Callahan’s May Trendwatch with first quarter 2024 data opened with an economic update from Alloya Corporate Federal Credit Union.

This opening analysis was one of the most thorough, well documented presentations on macro economic issues, credit union trends and Alloya’s own recent financial experience I have seen.

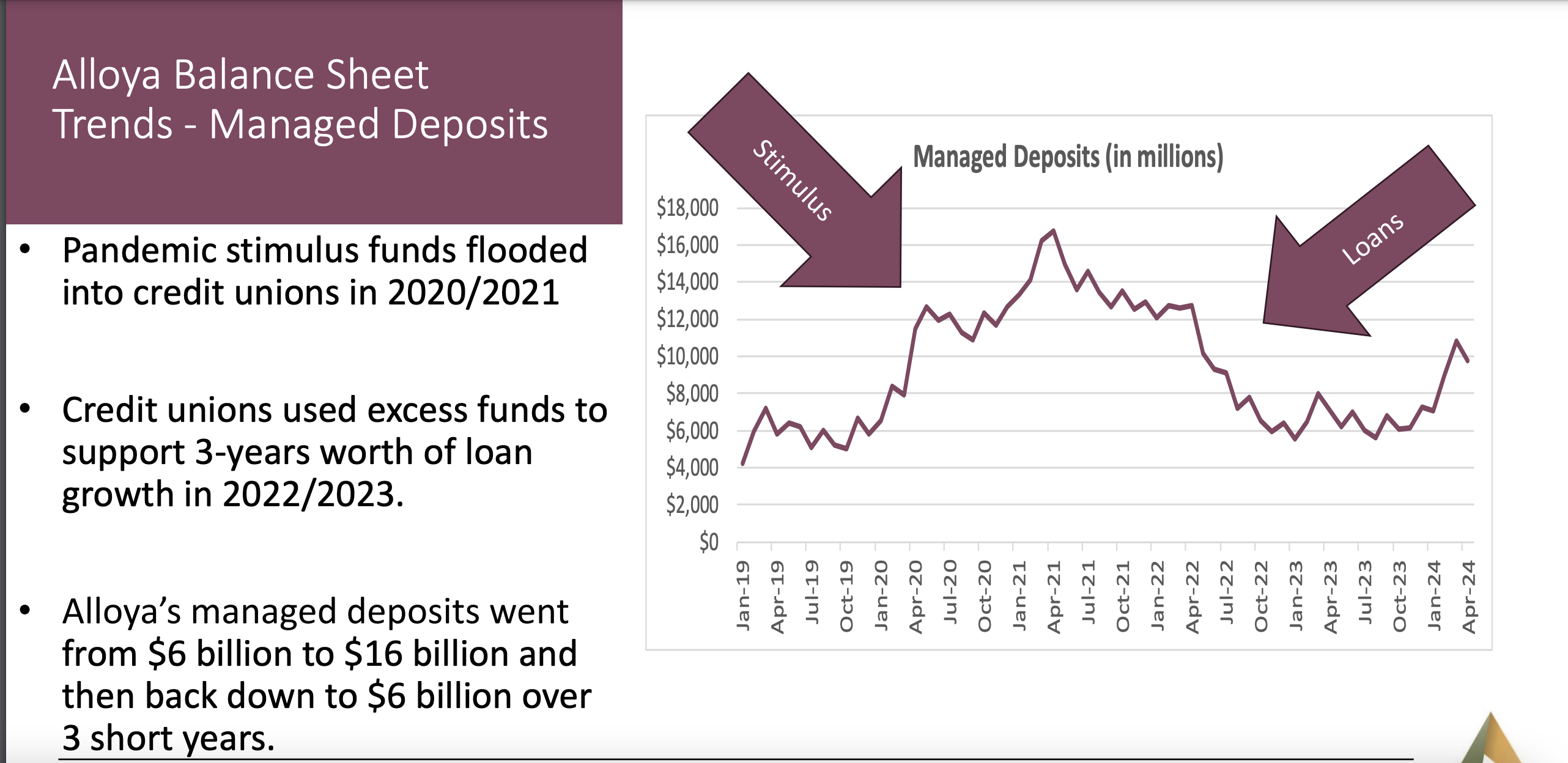

