I subscribe to a resource called Visual Capitalist +. The firm transforms data into pictures and graphs that present the meaning from the numbers.

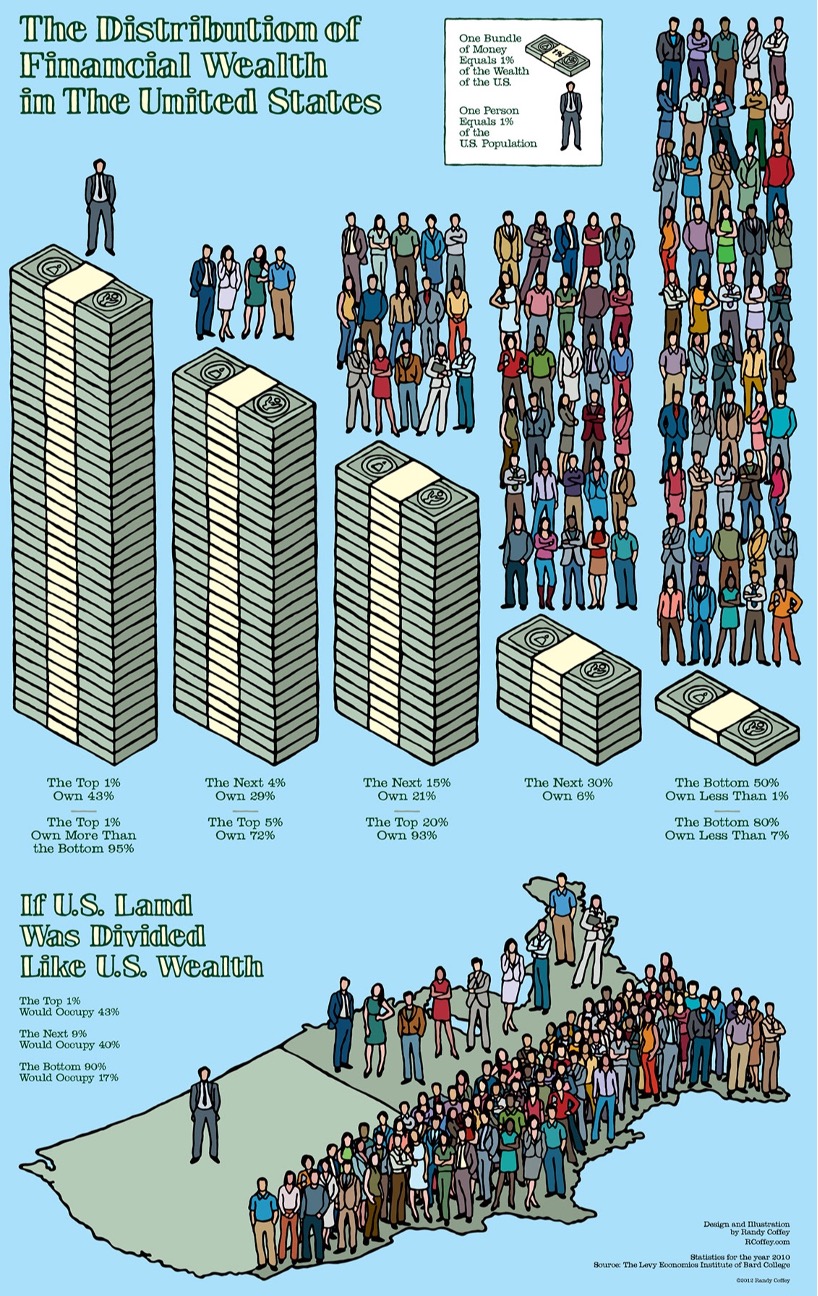

Below is an example of income distribution in the US using information from 2010. I suspect the outcome would not be much different today.

I believe this visual illustrates where credit unions have their largest market opportunity. If the cooperative’s goal is to serve the greatest number of members, versus the members with the greatest wealth, then 80% of Americans owning less than 7% of the country’s financial wealth should be the primary target.

This distribution is one reason Congress created cooperative credit unions founded on self-help.

From an anonymous writer:

Great post. A fun fact: Henry Ford went bankrupt at least three times when starting FoMoCo at the dawn of the 20th century. Primary reason was that his investors wanted him to build “fancy” cars that the investors could afford but the masses could not. Ford wanted to build a car for the majority, not the minority. Ford (& his investors) became successful with building the Model T which most of the masses in the USA could afford.

The automakers are going this way again with building more and more “unaffordable to the masses” cars and trucks (average new car price is $60k). The USA automakers franchised dealer networks are not helping with their “market adjustment” up charges and slippery in house financing. Some similarities of enrichment to the current CU problems. While I do not agree or support Musk’s libertarian, non union and poor treatment of his production workers, he is mirroring Ford’s model T direction with his model 3 and the firm’s direct, no BS, sales model.

The rich seem to prefer to help each other around the world. It is most glaringly in the USA in my opinion. So much missed opportunity and a personal feeling of goodwill from furthering society to greater prosperity. So simple but I guess there is more profit or power in despair.

Also appreciate the post yesterday about the need for a new book on the role of local financial institutions as “fountains of wealth.” I had no idea that women could not solely open bank accounts or have access to many financial products up until 1974. Dark fact! Now I get the revolutionary aspect of Bank of America’s “Women’s Branch” in San Francisco that was opened in the 1950s.