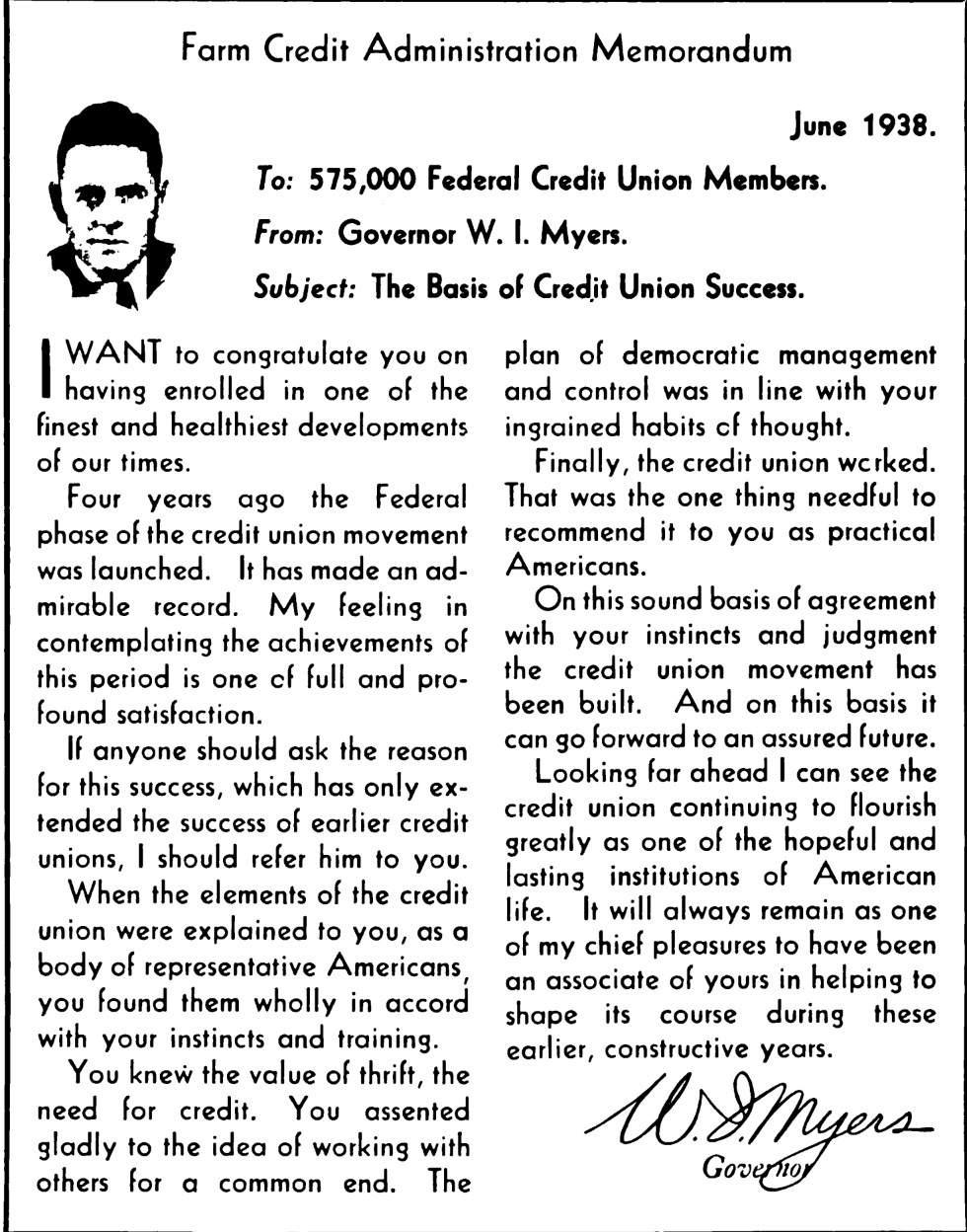

Today credit unions operate in two financial worlds. One is the so called “free market.” This is where open competition, winner-take-all, buying and selling happens. Members/consumers make their buying decisions comparing options. The winners are firms with superior value propositions including better products, service, convenience and sometimes marketing.