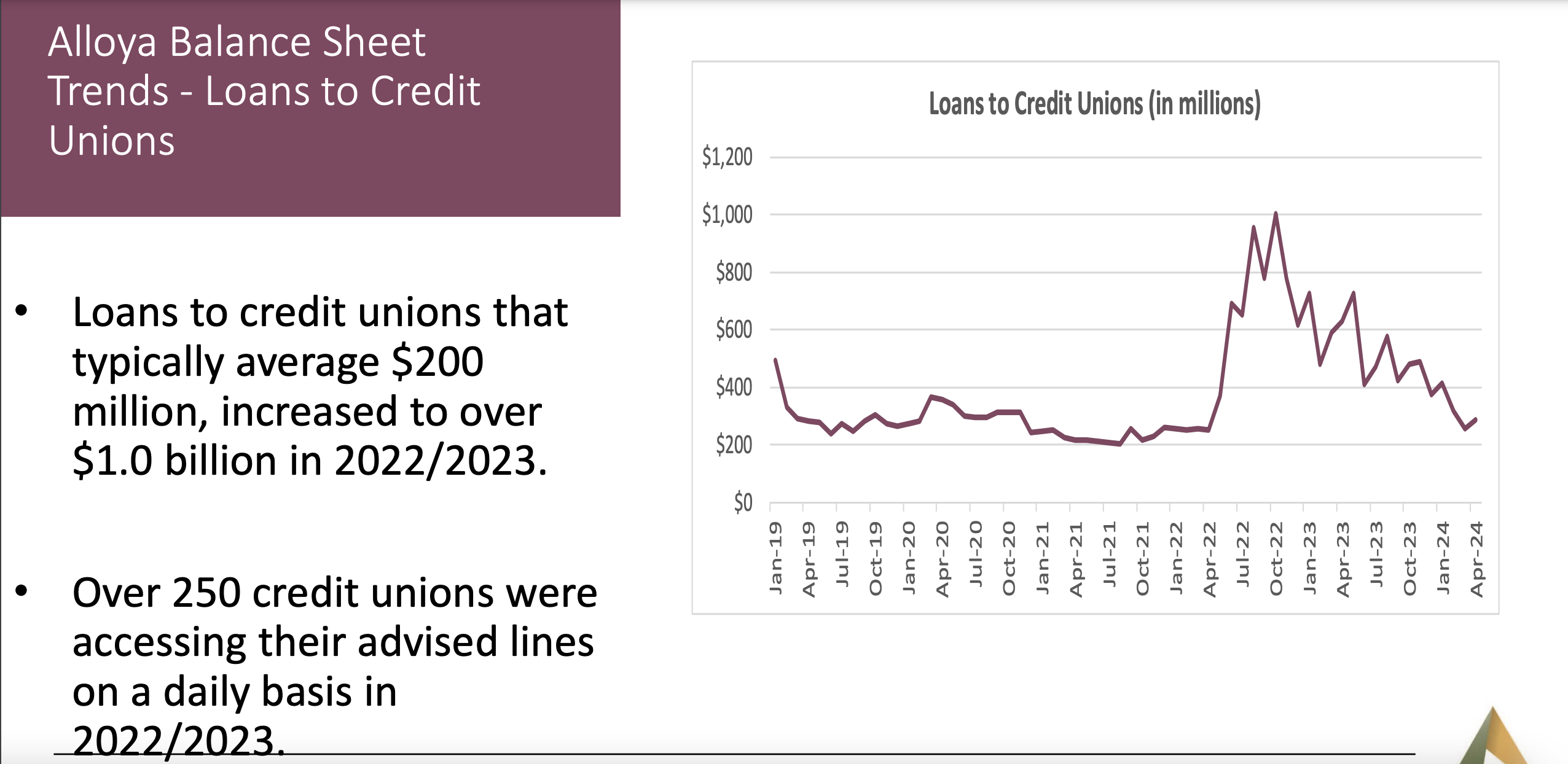

Todd Adams, CEO and Andy Kohl, Chief Investment Officer were the presenters of over 20 slides. They covered trends in consumer spending, interest rate volatility and future outlooks. They showed how Alloya navigated the dramatic inflows and then liquidity shortfalls in 2022/2023.

