Flying to Japan in April 1970, I had two days to find off-base housing for my family before beginning sea duty on the Windham County LST 1170. The ship left Yokosuka Naval Base to join a small task group in Operation Golden Dragon.

Golden Dragon was a joint military exercise with the South Korean navy off the coast of Korea. Our LST’s tank deck was filled with Korean marines, landing craft, trucks and tanks for amphibious landing drills.

As we crossed the Sea of Japan, the ship’s captain, CDR J. P. Mann, reminded us of the January 1968 seizure of the USS Pueblo (AGER-2), an intelligence gathering ship. Captain Bucher and his crew of 82 were held for eleven months before release.

Our captain told the officers in a wardroom meeting that should there be any threat of North Korean intervention, we should know he would never let his ship be captured, whatever the circumstances.

That was my introduction to how this commanding officer understood duty and our collective obligation. Growing up I had watched the WW II television series “Victory at Sea” with its portrayals of the Pacific island-hopping campaigns. Now it was real life.

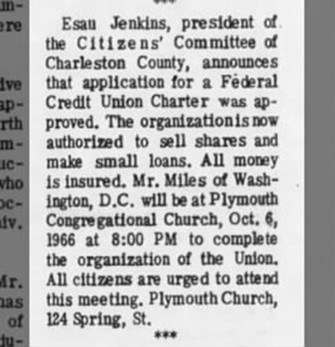

Credit Union Duty

There are three pillars of cooperative duty:

- The trust, loyalty and support of the members

- Leaders who take the fiduciary responsibility managing their inherited legacy to heart

- An effective networked collaborative support system including sponsors, joint ventures, supervision and collective resources.

If members lose confidence, leaders shun accountability, or supporting organizations forget who founded them, the cooperative model will slowly decline in relevance.

All Three Pillars Weakened

Two back-to-back emails from members about a current merger vote suggested that all three elements of duty are lacking in this proposal.

One read in part:

“I’ve learned a lot about credit union mergers from you. Curious if you have an opinion about the merger of Kinecta FCU (formerly Hughes Aircraft Employees FCU) and my credit union Xceed Financial/XFCU (formerly Xerox FCU).

Based on online reviews of Kinecta FCU, I voted against the merger. As a former Xerox employee myself, my father worked for Xerox in Rochester’s Xerox Square for 30 years I hate to lose the affiliation of what’s left of my Rochester focused credit union.”

The second was a comment on my blog, “Should a CEO’s Last Act be a Merger,” published August of 2020.

“Is there any organized attempt among members to oppose this merger?

I have been a member of Xceed for over 25 years and have been very satisfied with the institution.

I was also a member of Kinecta from 2002 until I closed the account in 2017 due to them nickel and diming me with fees that were often worse than the big banks, and horrible customer service.

In 2014, Xceed gave me a substantial personal loan, right after Kinecta rejected my loan application.

I have no desire to go back to Kinecta’s fees and horrible customer service and will likely close my account if the merger goes through.”

Until these emails, I had not seen Xceed’s Member Notice of December 30 requesting member approval for the merger. Reviewing this Notice confirmed the issues in my first blog. For this event is nothing less than giving up the ship. This sale of long-standing member relationships, loyalty and common resources by those in authority undercuts all three cooperative pillars.

Xceed’s Leaders Surrender

Voluntary mergers require that members vote to approve closing their charter. No minimum participation is needed. A simple majority determines the outcome. Each member has one vote regardless of account size or length of membership.

To properly make this voting decision, members should have sufficient information to exercise an informed choice. This Member Notice is woefully deficient in describing why the abandonment of this 1964 charter is necessary.

Some of the questions that should be addressed so Xceed’s 48,500 members can make a knowledgeable decision about management’s proposed “surrender” include:

- Since members are turning their long-standing relationships to an unknown management team and board, why is no information on these individuals provided?

- If Kinecta is the chosen successor, why is no data about their past and present financial performance, current business model and future plans given?

- If “enhanced convenience” is one of the reasons for merger, how does adding 23 Kinecta branches, all in Southern California, help Xceed’s members in their eight locations in New York, New Jersey and northern California?

- If Xceed’s employees and branch network are integral to member value, why were employees given no post-employment commitments and all branch locations now “subject to business necessity?”

- Xceed’s net worth ratio is 20% higher (10% versus 7.9%). Why are the members’ $94 million reserves given to the “continuing credit union’s” control and they receive nothing? Not even a token homage for their $2,000 individual pro rata value?

- If merger costs (contract cancellations, core conversions, etc.) are so great that transferring Xceed’s $94 million equity “will not result in a material increase” in Kinecta’s 7.9% net worth ratio, shouldn’t these new costs be fully disclosed?