This is the market credit unions enter when buying banks or investing in other firms (CUSO’s, Fintechs) to advance their credit union’s competitive position. Corporate transactions are marked by due diligence assisted by external experts, and financial projections with ROI’s and cash flow forecasts. Often these deals are subject to close regulatory scrutiny in addition to buyer and seller’s close analysis.

Transactions in credit union’s “off market” financial activity are not based on transparency, superior performance or even shareholder/owners best interest. This is the “insiders game” of private deal making, self-enrichment and public misinformation and rhetoric to benefit the players’ personal agendas.

Today this is the world of credit union mergers. It is increasingly a cesspool of pretend member advantages disguising payoffs to facilitate changes in control of sound long-serving institutions.

There is no owner payment or recognition as occurs in the “free market” transactions. In fact these are totally “free” transfers in which the continuing credit union is paid to take over the business. The owner’s net worth is transferred intact to the acquirer. This is the complete opposite of an open market transaction. It would never happen in a fully transparent actual market sale.

The Critical Issue

The critical question for the credit union system’s future is why aren’t members paid for their ownership interest when there is a change of control. It happens some with market facing events, but never in mergers. Without any payments upon a charter’s dissolution, member-ownership is a fiction.

Credit unions do know how to value a financial institution, their own coops and other for profit firms.

Credit union capacity and interest in buying other financial institutions, particularly banks is ever-increasing. These all-cash purchase and assumptions totaled 16 in 2022, 11 in 2023 and at least 17 announced so far in 2024.

In most purchases, the transaction price ranges from 1.5 to 2.0 times book value. Where the bank is publicly traded, the offers always exceed the last market quotation prior to the sale announcement. Here is an example.

The Most Recent Bank Purchase Announcement

Yesterday the $9.2 billion ESL FCU announced the acquisition of the $401 million Generations bank (Nasdaq: GBNY). Prior to the announcement GBNY’s one day high for the past year was $10.76. Today, post announcement, it closed at $15.75 per share.

In the announcement the bank estimates the range of final cash payments for each share to be $18-$20. From the joint press release: “ESL Federal Credit Union will pay Generations $26.2 million in cash and Generations Bank will retain its equity at the effective time of the P&A Transaction.”

Generations Bancorp has 2,241,801 outstanding shares of common stock. If $20 is the final disribution per share, then the bank owners will receive a total of $44.8 million, that is their equity and ESL’s $26.2 million payment.

We know there must be some pretty sharp financial analysts at ESL which is paying $26.2 million cash for an institution whose track record includes the following:

- The bank has lost money, every quarter, for the last three quarters.

- The bank has an efficiency ratio over 100%, every quarter, for the last three quarters.

- This means the bank lost money, before factoring in provision for loan loss expense.

- Since 2015, the bank has produced an ROA over 0.50% just once.

- It’s pretax ROA through 6/30 of this year is negative 0.90%.

How Bank Purchases Should Inform Credit Union Owners

The example of credit unions paying cash in a bank P&A, effectively a liquidation, demonstrates credit union’s willingness to analyze market value and to pay up for performing financial assets. In these deals, there is no charter acquired. just an operating business.

Moreover each of these transactions is reviewed and approved by at least three very interested parties:

- The owners who will ask is this price fair and a better option than not selling?

- The FDIC will examine for any residual risk to the bank fund.

- The NCUA will review for any safety and soundness implications and compliance with credit union regulations for acquired assets and FOM limits.

The point of this example, and almost 50 recent bank acquisitions is that credit union’s know how to value the potential future ROI of a financial institution’s assets.

So how might this skill apply to valuation of a credit union? While there are not many recent examples, there is one thoroughly documented transaction.

The Nationwide FCU Sale to Nationwide Bank

In 2006 the sponsor of Nationwide FCU announced its intent to buy its credit union to accelerate its banking operations. Founded in 1951, the single sponsor credit union was almost an extension of the insurance company. Almost all of its members were Nationwide employees, former employees or retirees and their families. The CU’s employees were all Nationwide Insurance employees and the CU performed very few of its administrative functions on its own.

The first question for the members was: “Will the 45,000 owners of the $564 million Nationwide FCU be offered enough money for their credit union?”