Below I excerpt several slides to provide examples of their analysis. The full Trendwatch slide deck from May 14 can be accessed from Callahans here.

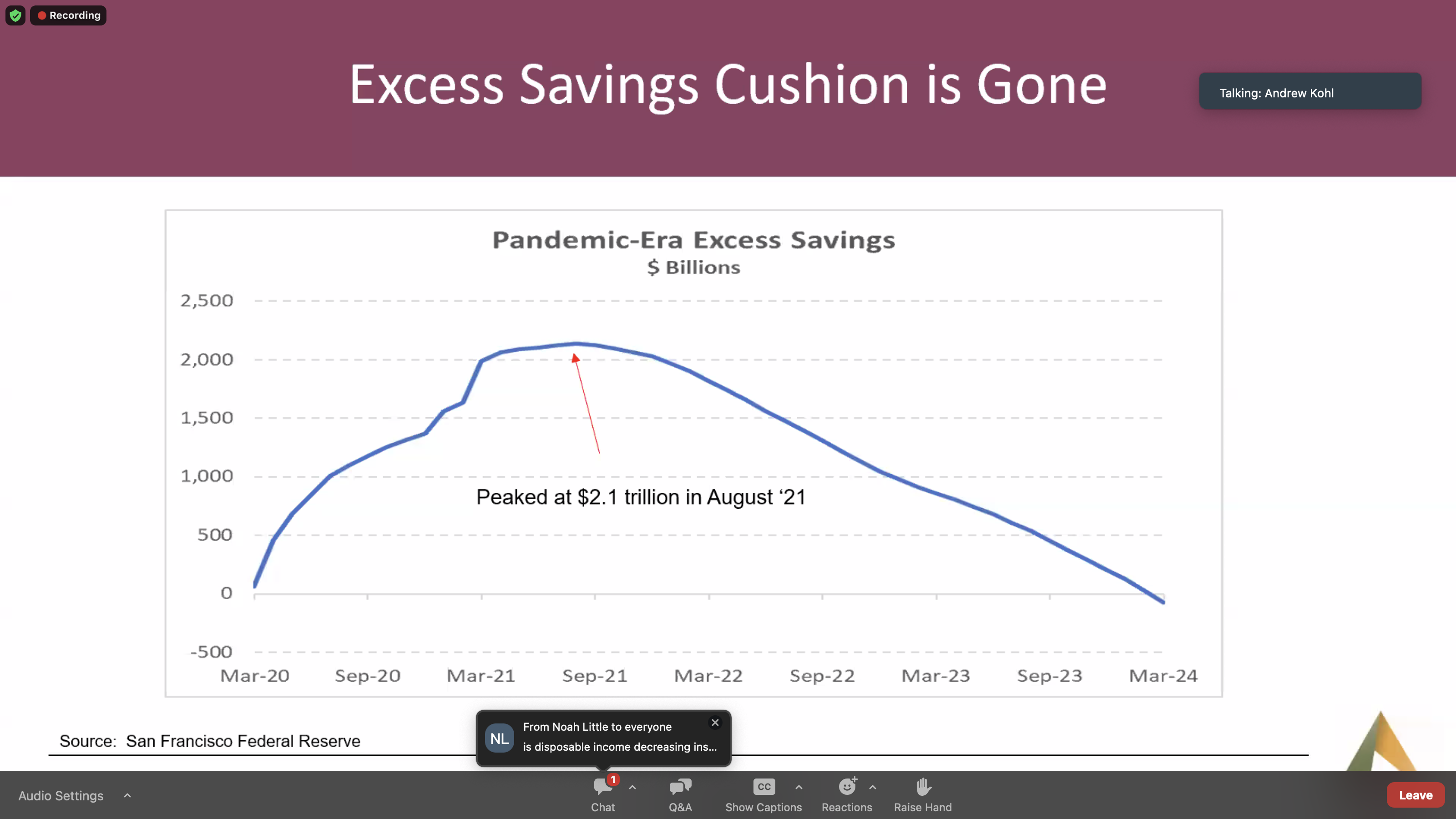

A key macro economic trend

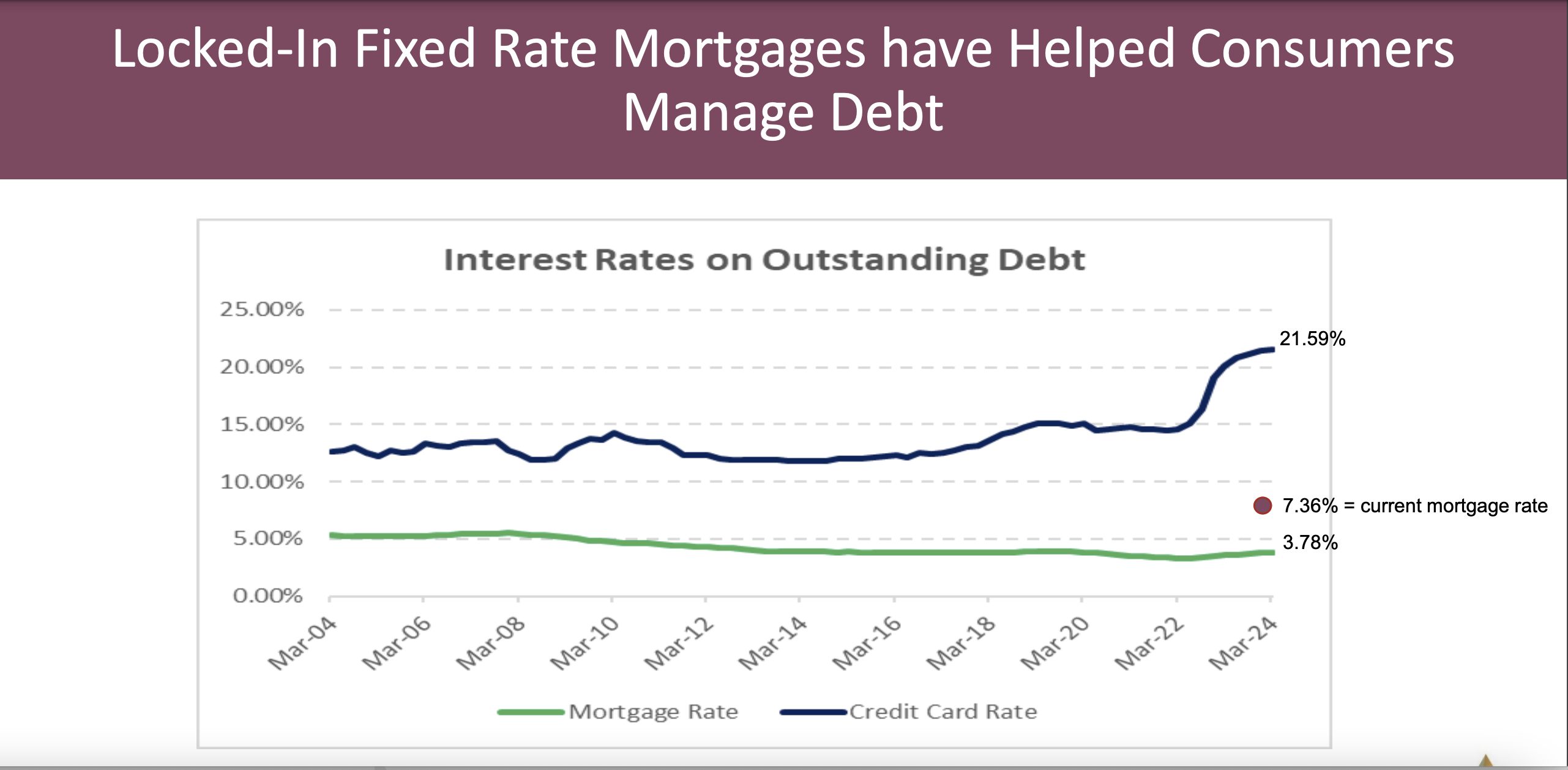

The mortgage fixed interest rate advantage