- If “better pricing, additional products, lower operating costs” will result in “lasting benefits” why is no single fact or comparison of existing fees, savings or loan rates provided to support this promise? What is the evidence of Kinecta’s superior member value?

- What is the basis for five senior employees receiving a “possible maximum amount” of additional compensation of $3.5 million while giving up their leadership roles and responsibility for future performance? What is the rationale for the CEO gaining $1.5 million in added compensation above that earned by staying on the job? Is this a conflict when senior managers negotiate their own benefits and do not provide any for members?

The Record of Xceed’s Board and CEO

When asked to approve a merger, members should have factual information not merely rhetorical promises of a better “low-cost” future. Lack of facts suggests the merger tactics have not been thought through.

Performance data is especially important in evaluating the marketing clichés and future hopes offered in the merger Notice.

The track record of Xceed’s leadership is one of continuing decline. The past five years show a compounded annual (CAGR) asset growth of negative (-0.67%) per year. The CAGR for the CEO’s 14-year tenure is 1.39%, less than a quarter of the industry’s 5.77% annual growth. This 1.39% long term growth includes five mergers that added $200 million in external assets and over 30% additional members in this time frame.

The September 2020 financial report shows a year-to-date loss of $1.7 million versus a $2.5 million gain for the same nine months in 2019. The members are already “voting” with their feet: over 4,000 (almost 8%) have left the credit union in the 12 months ending September 2020.

The board and management responsible for these trends state their future roles as President of Kinecta and two directors will “help ensure members have a voice.” What support could this “voice” be in light of their own abdication?

Xceed’s CEO provides members with the criteria they should apply in voting on this proposal. In a 2010 Credit Union Times the CEO wrote:

“At the end of the day, credit union mergers must be based on what’s best for the member (of both credit unions). At Xceed FCU, although we operate across the country, we wouldn’t merge a credit union just for the sake of expanded asset size.”

She continues: “Mergers call for serious consideration and although I appreciate the unprecedented difficult operating environment, we find ourselves in today-let’s continue asking the question “What’s in it for the member?”

Kinecta’s Track Record of Size and Performance

Since Xceed’s summer 2020 announcement, this combination has been justified by saying larger size will bring better value. As presented in the Notice:

“The combined credit union, and consequently the members will benefit from the economies of scale (including a combined entity totaling approximately $6 billion in assets and approximately 300,000 members) translating into lower operating costs by allowing such costs to be spread over a wider membership base. . .this merger (will) create a larger credit union that will be in a strong competitive position to offer members greater value than they have today.”

Kinecta’s record of its “competitive position” suggests that there is little relation between performance and size in this organization. The following shows long term and more recent trends in Kinecta’s asset ranking. It continues to fall even though it has been in the top 100 listing throughout this listing.

1978: Hughes FCU, #3 of all 12,759 FCU’s; no state cu listing available

1995: Hughes FCU, #9 of all 12,107 credit unions

2005: Hughes FCU, #16 of all 9,062 “ “

2015: Kinecta FCU, #34 of all 6,284 “ “

2017: Kinecta FCU, #40 of all 5,815 “ “

2018: Kinecta FCU, #43 of all 5,482 “ “

2019: Kinecta FCU. #47 of all 5,349 “ “

9/20: Kinecta FCU, #49 of all 5,244 “ “

This fall from #3 to #49 means Kinecta’s performance is not keeping pace with its peers. In 2010, Kinecta attempted a merger with NuVision using a two year trial run with a shared CEO. After reporting a $30 million loss in 2011, the effort was ended.

As of September 2020, Kinecta’s 2.74% operating expense to average assets is lower than Xceed’s 3.59%. But size does not automatically create better member value. Together the credit unions report losing 16,000 members in the past twelve months. Kinecta’s 12,000 drop is equal to almost 5% of its total from the previous year.

These declines are not a sign of member confidence. Member value depends on the business model, not the institution’s size.

Members Told to “Abandon Ship”

The two emails above suggest that members are disheartened as they are asked to leave the self-help craft in which they placed their trust, loyalty and belief for six decades. And how must they view the ship’s captain rewarding herself and the senior officers after bailing out of future responsibility.

With so many unanswered questions, Xceed’s members should vote No.

Management’s proposal to sell their cooperative’s future to an unnamed board, an unknown leadership group and then rewarding themselves with additional millions in compensation is a failure of leadership. A violation of duty.

If a No vote prevails, this $3.5 million dollar payoff plus the savings from added merger expenses, should be enough to find the right crew to set a better direction going forward.