The credit union’s key numbers at December 2006, right after the vote were: Assets $564.1 million; Loans $ 418.3 million; Net Worth $61.5 million (12.7%); shares $489.3 million; and Members, 45,002. Nationwide was the 4th largest of Ohio’s 495 credit unions.

Further comments from an August 8, 2006 Credit Union Times article about the sale:

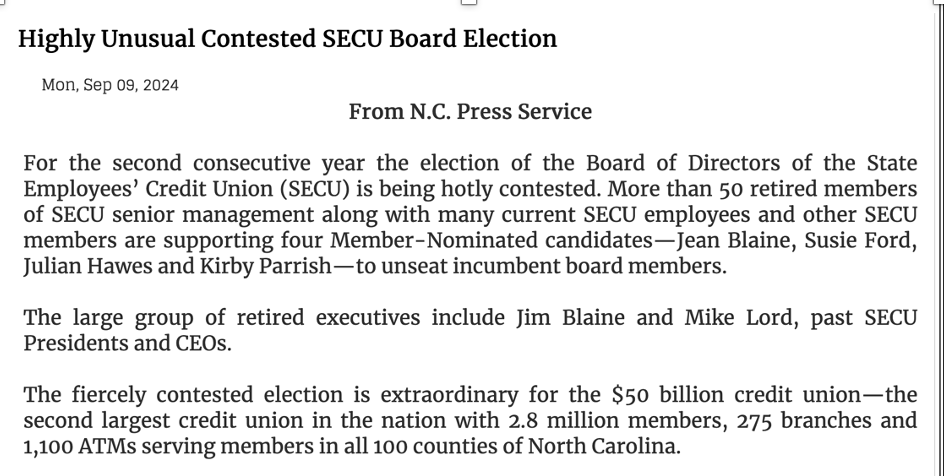

“When what is happening in so many other merger and charter conversions amounts to little more than thievery, the fact that Nationwide was willing to try to do the right thing means a lot,” said Jim Blaine, CEO of the $13 billion State Employees’ Credit Union.

Blaine said that his comments and support for the purchase reflected the degree of transparency that the CU has offered. “If that transparency were to diminish, if the CU were to hold back on letting its members and the public at large know about how it and Nationwide Bank arrived at the $79 million price tag, then the deal might face more of an uphill climb,” Blaine explained.

The final member Notice disclosures were significant including full details of merger costs, loss of member control, and that taxation of the bank might lower returns to savers. The article continues:

McCune and other banking analysts note that a premium of even 150% or 200% of equity for an independent CU might not be out of line and would still be considered inexpensive compared to the prices commanded by independent thrifts. . .

“The phenomenon (of a credit union sale) is more likely to remain an occasional development where banks might approach CUs which have access to particular markets or market niches and where CU members would be willing to sell. Everyone has a price,” the analyst noted,

The Nationwide sale was approved by a wide margin in as reported in this November 7 article:

CEO Paula Edwards said that almost 17,000 of the CU members took part in the election and that almost 90% of the members who voted cast ballots in favor of the merger.

Approving the deal means that Nationwide’s members will receive $79 million total, or roughly 15% of their account balances as of the end of March of this year as the price for the sale. The new bank will benefit from the purchase by having a readymade customer and deposit base that would have taken it months or years to develop otherwise.

The Significance of Nationwide FCU’s Sale

Members were returned all of their cooperative capital plus an estimated premium of $17 million more. This represented a gain of approximately 15% on their individual share balances. In banking sales, this valuation is often referred to as the deposit premium when valuing a transaction.

According to CU Times, there were some who thought this transaction could be an example for additional deals.

Some view the Nationwide deal as the model for the potential takeovers of credit unions. Nationwide was a very unique case, , , CEO Paula Edwards is one of the true good credit union people and had little choice in that deal. The reasons behind it can be thrown out, but what can’t be thrown out is the premium on capital Nationwide Bank was willing to pay, that’s the potential model going forward.

“This proposed merger ensures credit union members receive a financial benefit in the transaction. Nationwide has agreed to give members a payment for their ownership interest in the credit union,” said NFCU CEO Paula Edwards.