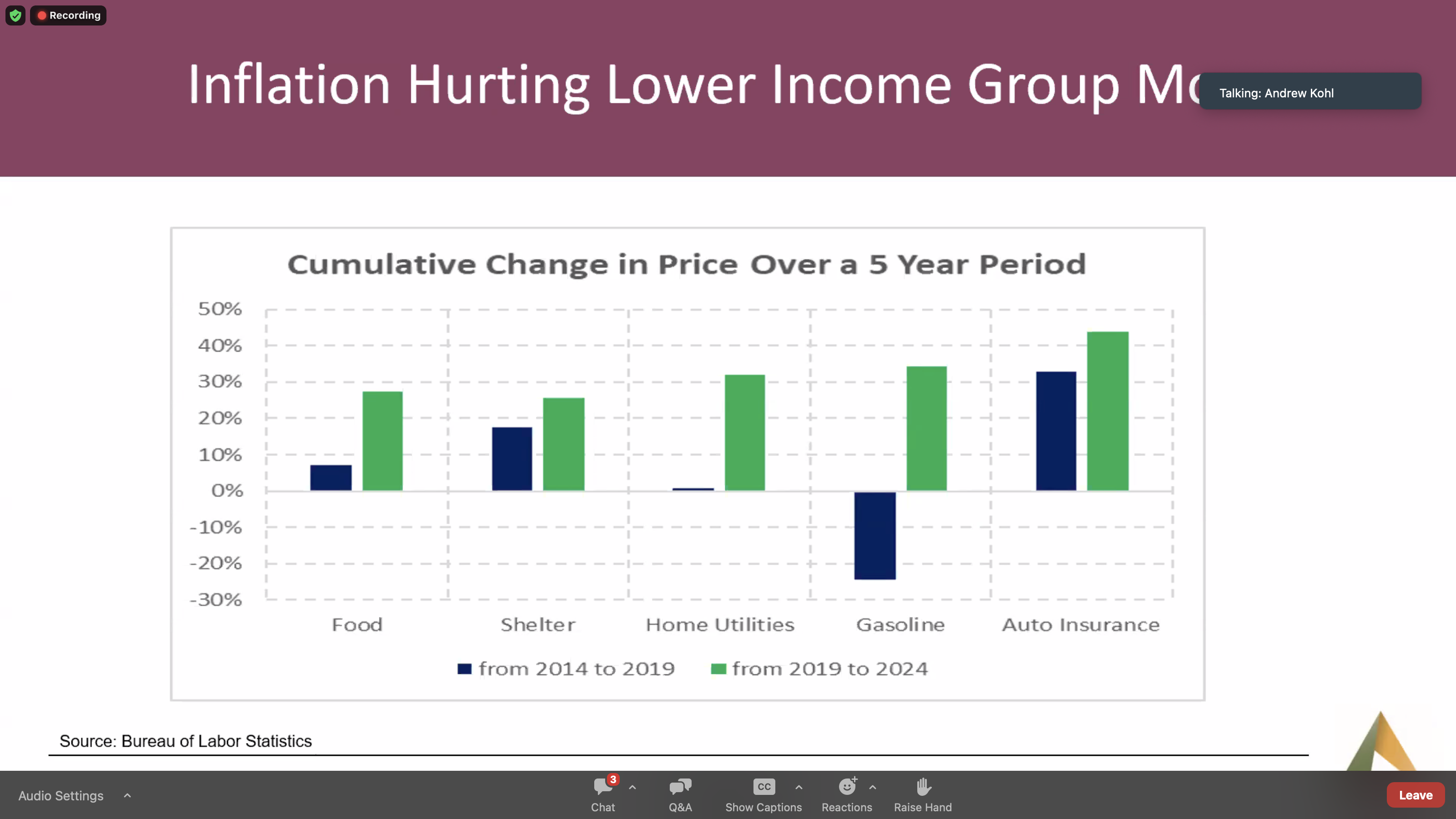

Lower income groups most affected by price increases

Alloya’s balance sheet flows 12/19 to 4/24

