall be revealed, and all flesh shall see it together.

Denham focused on the words we were singing. They are affirming the message of the tenor’s arias. The words say why this prophecy is true. The chorus sings because, The mouth of the Lord hath spoken it.

Denham acknowledges the many spiritual and secular backgrounds of chorus members. In singing these words his expectation was clear: “ I’m not asking you to believe the message, but I am asking you to understand what is being said. The words have meaning.”

Belief and Understanding In Cooperative Leadership

The most important competency for a cooperative leader is their understanding of cooperative design and its advantages. Without this “grasp” one will rely on habits learned in other professional roles: banking, government service, lobbying or perhaps non-profit experiences.

Ideally one hopes that understanding brings, in due course, belief in the purpose and roles enabled by cooperatives.

If a leader has only a superficial understanding based on generalities such as “people helping people” or “protecting the insurance fund,” then other management priorities, learned elsewhere, will dominate one’s goals: power, personal ambition, institutional growth. Effectiveness is measured by criteria other than how members’ and community well-being is advanced.

For example in NCUA’s public board meetings last week I listened for reference to cooperative differences when discussing the budget, the NCUSIF’s financials and the state of the industry.

I recall no comments referencing the advantages of cooperative differences and design.

The Cooperative Journey

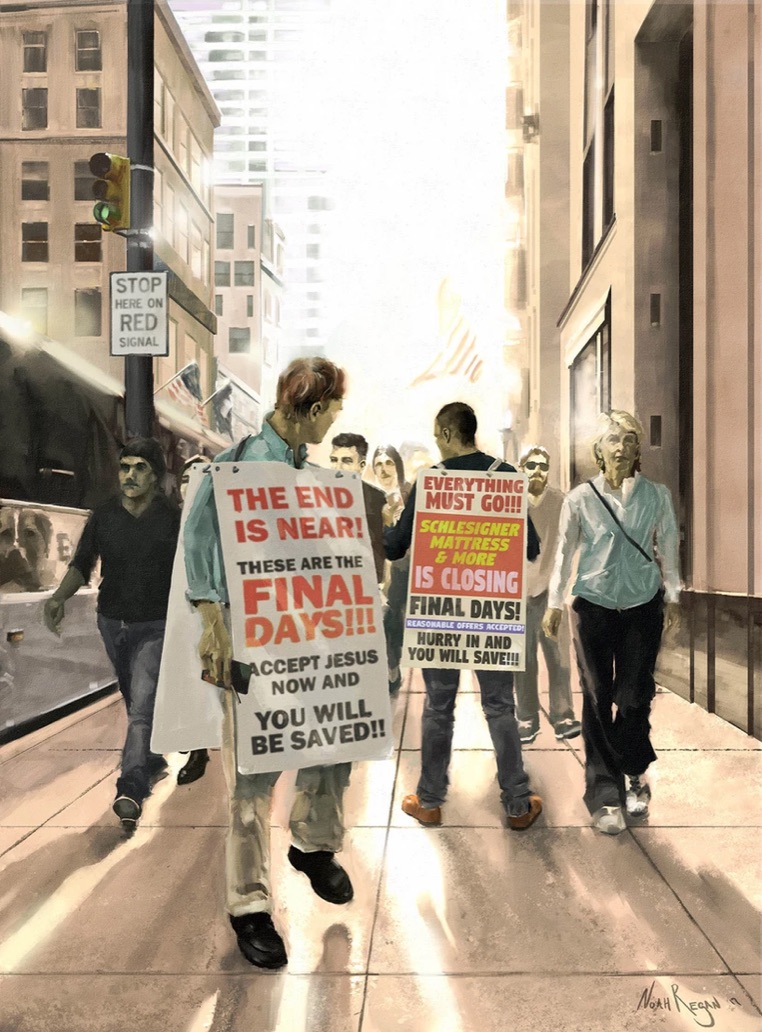

Credit unions were meant to be apart from the market driven, capitalist culture which dominates American society. And many individual’s personal goals.

Coops are about a community or group’s collective efforts working together.

The results are intended to be paid forward for the benefit of future generations, not cashed out for momentary personal profit. This inherited legacy is often taken for granted. New leaders forget how their institutional roots were planted. They honor themselves for what they have accomplished rather than acknowledging the inheritance of others’ labors.

Understanding cooperative operations is about much more than the mechanics of a financial institution. It takes time and experience to learn the history and how an institution’s success is intimately intertwined with the relationships with the people who own it.

The primary goal of a credit union is not institutional achievement or market dominance but a place where people can thrive and fulfill their dreams. That is not the ethos of capitalism where competition is about winning and losing, taking over one’s competitors, maximizing profit and outperforming the market.

Credit unions are about life lived in community. The design facilitates self-help and awareness of shared purpose.

They are also institutions that facilitate gratitude and at special moments, celebrate the joys of life together. Especially in this season.

This understanding is a journey. It is not learned from books or from courses and certainly not gained when one achieves a leadership responsibility. Familiarity with the credit union story is certainly helpful. Skills with the mechanics of management are essential.

But belief in the power of cooperatives, like other beliefs, is an awareness that occurs over time. It is sharing experiences with others and seeing their stewardship and in some cases, the impact of their life’s work.

When cooperative belief joins with understanding, the result can change the world. For that capability we should be grateful. For in much of the world purpose is equated with individual success. Whereas for cooperative credit unions meaning arises in community. That is something for which we should all be thankful.