The Irony of This Transaction

On May 7, 2018 Nationwide announced it was getting out of the retail banking business.

The insurer said Monday that it has decided to move away from operating as a full-service, federally chartered retail bank — the kind of place where people cash checks, sign up for CDs and the like. Instead, it plans to focus its bank-related services on those that support its retirement-plan business.

Implementing this intention, Nationwide made a follow on announcement August 3rd, 2018:

Nationwide has taken a big step as part of its plan to get out of the retail banking business.

The insurer said Friday that it is selling $3 billion in deposits at Nationwide Bank to BofI Holding, the parent of BofI Federal Bank, in a deal that is expected to close before the end of the year. The sales price was not disclosed.

BofI Federal Bank, based in San Diego, is a nationwide bank that provides financing for single-family and multifamily residential properties and small and medium-sized business in certain target areas.

Even selling to a new charter or transferring control does not assure financial longevity.

How NFCU and Bank Transactions Are Relevant Now

There are two immediate conversions from a credit union charter that will entail a valuation with potential member payout.

June 23, 20 24 the FDIC announced the following:

The FDIC approved a deposit insurance application submitted by Thrivent Financial for Lutherans in relation to a proposed Utah industrial bank, Thrivent Bank. The FDIC also approved a related merger application that will permit Thrivent FCU to merge the operations of its existing credit union into the newly formed Thrivent Bank.

The newly approved Thrivent Bank will not operate physical branch office locations and intends to deliver all bank products and services exclusively online, offering a diversified loan portfolio centered in consumer loans and funded primarily by core deposits, following a traditional bank business model. Thrivent Bank will offer products and services without regard to religious affiliation.

Thrivent FCU has total assets of $930 million and a net worth of $129 million . What will member-owners receive in this sale to an industrial bank charter formed by the Sponsoring company? Will it follow the Nationwide payment precedent?

The second event is the combination Arrah Credit Union with the $378 million, mortgage centric, Pittsfield Cooperative Bank. The details are in this August 14, 2024 Credit Union Times report:

Chartered in 1929, Arrha’s 27 employees operate three locations, and manage $110 million in loans, $122 million in total shares and deposits, and $12.4 million in equity, according to NCUA financial performance reports. The credit union posted a loss of $9,222 at the end of the second quarter.

The process to combine is very cumbersome. A minimum of 20% of the eligible members are required to vote for the transaction to proceed.

Arrha’s NIMRA application, under review by the NCUA, included 15 different documents and statements such as the merger plan, the proposed merger agreement, a copy of the bank’s last two examination reports, copies of all contracts reflecting any merger-related compensation or other benefit to be received by any director or senior executive, a statement of the merger valuation of the credit union, and a statement of whether any merger payment will be made to the members and how much of a payment will be distributed among members.

The question raised by these two current events, the growth in bank purchases and the Nationwide sale and other conversion precedents is why aren’t credit union being member-owners compensated today? When members are asked to approve the transfer and control of all their assets and common wealth to another credit union via merger, shouldn’t they be treated as least as well as when credit unions pay out bank owners?

Time to Take a Stand and Act

Its time for those who believe in a cooperative system to take a stand and ensure that intra-industry mergers reflect the same process and member-owner payments as every other credit union financial transaction requires.