Alloya’s lending to members in 2022/2023

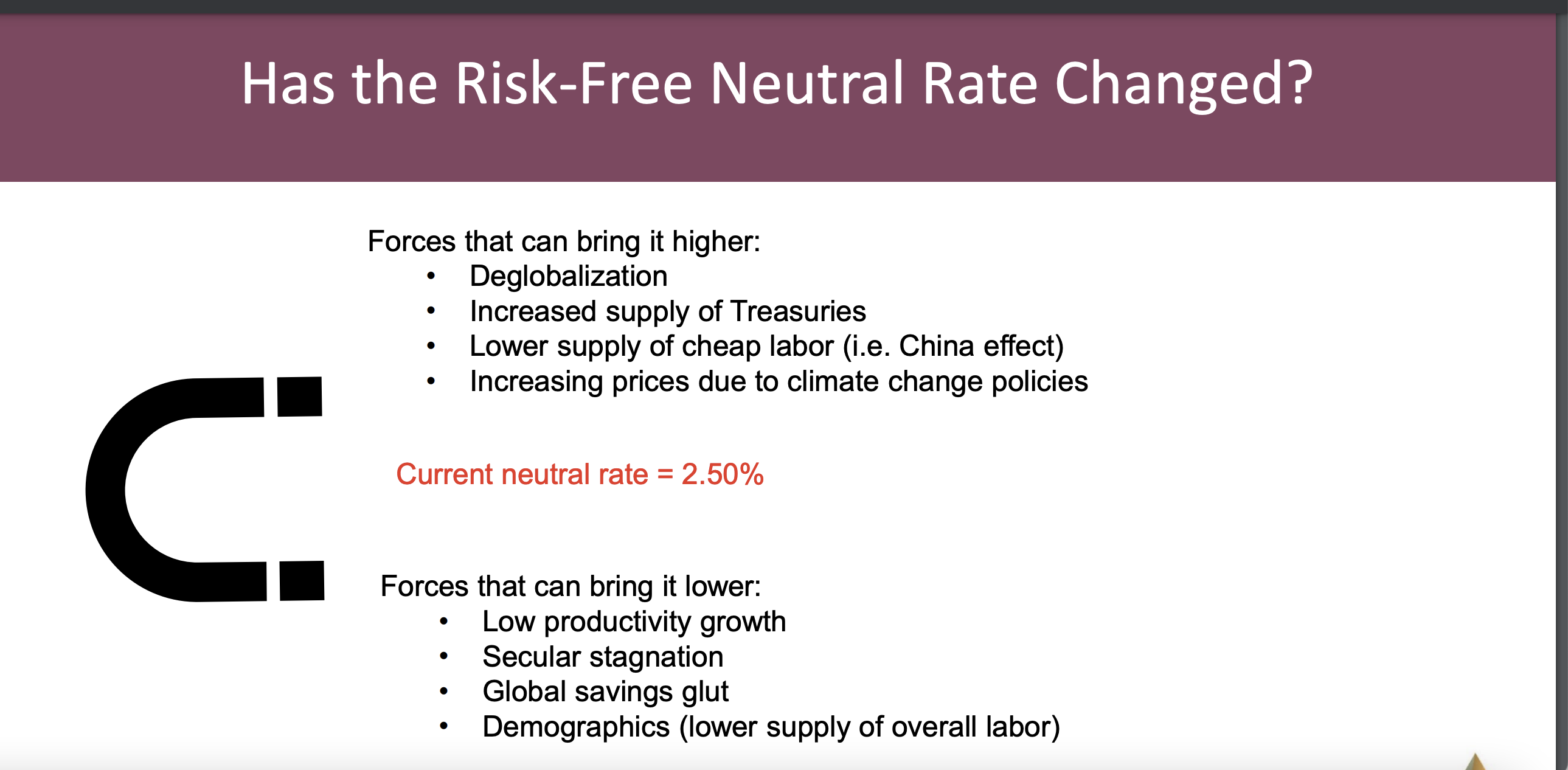

The outlook for short term rates. A Fed Funds of 2.5%?

