Winston Churchill wrote: “The farther backward you can look, the farther forward you are likely to see.”

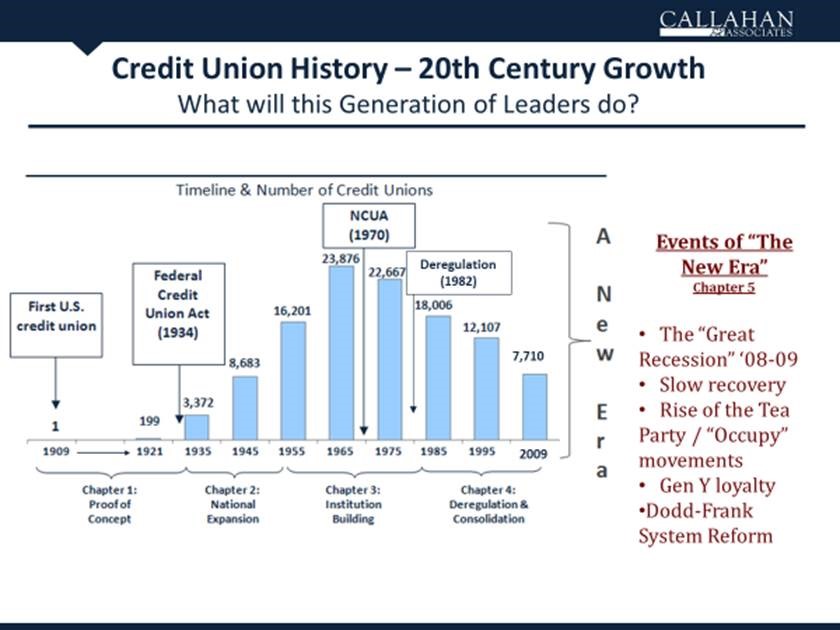

American credit union history covers almost five generations. The first four “eras” shown below established the modern credit union system. Each had a distinct theme. The amazing growth, and decline, of active charters is described on the bar graph.

What is the Current Era?

If the fourth chapter ended in 2008, credit unions are now halfway through the next part of their story. What will be the dominant theme from this generation of credit union leaders?

Some of the events so far are noted at right. COVID and related social crisis should certainly be added to this list.

How would you characterize the industry’s status at this interim stage? Some ideas might be:

- Consolidation, Concentration and Competition

- Regulatory Backlash

- Membership Passes the Century Mark

- The CUSO Era

- Maturing Coop Model Seeks New Growth Curve

- Etc.

The Value of Perspective

Seeing present day priorities through the lens of the past, can highlight what future outcomes might be.

The outlook of many of today’s leaders has been shaped by the 2008/2009 financial crisis. This interrupted the momentum and confidence from a generation that mined the benefits of deregulation for members.

The current crisis is the second in a decade to engulf members. Can credit unions be masters of their destiny or morph into just another financial option?

Churchill also remarked: “History will be kind to me for I intend to write it.”

Naming the current era is one way credit unions can shape their history. Please send your suggestions for the title of the chapter we are creating now.

Chip,

Helpful perspective. Other thoughts…

– In 2007, Steve Jobs introduced the i-phone, laying the groundwork for hand-held computing…starting the next era in 2008 makes sense. Consumers quickly acquired the ability to find out about almost anything…instantly. It was not long before full-function commerce followed. In the process, market power shifted dramatically from providers to consumers of service. Covid-19 has accelerated this transformation.

– The explosion of digital technologies, data harvesting, data analytics and (soon) AI will make it possible for service providers to intercept consumer needs before they begin their own buying journeys. Amazon and other online retailers are well down this path already.

– The proliferation of social networks is transforming promotional activity (marketing) and is enabling the creation of siloed information sourcing (again, putting consumers in control). ‘Trust’ is leaking away from advisers (like credit unions) to online reviews and networked peer testimonials.

Credit unions can succeed in the new order of things, but innovation will be essential. Institutionally, the mindset will likely have to shift from manufacturer (of deposits, loans, etc.) to distributor of services (some developed in-house, some developed in collaboration and others provided by partners). As distributor, it will be possible to source best-in-class solutions for members.

Maybe the new era could be characterized as ‘Digitization and Platformification’.

Very thoughtful. Also leads to the question, what will be the role of the live person interaction, virtually by zoom, or by chat or even by phone. .