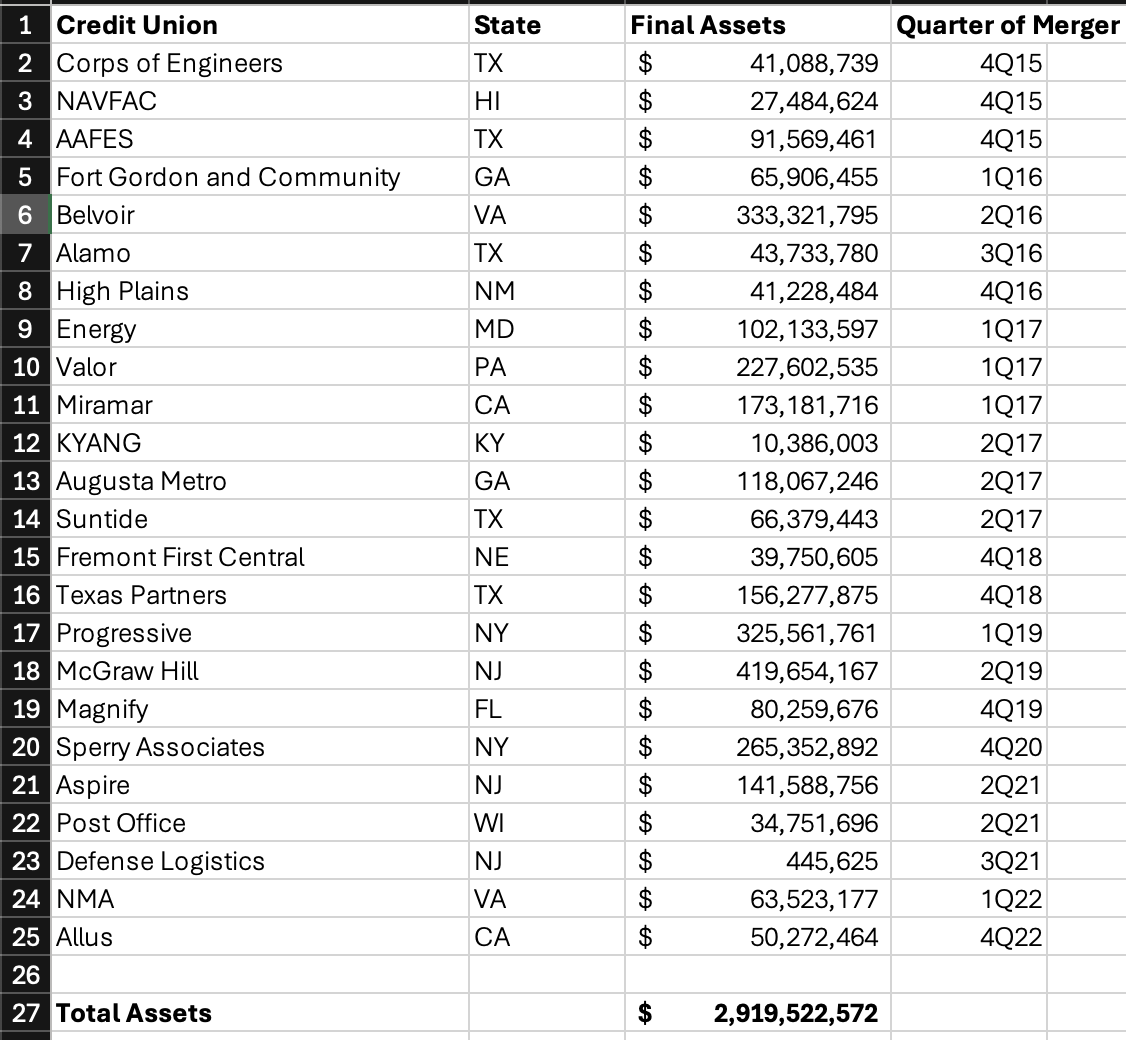

Without change, the industry will be in a race to the bottom. As I described yesterday, one predatory credit union, PenFed, has cancelled 30 long serving credit union charters via merger between 2003 and 2022. Even as PenFed hits a financial stall, this activity is being imitated by others daily.

Credit unions want all the authorities and options to compete in the open financial markets, but not when it comes to their own brethren. These industry predators want the opportunities of the free market, but not the responsibility of transparent dealing and ownership reward when taking over another credit union.

These “off market” dealings are corrupting leaders, perverting normal financial practice and encouraging credit unions to go out and “roll up” their kindred in bigger and bigger combinations. This trend is subverting not just the traditional practice of market based firms, but driving a consolidation eliminating one of the most stratgic advantages of a credit union charter: local control, investment, relationships and community building.

Why can’t the Nationwide outcome be the standard for all credit union mergers as well. From the above event:

what can’t be thrown out ( of the outcome) is the premium on capital Nationwide Bank was willing to pay, that’s the potential model going forward.

Shouldn’t that be the model today for all change of control credit union transactions?