Visual Capitalist is a website (https://www.visualcapitalist.com) that several times a week publishes graphs illustrating current or long-term trends covering many areas of economic, political and human activity.

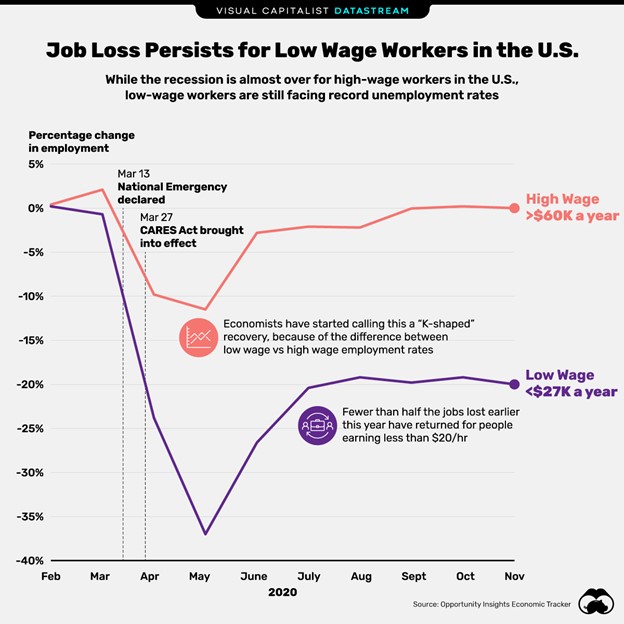

This week they printed the graph below comparing the economic recovery of high versus low wage earners in America. (https://www.visualcapitalist.com/high-wage-vs-low-wage-economic-recovery-us/)

Their full analysis about this “unequal recession” had two conclusions:

- The economic recession caused by COVID-19 has been especially devastating for low wage workers

- While the recession is nearly over for high income earners, fewer than half the jobs lost this spring are back for those making under $20/hr

The Credit Union Opportunity

Within current members and in every credit union’s FOM, this divergence in recovery occurs. How can your credit union reach these members and serve them best as we wait for the pandemic to recede?

Here are a few ideas to bury these folks deeper into debt: #1-Courtesy Pay: Sounds like you are doing ’em a favor. Wrong. Instead of bouncing checks for NSF activity pay the item and clip the member $35 to cover the NSF. Real courtesy, huh? Some members do get caught in this never ending vicious trap and get clipped $35 over 10X per month…do the math $350. Now that’s a courtesy. But fee income is intoxicating. Some credit unions would end the year with negative income but for the fee income. Credit unions are addicted to the fee income. The member continues to be stuck deeper in debt with ever increasing NSF items to pay. But life is good. How can they be overdrawn? They still have an unopened box of checks! #2-Kill Switch Car Loans: Got bad credit, bankrupt, unemployed? Who cares. Some credit unions will finance a “beater with a heater” & install a GPS kill switch. Late on the car payment, the credit union triggers the kill switch and send the repo man out. It’s easy, the kill switch includes a GPS so tracking is not an issue. The loan rate is excessive. WHY? Because they have bad credit, a low FICO score, prior bankruptcy, repo history, etc. Since the credit union financed it, they have an extra set of keys. And as the member leaves the late shift, or market late at nite, she finds the car disabled and while walking home she is forced to do things against her will. Endless opportunities for credit unions to pimp the less fortunate to feed the greed. The credit union should have declined the loan and financed a bus pass. With interest rates at or near 0.0% and dividend deposits earning on average less than 1.0% why are credit union credit cards (on average) still at 10.0%+? Why are unsecured signature loans at 15.0%? Reach the members? More like touch the members! The NCUA finance cap is at 18.0% so let’s go all in. How can the NCUA complain? They set the cap, and endorsed usury. Meanwhile, credit union boards approve CEO SERP (Supplemental Executive Retirement Plans) in the millions. Wes Corp FCU, CEO Bob Seravo banged it for $6M – not too shabby. Who approved it? The directors composed mostly of…you guessed it credit union CEO’s. People helping people. NO. People fleecing people. And you thought BANK was a 4 letter word. But we are a co-op. Drink the Kool-Aid.

@Stuart Perlitsh: Not only does a CU hit the gold mine with NSF fees, but there is a built-in advantage with those to begin with.

Let’s say that a member draws several drafts, and all would be paid except the last one drawn due to insufficient funds. But depending on the order in which they are presented for payment by the CU, those NSF’s can turn into far more revenue for the financial institution, and far more grief for the member.

Maybe there were 10 drafts drawn against the member’s account. And perhaps the last one was their rent check which was an amount exceeding the sum of all of the other share drafts. If that much larger draft is presented for payment before the rest make their way to the CU, then it is conceivable that every other draft will be NSF as well, rather than just the last one alone.

But wait for it, because this can be even more obscene. If all of those drafts are presented the same day, but the rent check is presented before the others, a computer algorithm COULD be written so as to minimize this damage when reconciling the accounts for the day, which probably was unintentional (in most cases). But we won’t because we make more money by pretending we are just like the commercial banks that screw their customers. It’s a game, Mr. Customer, and we are winning. Bwahaahahahaa!

It’s a smart day for that CU. And the member… well, uh, they can just crawl back into the sorry hole they fell into. This type of CU or bank is not interested in its members or customers, only its own benefit. Those $8M perquisites cost money too ya know!