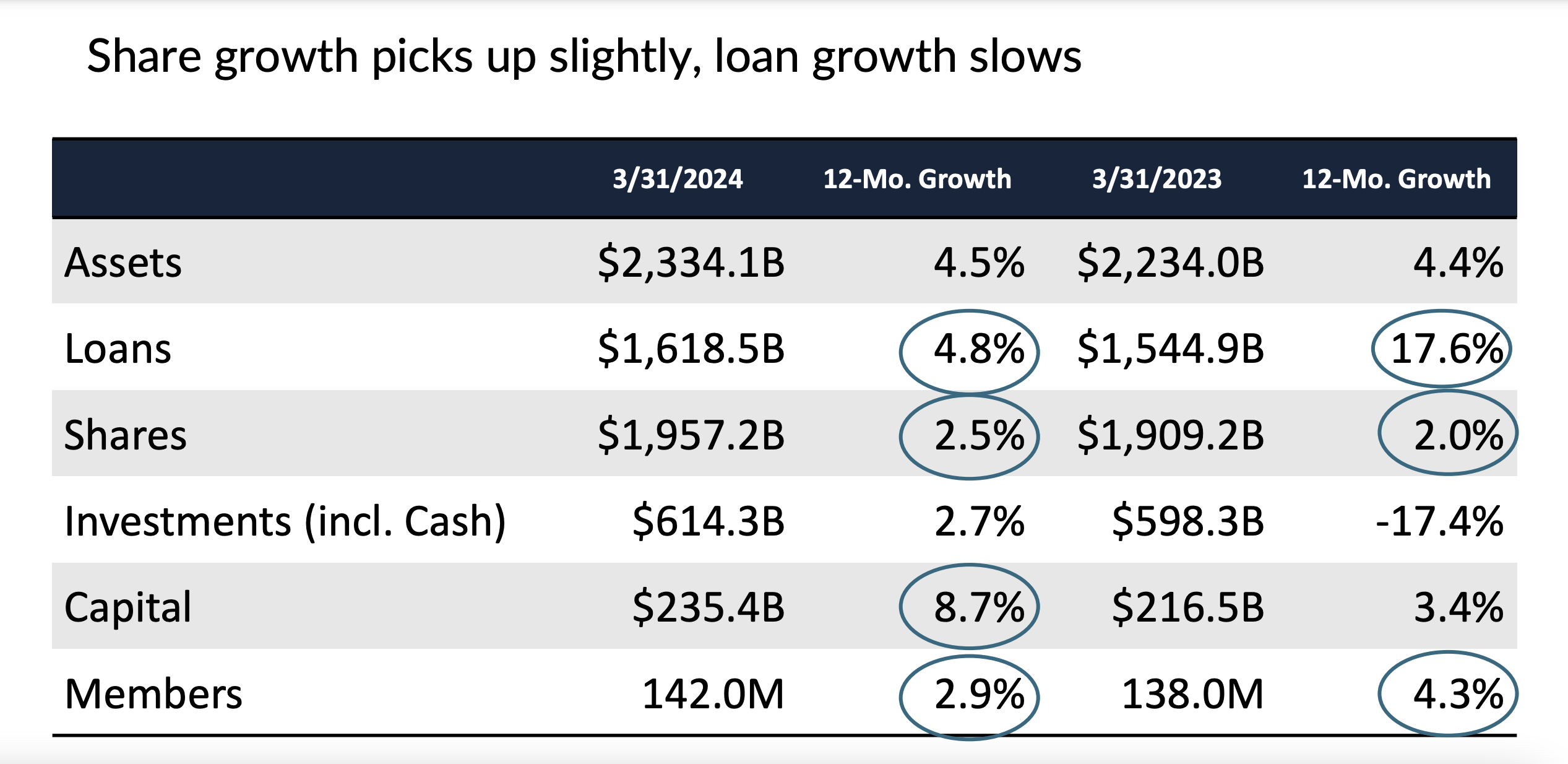

So that you don’t overlook the rest of the industry analysis, here is Callahan’s opening slide on credit union’s core balance sheet growth trends as of March 31, 2024 versus one year earlier.